Excel Payback Period Template

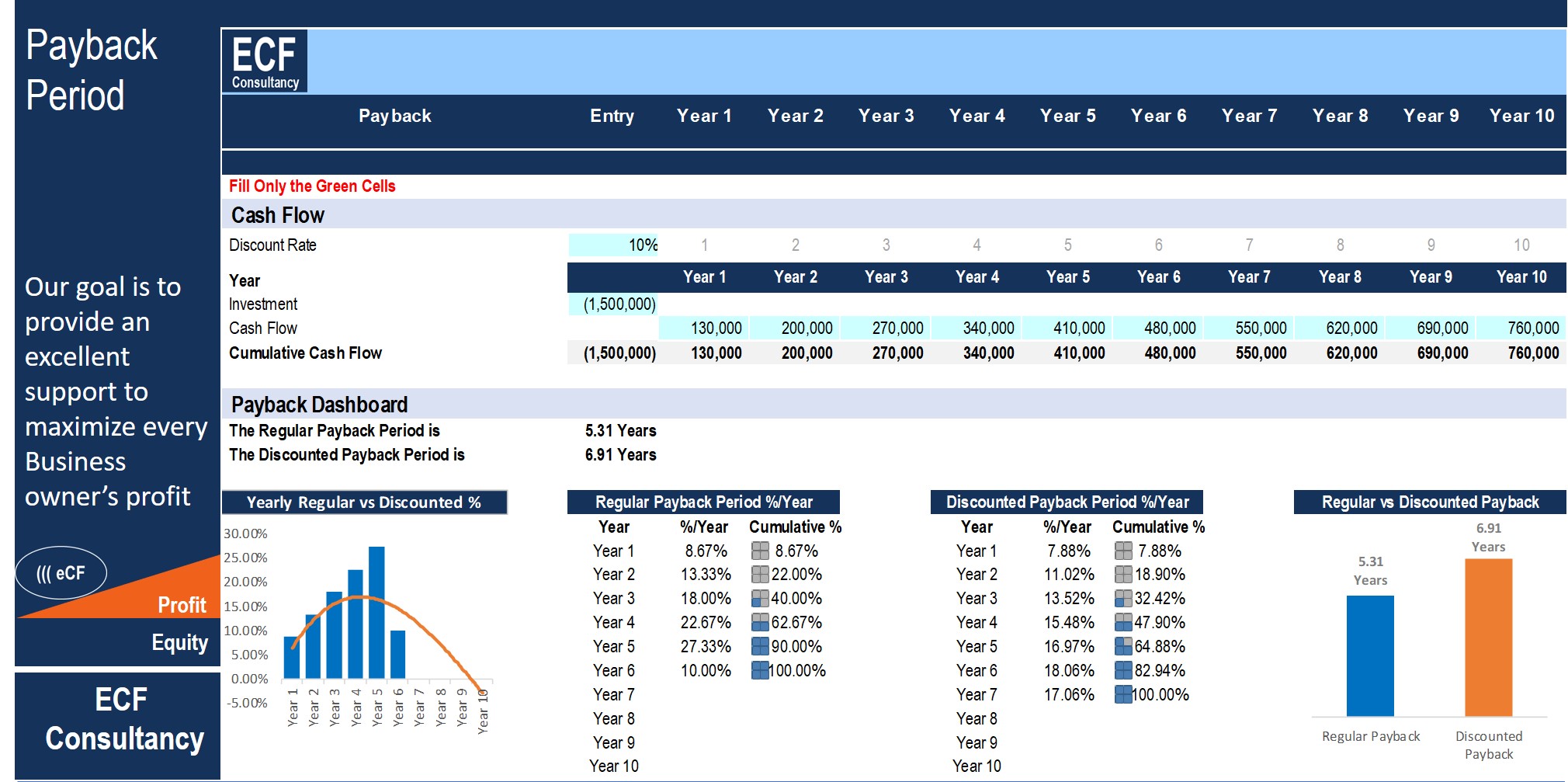

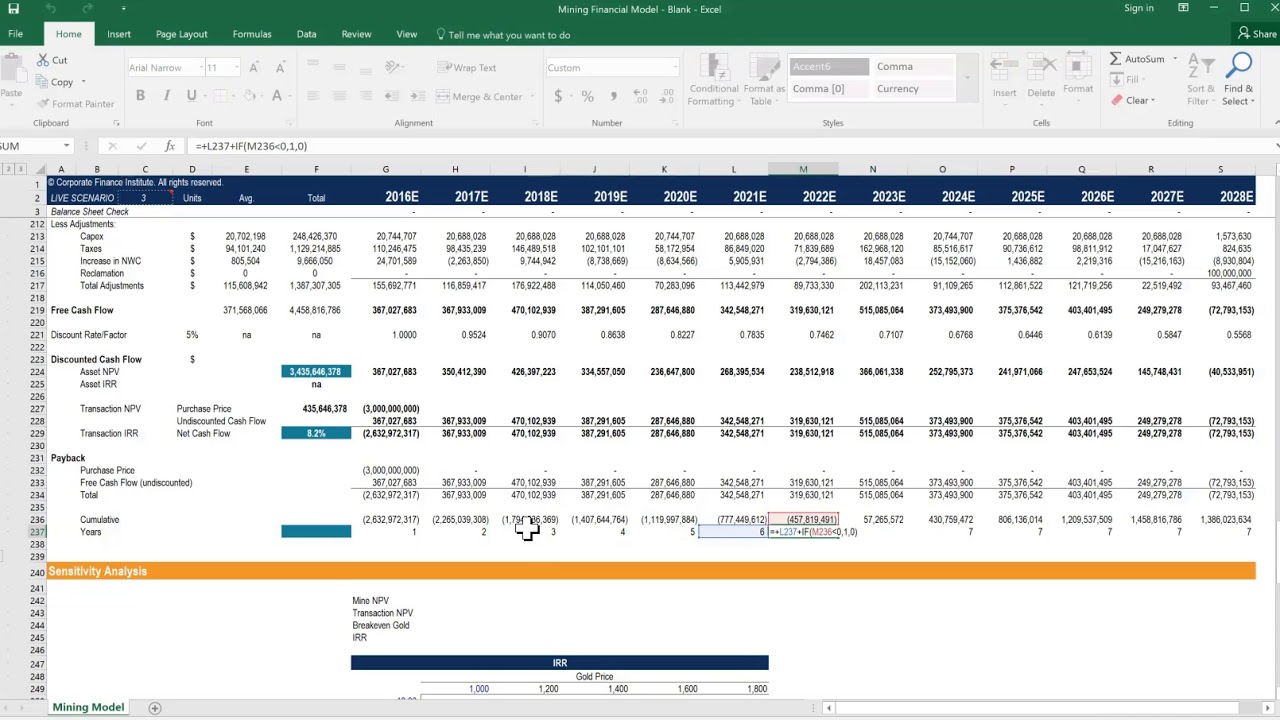

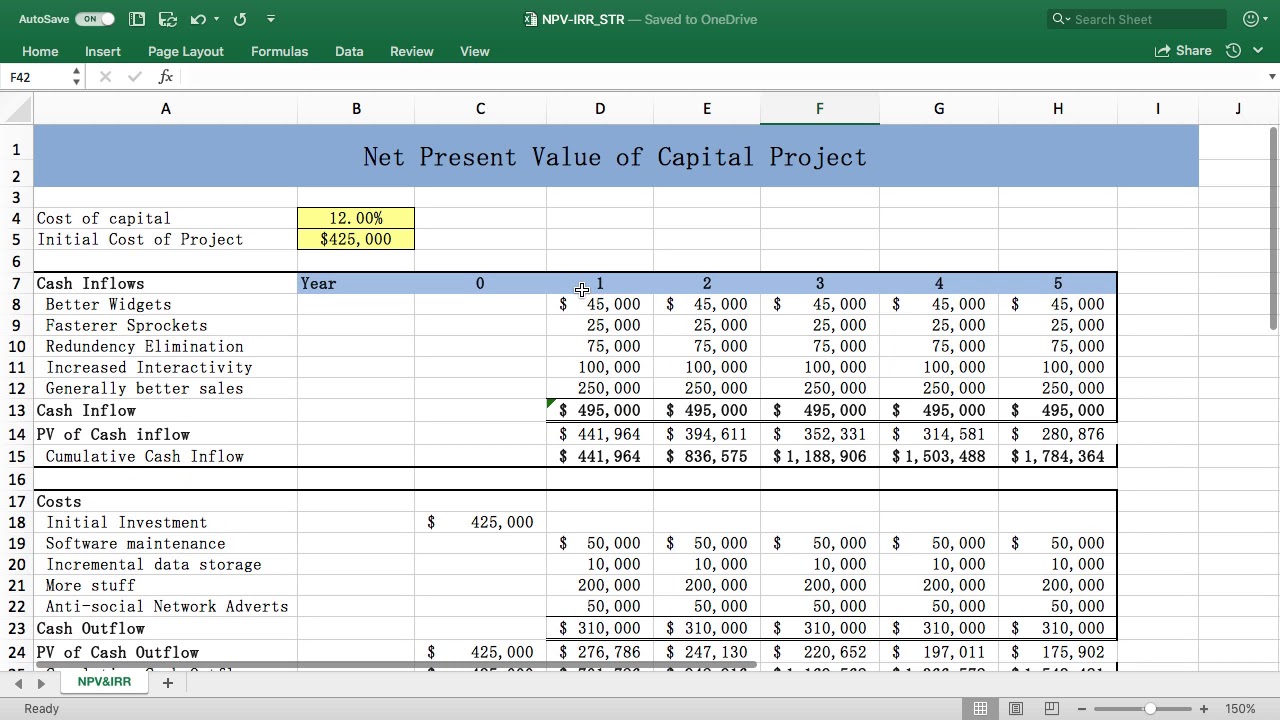

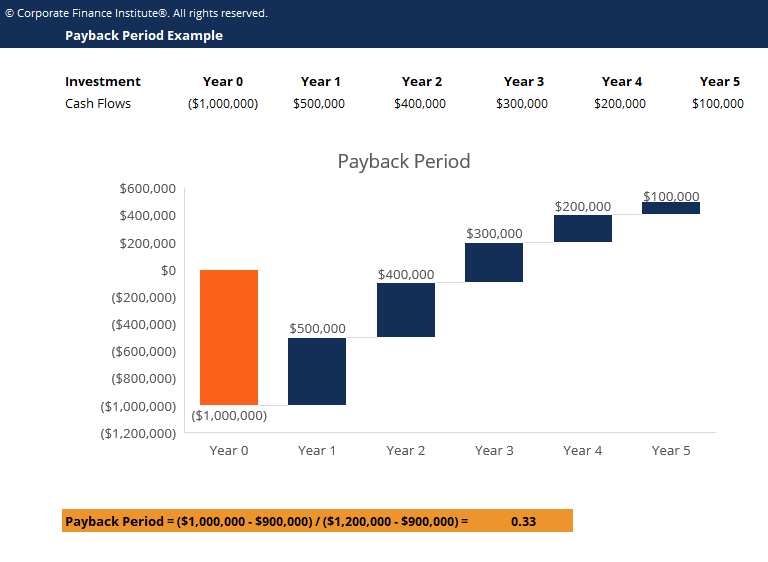

Excel Payback Period Template - Web corporate finance payback period guide to understanding the payback period learn online now corporate finance fundamentals guide corporate finance core concepts. Enter your name and email in the form below and download the free. Without any further ado, let’s get started with calculating the payback period in excel. Web payback period excel template: Web types of payback period. Web steps to calculate payback period in excel. Web capital investment model template. The regular payback period is number of years necessary to recover the funds invested without taking the. The equation for payback period depends whether the cash inflows are the same or uneven. Web the template includes regular and discount payback. Web the machine will generate $250 each year for its 10 year useful life. Web capital investment model template. Web corporate finance payback period guide to understanding the payback period learn online now corporate finance fundamentals guide corporate finance core concepts. Web enter your name and email in the form below and download the free template now! Enter your name. Web corporate finance payback period guide to understanding the payback period learn online now corporate finance fundamentals guide corporate finance core concepts. Without any further ado, let’s get started with calculating the payback period in excel. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take. The regular payback period is number of years necessary to recover the funds invested without taking the. The equation for payback period depends whether the cash inflows are the same or uneven. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. This capital. Using the payback method in essence, the payback period is used very similarly. Web npv npv returns the net value of the cash flows — represented in today's dollars. Because of the time value of money, receiving a dollar today is worth more than receiving a dollar. Web the machine will generate $250 each year for its 10 year useful. Without any further ado, let’s get started with calculating the payback period in excel. The equation for payback period depends whether the cash inflows are the same or uneven. The payback period is the amount of. So by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and. Web types of payback period. The payback period is the amount of. Web the template includes regular and discount payback. Web payback period excel template: Web types of payback period. Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5 if you invested. Web types of payback period. This capital investment model template will help you calculate key valuation metrics of a capital investment including the cash. Web capital investment model template. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. So by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and. Web the template includes regular and discount payback. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Web enter your name and email in the form below and download the free template now! Web that formula equates to “give me the first number in the last row where. The payback period is the amount of. The regular payback period is number of years necessary to recover the funds invested without taking the. Web capital investment model template. Web updated march 12, 2022 reviewed by david kindness fact checked by katrina munichiello what is a payback period? So by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and. Web steps to calculate payback period in excel. Web enter your name and email in the form below and download the free template now! Quickly calculate your investment return. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Enter your name and email in the form below and. Using the payback method in essence, the payback period is used very similarly. Web the machine will generate $250 each year for its 10 year useful life. Web steps to calculate payback period in excel. Web download practice workbook what is discounted payback period? Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. Here is a preview of the payback period template: Without any further ado, let’s get started with calculating the payback period in excel. Web npv npv returns the net value of the cash flows — represented in today's dollars. Web payback period excel template: Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5 if you invested. Enter your name and email in the form below and download the free. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Quickly calculate your investment return. The payback period is the amount of. Web that formula equates to “give me the first number in the last row where the cumulative cash flow is not zero. The regular payback period is number of years necessary to recover the funds invested without taking the. This capital investment model template will help you calculate key valuation metrics of a capital investment including the cash. The equation for payback period depends whether the cash inflows are the same or uneven. Web the template includes regular and discount payback. Web enter your name and email in the form below and download the free template now! So by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and. Web updated march 12, 2022 reviewed by david kindness fact checked by katrina munichiello what is a payback period? Web that formula equates to “give me the first number in the last row where the cumulative cash flow is not zero. The payback period is the amount of. Payback period excel template to help you calculate the time required to recoup the. Web capital investment model template. Enter your name and email in the form below and download the free. Web steps to calculate payback period in excel. Web the template includes regular and discount payback. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. Web corporate finance payback period guide to understanding the payback period learn online now corporate finance fundamentals guide corporate finance core concepts. Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5 if you invested. Web download practice workbook what is discounted payback period? Using the payback method in essence, the payback period is used very similarly. Quickly calculate your investment return. Web payback period excel template:Payback Period Excel Model Eloquens

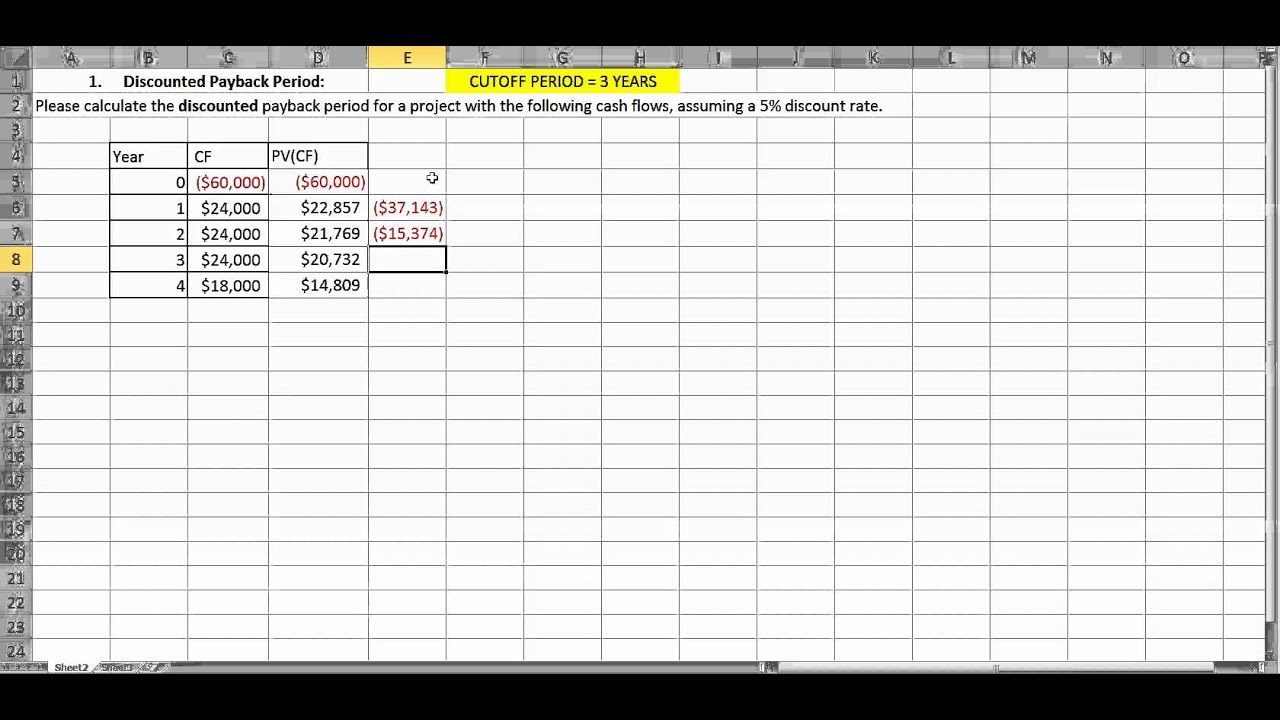

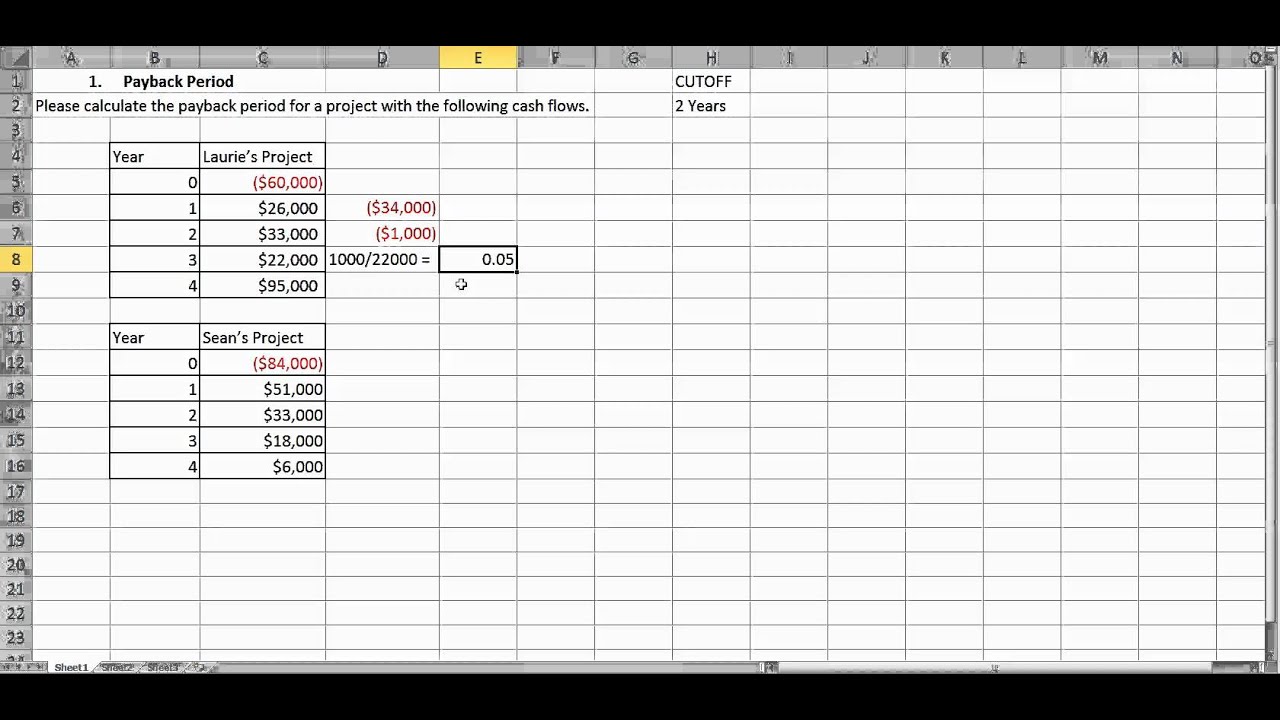

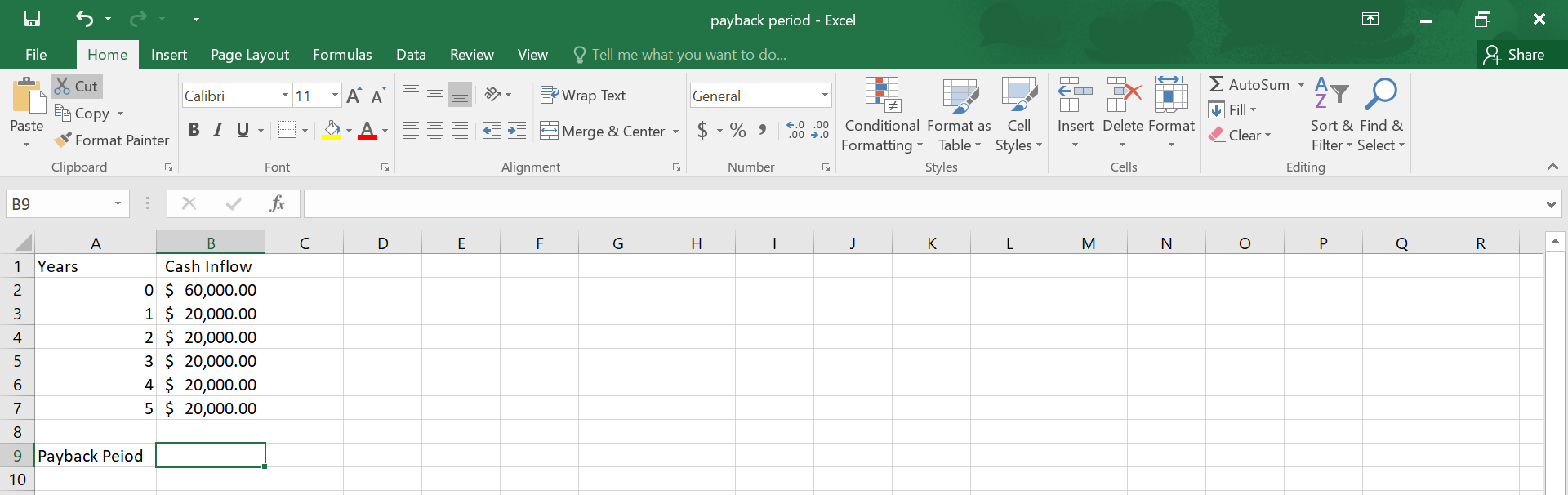

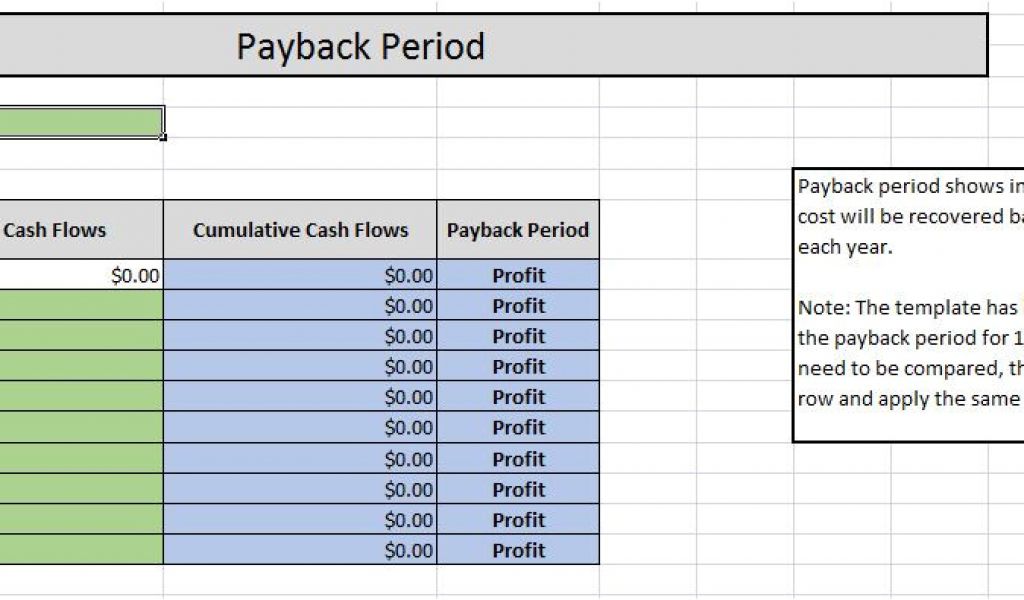

Download How to calculate PAYBACK PERIOD in MS Excel Spread

How to Calculate Accounting Payback Period or Capital Budgeting Break

Payback Time Formula Excel BHe

Payback Period Calculator Double Entry Bookkeeping

Payback Period Template Download Free Excel Template

Payback Period Excel Template PDF Template

Payback Period.mp4 YouTube

How to Calculate Payback Period in Excel.

Payback Period Template Project Finance Analytical Methods Project

The Equation For Payback Period Depends Whether The Cash Inflows Are The Same Or Uneven.

This Capital Investment Model Template Will Help You Calculate Key Valuation Metrics Of A Capital Investment Including The Cash.

Web Enter Your Name And Email In The Form Below And Download The Free Template Now!

Web Types Of Payback Period.

Related Post: