Debt Collection Dispute Letter Template

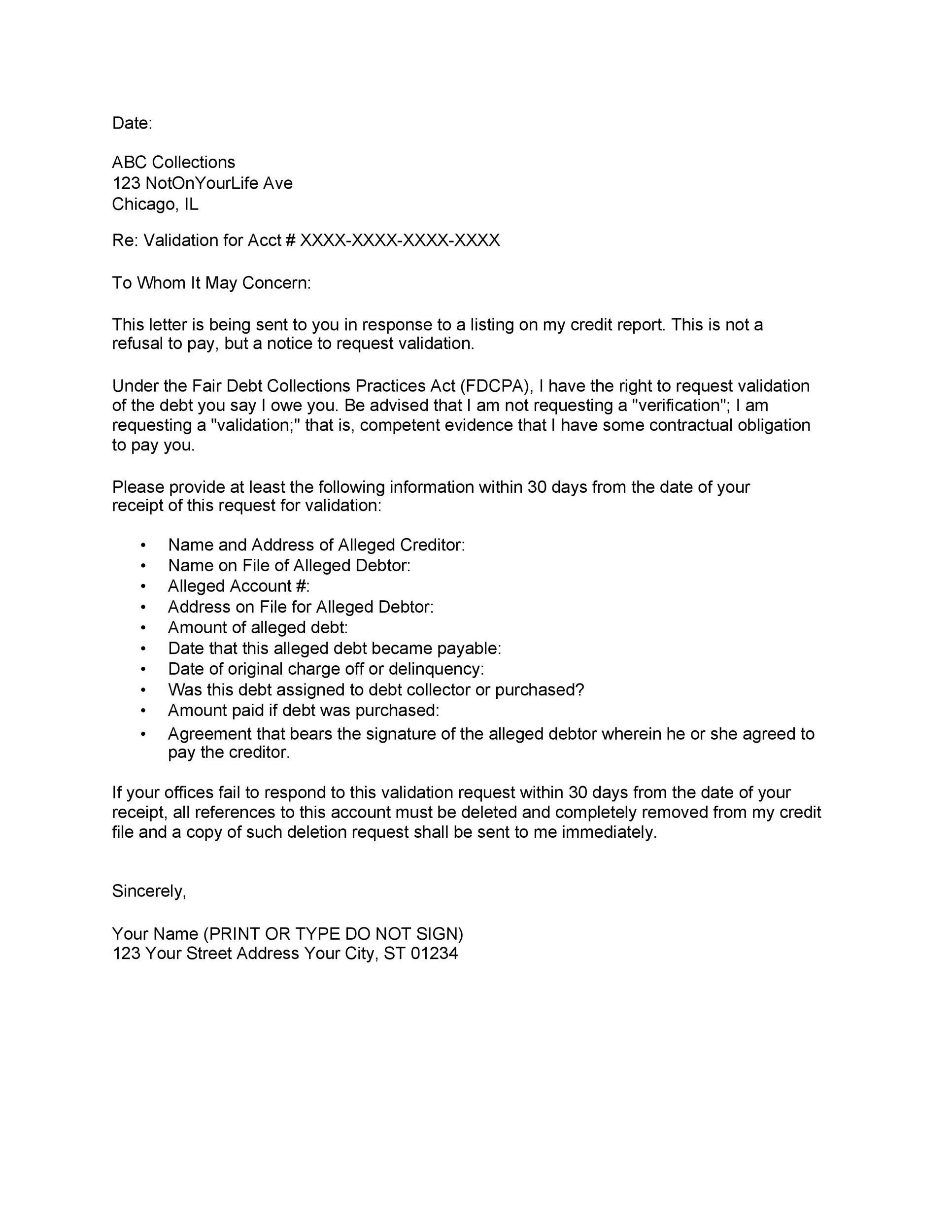

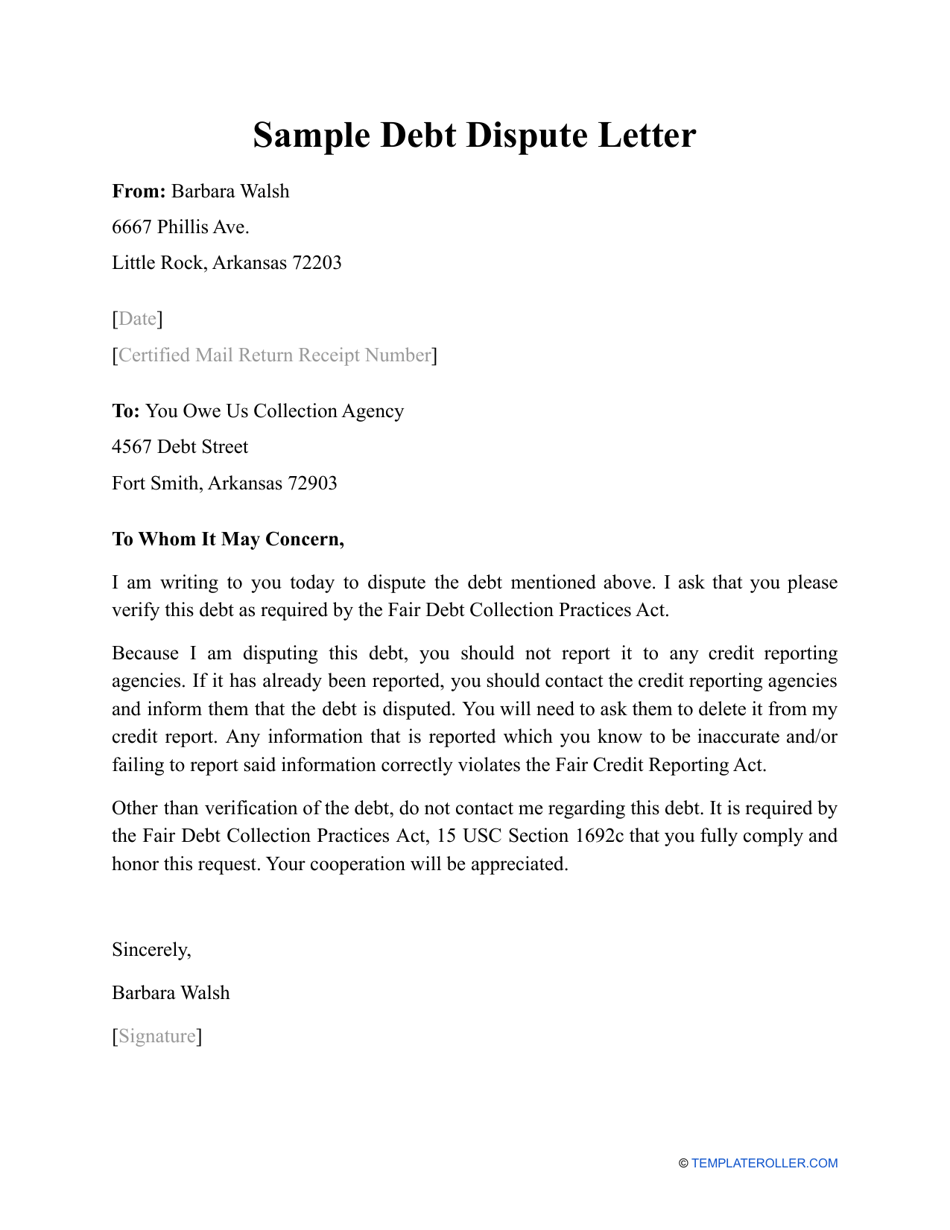

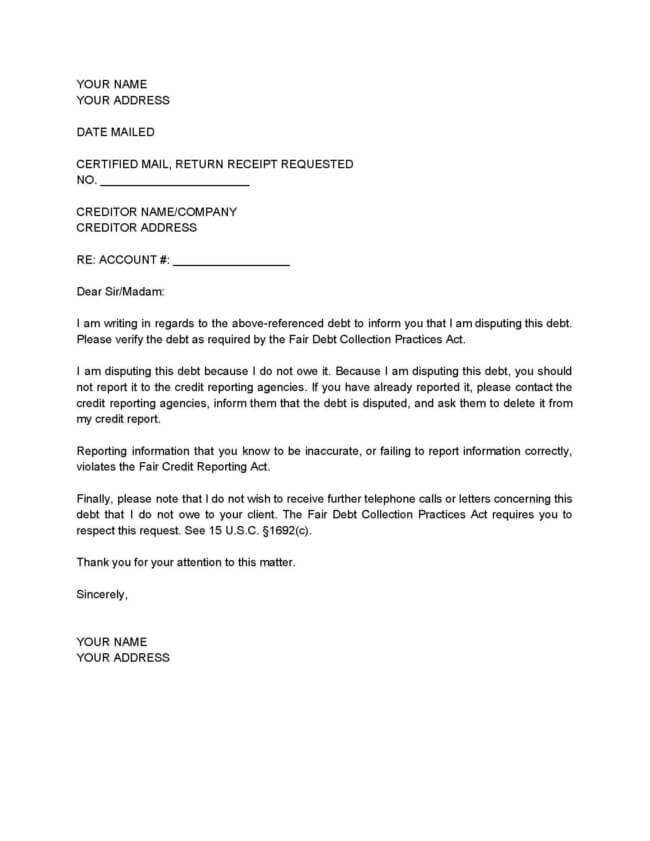

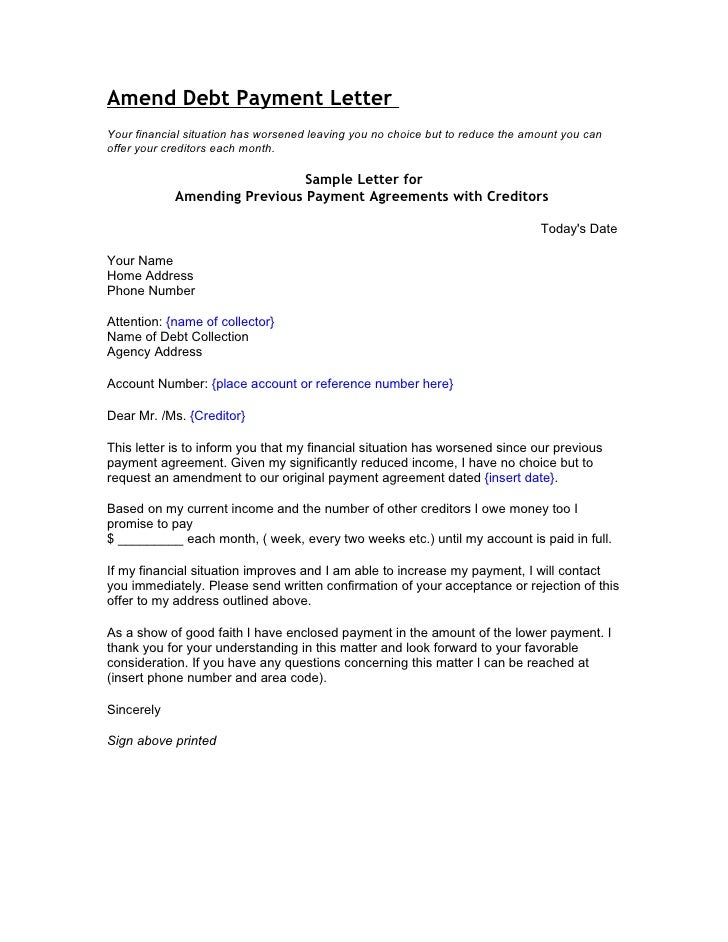

Debt Collection Dispute Letter Template - You can download a template letter in. I do not owe this. Provide me a copy of the last billing statement from the original creditor. Web tell me the date the debt became delinquent and the date the last payment was made. Ad our software automatically generates inquiry and collection dispute letters for you. Web free sample & template letters for writing to creditors. Create and print official pay for delete letters. Web how to write a dispute letter to debt collector [with sample] sample dispute letter to debt collector editorial note: Web create a high quality document now! The full name and mailing address of the original creditor for this alleged debt; The amount of the debt; Web debt collector response sample letter you’re saying: You can download a template letter in. Web tell me the date the debt became delinquent and the date the last payment was made. It requests information from the collection agency. Ad reduce debt w/ best bbb authorized debt collection agencies. Web respectfully request that you provide me with the following: If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Web debt collector response sample letter you’re saying: Web sample letters to dispute information on a credit. A credit report dispute letter is used to remove an invalid collection. Here’s what to do and a sample letter to help get your money back. Ad reduce debt w/ best bbb authorized debt collection agencies. Web if errors are found, gather evidence to support your claim. Web tell me the date the debt became delinquent and the date the. Web petitions to modify or set aside warning letters payments to harmed consumers industry whistleblowers debt collection last reviewed: Web debt collection dispute letter. The amount of the alleged debt; Web if errors are found, gather evidence to support your claim. Ad custom pay for delete letters in pdf or word. Web if errors are found, gather evidence to support your claim. Web respectfully request that you provide me with the following: Web petitions to modify or set aside warning letters payments to harmed consumers industry whistleblowers debt collection last reviewed: I do not owe this. This document is intended to be used by the debtor (the business or individual owing. Here’s what to do and a sample letter to help get your money back. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Web sample letters to dispute information on a credit report. The full name and mailing address of the original creditor for this alleged. Web sample letter to collection agency disputing debt the following page is a sample of a letter that you can send to a collection agency if you think you do not owe. “this is not my debt.” use the sample letter on the next page if you want to tell a debt collector that you aren’t responsible for. If you. It requests information from the collection agency. Web respectfully request that you provide me with the following: A credit report dispute letter is used to remove an invalid collection. Verification or copy of any judgment (if. Web this template is a letter that can be used to dispute a debt collection that has been placed on your credit report. The name of the creditor to whom the debt is owed; Provide me a copy of the last billing statement from the original creditor. The amount of the alleged debt; You can download a template letter in. The amount of the debt; Provide me a copy of the last billing statement from the original creditor. (3) provide a verification or copy of any judgment (if applicable); Import your credit report and automatically generate dispute letters using disputebee. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Web when. Web this template is a letter that can be used to dispute a debt collection that has been placed on your credit report. The amount of the debt; Web if errors are found, gather evidence to support your claim. Web debt collector response sample letter you’re saying: Web sample letter to collection agency disputing debt the following page is a sample of a letter that you can send to a collection agency if you think you do not owe. Provide me a copy of the last billing statement from the original creditor. Write a letter of authority, cancel a continuous payment, or tell a creditor a debt is statute barred. Below you will find samples of the four types of dispute letters we outline above. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. You can download a template letter in. Ad get your legal documents today. It requests information from the collection agency. (2) the name of the creditor to whom the debt is owed; The amount of the alleged debt; (4) proof that you are. Web tell me the date the debt became delinquent and the date the last payment was made. (3) provide a verification or copy of any judgment (if applicable); Craft a collection dispute letter to the creditor or collection agency, explaining. Here’s what to do and a sample letter to help get your money back. Web debt collection dispute letter. This document is intended to be used by the debtor (the business or individual owing money) who will send the letter to the collection. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the. Below you will find samples of the four types of dispute letters we outline above. The amount of the debt; Web create a high quality document now! Web (1) the amount of the debt; Web sample letters to dispute information on a credit report. Web debt collection dispute letter. Provide me a copy of the last billing statement from the original creditor. Ad custom pay for delete letters in pdf or word. (3) provide a verification or copy of any judgment (if applicable); These blog posts represent the opinion of donotpay’s. I do not owe this. Ad reduce debt w/ best bbb authorized debt collection agencies. In the case of debt sent to collection, you. Web this template is a letter that can be used to dispute a debt collection that has been placed on your credit report.Sample Debt Dispute Letter Download Printable PDF Templateroller

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

Debt Dispute Letter Mt Home Arts

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

writing dispute letter format Credit bureaus, Dispute credit report

Credit and Debt Dispute Letters

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Web If Errors Are Found, Gather Evidence To Support Your Claim.

“This Is Not My Debt.” Use The Sample Letter On The Next Page If You Want To Tell A Debt Collector That You Aren’t Responsible For.

Documentation Showing You Have Verified.

Web Respectfully Request That You Provide Me With The Following:

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-13-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-14.jpg)