Acquisition Target Screening Template

Acquisition Target Screening Template - This usually involves two steps: Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. However, the criteria for screening are specific. Web target screening involves thoroughly analyzing potential acquisition targets to determine whether they align with your company's strategic goals, financial. Select one of these options: Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Quantitation, target screening, or unknown screening. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. This usually involves two steps: Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. Web the targets search is a clear definition of the basic principles and criteria. Domontconsulting.com has been visited by 10k+ users in the past month 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web you want to capture six data points about each possible target: Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of. Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Select one of these options: Web before fully committing to a transaction,. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Quantitation, target screening, or unknown screening. Use our acquisition due diligence checklist to help make sure you get the. Web the business case should explain how the acquiring company plans to add value to the. Domontconsulting.com has been visited by 10k+ users in the past month Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Web you want to capture six data points about each possible. Select one of these options: However, the criteria for screening are specific. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Web you want to capture six data points about each possible target: This usually involves two steps: Web you want to capture six data points about each possible target: Web to start a new batch from a template in the navigation pane, click create a new batch. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Domontconsulting.com has been visited by 10k+ users. Web you want to capture six data points about each possible target: One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Web a reusable m&a playbook can be quickly deployed when. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Use our acquisition due diligence checklist to help make sure you get the. Web the business case should explain how the acquiring company plans to add value to the target or targets within a given. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. Web one of. Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Web to start a new batch from a template in the navigation pane, click create a new batch. Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. Select one of these options: Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Web you want to capture six data points about each possible target: One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early. Valuing the target on a standalone. However, the criteria for screening are specific. This usually involves two steps: Web the business case should explain how the acquiring company plans to add value to the target or targets within a given m&a theme—for instance, the capital and. Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. Use our acquisition due diligence checklist to help make sure you get the. Web target screening involves thoroughly analyzing potential acquisition targets to determine whether they align with your company's strategic goals, financial. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Quantitation, target screening, or unknown screening. Domontconsulting.com has been visited by 10k+ users in the past month One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early. Use our acquisition due diligence checklist to help make sure you get the. However, the criteria for screening are specific. Web the business case should explain how the acquiring company plans to add value to the target or targets within a given m&a theme—for instance, the capital and. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Quantitation, target screening, or unknown screening. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Domontconsulting.com has been visited by 10k+ users in the past month 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Select one of these options: Web you want to capture six data points about each possible target: Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. Web to start a new batch from a template in the navigation pane, click create a new batch. This usually involves two steps:Simple Strategic Plan Template

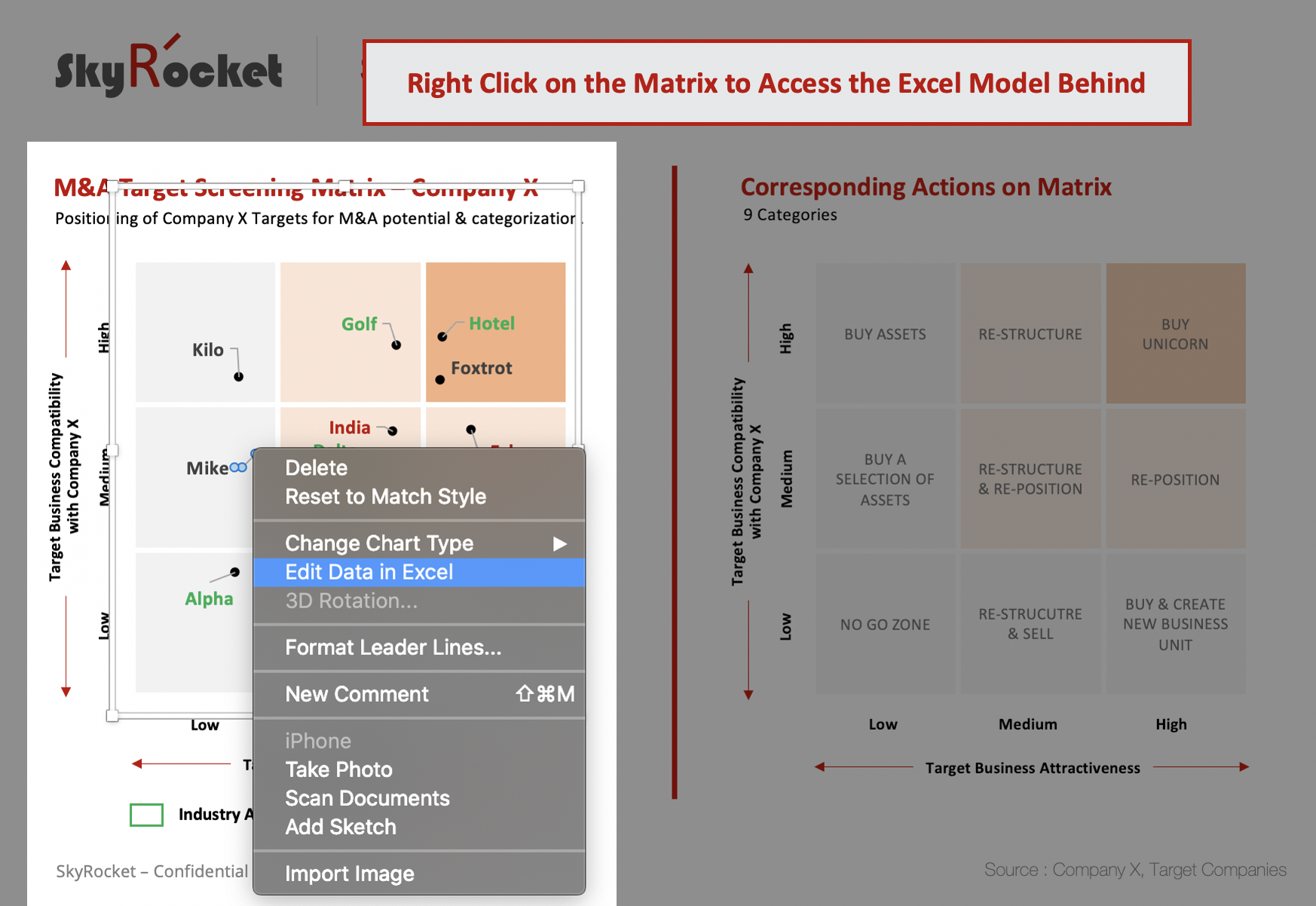

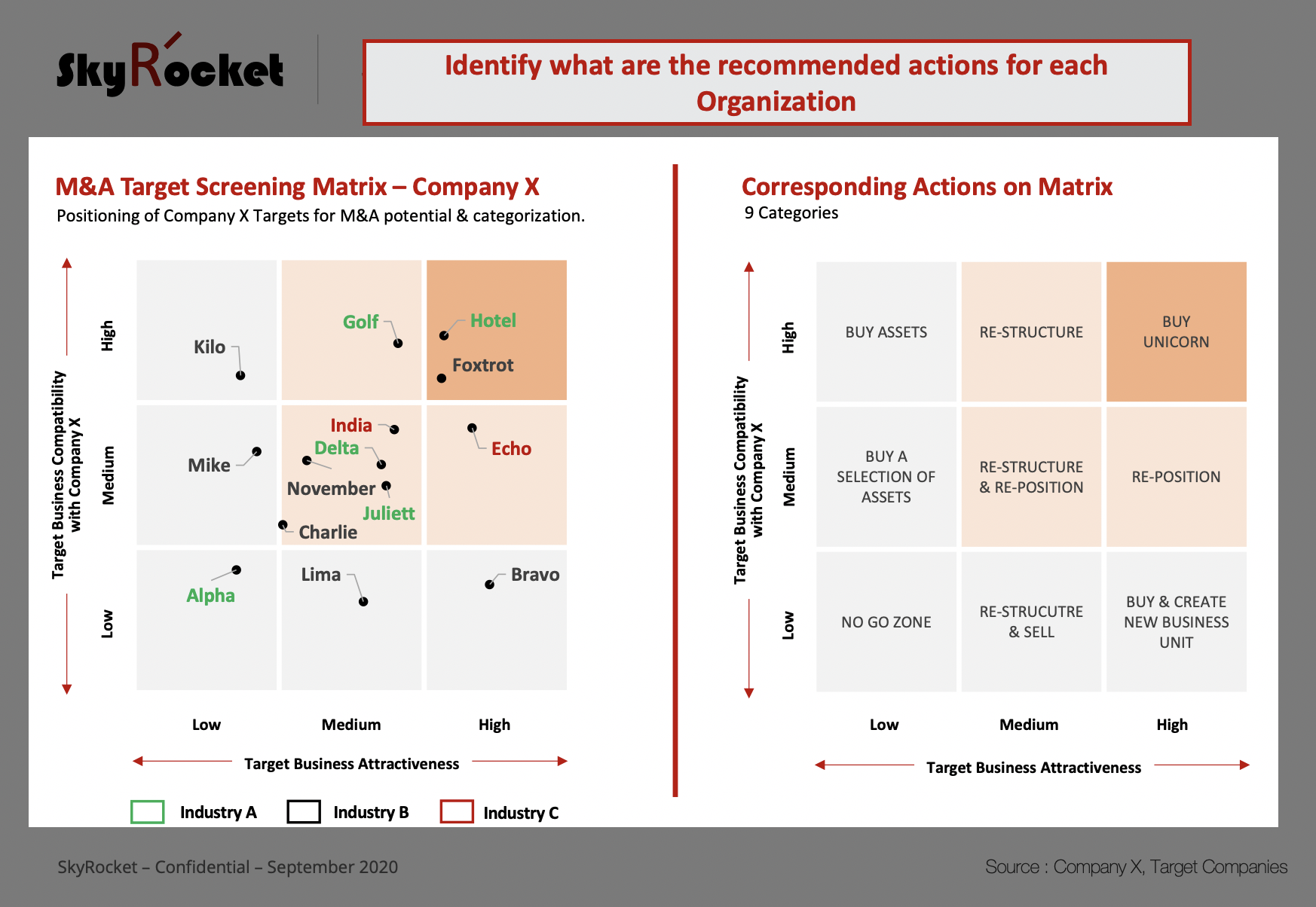

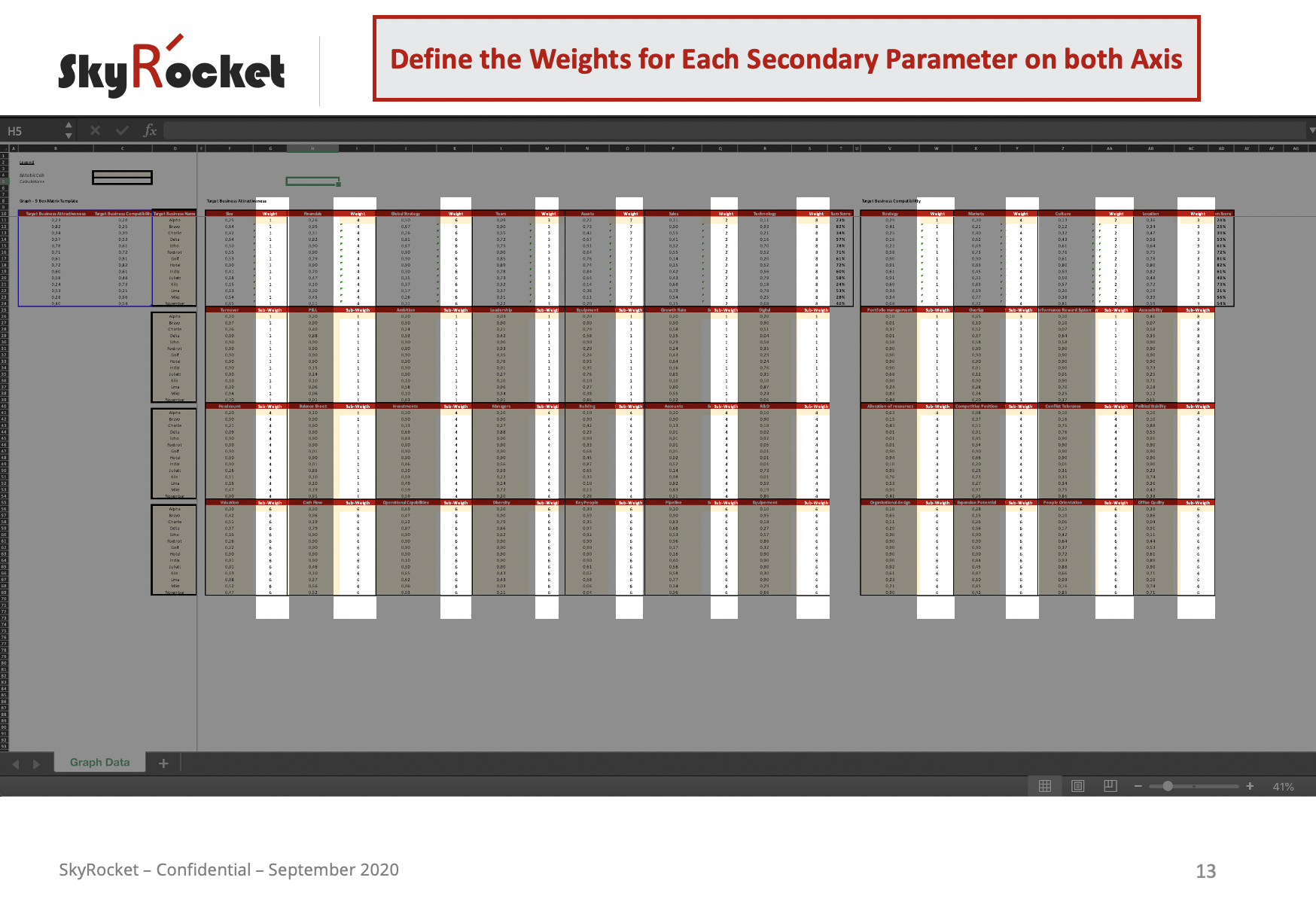

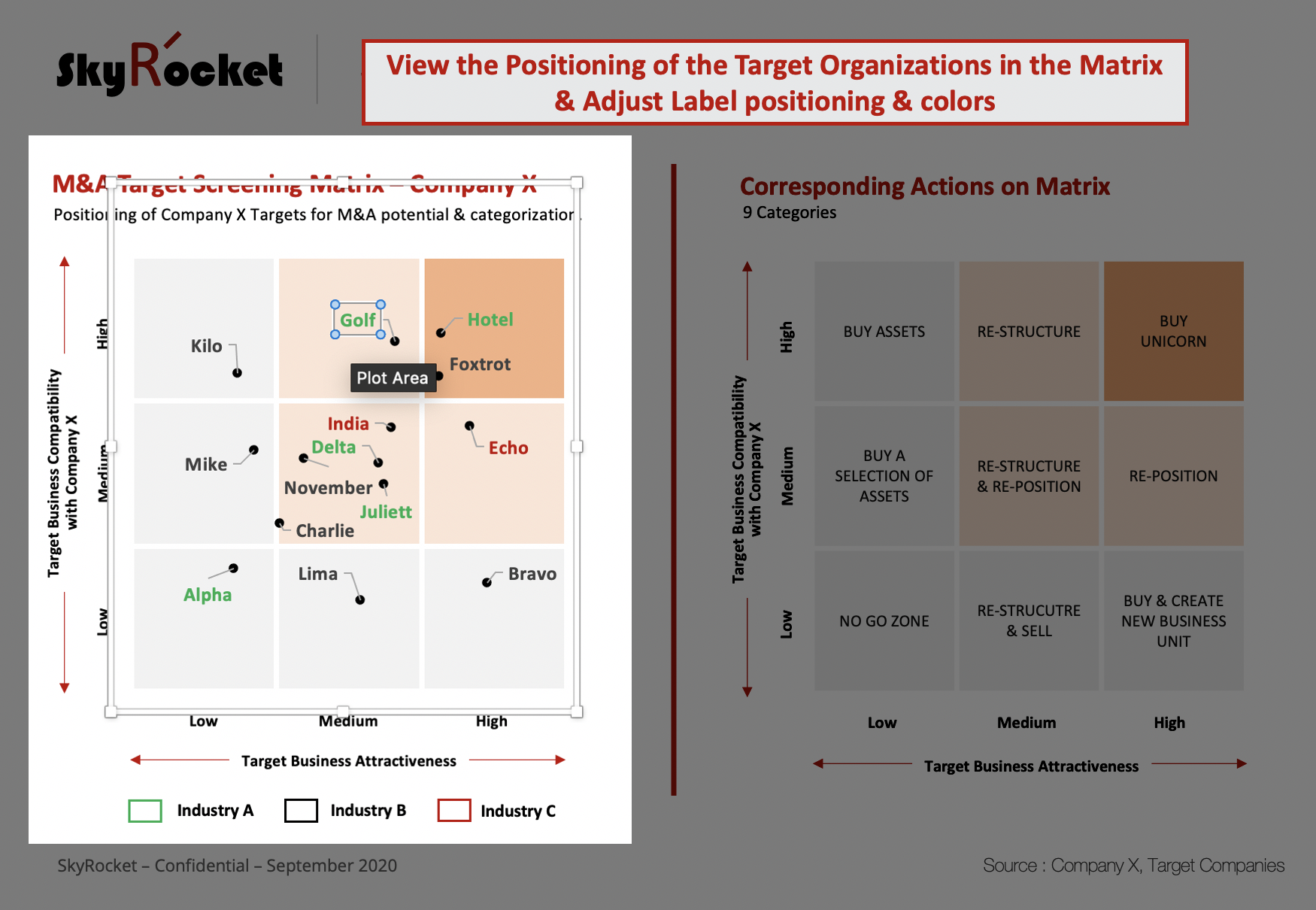

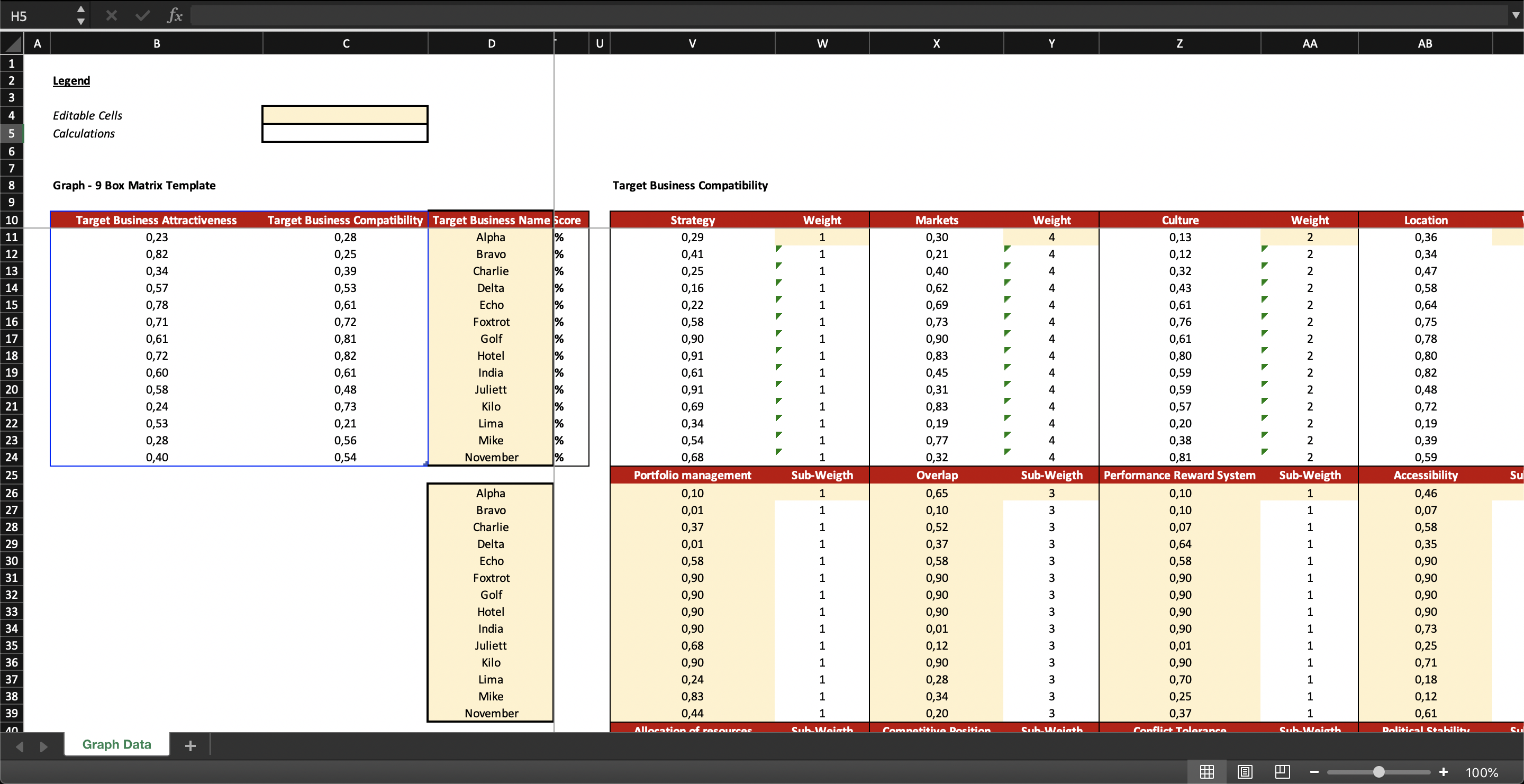

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

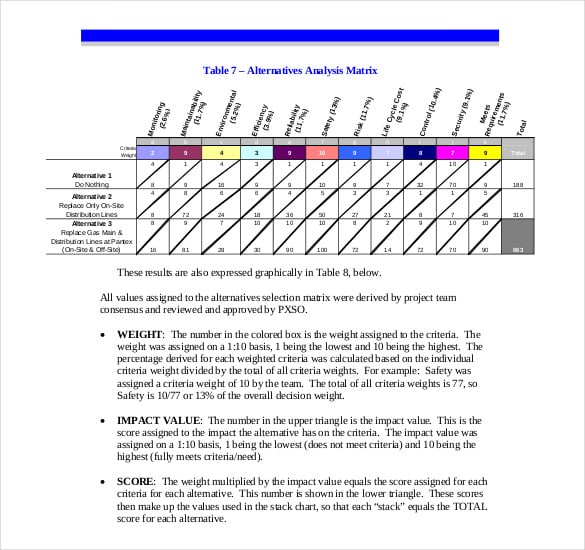

Pin on Business Analysis Tools Strategy Frameworks

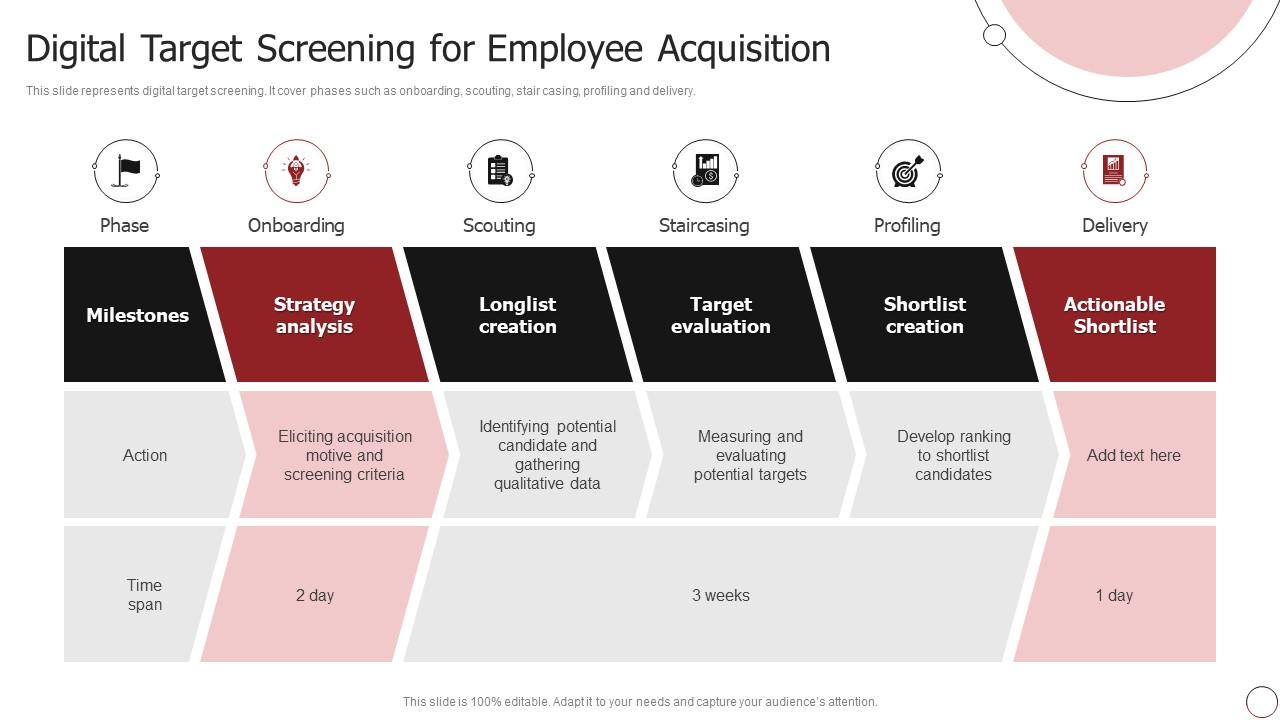

Digital Target Screening For Employee Acquisition

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A Screening New Strategies Require a Wider View (2023)

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

Target Acquisition Synonyms, Target Acquisition Pronunciation, Target Acquisition Translation, English Dictionary Definition Of Target Acquisition.

Web Target Screening Involves Thoroughly Analyzing Potential Acquisition Targets To Determine Whether They Align With Your Company's Strategic Goals, Financial.

Web Collect Screening Data From Entire Universe Of Potential Targets, And Apply The Acquisition Criteria To Evaluate Potential Fit Prioritize Initial Acquisition Candidates And Develop.

Valuing The Target On A Standalone.

Related Post: