Form 8962 Printable

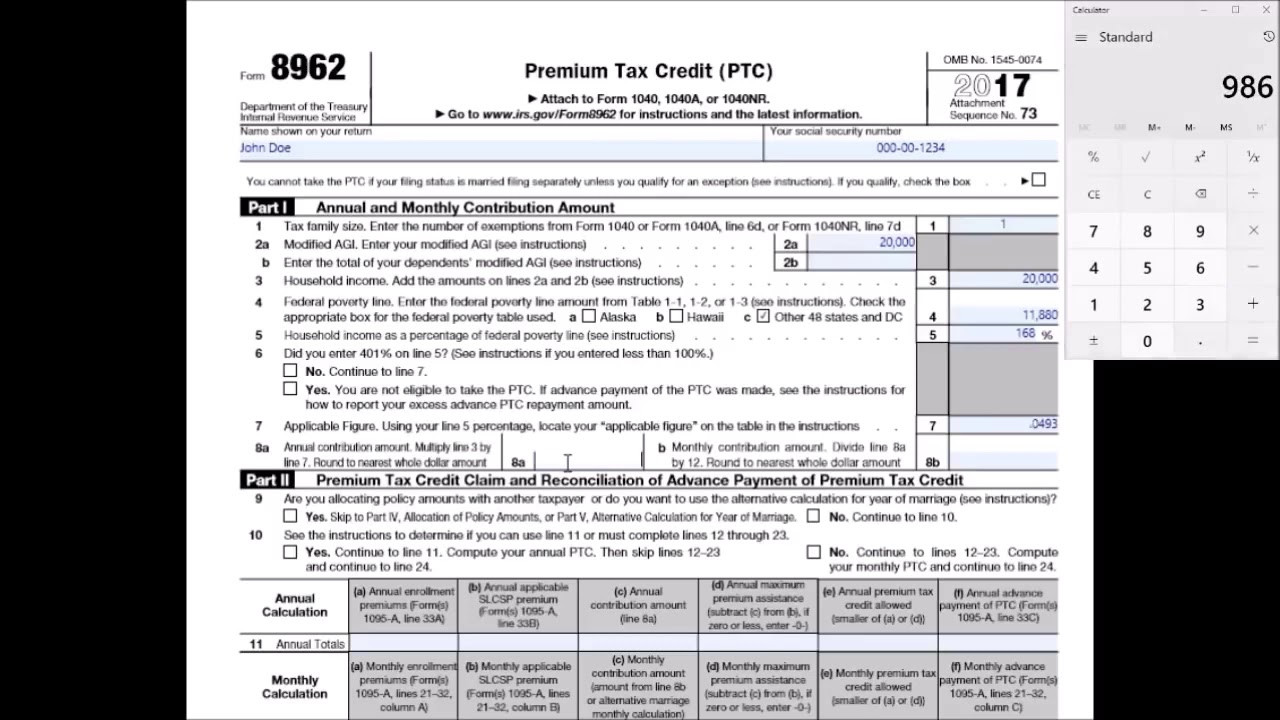

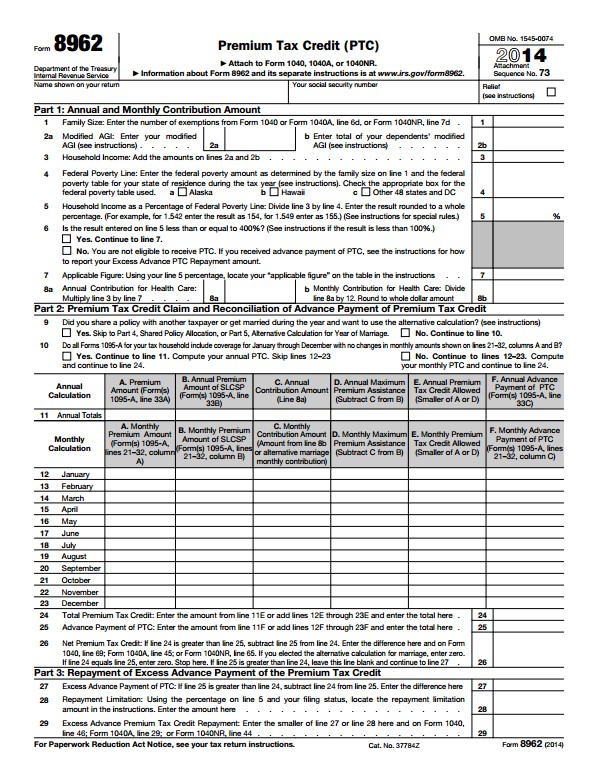

Form 8962 Printable - You may take ptc (and aptc may. Try it for free now! Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you. This form is for income earned in tax year 2022, with tax returns due in april. You may need to scroll. Go to www.irs.gov/form8962 for instructions and. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. Calculate the annual and monthly. Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). This form is only used by taxpayers who. Web instructions for form 8962 premium tax credit (ptc) department. Try it for free now! This form is for income earned in tax year 2022, with tax returns due in april. If you’re claiming a net premium tax credit for. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit. Web you’ll need it to complete form 8962, premium tax credit. Go to www.irs.gov/form8962 for instructions and. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. This form is only used by taxpayers who. This form is for income earned in tax year. This form is only used by taxpayers who. Signnow.com has been visited by 100k+ users in the past month Ad get ready for tax season deadlines by completing any required tax forms today. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). This form is for income earned in tax year 2022, with tax returns due in april. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit. You may take ptc (and aptc may. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Go to www.irs.gov/form8962 for instructions and. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web when you're done in turbotax,. Upload, modify or create forms. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web irs form 8962 if you are claimed as somebody’s dependent, then you aren't. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 8962 form,. Ad get ready for tax season deadlines by completing any required tax forms today. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. If you’re. Calculate the annual and monthly. Go to www.irs.gov/form8962 for instructions and. Enter personal information shown on your tax return. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Upload, modify or create forms. You can download or print current or past. This form is only used by taxpayers who. Calculate the annual and monthly. Watch this brief video to get answers on many questions you will have while completing the irs. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web video instructions and help with filling out and completing 8962 form 2021 printable. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. This form is for income earned in tax year 2022, with tax returns due in april. You may take ptc (and aptc may. Web you must use form 8962 to reconcile your estimated and actual income for the year. To open the printable form 8962 click the fill out form button. Calculate the annual and monthly. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health. You may take ptc (and aptc may. You may need to scroll. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web irs form 8962 if you are claimed as somebody’s dependent, then you aren't eligible for the premium tax credit, and you do not file according to instructions for 8962 tax form. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you. Signnow.com has been visited by 100k+ users in the past month Go to www.irs.gov/form8962 for instructions and. Enter personal information shown on your tax return. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. You may need to scroll. Web from within your taxact online return, click print center down the left to expand, then click custom print. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 8962 form,. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you. Upload, modify or create forms. Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. Signnow.com has been visited by 100k+ users in the past month Calculate the annual and monthly. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health. This form is only used by taxpayers who. Ad get ready for tax season deadlines by completing any required tax forms today. If you’re claiming a net premium tax credit for. This form is for income earned in tax year 2022, with tax returns due in april. Go to www.irs.gov/form8962 for instructions and.IRS 8962 2019 Fill out Tax Template Online US Legal Forms

how to fill out 8962 form 2022 Fill Online, Printable, Fillable Blank

Form 8962 Edit, Fill, Sign Online Handypdf

Irs form 8962 Fillable Irs form 8962 Instruction for How to Fill It

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

8962 (2014) Edit Forms Online PDFFormPro

Health Insurance Tax Form 8962 Free Nude Porn Photos

form 8962 2020 2021 pdf Fill Online, Printable, Fillable Blank

How To Fill Out Form 8962 laurasyearinhongkong

Web Use Form 8962 To Figure The Amount Of Your Premium Tax Credit (Ptc) And Reconcile It With Advance Payment Of The Premium Tax Credit (Aptc).

Even If You Estimated Your Income Perfectly, You Must Complete Form 8962 And Submit It With.

Web Video Instructions And Help With Filling Out And Completing 8962 Form 2021 Printable.

Watch This Brief Video To Get Answers On Many Questions You Will Have While Completing The Irs.

Related Post: