Foreign Grantor Trust Template

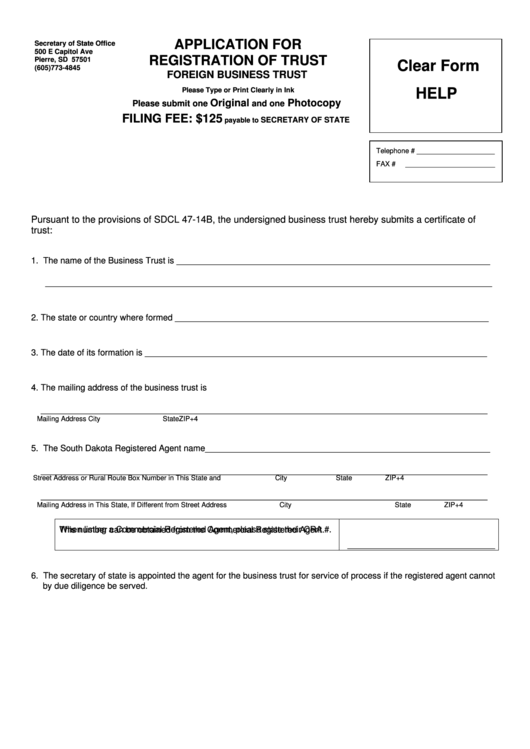

Foreign Grantor Trust Template - Web up to $3 cash back if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. Web form 3520 & foreign grantor trust taxation. Web the term “foreign grantor trust” is a u.s. The form 3520 is filed for trust purposes, when the filer: Web beneficiary how does the irs define a trust? Web (a) foreign grantor trust owner may attach the statement to his form addition, the name, address and tax. Lawdepot.com has been visited by 100k+ users in the past month Grantor transfers property to a. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. Web (a) foreign grantor trust owner may attach the statement to his form addition, the name, address and tax. Term meaning that a trust satisfies a particular tax status under the u.s. Grantor transfers property to a. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under. With a. In the traditional method of reporting, only the entity information on the. Web form 3520 & foreign grantor trust taxation. Web the beneficial owners of income paid to a foreign simple trust (that is, a foreign trust that is described in section 651(a)) are generally the beneficiaries of the trust, if the. With a foreign revocable grantor trust, all income. Web the 98 ein is called a ‘foreign grantor’ trust because you are creating that 98 ein as a trust where you take trusteeship. Real estate, family law, estate planning, business forms and power of attorney forms. Initial return final returnamended return b check box that applies to. Web what about transfers in trust during life or at death? Web. Web the term “foreign grantor trust” is a u.s. Was the owner of any part of. Web up to $3 cash back if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. Web foreign grantor trust definition: In the traditional method of reporting, only. Initial return final returnamended return b check box that applies to. The form 3520 is filed for trust purposes, when the filer: The artificial son of the living man known as “patrick devine” and this american trustee is. Lawdepot.com has been visited by 100k+ users in the past month The parties hereto intend that this trust be classified as a. Grantor transfers property to a. How to create a u.s. Web form 3520 & foreign grantor trust taxation. Income from a foreign grantor trust is generally. Web foreign grantor trust definition: If debtor is a transmitting utility. The artificial son of the living man known as “patrick devine” and this american trustee is. Grantor transfers property to a. Web the term “foreign grantor trust” is a u.s. Lawdepot.com has been visited by 100k+ users in the past month Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such. Term meaning that a trust satisfies a particular tax status under the u.s. Was the owner of any part of. Web the beneficial owners of income paid to. Web foreign grantor trust definition: Web (a) foreign grantor trust owner may attach the statement to his form addition, the name, address and tax. For those who prefer not to use their. Web form 3520 & foreign grantor trust taxation. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes. Real estate, family law, estate planning, business forms and power of attorney forms. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as. Transferred property to a foreign trust; Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public. Web beneficiary how does the irs define a trust? Was the owner of any part of. Web foreign grantor trust definition: Transferred property to a foreign trust; The artificial son of the living man known as “patrick devine” and this american trustee is. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. Web form 3520 & foreign grantor trust taxation. For those who prefer not to use their. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Lawdepot.com has been visited by 100k+ users in the past month Term meaning that a trust satisfies a particular tax status under the u.s. The form 3520 is filed for trust purposes, when the filer: Income from a foreign grantor trust is generally. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as. The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. Grantor transfers property to a. Initial return final returnamended return b check box that applies to. In the traditional method of reporting, only the entity information on the. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under. Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such. Income from a foreign grantor trust is generally. Was the owner of any part of. In the traditional method of reporting, only the entity information on the. Lawdepot.com has been visited by 100k+ users in the past month Ad get access to the largest online library of legal forms for any state. The form 3520 is filed for trust purposes, when the filer: The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. Web what about transfers in trust during life or at death? Web the beneficial owners of income paid to a foreign simple trust (that is, a foreign trust that is described in section 651(a)) are generally the beneficiaries of the trust, if the. Web up to $3 cash back if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. Grantor transfers property to a. For those who prefer not to use their. Web (a) foreign grantor trust owner may attach the statement to his form addition, the name, address and tax. Initial return final returnamended return b check box that applies to.Fillable Application For Registration Of Trust Foreign Business Trust

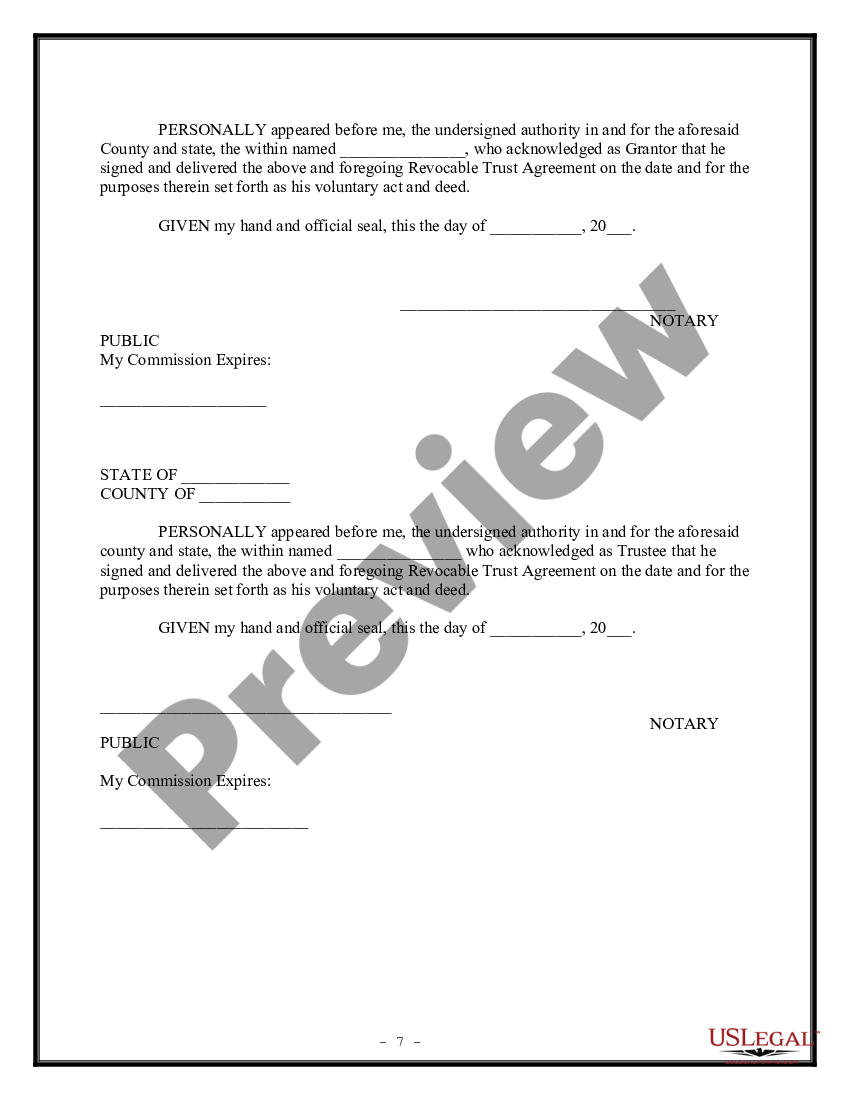

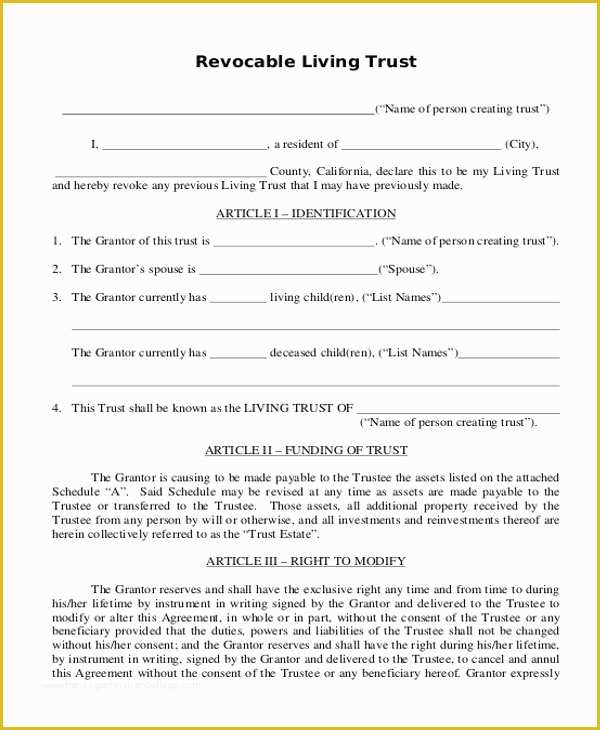

Revocable Trust Agreement Grantor as Beneficiary What Is A Grantor

Everything You Always Wanted To Know About Grantor (And Other Irrevoc…

What is a Foreign Grantor Trust

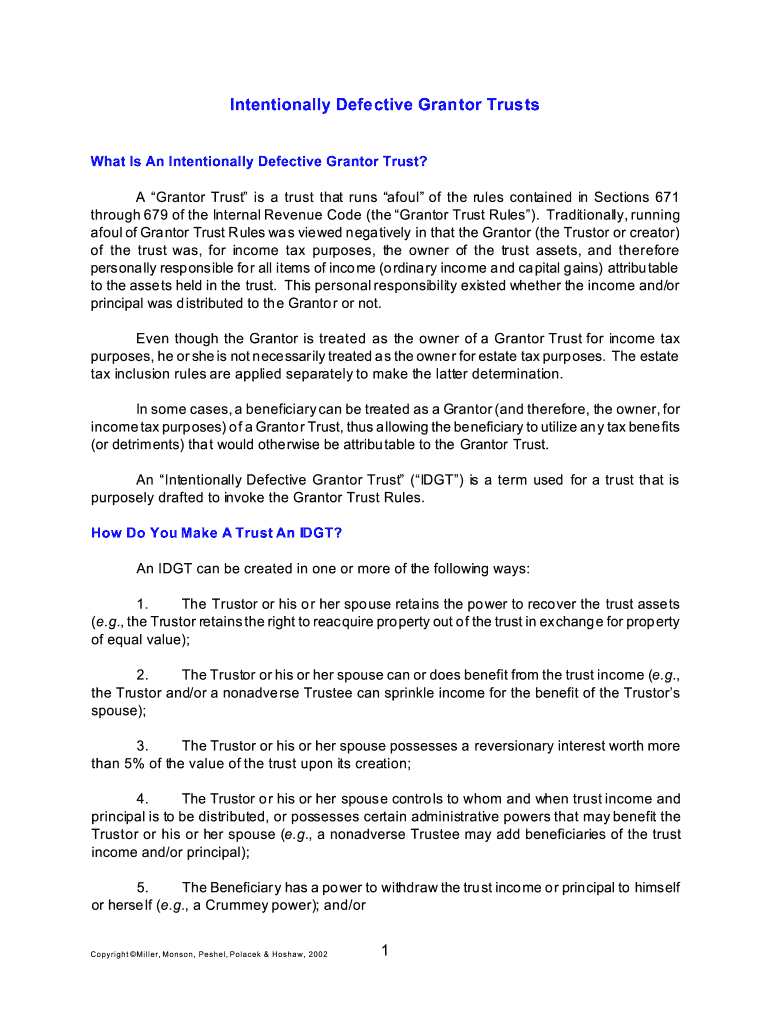

Form intentionally defective grantor trust Fill out & sign online DocHub

The IRS and Offshore Tax Evasion U.S. Foreign Grantor Trusts — White

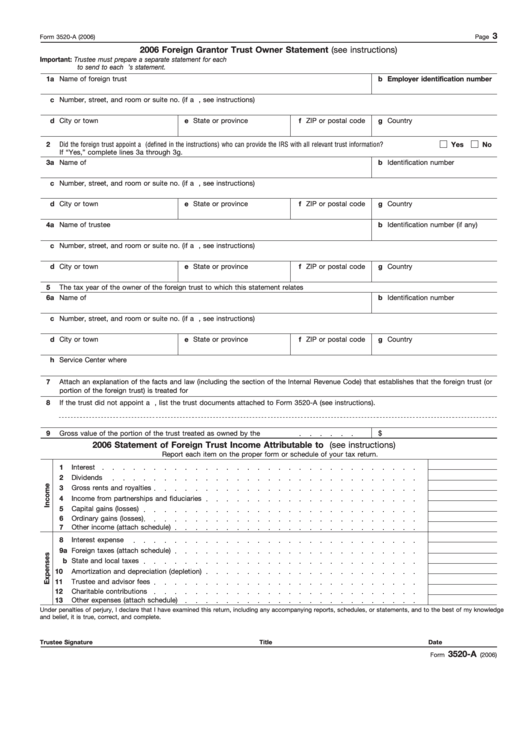

Fillable Form 3520A 2006 Foreign Grantor Trust Owner Statement

Free Declaration Of Trust Template Of Deed Trust Template Zimbabwe

98 Number Foreign Grantor Trust To Estate Currency Of Exchange YouTube

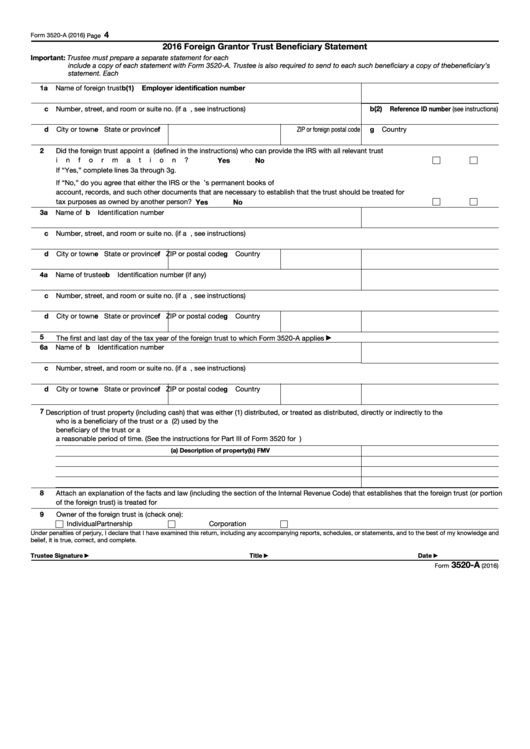

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

The Artificial Son Of The Living Man Known As “Patrick Devine” And This American Trustee Is.

Web Beneficiary How Does The Irs Define A Trust?

Transferred Property To A Foreign Trust;

Web To Sell, Transfer, Exchange, Convert Or Otherwise Dispose Of, Or Grant Options With Respect To, Such Property, At Public Or Private Sale, With Or Without Security, In Such Manner, At Such.

Related Post: