501C3 Tax Receipt Template

501C3 Tax Receipt Template - It offers premium templates of cash receipt type. Ad get a free guided quickbooks® setup. Web 501(c)(3) organization donation receipt. Automatically track all your income and expenses. § 501(c)(3) organizations that must apply annually. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. Web 501c3 donation receipt template pdf, word, excel. Web of course, if you lose your receipt you can download another from this website at any time. Some organizations that qualify as nonprofit organizations. Some organizations that qualify as nonprofit organizations. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Automatically track all your income and expenses. Ad create and send pdf receipts using 100 professional templates. Web 501c3 donation receipt template pdf, word, excel. Content includes references to the statute,. Ad get a free guided quickbooks® setup. § 501(c)(3) organizations that must apply annually. It offers premium templates of cash receipt type. Web of course, if you lose your receipt you can download another from this website at any time. For example, you can send a consolidated receipt of the year’s. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Web 501c3 donation receipt template pdf, word, excel. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt. This includes both receipts for every individual donation and consolidated receipts for the entire year of donations. Manage all your business expenses in one place with quickbooks®. Web 501(c)(3) organization donation receipt. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. Content includes references to the statute,. The users can access the template of 501c3 donation formats from this site. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Manage all your business expenses in one place with quickbooks®. Some organizations that qualify as nonprofit organizations. Web 501(c)(3). Ad create and send pdf receipts using 100 professional templates. This includes both receipts for every individual donation and consolidated receipts for the entire year of donations. Web 501c3 donation receipt template pdf, word, excel. Web donation receipt template for a 501 (c) (3) nonprofit home learn accounting part of running most successful nonprofit organizations includes fundraising and handling. Automatically. Manage all your business expenses in one place with quickbooks®. For example, you can send a consolidated receipt of the year’s. Web of course, if you lose your receipt you can download another from this website at any time. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an. Content includes references to the statute,. This includes both receipts for every individual donation and consolidated receipts for the entire year of donations. Ad get a free guided quickbooks® setup. Web 501(c)(3) organization donation receipt. Web 501c3 donation receipt template pdf, word, excel. Web 501c3 donation receipt template pdf, word, excel. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date: Manage all your business expenses in one place with quickbooks®. Automatically track all your income and expenses. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. Web donation receipt template for a 501 (c) (3) nonprofit home learn accounting part of running most successful nonprofit organizations includes fundraising and handling. § 501(c)(3) organizations that must apply annually. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Automatically track all your income and expenses. Web 501(c)(3) organization donation receipt. It offers premium templates of cash receipt type. This includes both receipts for every individual donation and consolidated receipts for the entire year of donations. Content includes references to the statute,. For example, you can send a consolidated receipt of the year’s. Some organizations that qualify as nonprofit organizations. Web of course, if you lose your receipt you can download another from this website at any time. Manage all your business expenses in one place with quickbooks®. Web 501c3 donation receipt template pdf, word, excel. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date: Ad get a free guided quickbooks® setup. Ad create and send pdf receipts using 100 professional templates. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. The users can access the template of 501c3 donation formats from this site. Web 501(c)(3) donation receipt template page 1 of 3 501(c)(3) organization donation receipt date: Ad create and send pdf receipts using 100 professional templates. Web those who donate an amount more than $250 are entitled to tax reductions, and the charitable organization must issue an official 501(c)(3) donation receipt as proof of. Web of course, if you lose your receipt you can download another from this website at any time. For example, you can send a consolidated receipt of the year’s. § 501(c)(3) organizations that must apply annually. Web 501c3 donation receipt template pdf, word, excel. Web donation receipt template for a 501 (c) (3) nonprofit home learn accounting part of running most successful nonprofit organizations includes fundraising and handling. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. It offers premium templates of cash receipt type. The users can access the template of 501c3 donation formats from this site. Manage all your business expenses in one place with quickbooks®. Some organizations that qualify as nonprofit organizations. Ad get a free guided quickbooks® setup.501c3 Donation Receipt Template Business

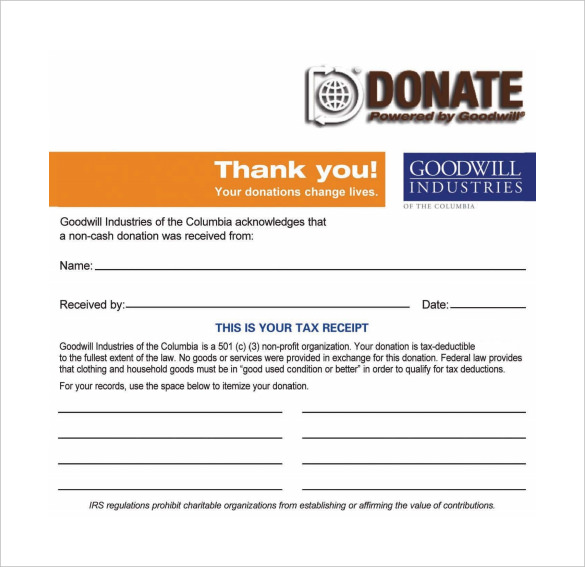

501c3 Donation Receipt Template printable receipt template

Irs Tax Form For 501c3 Universal Network

501c3 Donation Receipt Template Addictionary

501c3 Donation Receipt Template Business

How to Write a 501c3 Donation Receipt Letter PDF Word YouTube

501c3 donation receipt template addictionary download 501c3 donation

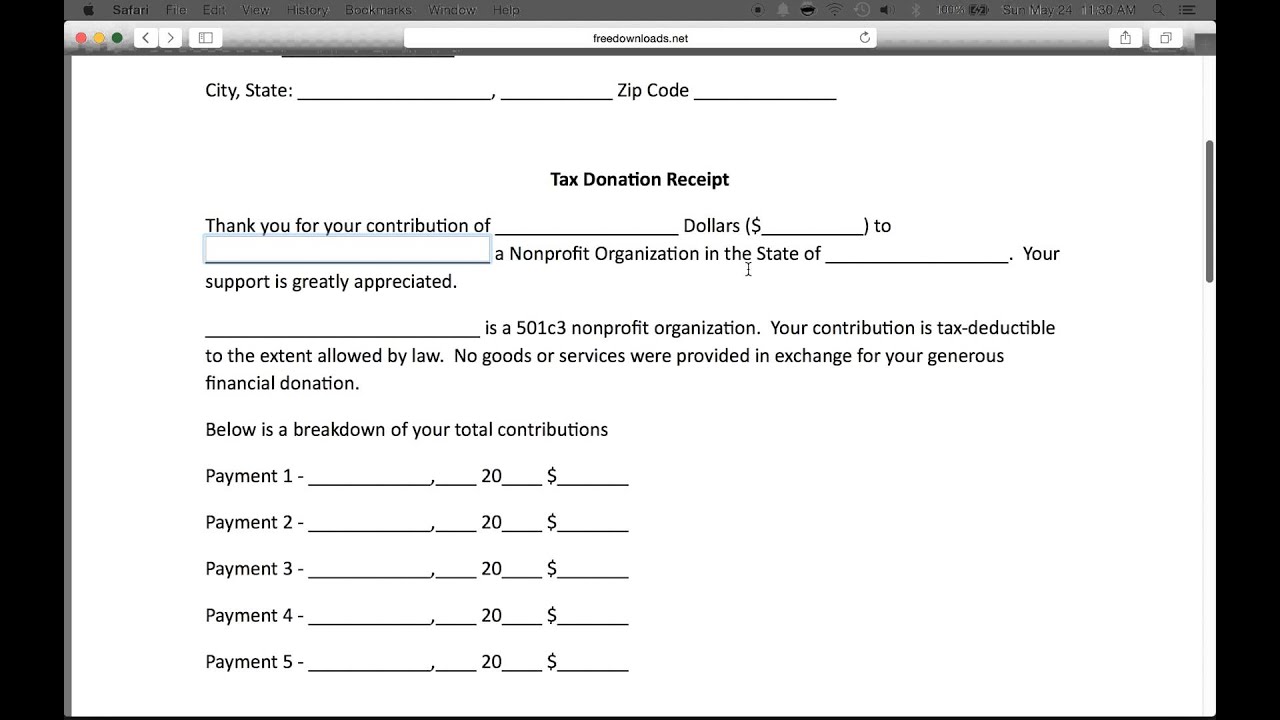

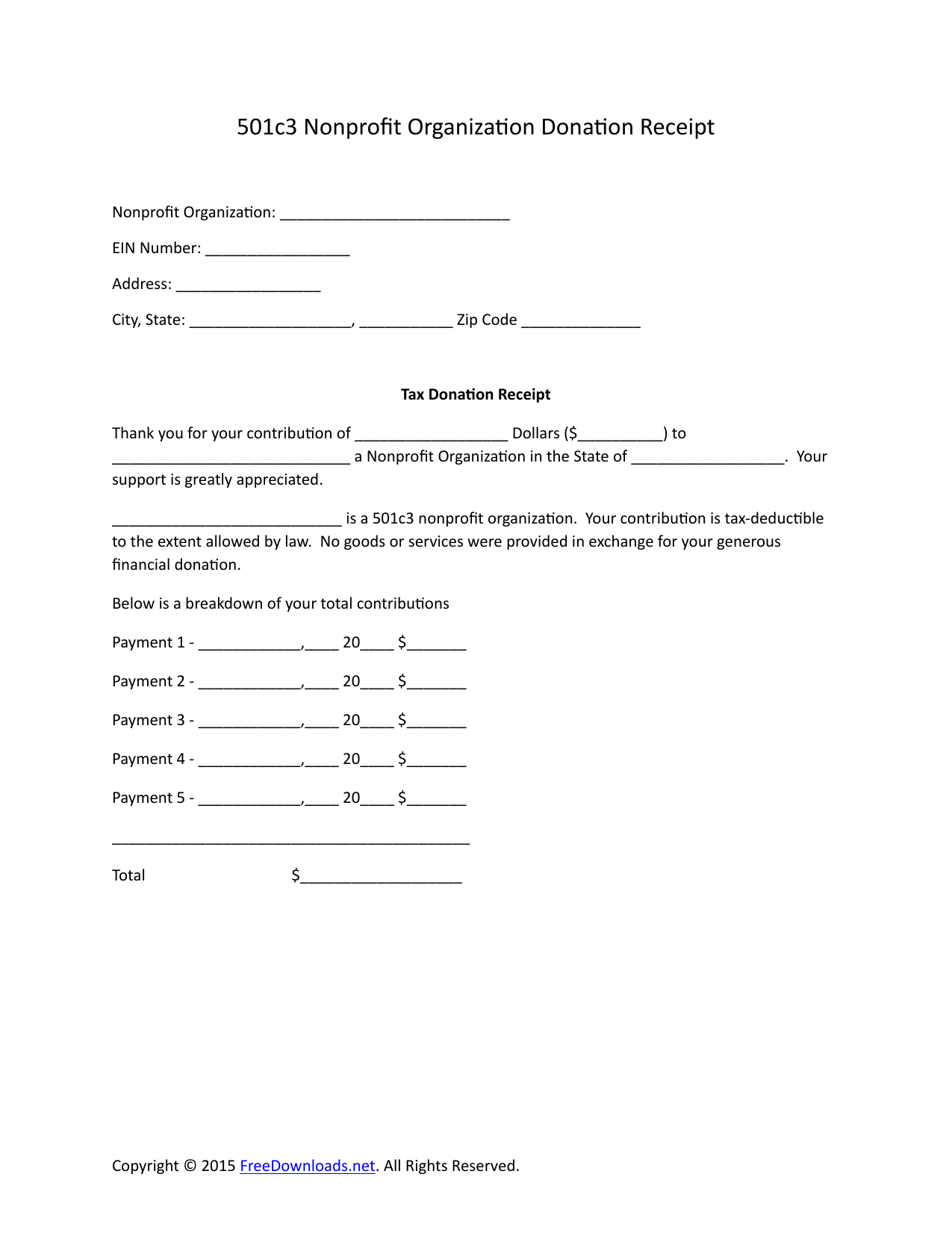

Download 501c3 Donation Receipt Letter for Tax Purposes PDF RTF

Printable 501c3 Donation Receipt Template Printable Templates

download 501c3 donation receipt letter for tax purposes pdf rtf 501 c

Content Includes References To The Statute,.

Web 501(C)(3) Organization Donation Receipt.

This Includes Both Receipts For Every Individual Donation And Consolidated Receipts For The Entire Year Of Donations.

Automatically Track All Your Income And Expenses.

Related Post: