Free Printable Schedule C Tax Form

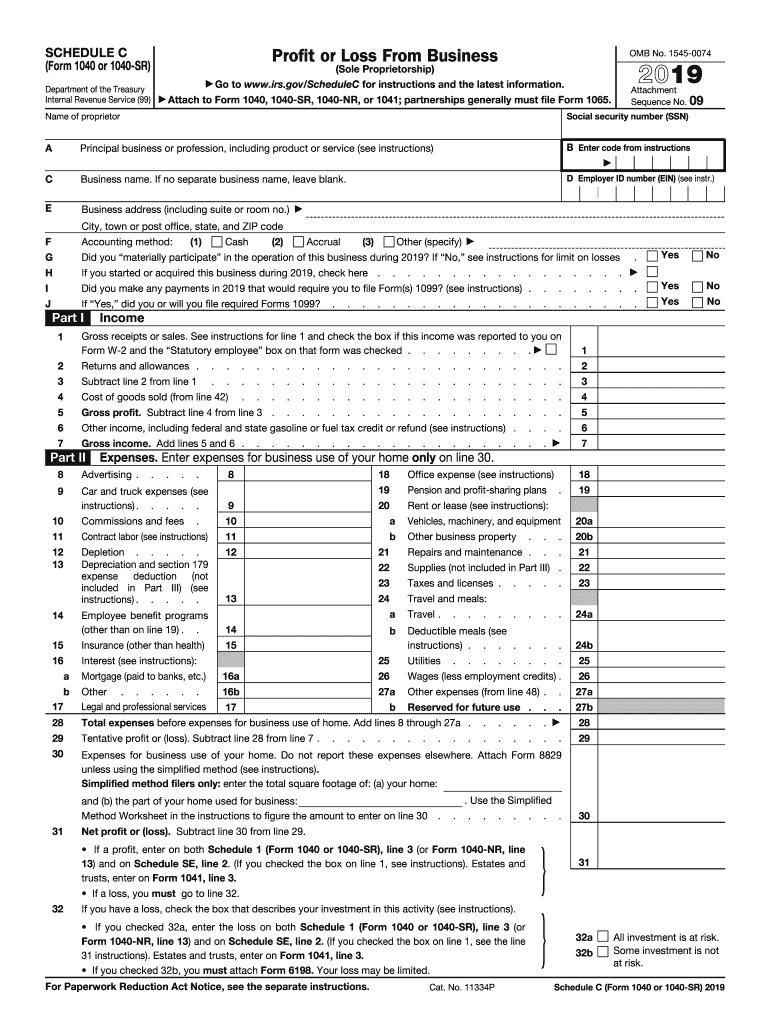

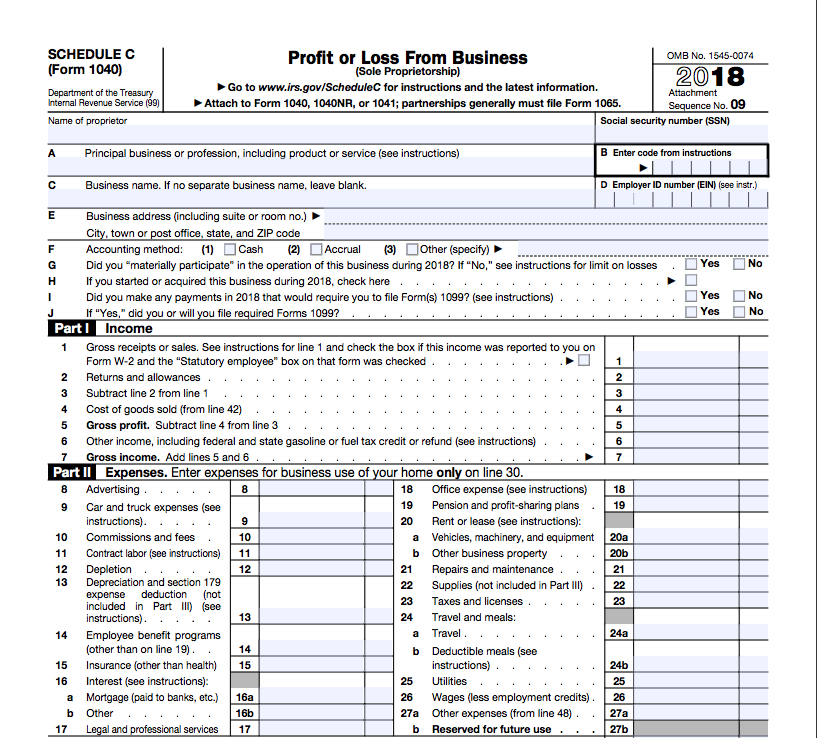

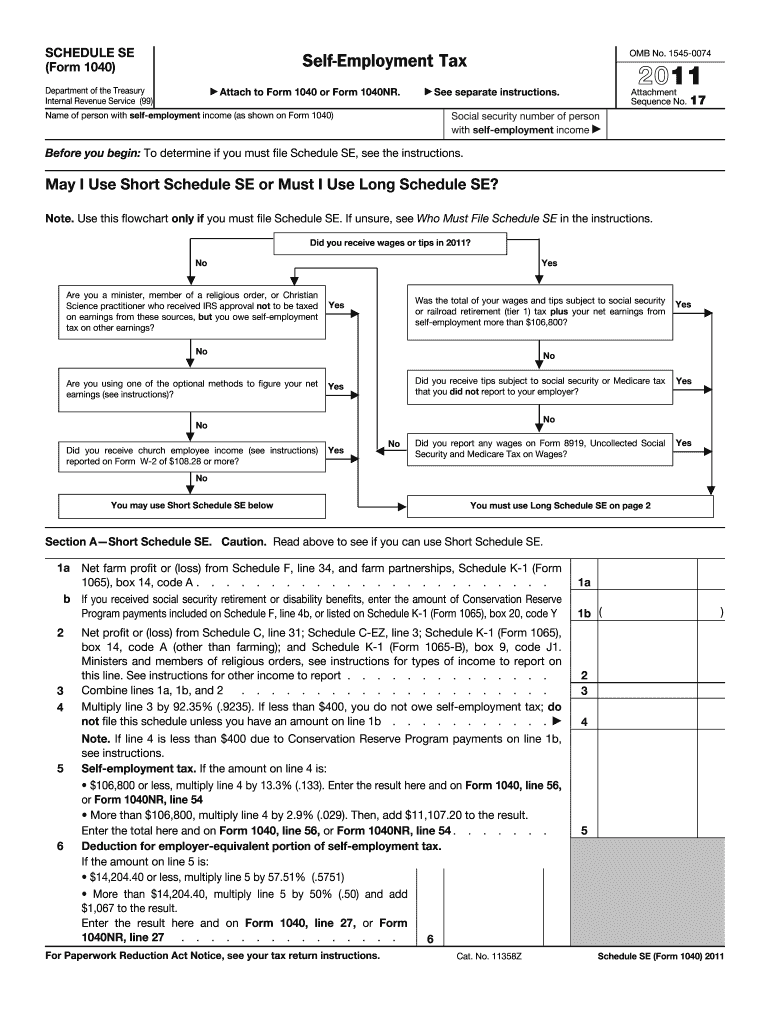

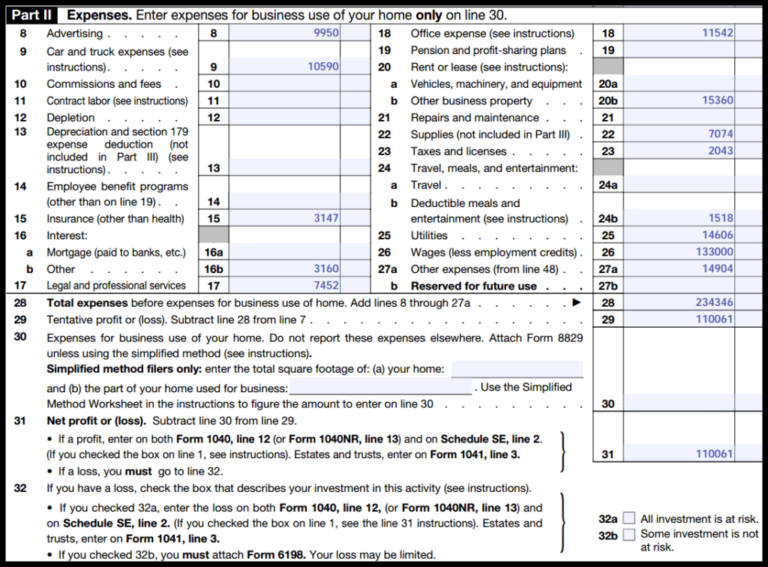

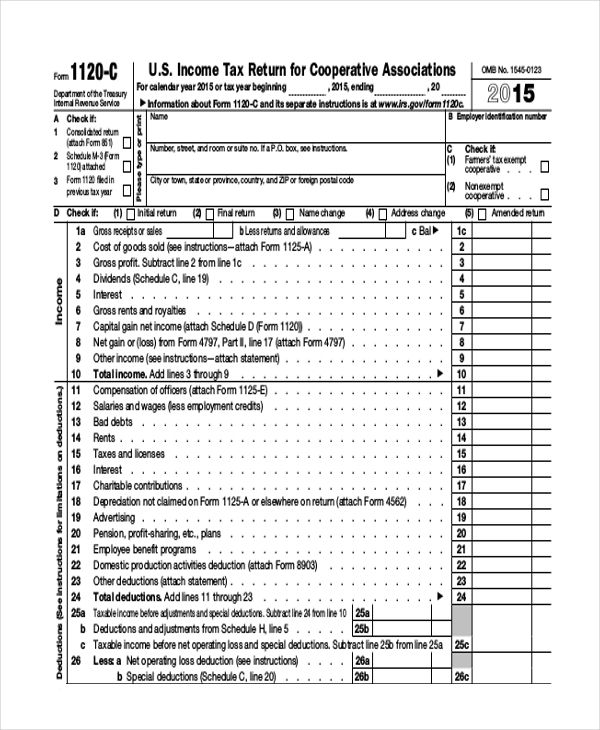

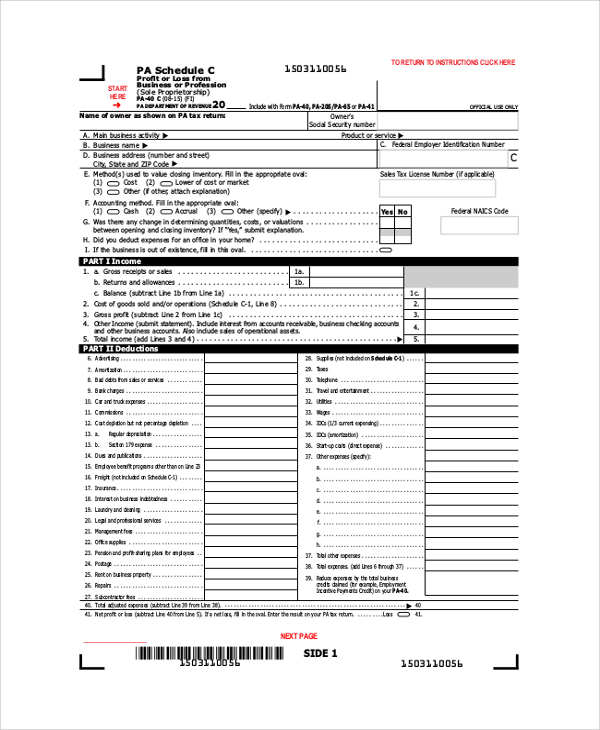

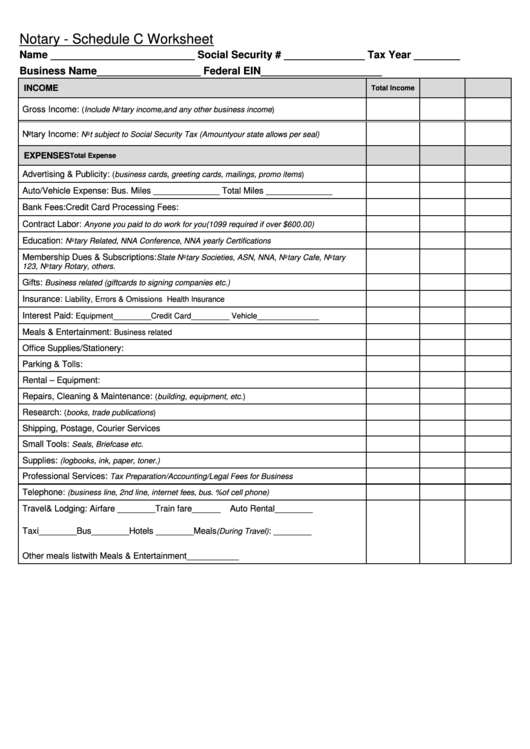

Free Printable Schedule C Tax Form - The resulting profit or loss. Web a form schedule c: $520 for married couples who filed jointly with an. Web who must file. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. This form is for income earned in tax year 2022, with tax returns due. An organization that answered “yes” on form 990, part iv, checklist of required schedules, line 3, 4, or 5, must complete the appropriate parts of. It shows your income and how much taxes you owe. Complete, sign, print and send your tax documents easily with us legal forms. $520 for married couples who filed jointly with an. Your irs tax return will be sent to you in due. Ad free for simple tax returns only with turbotax® free edition. Web who must file. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Follow these 9 steps to filling out and filing schedule c. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. $260. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Over 12m americans filed 100% free with turbotax® last year. Complete, sign,. $520 for married couples who filed jointly with an. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Schedule c is an addition. Web how much will i receive? Follow these 9 steps to filling out and filing schedule c. See if you qualify today. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. It shows your income and how much taxes you owe. Schedule c is an addition. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. It shows your income and how much taxes you owe. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Follow these 9 steps to filling out and filing schedule c. Web how much will i receive? Your irs tax return will be sent to you. $520 for married couples who filed jointly with an. This form is for income earned in tax year 2022, with tax returns due. Your irs tax return will be sent to you in due. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Ad edit,. Web how much will i receive? Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. An activity qualifies as a business if: Schedule c is an addition. Over 12m americans filed 100% free with turbotax® last year. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Ad free for simple tax returns only with turbotax® free edition. Your irs tax return will be sent to you in due. See if you qualify. Web a form schedule c: An organization that answered “yes” on form 990, part iv, checklist of required schedules, line 3, 4, or 5, must complete the appropriate parts of. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. See if you qualify today. The resulting profit or loss. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Download blank or fill out online in pdf format. The resulting profit or loss. Follow these 9 steps to filling out and filing schedule c. Schedule c is an addition. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Ad edit, sign and print irs schedule c (form 1040) tax form on any device with uslegalforms. Complete, edit or print tax forms instantly. Complete, sign, print and send your tax documents easily with us legal forms. It shows your income and how much taxes you owe. Ad free for simple tax returns only with turbotax® free edition. Over 12m americans filed 100% free with turbotax® last year. This form is for income earned in tax year 2022, with tax returns due. Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. Web a form schedule c: An organization that answered “yes” on form 990, part iv, checklist of required schedules, line 3, 4, or 5, must complete the appropriate parts of. Web who must file. See if you qualify today. Schedule c is an addition. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Follow these 9 steps to filling out and filing schedule c. Ad free for simple tax returns only with turbotax® free edition. $520 for married couples who filed jointly with an. Web a form schedule c: Your irs tax return will be sent to you in due. Complete, edit or print tax forms instantly. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. An organization that answered “yes” on form 990, part iv, checklist of required schedules, line 3, 4, or 5, must complete the appropriate parts of. This form is for income earned in tax year 2022, with tax returns due. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other.2019 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

Editable Schedule C Fill Online, Printable, Fillable, Blank pdfFiller

How To File Schedule C Form 1040 Bench Accounting

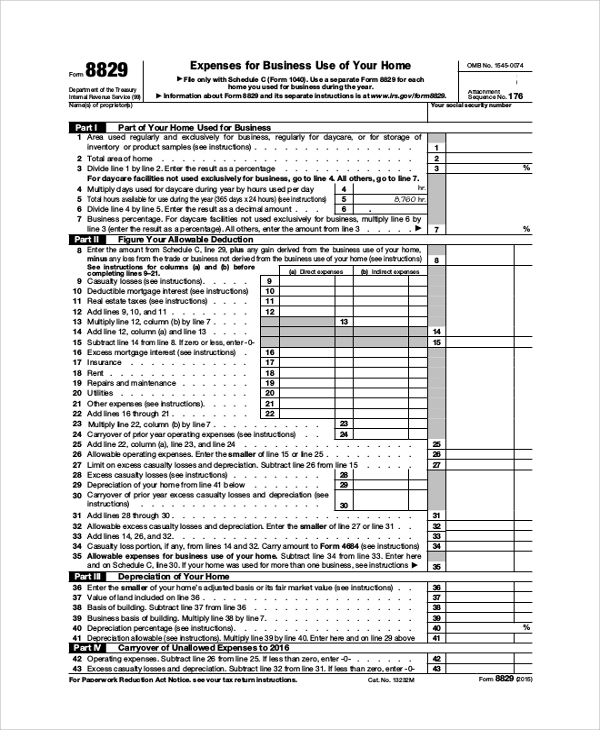

Form 1040 Schedule C Form 8829 1040 Form Printable

1040 Schedule C 2012 Form Fill Out and Sign Printable PDF Template

How to File SelfEmployed Taxes Online for 100 or Less Careful Cents

How To Complete Schedule C Profit And Loss From A Business 2021 Tax

FREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

Schedule C Worksheet printable pdf download

It Shows Your Income And How Much Taxes You Owe.

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

Download Blank Or Fill Out Online In Pdf Format.

Over 12M Americans Filed 100% Free With Turbotax® Last Year.

Related Post: