Credit Card Payoff Excel Spreadsheet Template

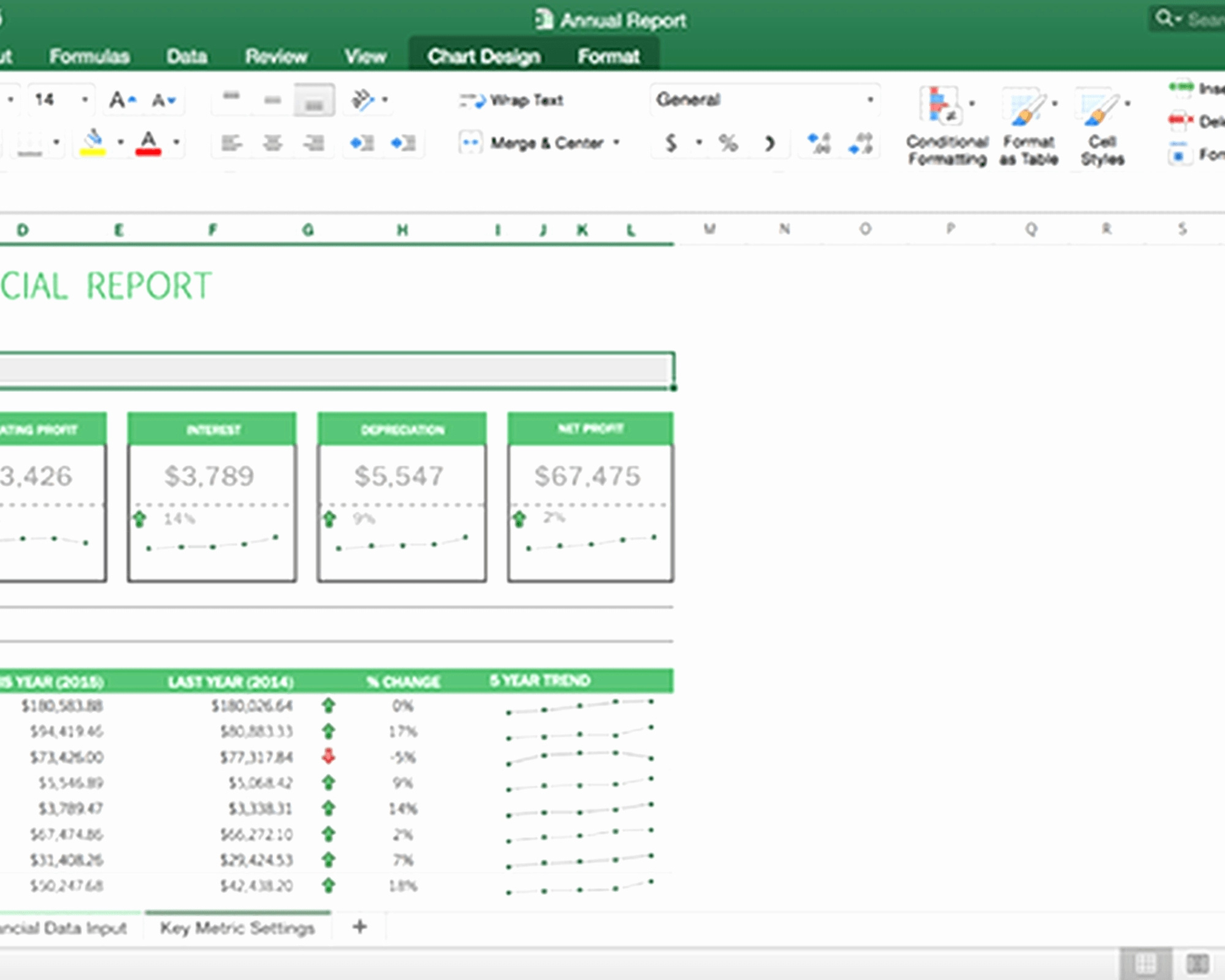

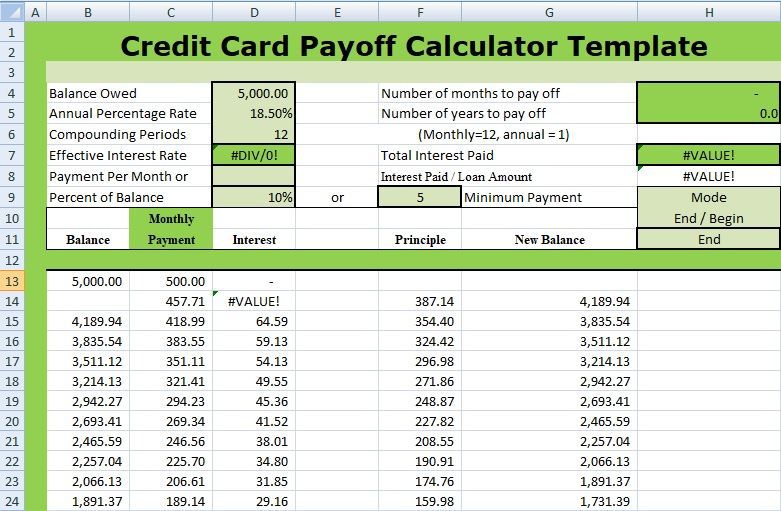

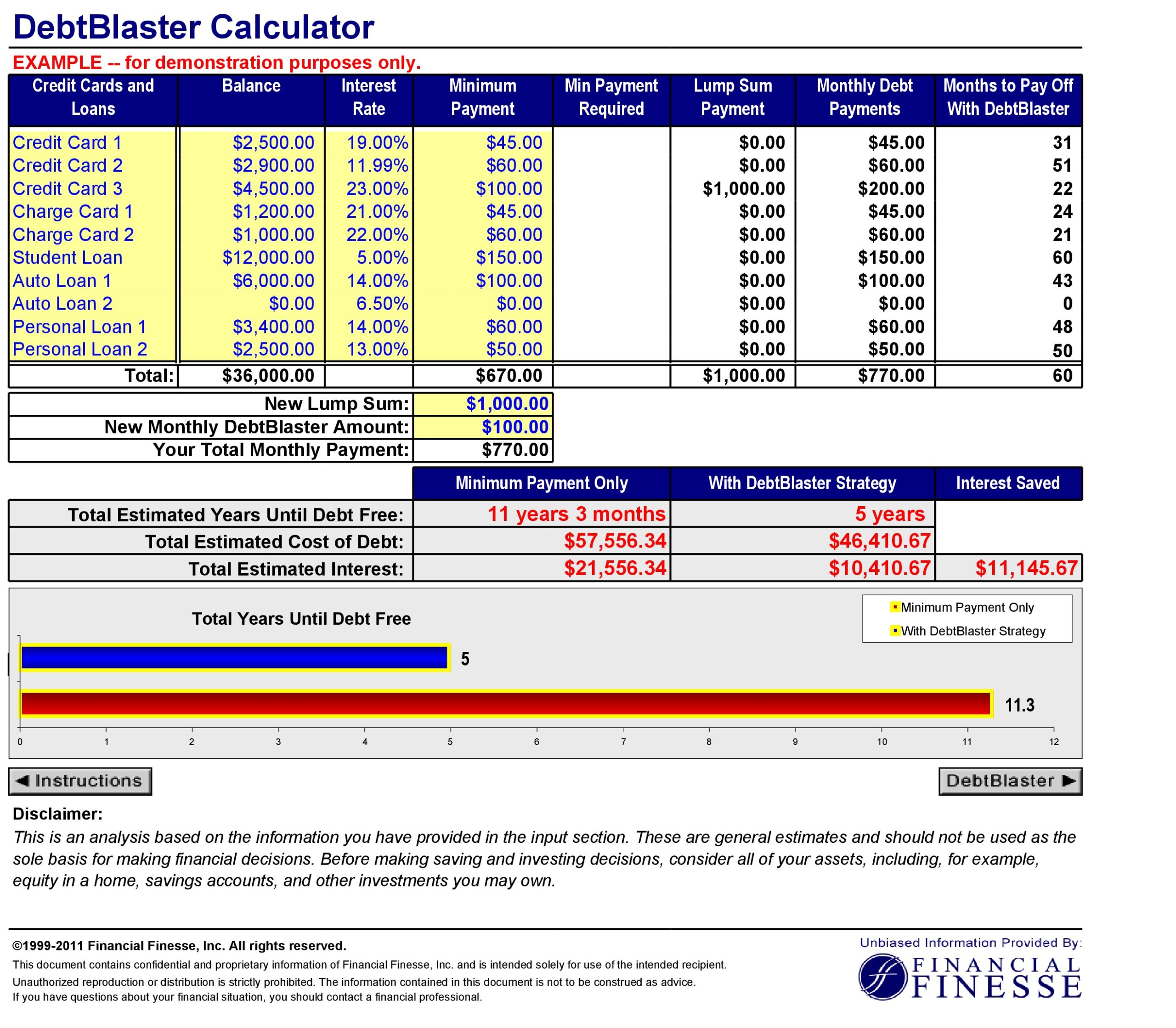

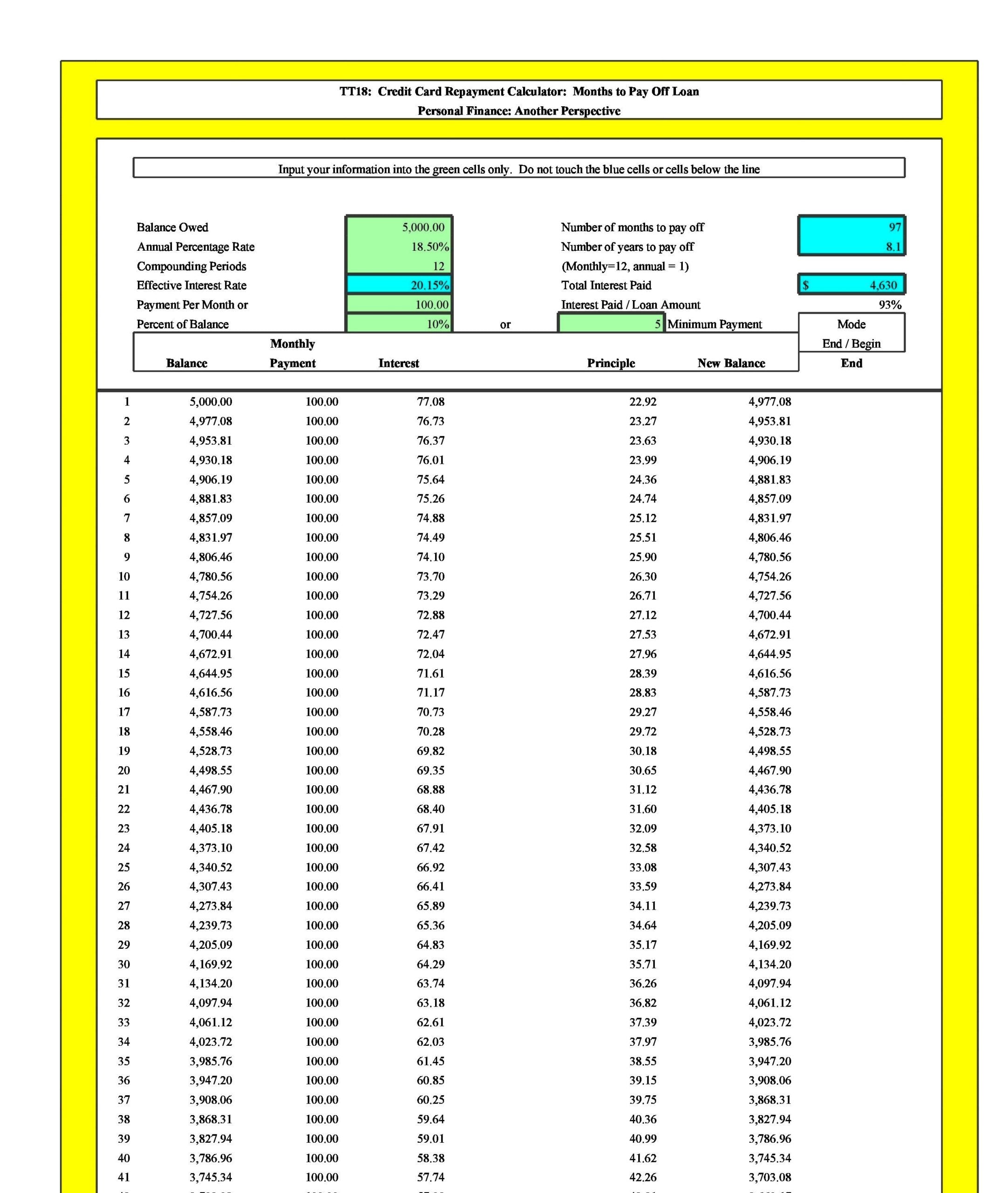

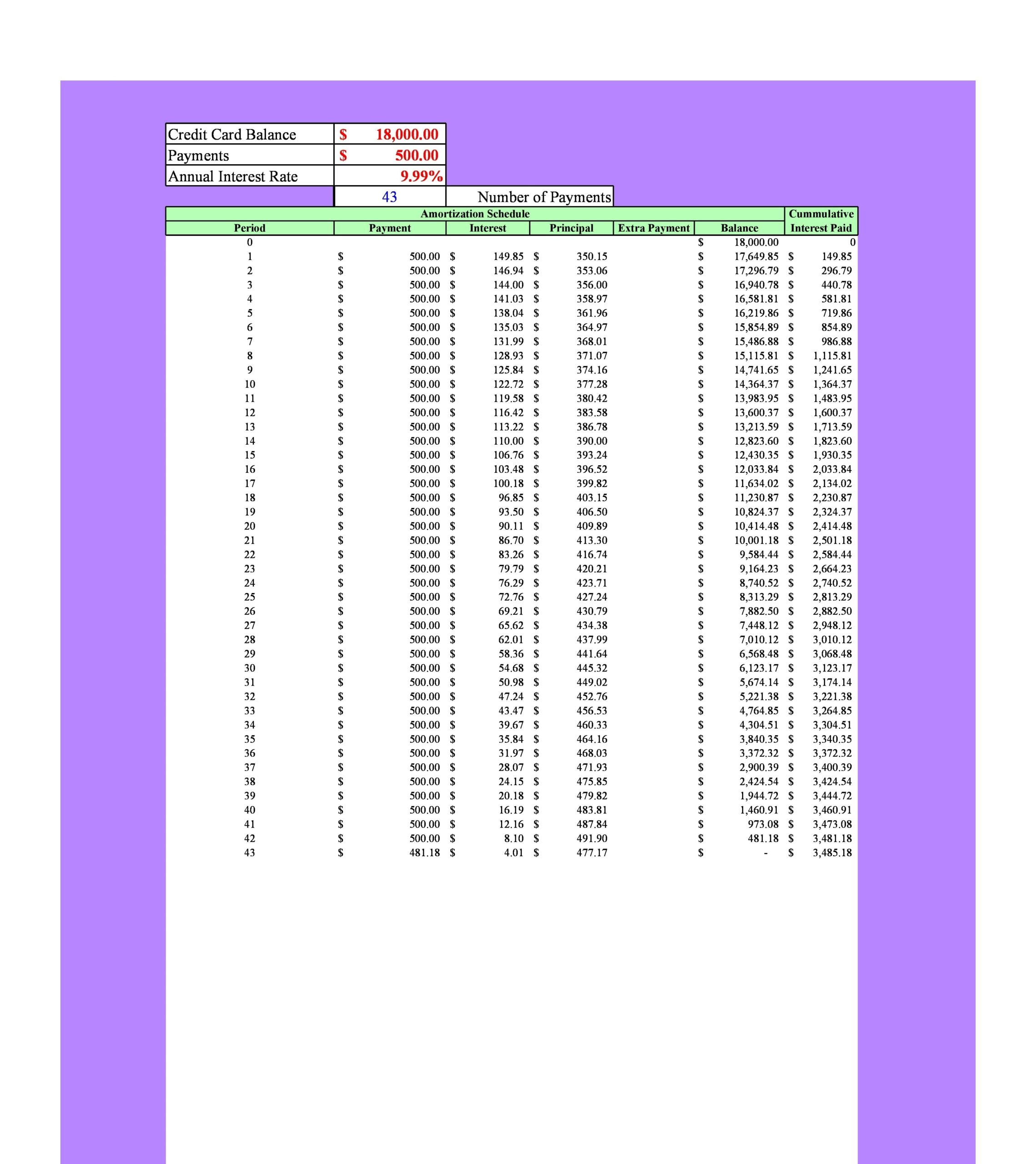

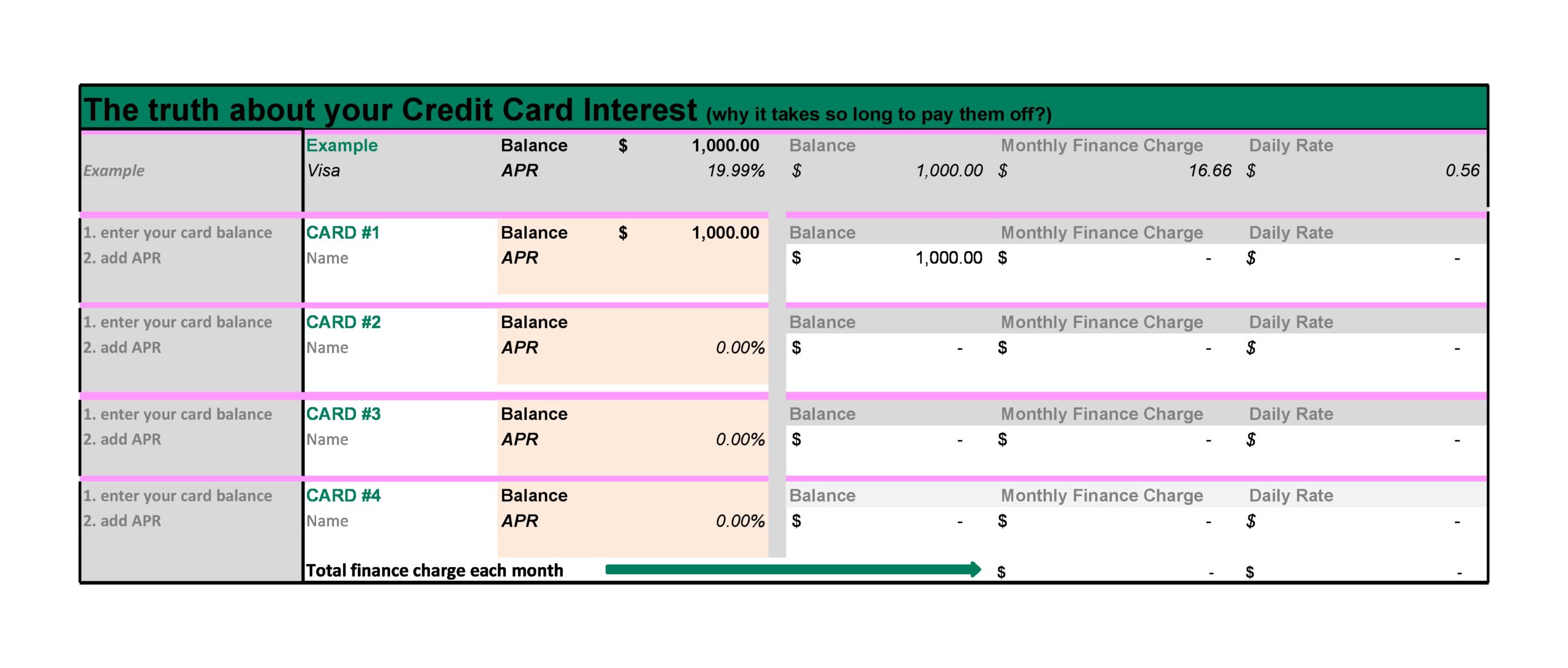

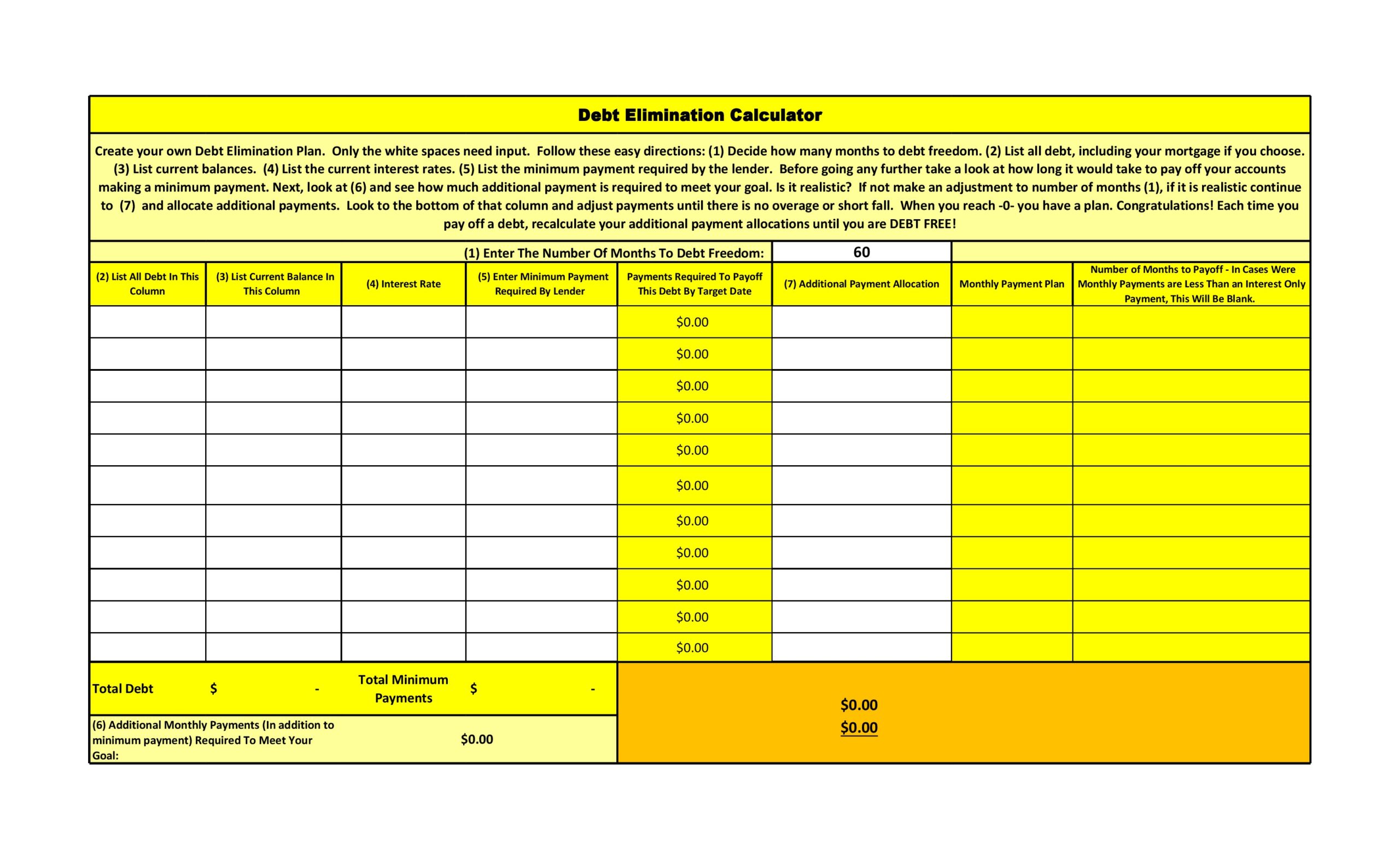

Credit Card Payoff Excel Spreadsheet Template - Track and map your credit card payments with our credit card payoff calculator excel template. Web take charge of your financial freedom with our credit card expense tracker template. It’s based on the popular debt. You will use the interest rate later,. Web if you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche excel spreadsheet that's linked a few sections below. Built with smart formulas, formatting, and dynamic tables,. When calculating the monthly payment, enter the number of months when you want to have your credit card balance completely paid off. Here are the steps to create a perfect one. Web here are 15 of their best financial spreadsheets. Some of the options listed also present schemes for. You will use the interest rate later,. This article will show you two quick ways to create a credit card payoff spreadsheet in excel. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web if you want a crystal clear picture of how long it will take. Discover how to use free debt payoff spreadsheets to manage and reduce your. It’s based on the popular debt. Web take charge of your financial freedom with our credit card expense tracker template. Nothing else will be purchased on the card while. Stay organized and vigilant in paying your credit card bills on time, avoiding. Here are the steps to create a perfect one. Web it all depends on a person’s financial knowledge. Track and map your credit card payments with our credit card payoff calculator excel template. To create a credit card payoff spreadsheet for your debt snowball method, you can use excel. Web if you want a crystal clear picture of how long. To create a credit card payoff spreadsheet for your debt snowball method, you can use excel. It’s based on the popular debt. When calculating the monthly payment, enter the number of months when you want to have your credit card balance completely paid off. Web find the best budgeting and debt tracker templates to help you pay off debt faster.. First, at the top of the spreadsheet, input the name of each of the loans you have and the corresponding interest rates. You will use the interest rate later,. Web find the best budgeting and debt tracker templates to help you pay off debt faster. Track and map your credit card payments with our credit card payoff calculator excel template.. Web if you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche excel spreadsheet that's linked a few sections below. When calculating the monthly payment, enter the number of months when you want to have your credit card balance completely paid off. Web by brynne conroy december 10,. First, at the top of the spreadsheet, input the name of each of the loans you have and the corresponding interest rates. When calculating the monthly payment, enter the number of months when you want to have your credit card balance completely paid off. Web here are 15 of their best financial spreadsheets. Web find the best budgeting and debt. This article will show you two quick ways to create a credit card payoff spreadsheet in excel. Discover how to use free debt payoff spreadsheets to manage and reduce your. 'you're forced to see what's going on'. Built with smart formulas, formatting, and dynamic tables,. First, at the top of the spreadsheet, input the name of each of the loans. This article will show you two quick ways to create a credit card payoff spreadsheet in excel. Stay organized and vigilant in paying your credit card bills on time, avoiding. When calculating the monthly payment, enter the number of months when you want to have your credit card balance completely paid off. It’s based on the popular debt. First, at. Web figure out the monthly payments to pay off a credit card debt assume that the balance due is $5,400 at a 17% annual interest rate. Some of the options listed also present schemes for. Built with smart formulas, formatting, and dynamic tables,. Nothing else will be purchased on the card while. First, at the top of the spreadsheet, input. Web here are 15 of their best financial spreadsheets. 'you're forced to see what's going on'. To create a credit card payoff spreadsheet for your debt snowball method, you can use excel. Here are the steps to create a perfect one. Track and map your credit card payments with our credit card payoff calculator excel template. Web find the best budgeting and debt tracker templates to help you pay off debt faster. First, at the top of the spreadsheet, input the name of each of the loans you have and the corresponding interest rates. Discover how to use free debt payoff spreadsheets to manage and reduce your. Web figure out the monthly payments to pay off a credit card debt assume that the balance due is $5,400 at a 17% annual interest rate. You will use the interest rate later,. This article will show you two quick ways to create a credit card payoff spreadsheet in excel. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web it all depends on a person’s financial knowledge. Web if you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche excel spreadsheet that's linked a few sections below. It’s based on the popular debt. When calculating the monthly payment, enter the number of months when you want to have your credit card balance completely paid off. Web take charge of your financial freedom with our credit card expense tracker template. Nothing else will be purchased on the card while. When you've got a mortgage, children, a car payment, and other expenses to. Built with smart formulas, formatting, and dynamic tables,. Web find the best budgeting and debt tracker templates to help you pay off debt faster. Built with smart formulas, formatting, and dynamic tables,. This article will show you two quick ways to create a credit card payoff spreadsheet in excel. First, at the top of the spreadsheet, input the name of each of the loans you have and the corresponding interest rates. You will use the interest rate later,. Discover how to use free debt payoff spreadsheets to manage and reduce your. Track and map your credit card payments with our credit card payoff calculator excel template. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web it all depends on a person’s financial knowledge. When you've got a mortgage, children, a car payment, and other expenses to. Web by brynne conroy december 10, 2022 a debt snowball spreadsheet is one of the most effective tools for tackling your debt payoff goals in 2023. Web if you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche excel spreadsheet that's linked a few sections below. 'you're forced to see what's going on'. To create a credit card payoff spreadsheet for your debt snowball method, you can use excel. Web here are 15 of their best financial spreadsheets. Web take charge of your financial freedom with our credit card expense tracker template.Multiple Credit Card Payoff Calculator Spreadsheet —

Credit Card Debt Payoff Spreadsheet Excel Templates

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Credit Card Payoff Calculator Excel Project Management Excel

Nothing Else Will Be Purchased On The Card While.

When Calculating The Monthly Payment, Enter The Number Of Months When You Want To Have Your Credit Card Balance Completely Paid Off.

Here Are The Steps To Create A Perfect One.

Stay Organized And Vigilant In Paying Your Credit Card Bills On Time, Avoiding.

Related Post: