1031 Exchange Template

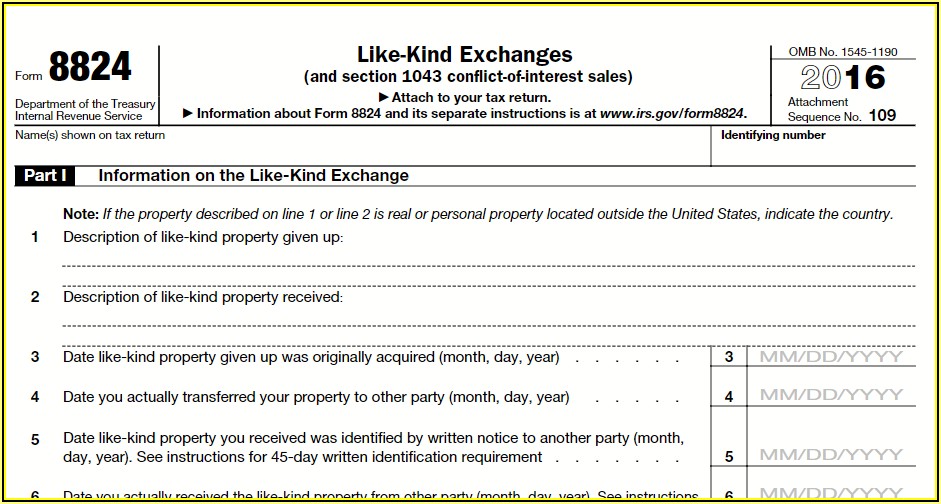

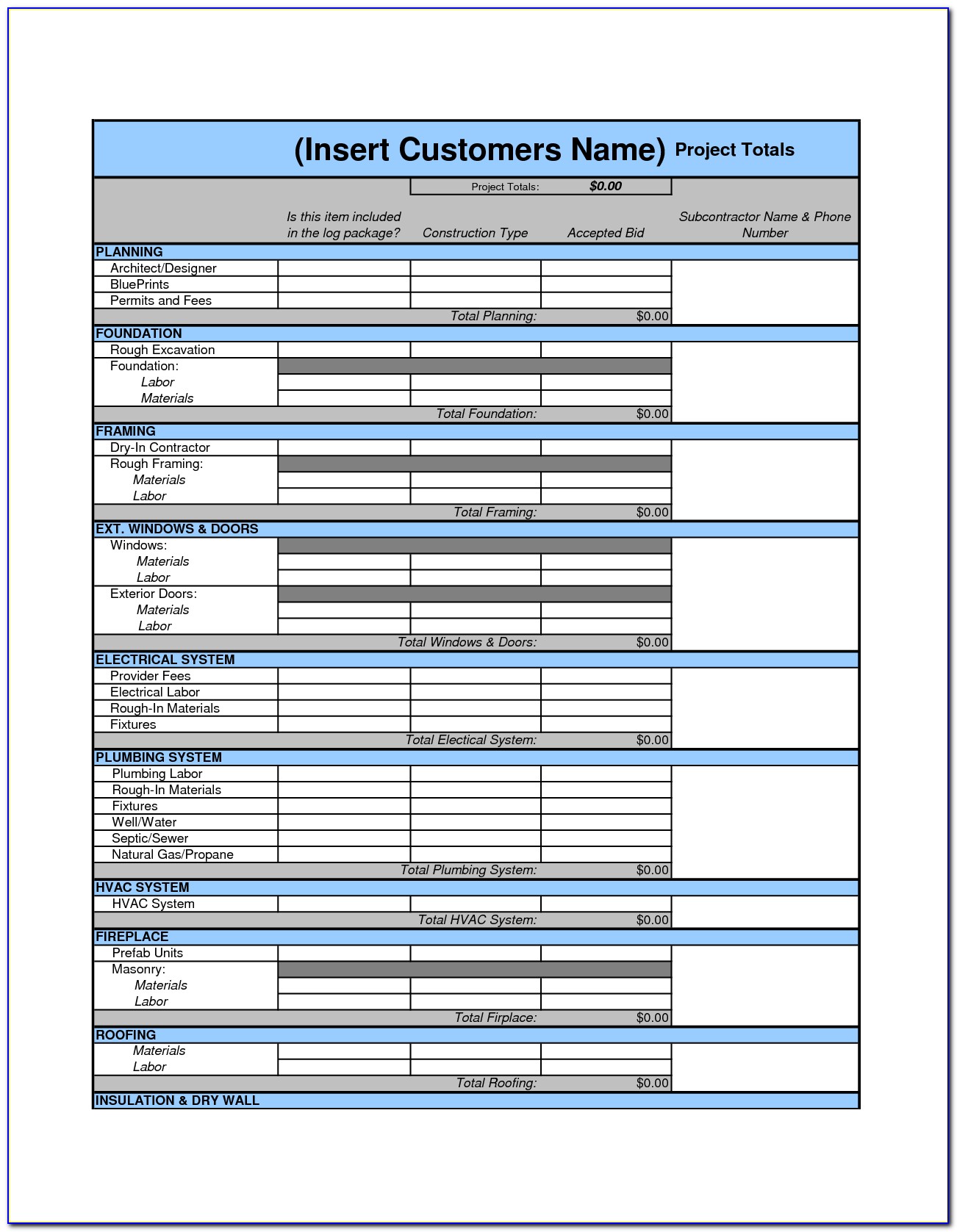

1031 Exchange Template - If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure out your tax deferment. Ad you've worked hard for your money, we work hard to keep it yours. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Web how 1031 exchanges are different in 2021 feb 23, 2021. Web visit our library of important 1031 exchange forms. To pay no tax when executing a 1031 exchange, you must purchase at least. (iv) a document prepared in connection with the exchange (for example, the. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Includes editor's notes written by expert staff. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; How to divide the 1031 proceeds after the sale of the relinquished property feb 18,. Includes editor's notes written by expert staff. Replacement property should be of equal or greater value. § 1031), a taxpayer may defer recognition of capital gains and related federal income tax liability on. To pay no tax when executing a 1031 exchange, you must purchase. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Ad you've worked hard for your money, we work hard to keep it yours. Web visit our library of important 1031 exchange forms. Intermediary agrees to act as a qualified intermediary within the. The. Exchange today and keep your investment property's equity intact! Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Intermediary agrees to act as a qualified intermediary within the.. Each party shall reasonably cooperate if another party intends to structure the transfer or acquisition of the property as part of an exchange under 26 u.s.c. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. The pros at equity advantage have provided everything. Each party shall reasonably cooperate if another party intends to structure the transfer or acquisition of the property as part of an exchange under 26 u.s.c. (iv) a document prepared in connection with the exchange (for example, the. If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure. Web visit our library of important 1031 exchange forms. Intermediary agrees to act as a qualified intermediary within the. How to divide the 1031 proceeds after the sale of the relinquished property feb 18,. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains. Web under section 1031 of the united states internal revenue code (26 u.s.c. Includes editor's notes written by expert staff. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Web the form requires a description of the relinquished and replacement. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web under section 1031 of the united states internal revenue code (26 u.s.c. Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Replacement property should be of equal. Intermediary agrees to act as a qualified intermediary within the. Replacement property should be of equal or greater value. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. How to divide the 1031 proceeds after the sale of the relinquished property feb 18,. The. § 1031), a taxpayer may defer recognition of capital gains and related federal income tax liability on. Each party shall reasonably cooperate if another party intends to structure the transfer or acquisition of the property as part of an exchange under 26 u.s.c. Ad you've worked hard for your money, we work hard to keep it yours. Web under section 1031 of the united states internal revenue code (26 u.s.c. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Replacement property should be of equal or greater value. Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. To pay no tax when executing a 1031 exchange, you must purchase at least. Ad site is updated continuously. Includes editor's notes written by expert staff. How to divide the 1031 proceeds after the sale of the relinquished property feb 18,. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Exchange today and keep your investment property's equity intact! (iv) a document prepared in connection with the exchange (for example, the. Web your 1031 exchange roadmapidentify the property you want to sell.select a qi.add a relinquished property addendum to any contract offer.get a copy of the sales contract to. Web visit our library of important 1031 exchange forms. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web how 1031 exchanges are different in 2021 feb 23, 2021. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; Web under section 1031 of the united states internal revenue code (26 u.s.c. To pay no tax when executing a 1031 exchange, you must purchase at least. Exchange today and keep your investment property's equity intact! Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web visit our library of important 1031 exchange forms. (iv) a document prepared in connection with the exchange (for example, the. The three primary 1031 exchange rules to follow are: Each party shall reasonably cooperate if another party intends to structure the transfer or acquisition of the property as part of an exchange under 26 u.s.c. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Intermediary agrees to act as a qualified intermediary within the. § 1031), a taxpayer may defer recognition of capital gains and related federal income tax liability on.1031 Exchange Calculation Worksheet CALCULATORVGW

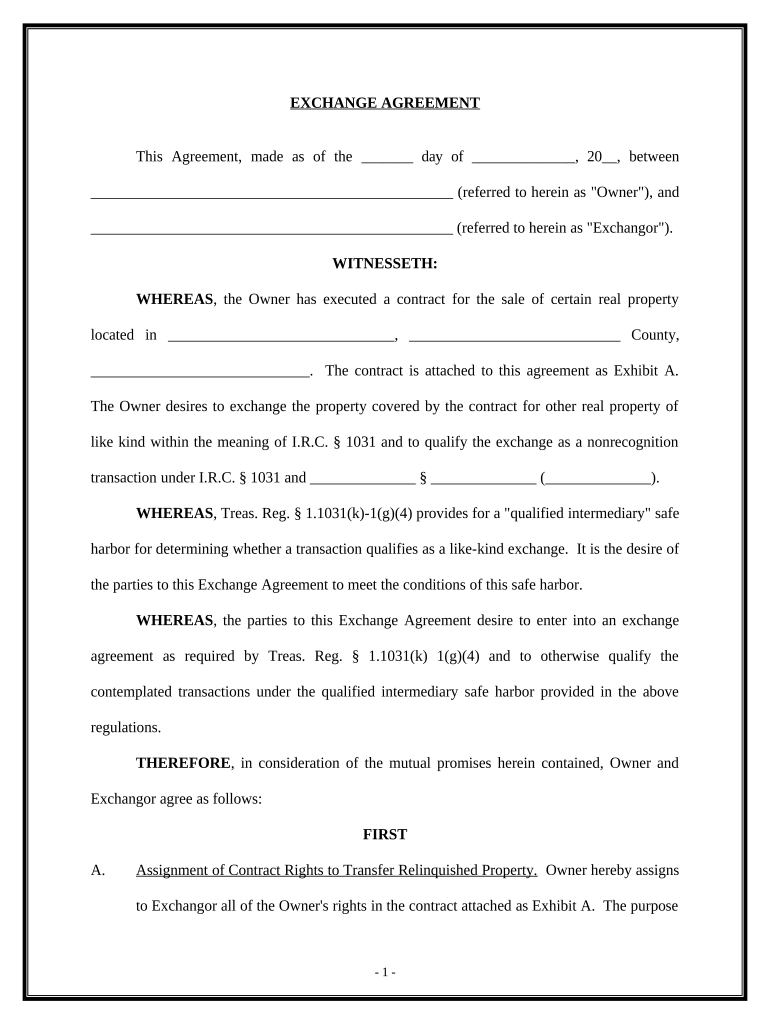

1031 Exchange Documents Form Fill Out and Sign Printable PDF Template

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

turbotax entering 1031 exchange Fill Online, Printable, Fillable

39 1031 like kind exchange worksheet Worksheet Live

1031 Exchange Order Form

1031 Exchange Worksheet Live Worksheet Online

1031 Exchange Worksheet Excel Ivuyteq

️1031 Exchange Worksheet Excel Free Download Goodimg.co

Tax Free Exchange Agreement Section 1031 1031 Exchange Agreement Form

Ad Site Is Updated Continuously.

If You’re Considering Performing A 1031 Tax Exchange Instead Of A Taxable Sale Of A Property, This Calculator Will Help You Figure Out Your Tax Deferment.

Web Your 1031 Exchange Roadmapidentify The Property You Want To Sell.select A Qi.add A Relinquished Property Addendum To Any Contract Offer.get A Copy Of The Sales Contract To.

The Pros At Equity Advantage Have Provided Everything You Need In Easily Downloadable Pdf Files.

Related Post: