1099 Int Template

1099 Int Template - Web check out our 1099 int template selection for the very best in unique or custom, handmade pieces from our shops. Ad find deals on form 1099 int in office supplies on amazon. Save time and hassle during filing! Web get the latest printable irs form templates for word. It does not take much time. Iris is a free service that lets you: Submit up to 100 records per. When preparing an excel file for uploading, please name it. For internal revenue service center. Web the filer information sheet embedded with each template should be filled out for every template file submitted. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been. Web to calculate and print to irs 1099 forms with their unconventional spacing. Ad find deals on form 1099 int in office supplies on amazon. Both the. Download this 2022 excel template. When preparing an excel file for uploading, please name it. Ad 1) get access to 500+ legal templates 2) print & download, start free! Web the filer information sheet embedded with each template should be filled out for every template file submitted. Submit up to 100 records per. It does not take much time. Web get the latest printable irs form templates for word. Download this 2022 excel template. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. Save time and hassle during filing! Save time and hassle during filing! Web the filer information sheet embedded with each template should be filled out for every template file submitted. Web to calculate and print to irs 1099 forms with their unconventional spacing. Ad find deals on form 1099 int in office supplies on amazon. Submit up to 100 records per. Download this 2022 excel template. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. Both the form and instructions will. Iris is a free service that lets you: Submit up to 100 records per. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been. When preparing an excel file for uploading, please name it. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. Web. Iris is a free service that lets you: Use a fillable 1099 forms 2021 template to make your document workflow more streamlined. Treasury obligation that is a covered security, shows the amount of premium amortization allocable to the interest payment(s), unless you notified the payer in writing. Web check out our 1099 int template selection for the very best in. Ad find deals on form 1099 int in office supplies on amazon. Both the form and instructions will. Web get the latest printable irs form templates for word. Web check out our 1099 int template selection for the very best in unique or custom, handmade pieces from our shops. Web the filer information sheet embedded with each template should be. For internal revenue service center. For whom you withheld and paid any foreign tax on. Web to calculate and print to irs 1099 forms with their unconventional spacing. Use a fillable 1099 forms 2021 template to make your document workflow more streamlined. When preparing an excel file for uploading, please name it. For internal revenue service center. Web to calculate and print to irs 1099 forms with their unconventional spacing. Determine who receives a form. Save time and hassle during filing! When preparing an excel file for uploading, please name it. For whom you withheld and paid any foreign tax on. Determine who receives a form. When preparing an excel file for uploading, please name it. Save time and hassle during filing! Both the form and instructions will. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been. For internal revenue service center. Web check out our 1099 int template selection for the very best in unique or custom, handmade pieces from our shops. Ad 1) get access to 500+ legal templates 2) print & download, start free! To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. Web get the latest printable irs form templates for word. Web the filer information sheet embedded with each template should be filled out for every template file submitted. Web it's easy to see irs form 1099 as representing a big liability since it reports income that hasn't already been taxed in the form of withholding. Create, edit, and print your business and legal documents quickly and easily! Submit up to 100 records per. Web to calculate and print to irs 1099 forms with their unconventional spacing. Download this 2022 excel template. Use a fillable 1099 forms 2021 template to make your document workflow more streamlined. Iris is a free service that lets you: It does not take much time. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. Web get the latest printable irs form templates for word. Submit up to 100 records per. Web to calculate and print to irs 1099 forms with their unconventional spacing. It does not take much time. Ad find deals on form 1099 int in office supplies on amazon. Both the form and instructions will. Web it's easy to see irs form 1099 as representing a big liability since it reports income that hasn't already been taxed in the form of withholding. Use a fillable 1099 forms 2021 template to make your document workflow more streamlined. Save time and hassle during filing! Download this 2022 excel template. Create, edit, and print your business and legal documents quickly and easily! For whom you withheld and paid any foreign tax on. Web the filer information sheet embedded with each template should be filled out for every template file submitted. When preparing an excel file for uploading, please name it. Determine who receives a form.How to Calculate Taxable Amount on a 1099R for Life Insurance

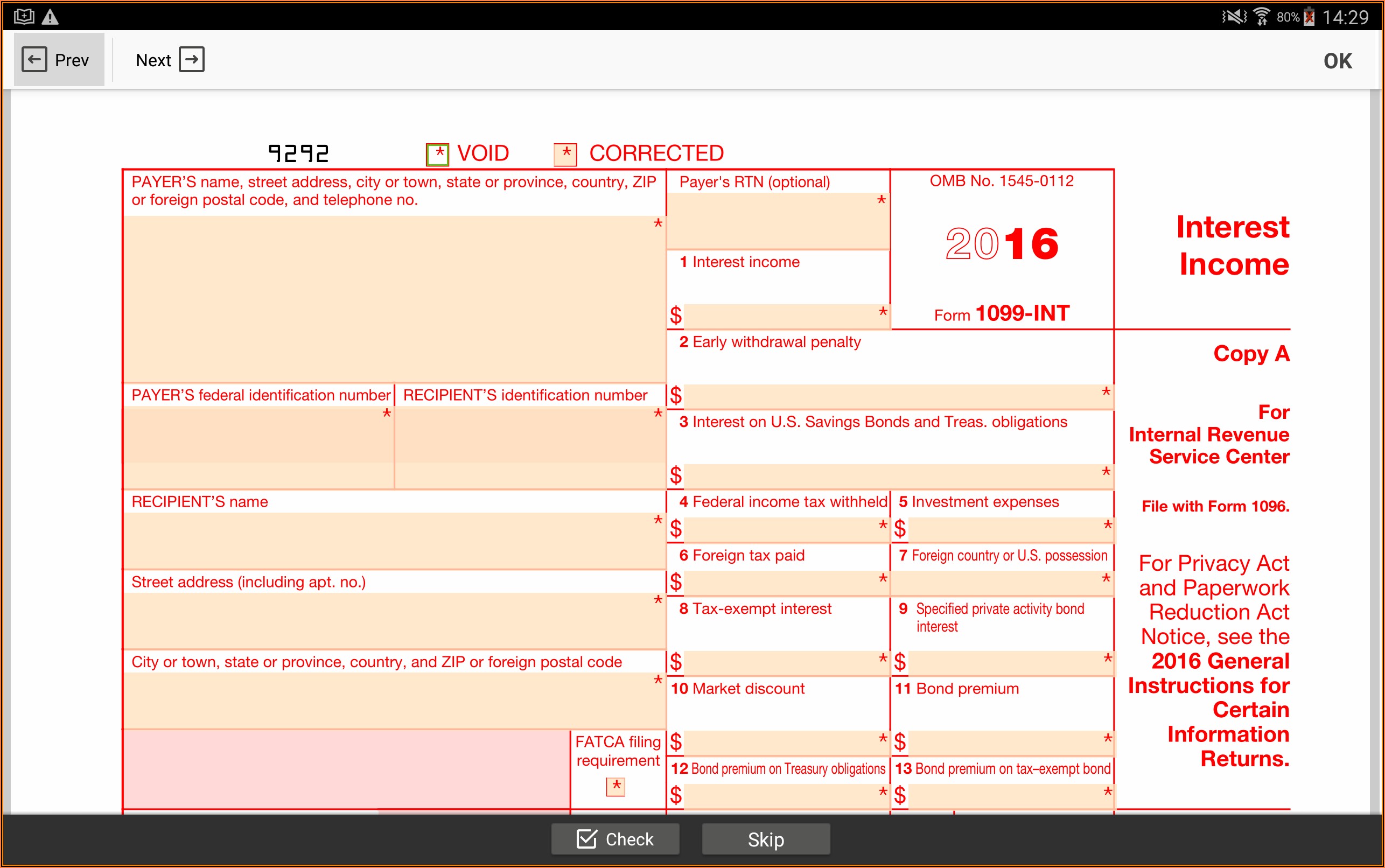

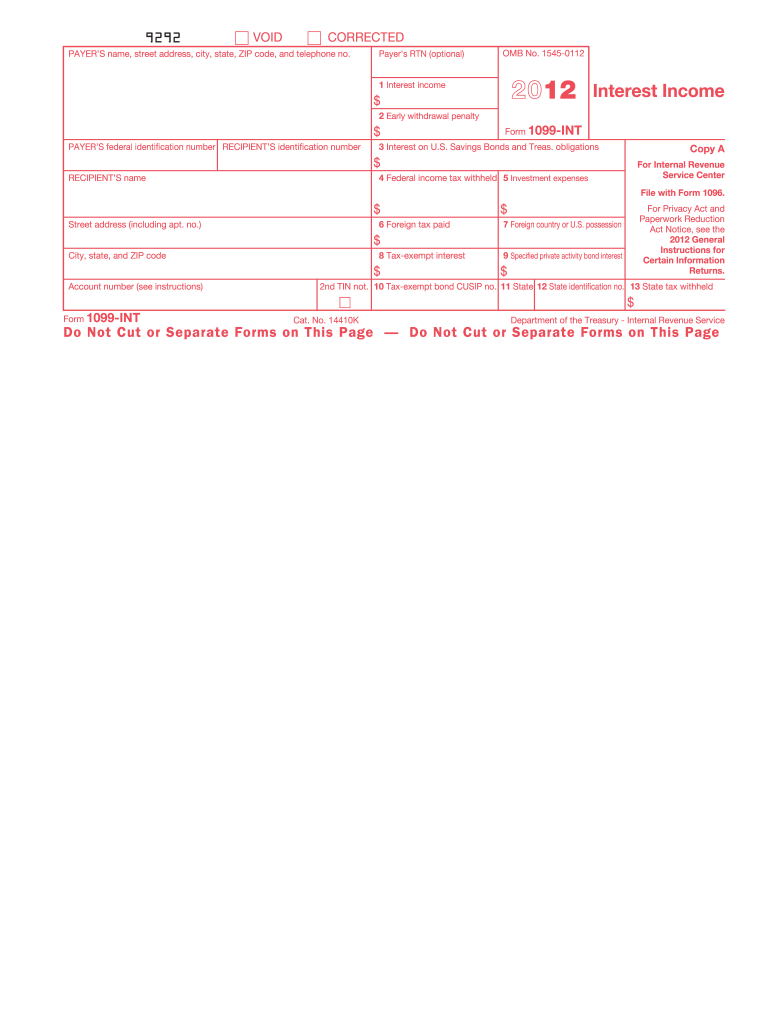

1099INT Form Fillable, Printable, Download Free. 2021 Instructions

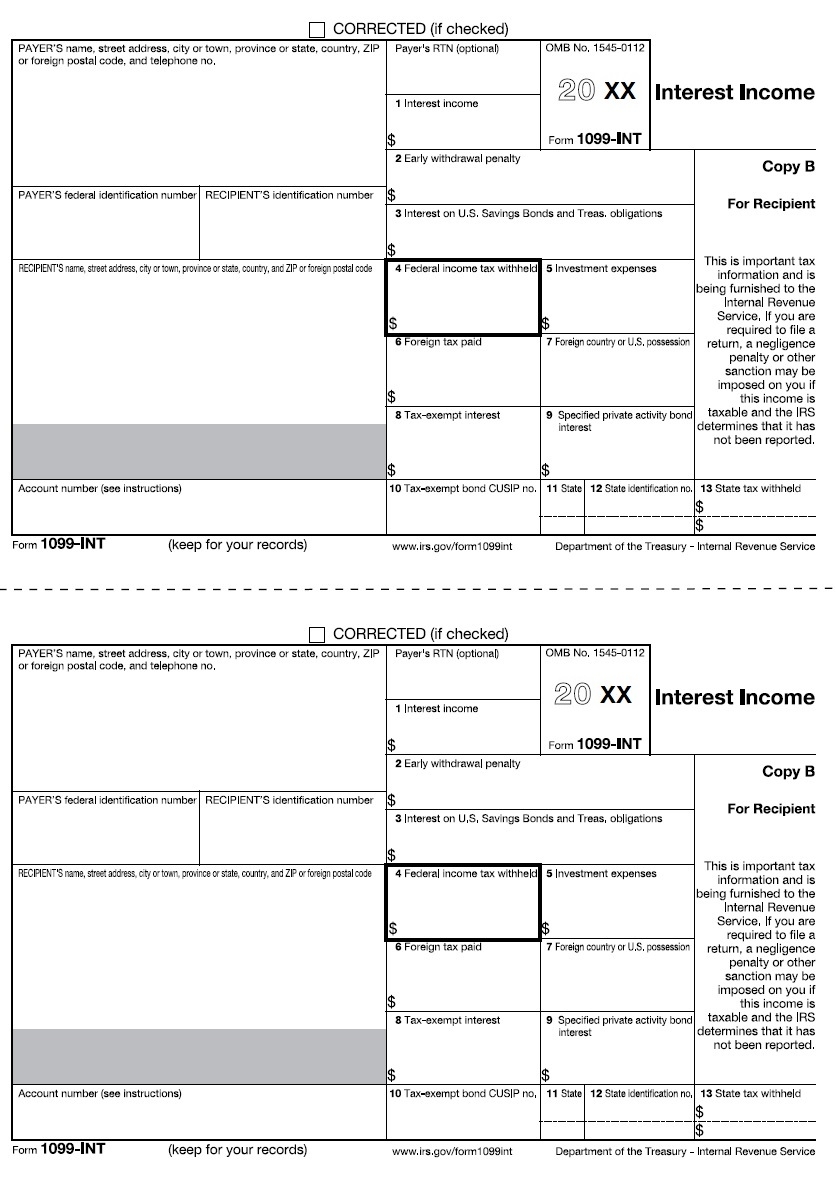

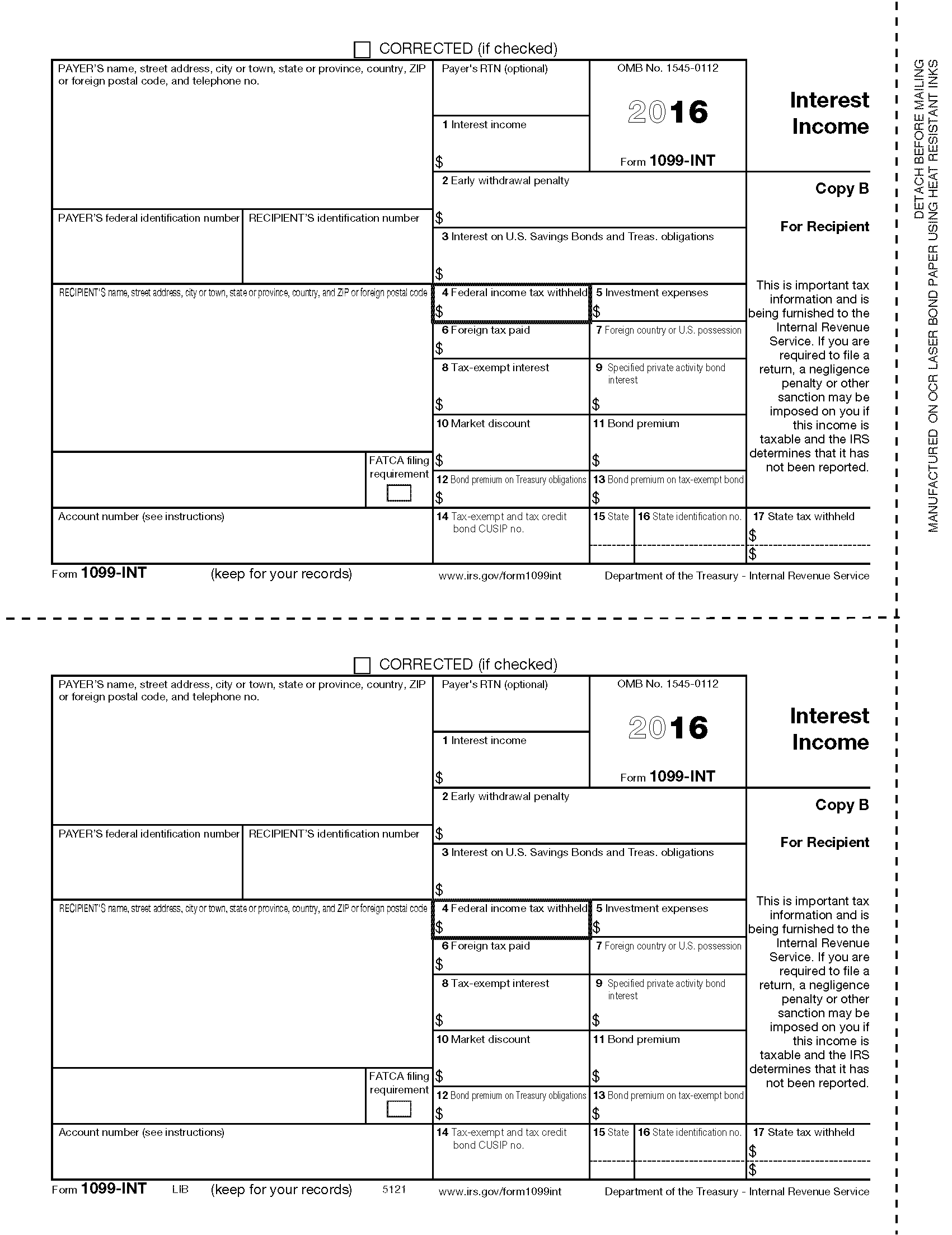

1099INT Recipient Copy B Forms & Fulfillment

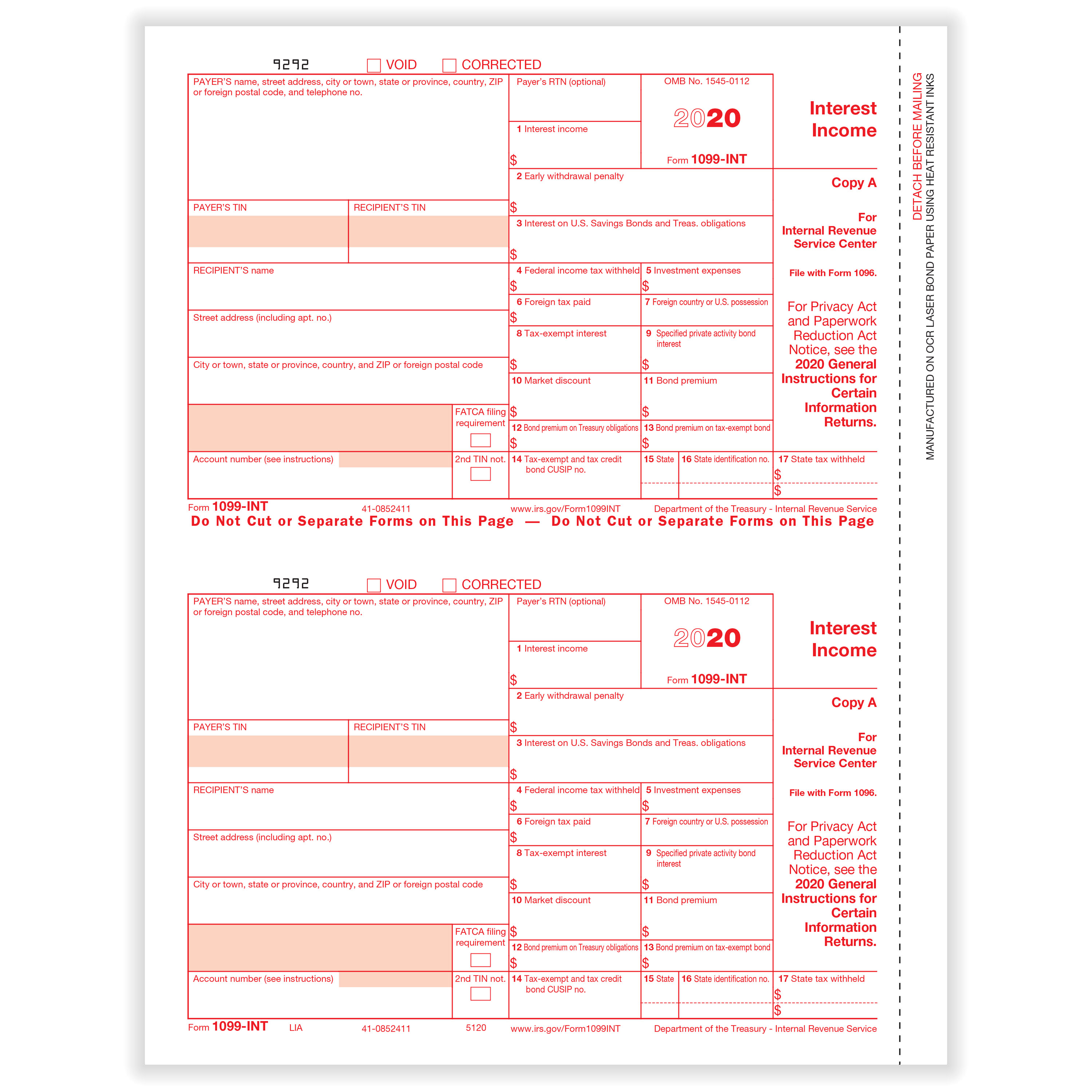

1099 Int Federal Form 1099INT Formstax

1099 Int Form Fillable Pdf Template Download Here!

Form 1099INT Interest Definition

Fillable Form 1099 S Exemption Form Printable Forms Free Online

Irs Form 1099 Misc Printable Printable Forms Free Online

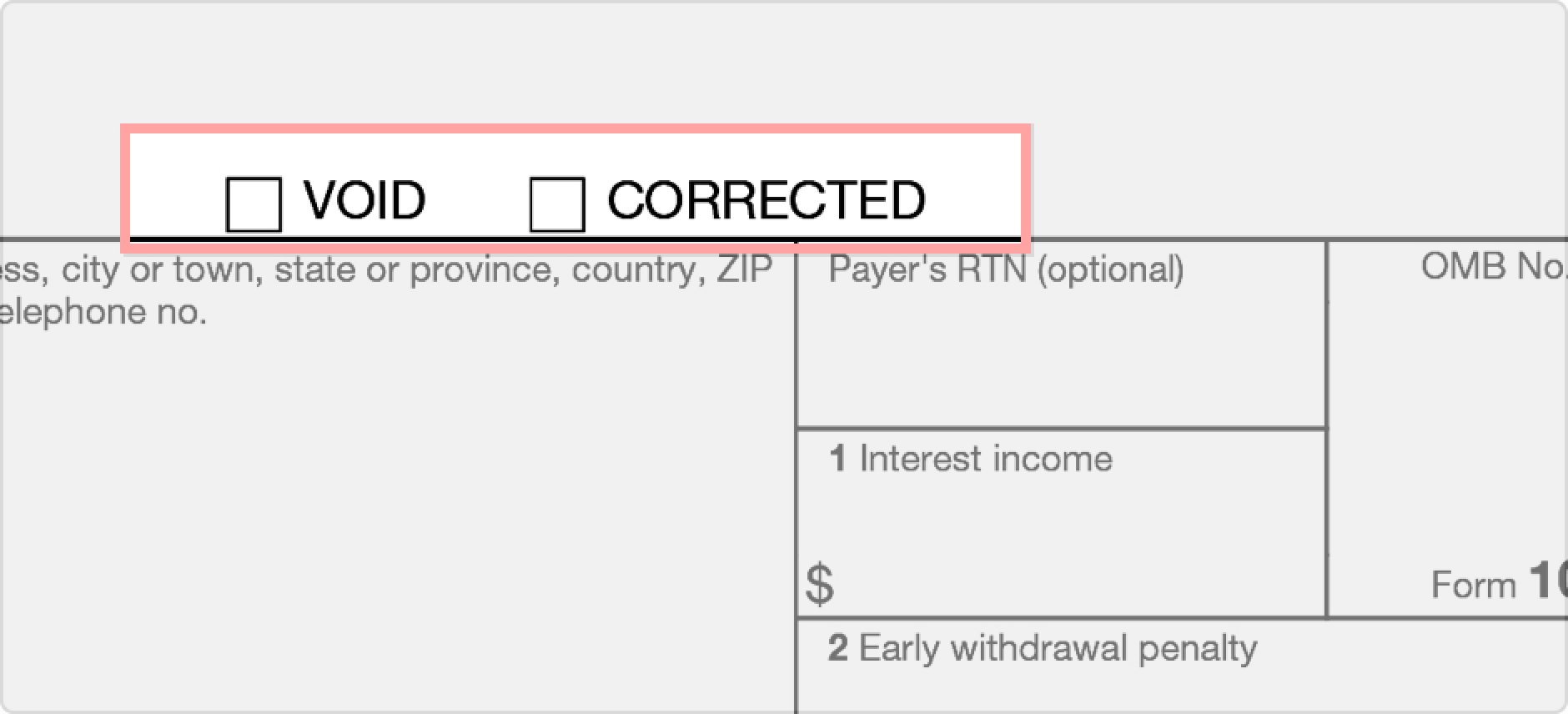

Form 1099 Int Rev 10 2013 Fill Out and Sign Printable PDF Template

1099INT Recipient Copy B

Web Check Out Our 1099 Int Template Selection For The Very Best In Unique Or Custom, Handmade Pieces From Our Shops.

Ad 1) Get Access To 500+ Legal Templates 2) Print & Download, Start Free!

Treasury Obligation That Is A Covered Security, Shows The Amount Of Premium Amortization Allocable To The Interest Payment(S), Unless You Notified The Payer In Writing.

If You Are Required To File A Return, A Negligence Penalty Or Other Sanction May Be Imposed On You If This Income Is Taxable And The Irs Determines That It Has Not Been.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)