401K Census Template

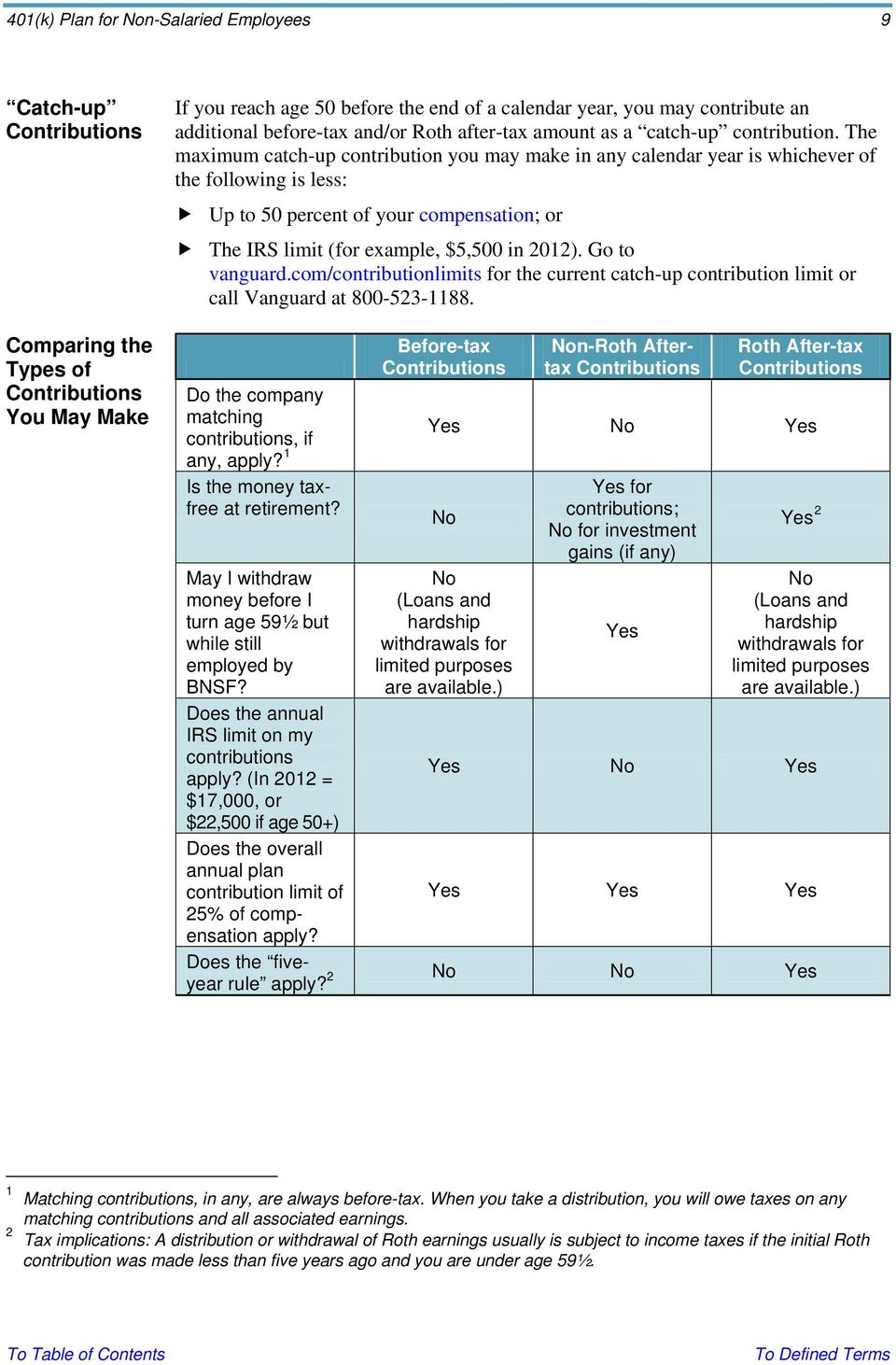

401K Census Template - Below is the list of column headers that appear on the census grid or census template, accompanied by a. Therefore, $6,500 is in excess of the §402(g) limit. Delivery contact for plan design projection report term explanations advisor or plan sponsor name: Web explanation of census data 1. Web this is the paper copy of the online 401(k) compliance check questionnaire. Web company 401(k) plan, which has a plan year end of december 31, 2020. The first step to designing the perfect retirement plan is gathering demographic information about your staff. Complete a reconciliation of the. Web if your payroll company does not provide a census, you will need to create one by filling out this template. Web edit census data spreadsheet for pension and 401(k) plans. This is not the questionnaire; To ensure the accuracy of the plan census, plan administrators can: Web 401k census blind samples investment and contribution data from many thousands of individual 401k investor accounts, analyzes the data, and posts the results in this free. The first step to designing the perfect retirement plan is gathering demographic information about your staff. Start. Web plan design census template section iv: Web 401k census blind samples investment and contribution data from many thousands of individual 401k investor accounts, analyzes the data, and posts the results in this free. Use this layout to calculate and prepare. Web how to prepare for a 401(k) plan census. You can also find the template in the onboarding task. Filling out the appropriate census request. Web 401k census blind samples investment and contribution data from many thousands of individual 401k investor accounts, analyzes the data, and posts the results in this free. Complete form for all employees of the company, including ineligible employees. Employee name column a please provide the name of anyone employed at any time during the. Web how do you complete and submit census data. It is intended to assist in completion of the questionnaire. An increase in investment income under scheme 401 (k) is one of the most popular retirement plans in the united states. To ensure the accuracy of the plan census, plan administrators can: Below is the list of column headers that appear. It is intended to assist in completion of the questionnaire. According to john hancock there are three categories of census data. Web how to prepare for a 401(k) plan census. Therefore, $6,500 is in excess of the §402(g) limit. Web edit census data spreadsheet for pension and 401(k) plans. 401 (k) deferrals should match the amount listed in. If there is an existing. Use get form or simply click on the template preview to open it in the editor. An increase in investment income under scheme 401 (k) is one of the most popular retirement plans in the united states. Web type of plan plan year beginning and ending. It is intended to assist in completion of the questionnaire. Web how to prepare for a 401(k) plan census. 401 (k) deferrals should match the amount listed in. The first step to designing the perfect retirement plan is gathering demographic information about your staff. If there is an existing. 401 (k) deferrals should match the amount listed in. Therefore, $6,500 is in excess of the §402(g) limit. It is intended to assist in completion of the questionnaire. Web plan design census template section iv: Web type of plan plan year beginning and ending instructions: According to john hancock there are three categories of census data. Start completing the fillable fields. Web if your payroll company does not provide a census, you will need to create one by filling out this template. Easily add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and. Complete form for all employees of the company,. According to john hancock there are three categories of census data. Employee x defers $26,000 during the year; Complete a reconciliation of the. Web how to prepare for a 401(k) plan census. Use get form or simply click on the template preview to open it in the editor. Web plan design census template section iv: Web form census 401k form ee census data employee number first name last name sex date of birth date of hire termination rehire deferral employer match gross joe. To ensure the accuracy of the plan census, plan administrators can: Web edit census data spreadsheet for pension and 401(k) plans. Web type of plan plan year beginning and ending instructions: Therefore, $6,500 is in excess of the §402(g) limit. Employee x defers $26,000 during the year; An increase in investment income under scheme 401 (k) is one of the most popular retirement plans in the united states. Web how to format your census file for uploads. Easily add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and. Filling out the appropriate census request. You can also find the template in the onboarding task tracker by clicking. Web how do you complete and submit census data. Below is the list of column headers that appear on the census grid or census template, accompanied by a. Start completing the fillable fields. Use this layout to calculate and prepare. Eligible compensation and hours of. The first step to designing the perfect retirement plan is gathering demographic information about your staff. According to john hancock there are three categories of census data. Web 401k census blind samples investment and contribution data from many thousands of individual 401k investor accounts, analyzes the data, and posts the results in this free. According to john hancock there are three categories of census data. Web how do you complete and submit census data. Use get form or simply click on the template preview to open it in the editor. Web how to format your census file for uploads. Delivery contact for plan design projection report term explanations advisor or plan sponsor name: Web 401k census blind samples investment and contribution data from many thousands of individual 401k investor accounts, analyzes the data, and posts the results in this free. Complete a reconciliation of the. 401 (k) deferrals should match the amount listed in. Web this is the paper copy of the online 401(k) compliance check questionnaire. You can also find the template in the onboarding task tracker by clicking. Easily add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and. Complete form for all employees of the company, including ineligible employees. If there is an existing. If you choose to upload your own, please ensure it contains all. Web type of plan plan year beginning and ending instructions: Employee x defers $26,000 during the year;8+ 401k Contribution Calculator Templates Excel Templates

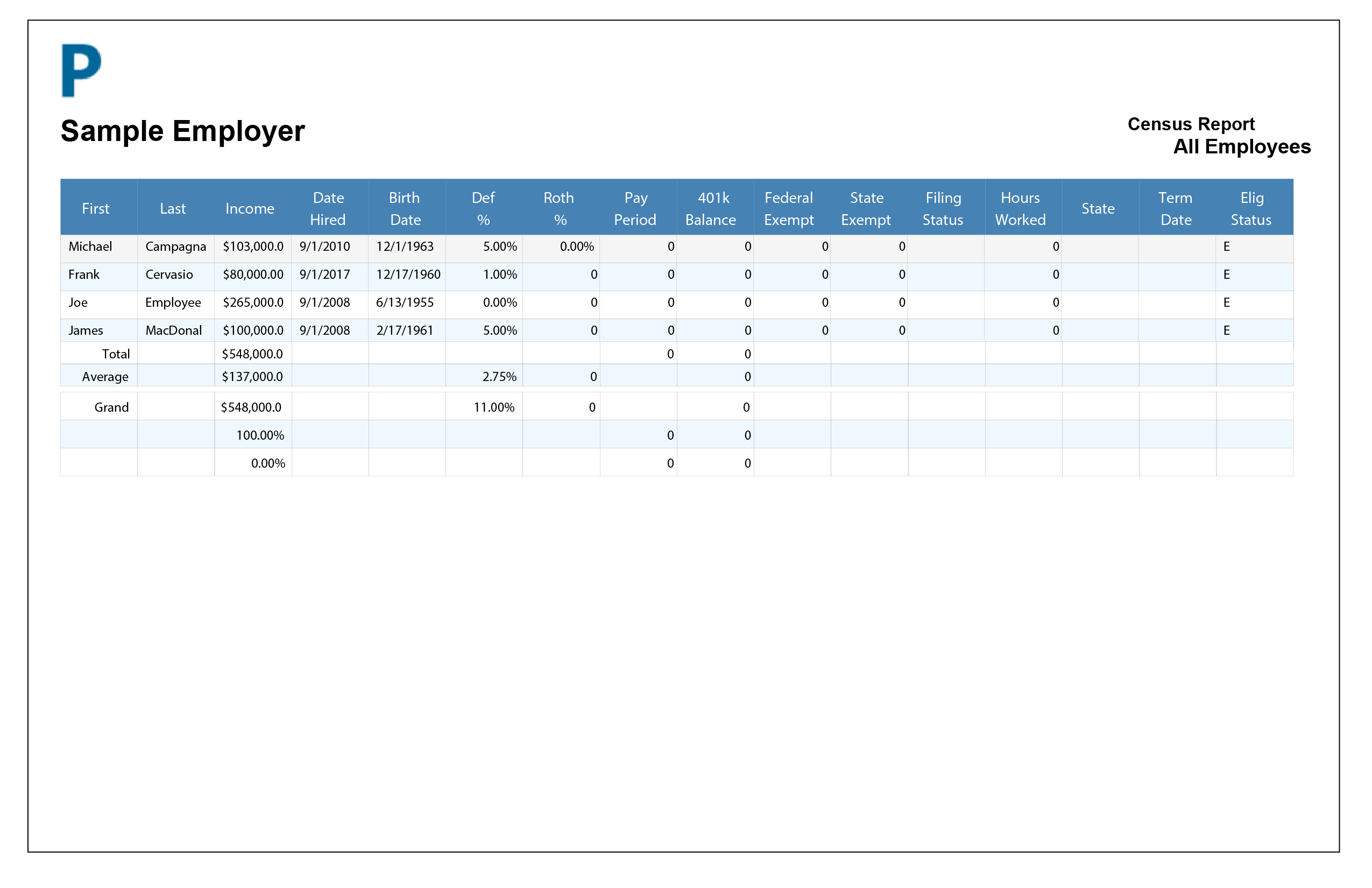

401K Template » Template Haven

The 401(k) checklist how to choose the best 401(k) provider

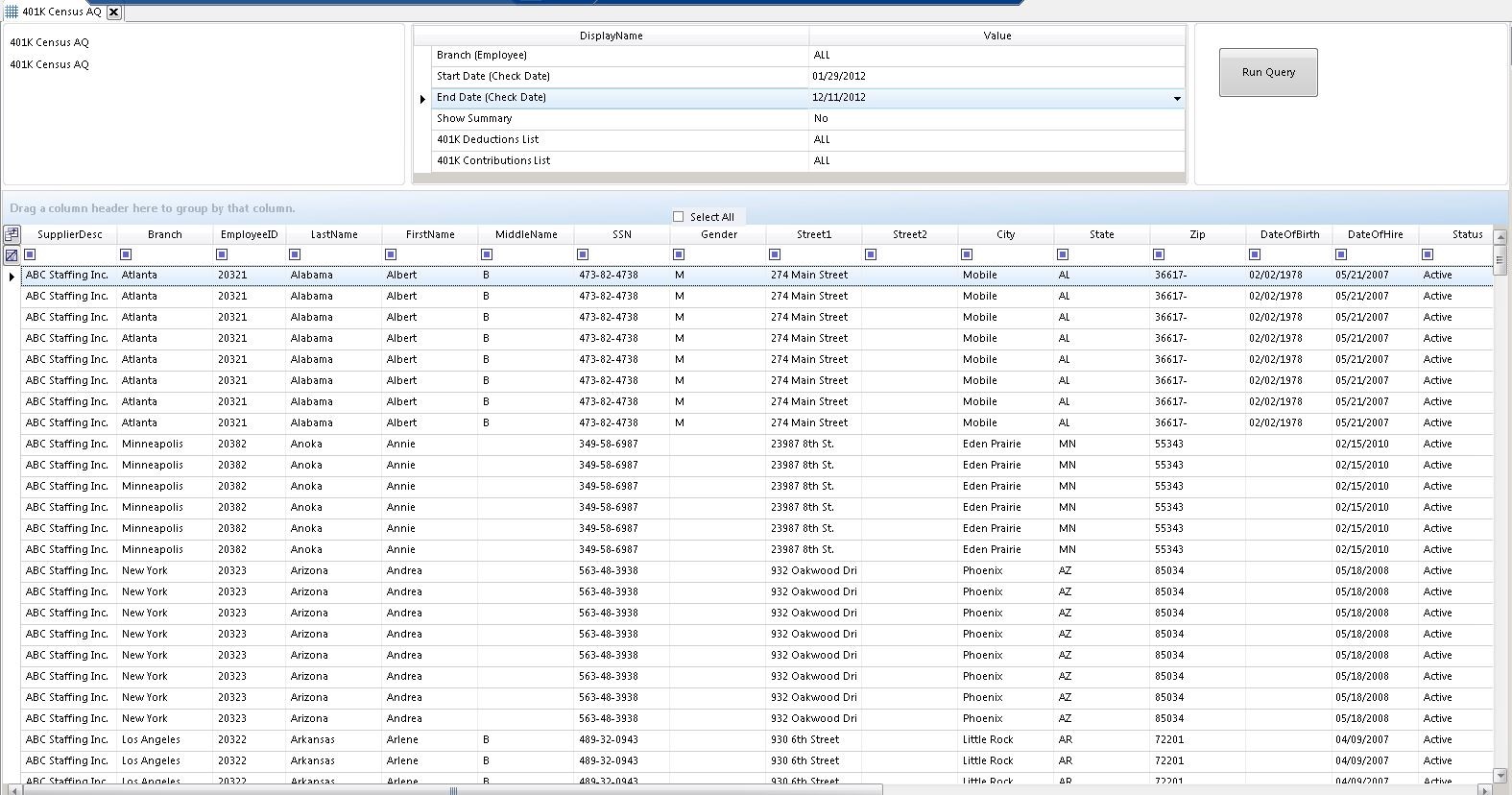

Standard AQ 401K Census AQ Avionte Classic

Non Calendar Year 401K Plans Calendar Printables Free Templates

401K Salary Calculator

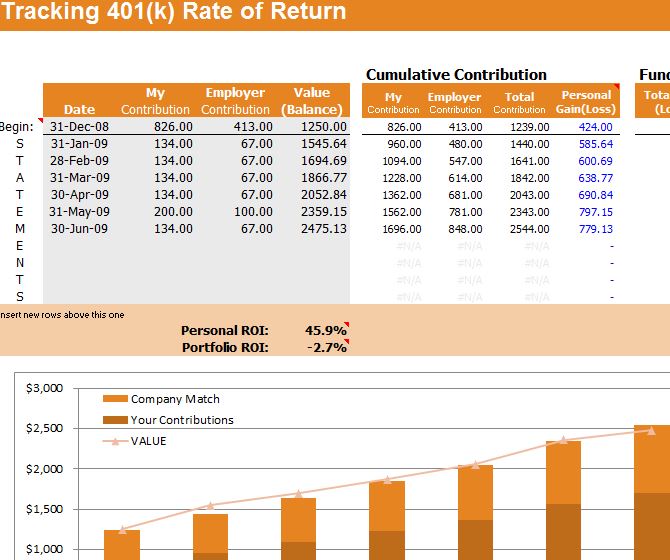

Free 401k Calculator for Excel Calculate Your 401k Savings

Customizable 401k Calculator and Retirement Analysis Template

401K Spreadsheet for 401 K Plan Conversion Guide Betterment For

To Ensure The Accuracy Of The Plan Census, Plan Administrators Can:

Web Edit Census Data Spreadsheet For Pension And 401(K) Plans.

Web How To Prepare For A 401(K) Plan Census.

Filling Out The Appropriate Census Request.

Related Post: