Company Valuation Excel Template

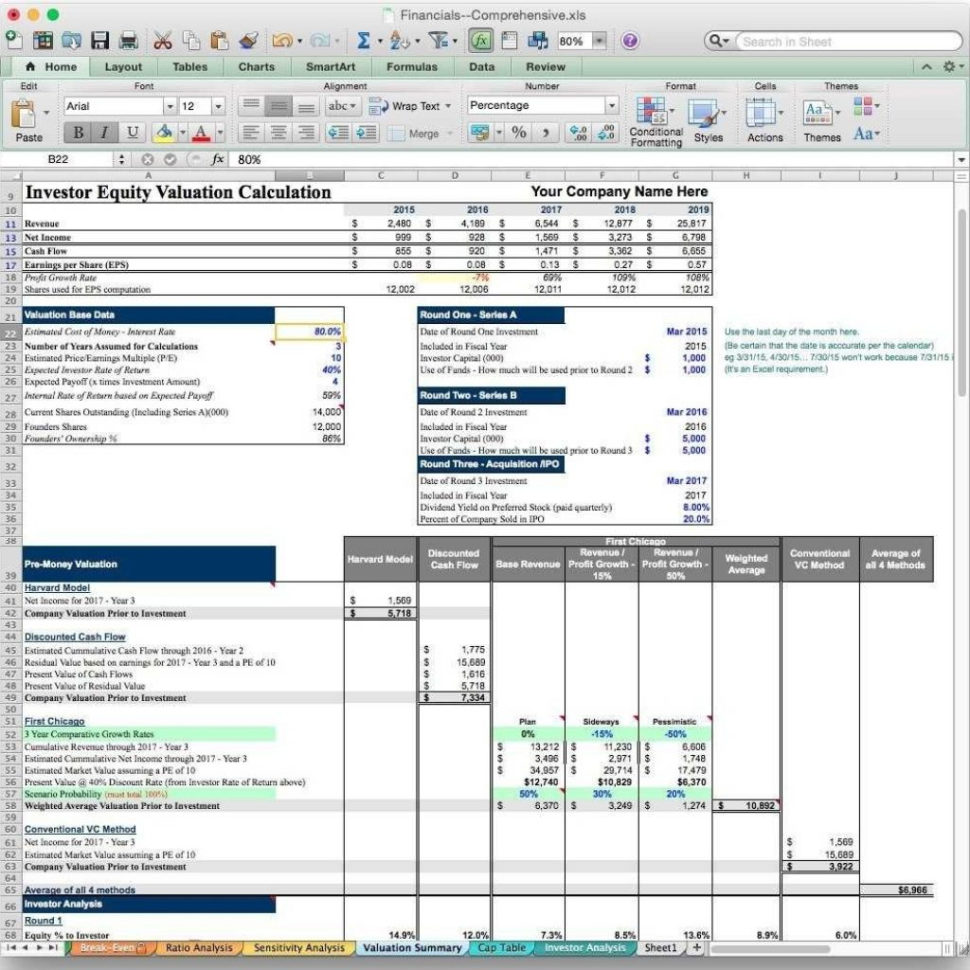

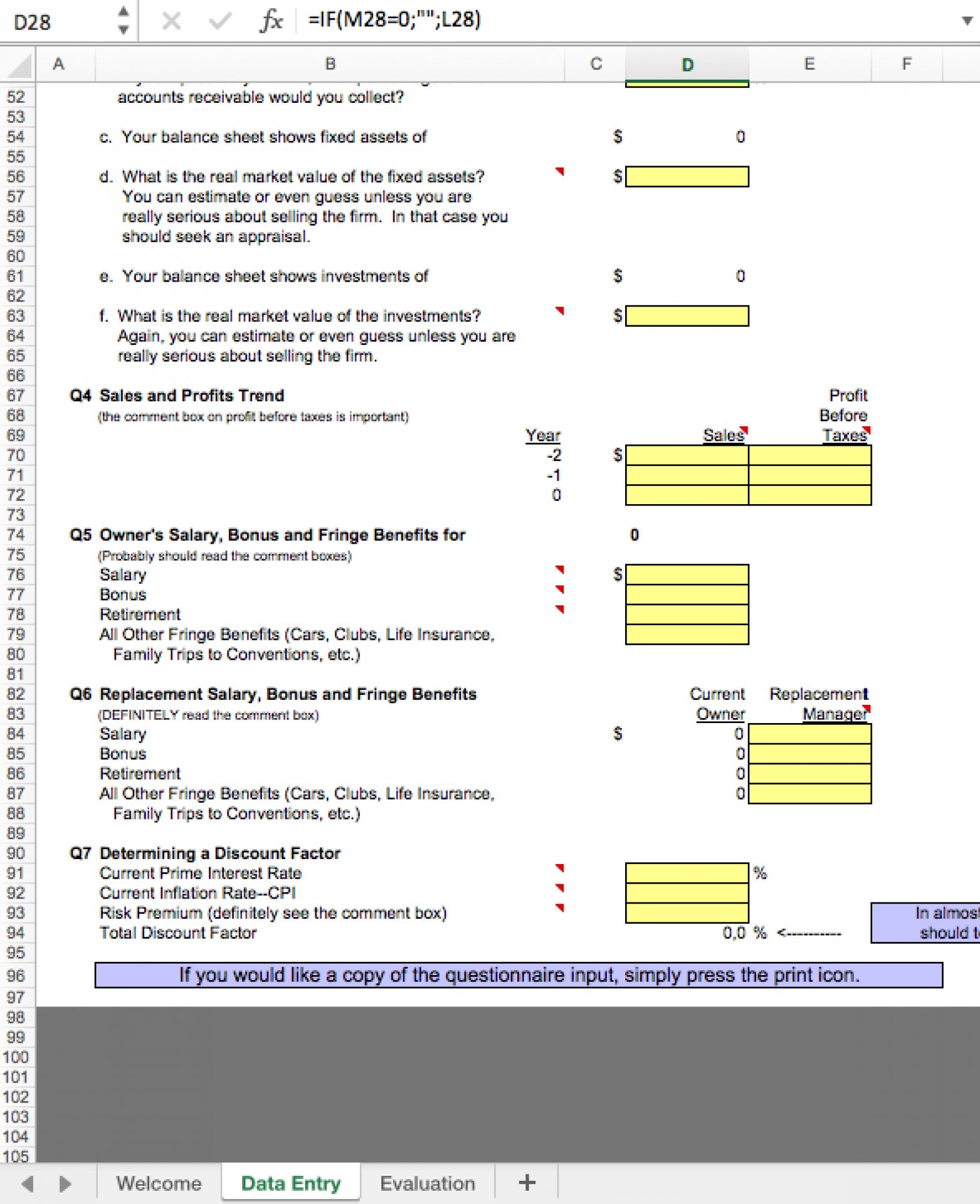

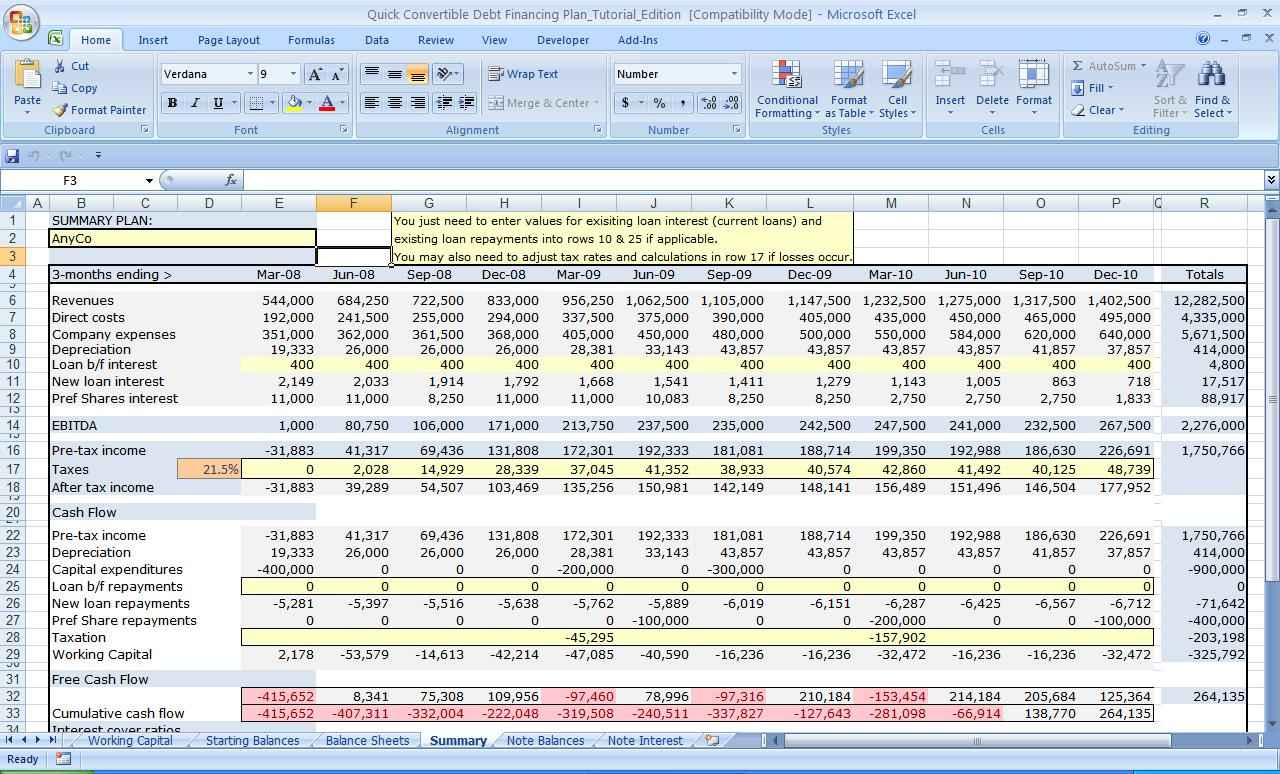

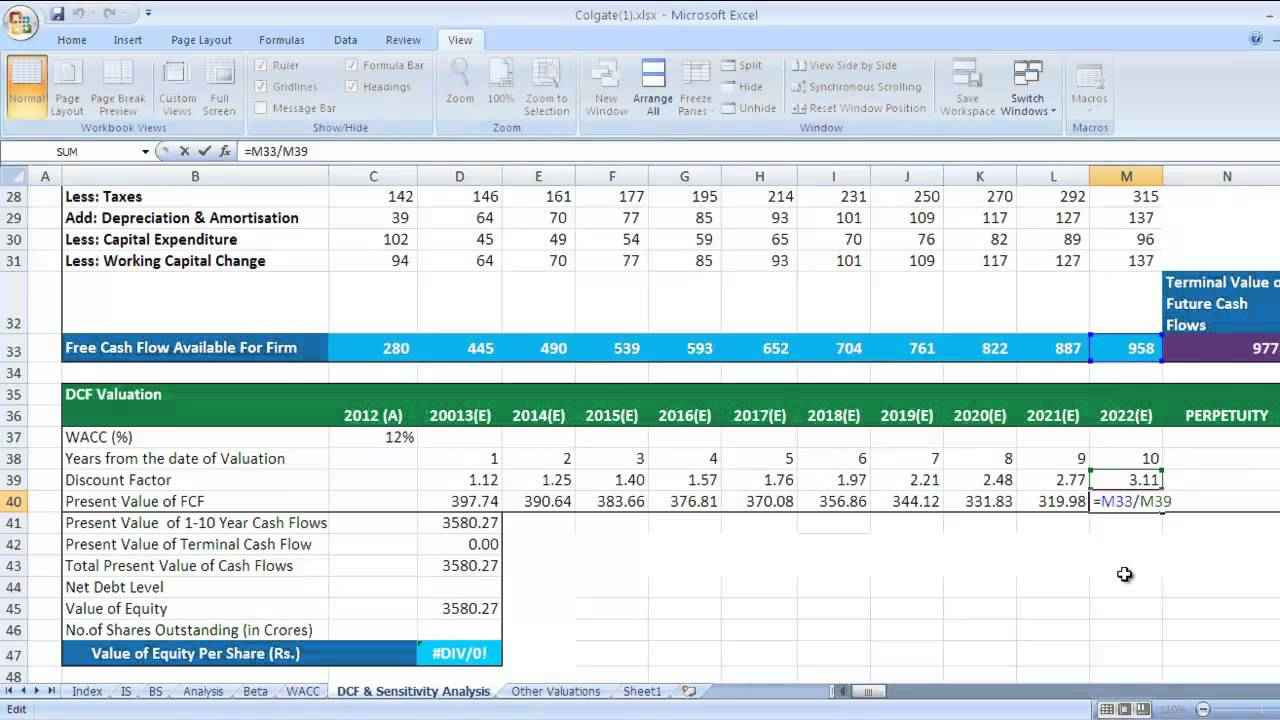

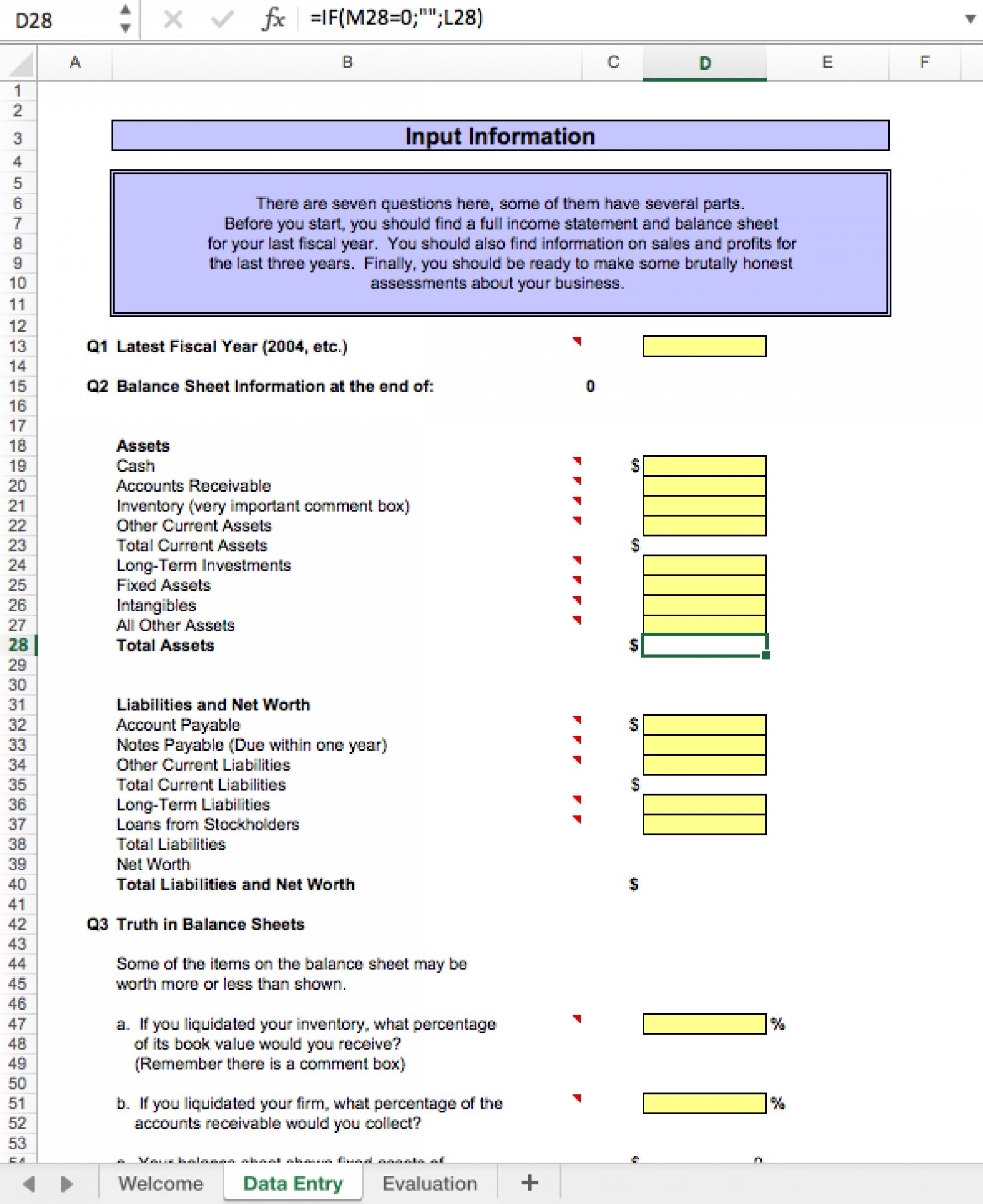

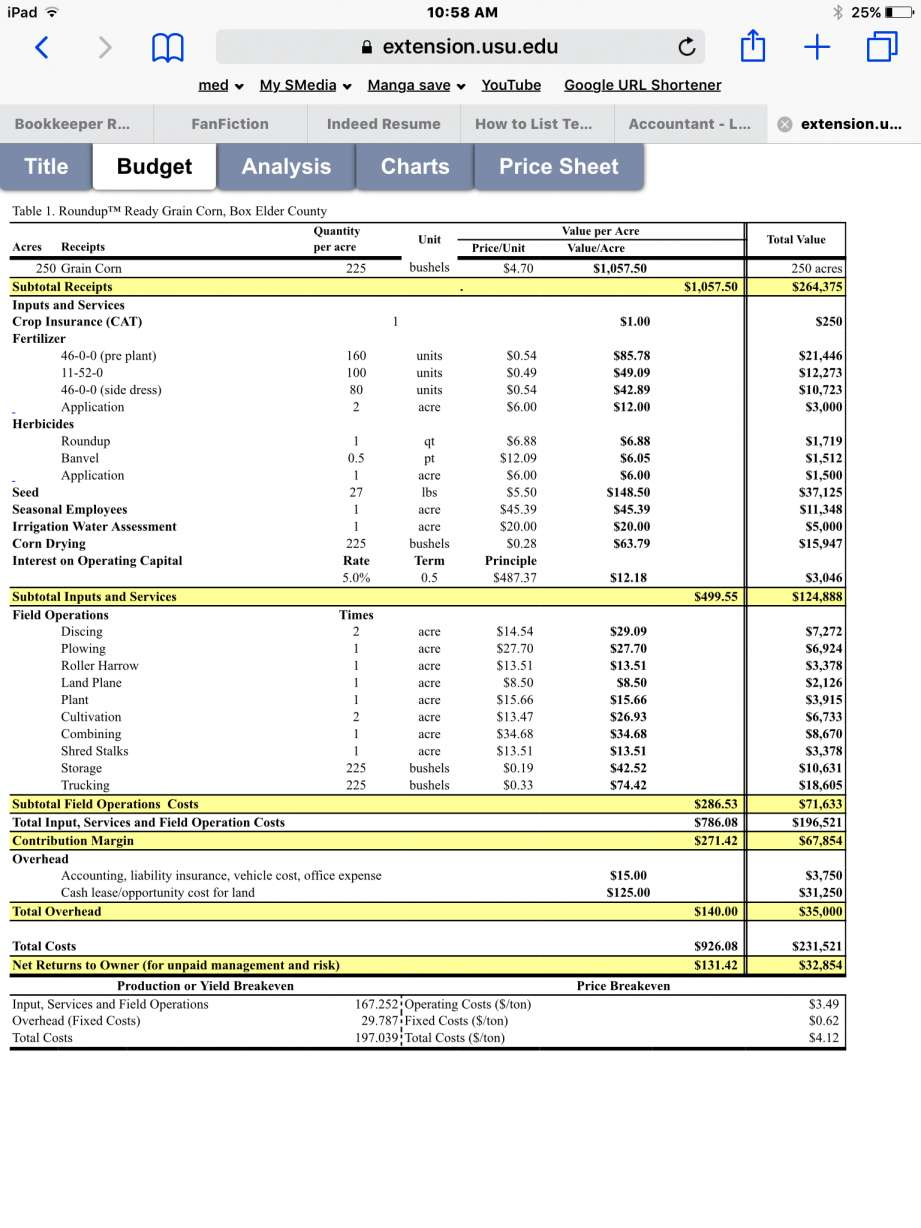

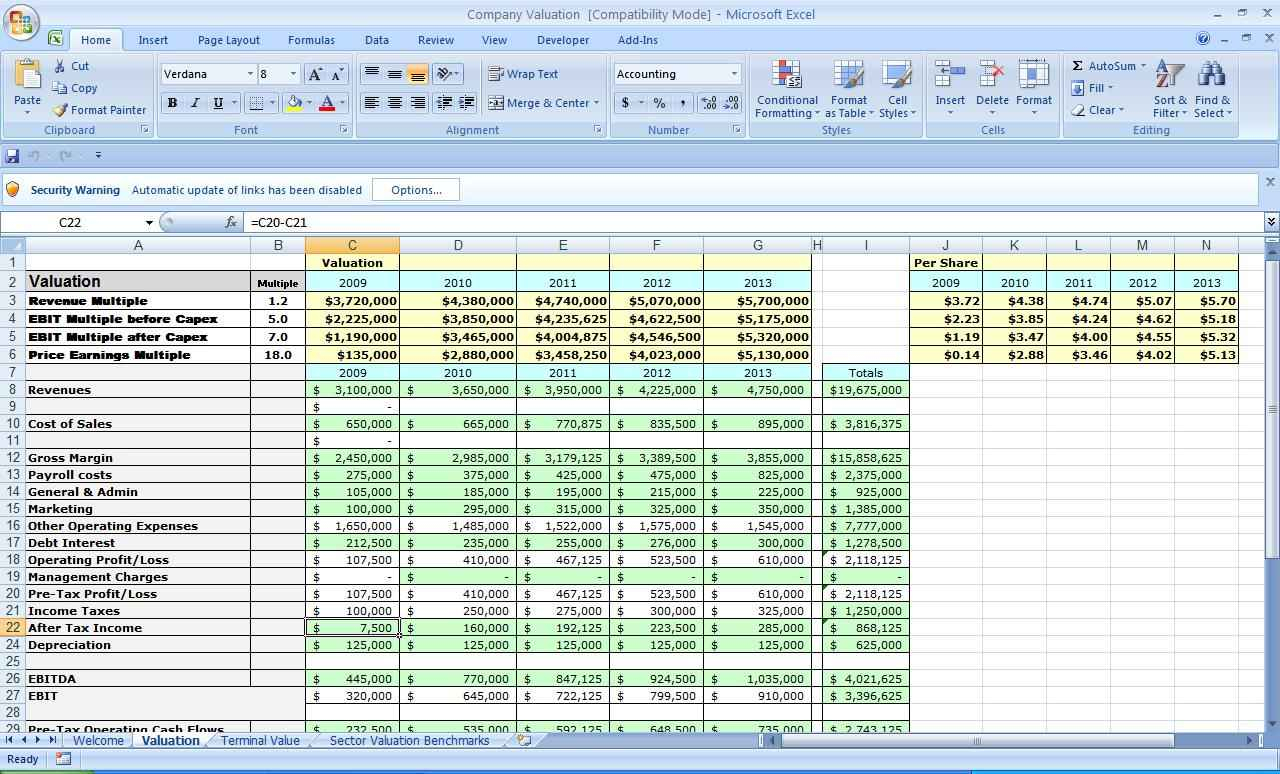

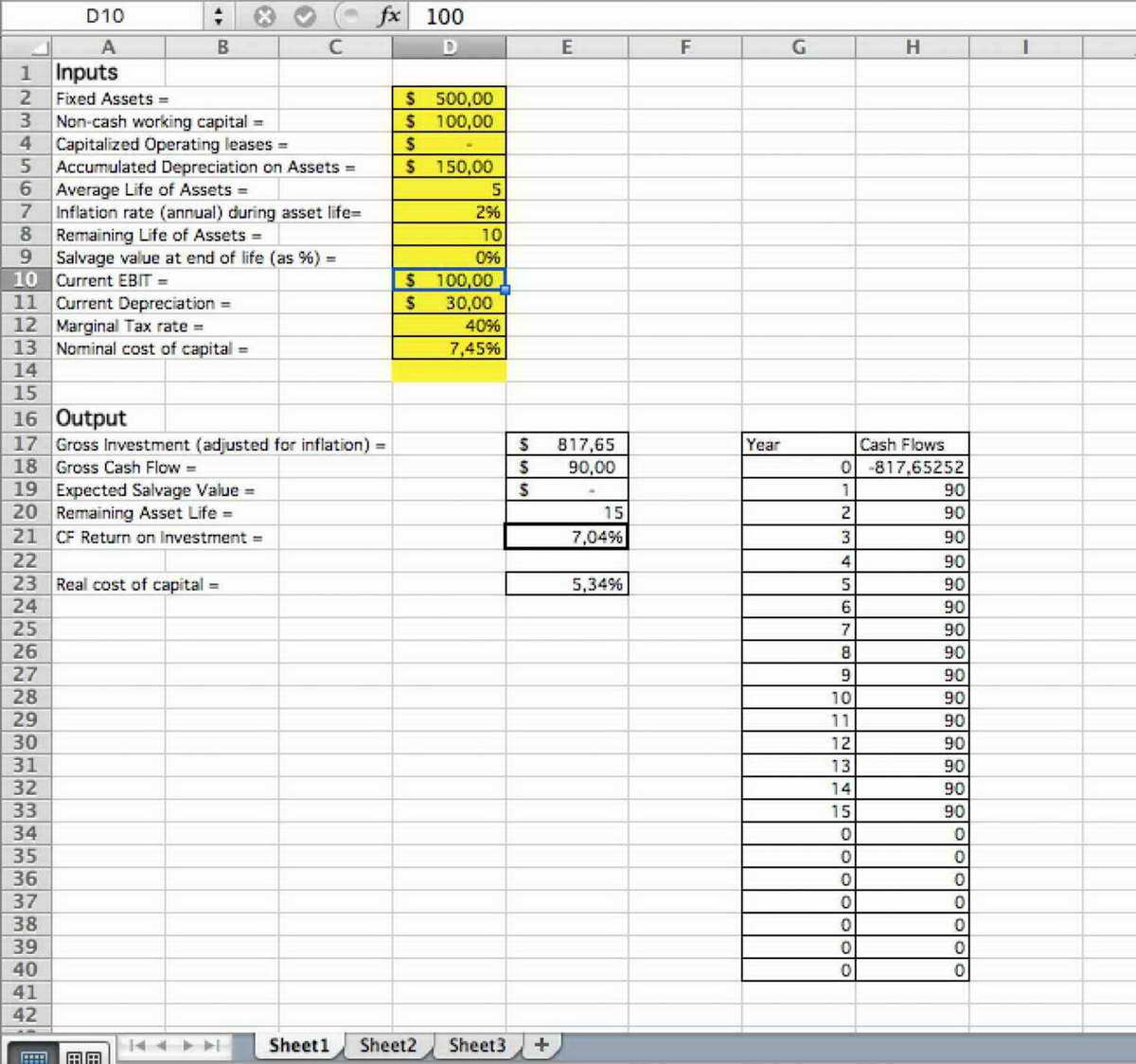

Company Valuation Excel Template - It includes discounted cash flow (dcf) analysis,. Basic discounted cash flow valuation template. Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company. Examples of assets are stocks,. Web $ 190 oak business consultant presents the new product named company valuation excel template. Valuation is the process of calculating the current worth of an asset or liability. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. I am always amazed how many business owners. Valuing your business with our. It may be either a business valuation calculator or an excel template. You can valuate your company without any prior financial background. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company. Web free download this business valuation template design in excel, google sheets format. They typically indicate the. Examples of assets are stocks,. Valuing your business with our. Web valuation ratios measure the value of common equity. Basic discounted cash flow valuation template. Web business valuation excel template: Web valuation model excel templates 1 comment what is valuation? Basic discounted cash flow valuation template. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial models. Valuing your business with our. It may be either a business valuation calculator or an excel template. Web valuation ratios measure the value of common equity. Web explore cfi's free resource library of excel templates, interview prep, and deep dives into the topics you need to know for a career in finance and banking. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial models. Get an overview of your company’s. Web explore cfi's free resource library of excel templates, interview prep, and deep dives into the topics you need to know for a career in finance and banking. Valuing your business with our. Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. Web business valuation excel template: Comparable company analysis (or. It includes discounted cash flow (dcf) analysis,. Web valuation model excel templates 1 comment what is valuation? Basic discounted cash flow valuation template. You can valuate your company without any prior financial background. Web valuation ratios measure the value of common equity. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial models. I am always amazed how many business owners. Web download calculator quantic startup valuation calculator how to value a startup there are many ways to calculate the value, but no magic number will meet. Basic discounted cash flow valuation template. Web valuation model. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company. Web free download this business valuation template design in excel, google sheets format. Web enter your name and email in the form below and download the free template now! The template is handy for business owners who want to. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial models. Web up to 10% cash back you can learn basic terminology of financial modeling and company valuation methods. They typically indicate the intrinsic value per 1 common share of a firm’s outstanding stock. Using a firm’s balance sheet. You can valuate your company. Examples of assets are stocks,. It includes discounted cash flow (dcf) analysis,. Web explore cfi's free resource library of excel templates, interview prep, and deep dives into the topics you need to know for a career in finance and banking. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or. Calculate ebitda of your company. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial models. Web up to 10% cash back you can learn basic terminology of financial modeling and company valuation methods. They typically indicate the intrinsic value per 1 common share of a firm’s outstanding stock. Web download calculator quantic startup valuation calculator how to value a startup there are many ways to calculate the value, but no magic number will meet. 10 simple steps to success 1: Web $ 190 oak business consultant presents the new product named company valuation excel template. Comparable company analysis (or “comps” for short) is a valuation. Valuing your business with our. It may be either a business valuation calculator or an excel template. Web business valuation excel template: Get an overview of your company’s or. Web explore cfi's free resource library of excel templates, interview prep, and deep dives into the topics you need to know for a career in finance and banking. The template is handy for business owners who want to know the. Web dcf model template. Web free download this business valuation template design in excel, google sheets format. You can valuate your company without any prior financial background. Web valuation ratios measure the value of common equity. I am always amazed how many business owners. Web valuation model excel templates 1 comment what is valuation? Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial models. Basic discounted cash flow valuation template. Using a firm’s balance sheet. Web business valuation excel template: It includes discounted cash flow (dcf) analysis,. Comparable company analysis (or “comps” for short) is a valuation. Web explore cfi's free resource library of excel templates, interview prep, and deep dives into the topics you need to know for a career in finance and banking. Valuing your business with our. Get an overview of your company’s or. It may be either a business valuation calculator or an excel template. Examples of assets are stocks,. Web enter your name and email in the form below and download the free template now! This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Calculate ebitda of your company. You can valuate your company without any prior financial background. They typically indicate the intrinsic value per 1 common share of a firm’s outstanding stock.Free Excel Business Valuation Spreadsheet —

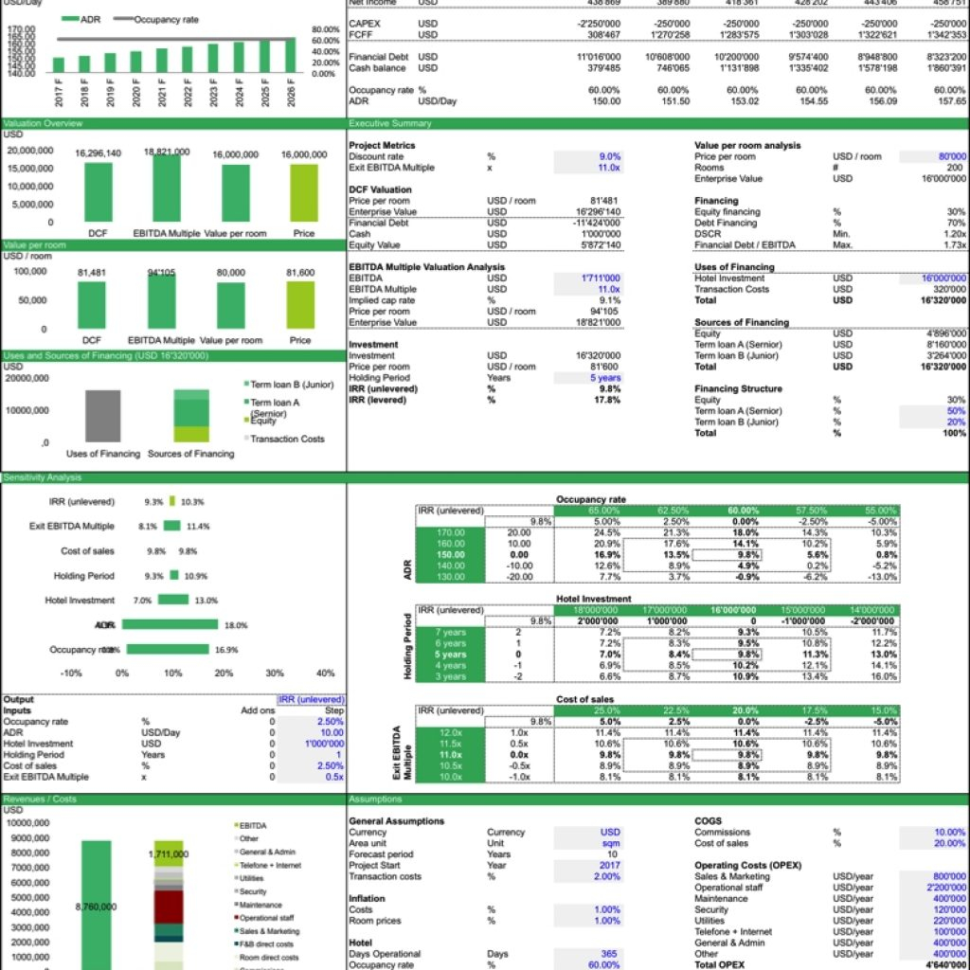

Business Valuation Excel Template for Private Equity Eloquens

Business Valuation Template Excel Free Printable Templates

Business Valuation Spreadsheet Excel Pertaining To Business Valuation

Business Valuation Excel Template for Private Equity Eloquens

Download Microsoft Excel Business Valuation Template Fr...

Company Valuation Excel Spreadsheet —

You May Download Shareware Here BUSINESS VALUATION EXCEL TEMPLATE

Business Valuation Spreadsheet Excel Google Spreadshee business

Business Valuation Template Excel Free Printable Templates

Web Up To 10% Cash Back You Can Learn Basic Terminology Of Financial Modeling And Company Valuation Methods.

Web Free Download This Business Valuation Template Design In Excel, Google Sheets Format.

This Template Enables Business Owners And Buyers Or Sellers Of Businesses To Calculate An Estimated Valuation Of A Business Or Company.

Web Dcf Model Template.

Related Post: