Free Printable W9

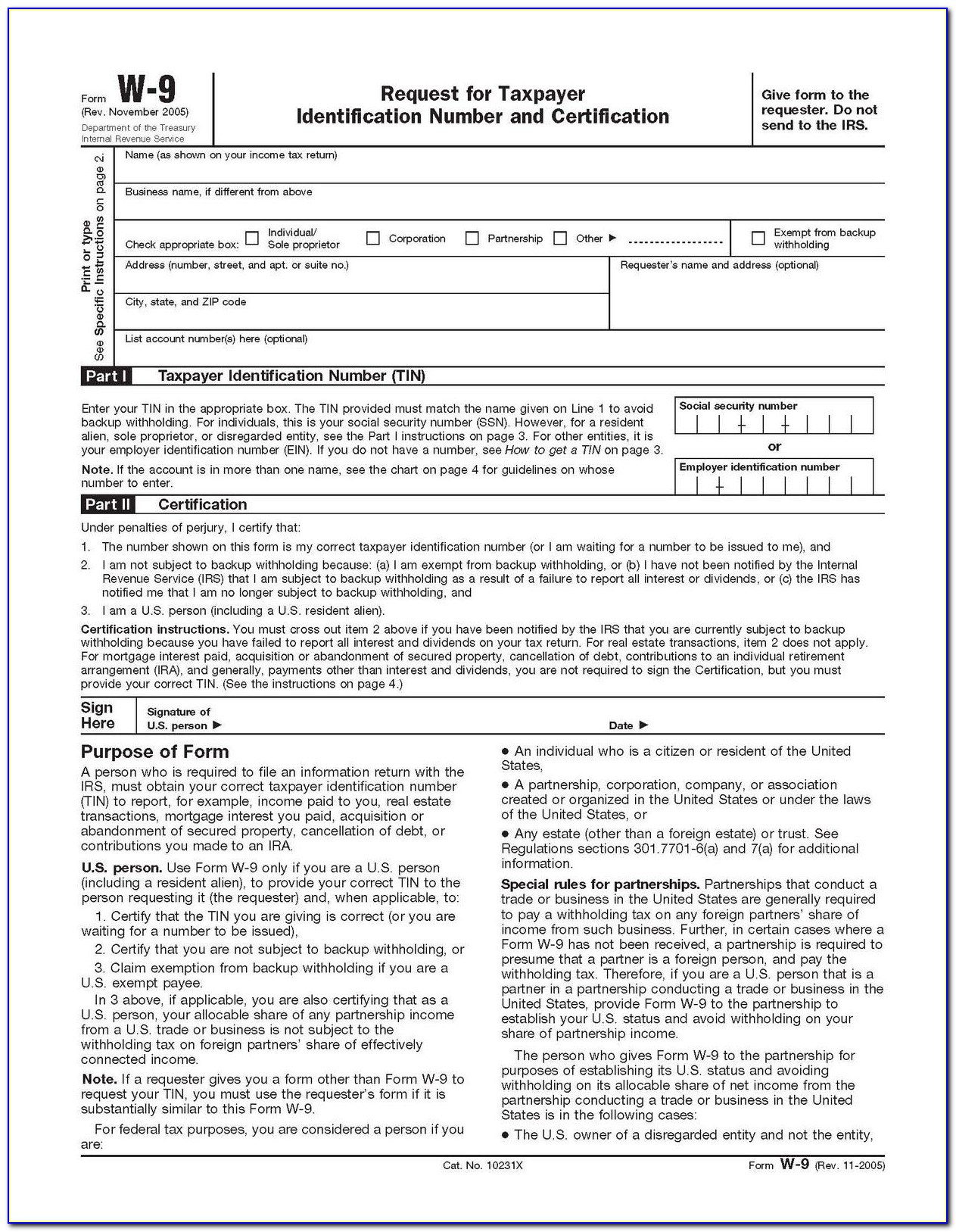

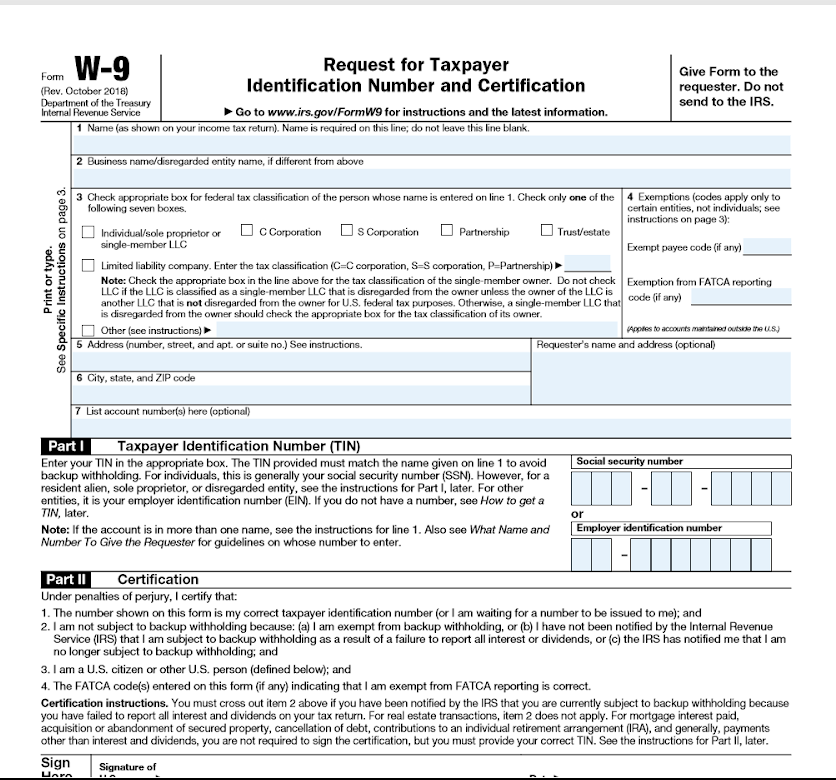

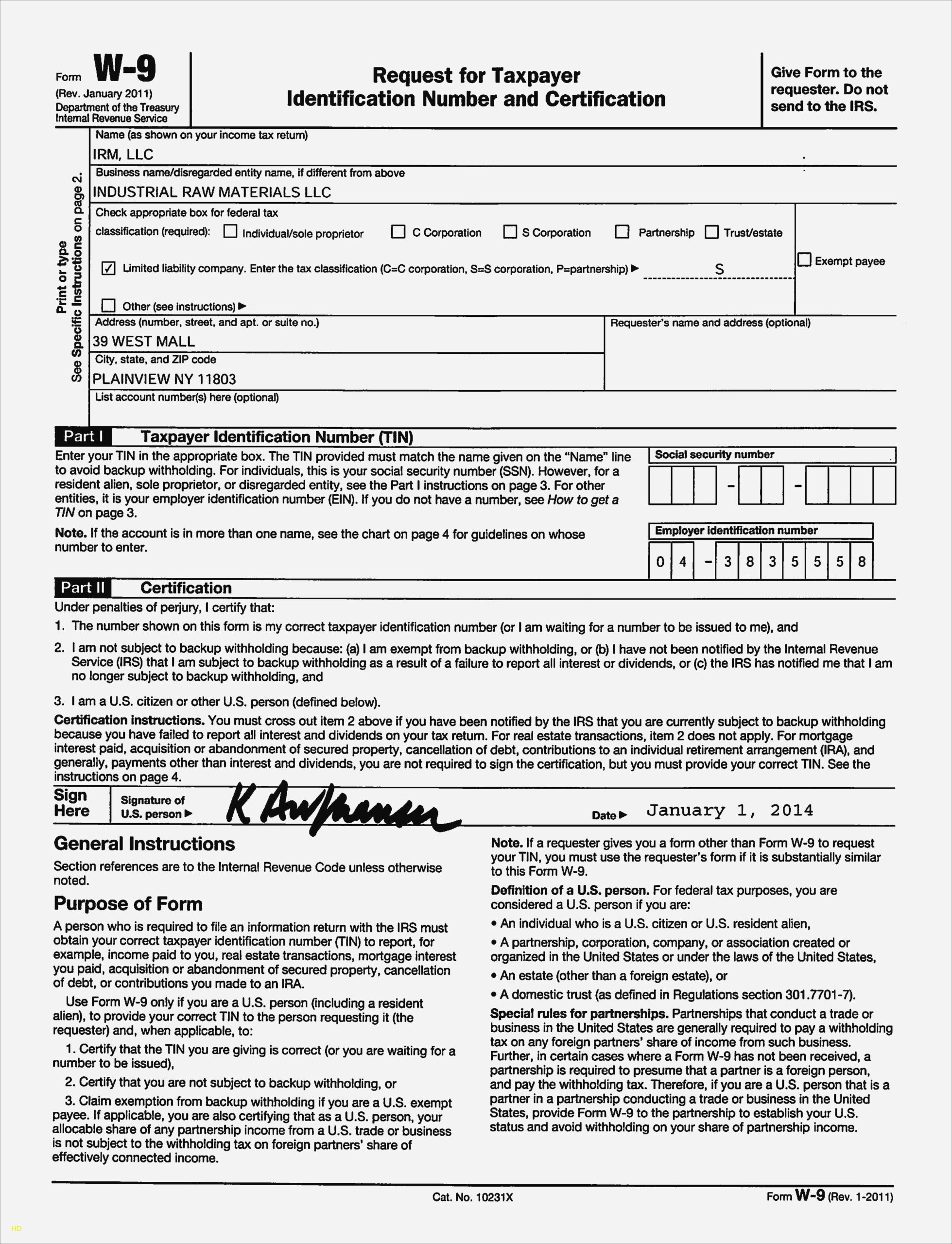

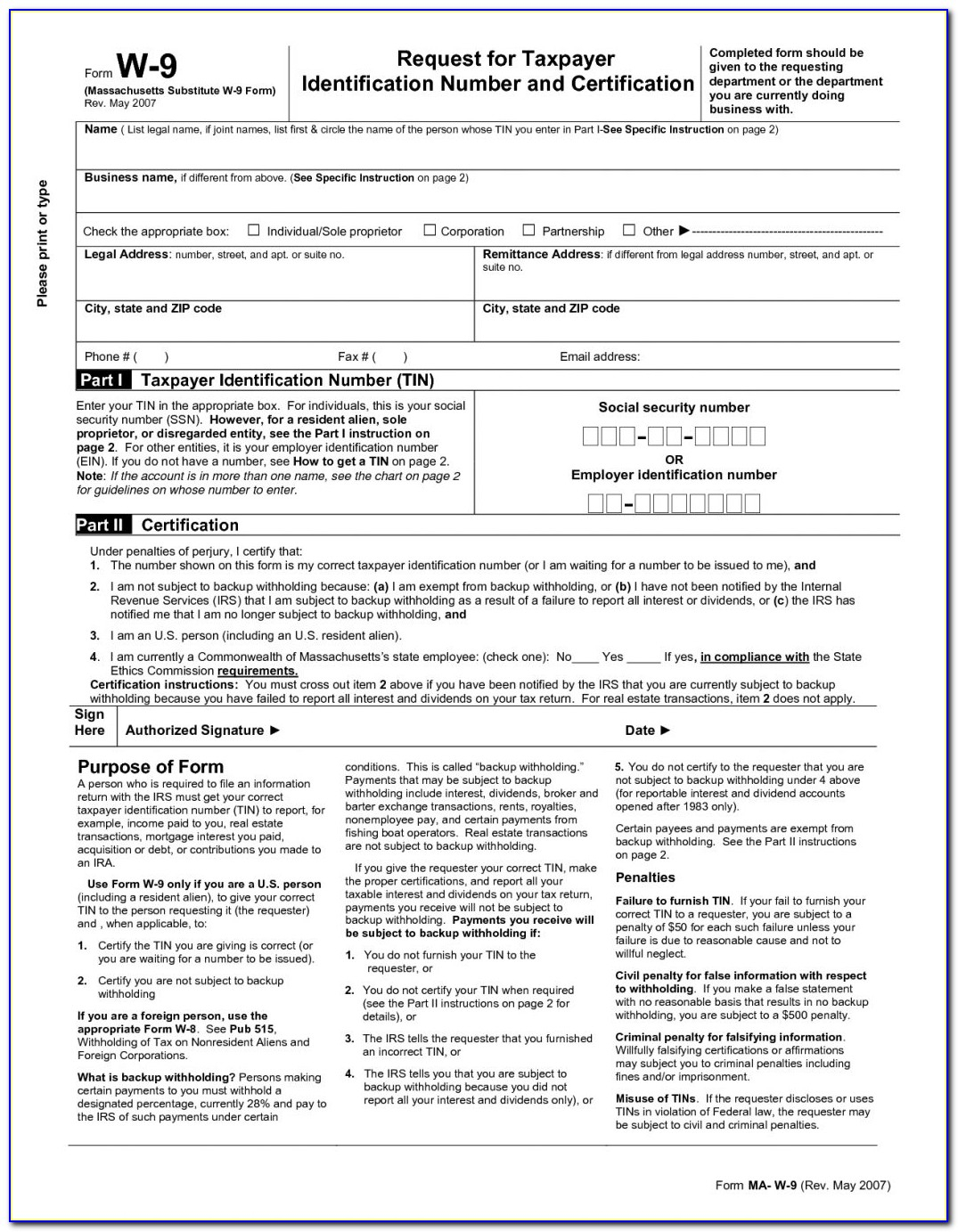

Free Printable W9 - Web file your pact act claim for free online through the va’s website or in person at a va regional office. View more information about using irs forms, instructions, publications and other item files. Web the form asks for information such as the ic's name, address, social security number (ssn), and more. Web print or type see specific instructions on page 2. Name (as shown on your income tax return). Ad get ready for tax season deadlines by completing any required tax forms today. The adobe acrobat sign library contains free. Web print or type see specific instructions on page 2. Scammers may offer to help you file your. Web st paul, minn. Name is required on this line; Web print or type see specific instructions on page 2. Scammers may offer to help you file your. You can get a free printable w9 form here or at the w9 website www.printw9.com. View more information about using irs forms, instructions, publications and other item files. Name is required on this line; Save time with our amazing tool. View more information about using irs forms, instructions, publications and other item files. Web the form asks for information such as the ic's name, address, social security number (ssn), and more. You can get a free printable w9 form here or at the w9 website www.printw9.com. Web acquisition or abandonment of secured property. — minnesota taxpayers, keep an eye on your bank accounts. Contributions you made to an ira. View more information about using irs forms, instructions, publications and other item files. Complete, edit or print tax forms instantly. Name (as shown on your income tax return). Ad get ready for tax season deadlines by completing any required tax forms today. Taxpayer identification number (tin) enter your tin in the appropriate box. Save time with our amazing tool. You can get a free printable w9 form here or at the w9 website www.printw9.com. The site also offers free spanish language w9 forms. Web file your pact act claim for free online through the va’s website or in person at a va regional office. Scammers may offer to help you file your. Name (as shown on your income tax return) business name/disregarded entity name, if different from above check. Web acquisition or abandonment of. Save time with our amazing tool. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Complete, edit or print tax forms instantly. Our simple steps and detailed instructions help you complete &. Scammers may offer to help you file your. Name (as shown on your income tax return) business name/disregarded entity name, if different from above check. Web the field has been trimmed to 50 players, but the stakes have intensified as players travel to the 2023 bmw championship at olympia fields country club. Page last reviewed or updated: Name is required on this line; View more information about using. Do not leave this line blank. Contributions you made to an ira. Name is required on this line; The adobe acrobat sign library contains free. Web acquisition or abandonment of secured property. Our simple steps and detailed instructions help you complete &. Complete, edit or print tax forms instantly. Web the latest versions of irs forms, instructions, and publications. Contributions you made to an ira. For individuals, this is your social security number. Name (as shown on your income tax return). December 2014) department of the treasury identification number and certification internal revenue service give form to the. View more information about using irs forms, instructions, publications and other item files. The adobe acrobat sign library contains free. Web the form asks for information such as the ic's name, address, social security number. Contributions you made to an ira. For individuals, this is your social security number. Do not leave this line blank. Web forms, instructions and publications search. Scammers may offer to help you file your. Web the latest versions of irs forms, instructions, and publications. Save time with our amazing tool. Name is required on this line; Taxpayer identification number (tin) enter your tin in the appropriate box. Web st paul, minn. The site also offers free spanish language w9 forms. View more information about using irs forms, instructions, publications and other item files. Web the field has been trimmed to 50 players, but the stakes have intensified as players travel to the 2023 bmw championship at olympia fields country club. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Name (as shown on your income tax return) business name/disregarded entity name, if different from above check. Ad get ready for tax season deadlines by completing any required tax forms today. Web print or type see specific instructions on page 2. Web print or type see specific instructions on page 2. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Web acquisition or abandonment of secured property. Our simple steps and detailed instructions help you complete &. View more information about using irs forms, instructions, publications and other item files. For individuals, this is your social security number. December 2014) department of the treasury identification number and certification internal revenue service give form to the. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Taxpayer identification number (tin) enter your tin in the appropriate box. Web print or type see specific instructions on page 2. Web the latest versions of irs forms, instructions, and publications. Web print or type see specific instructions on page 2. Web st paul, minn. Web the form asks for information such as the ic's name, address, social security number (ssn), and more. Contributions you made to an ira. The site also offers free spanish language w9 forms. Scammers may offer to help you file your. You can get a free printable w9 form here or at the w9 website www.printw9.com. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:Topic Creating a fillable pdf form with an existing content WS Form

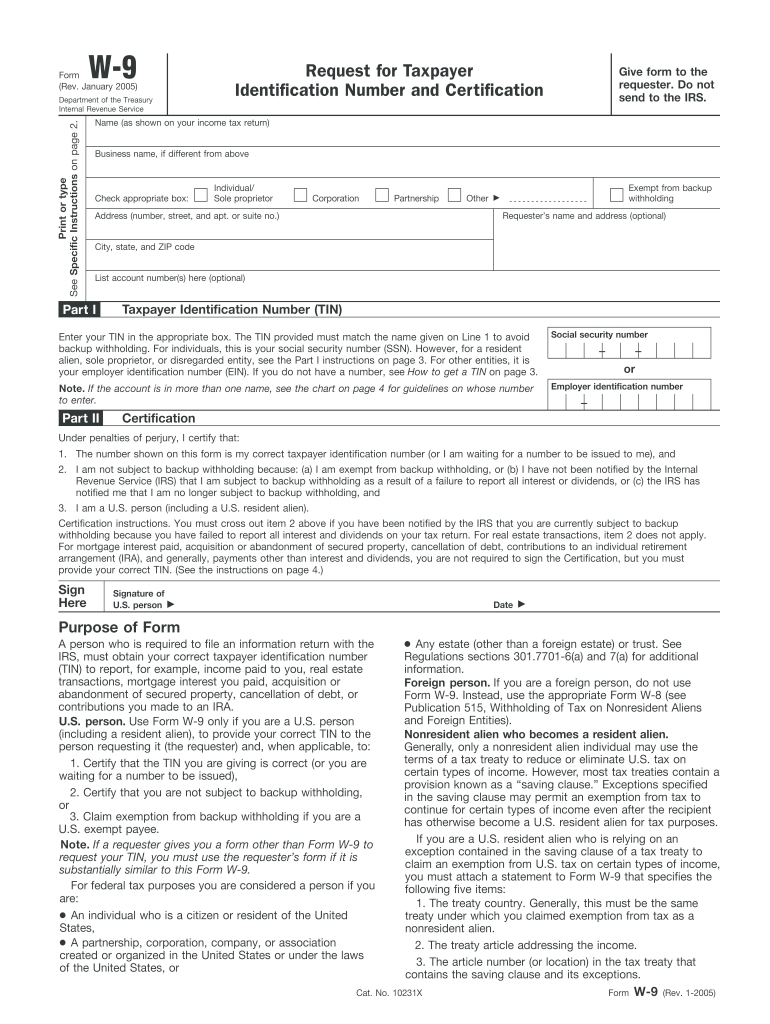

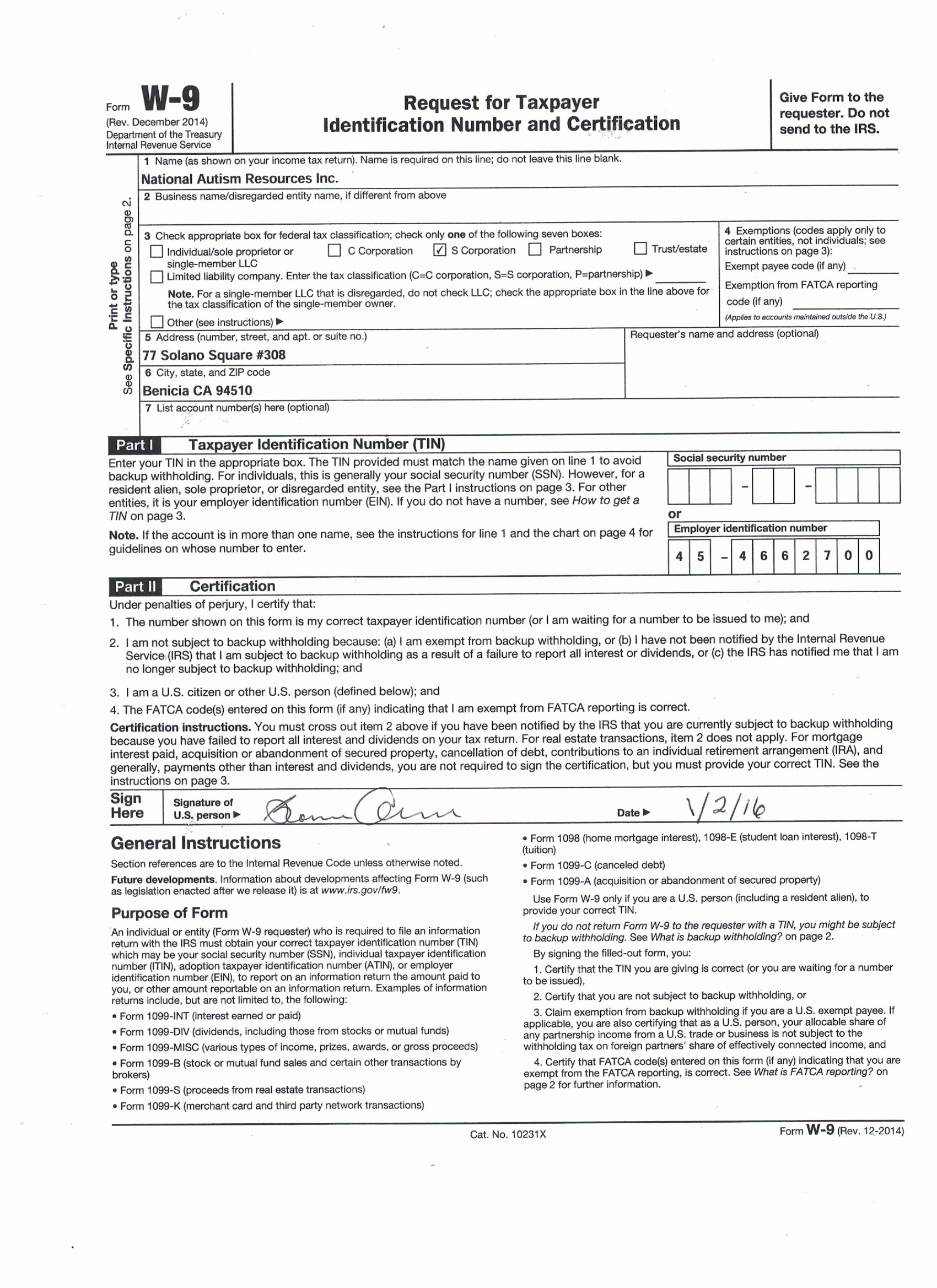

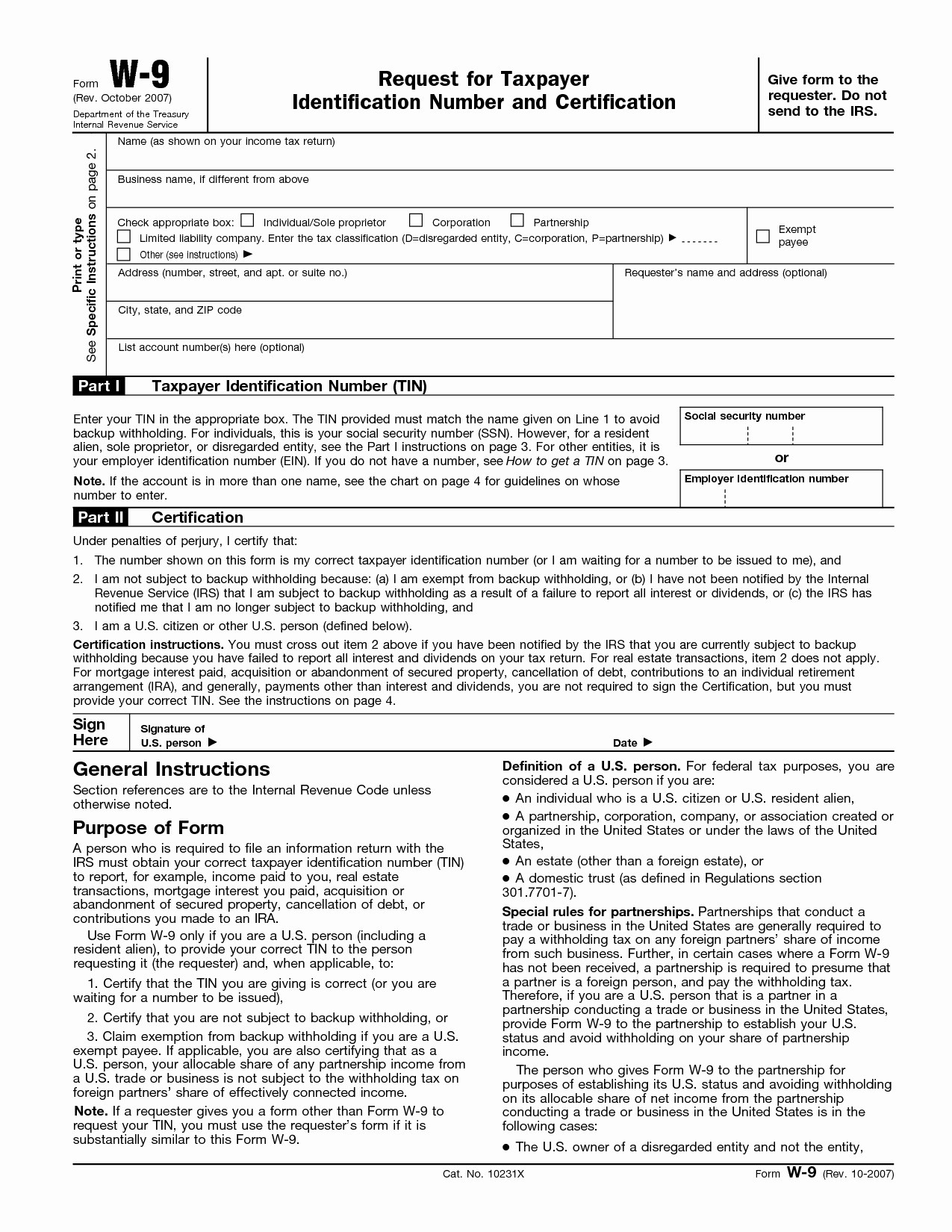

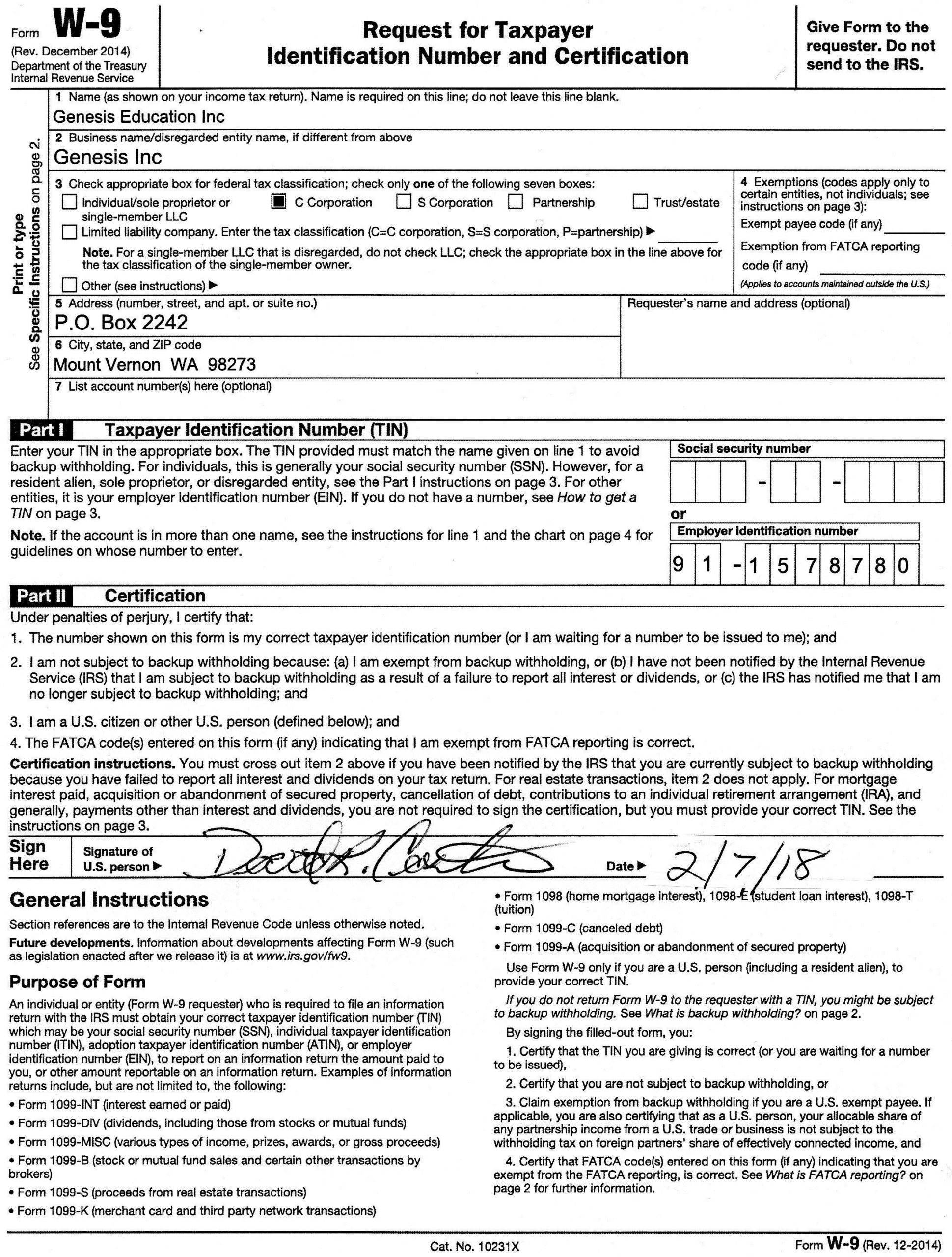

Free Printable W9 Form From Irs

How to Submit Your W 9 Forms Pdf Free Job Application Form

Sample W 9 Form Example Calendar Printable

Printable Blank W9 Form Example Calendar Printable

Blank W 9 Form 2021 Fillable Printable Calendar Template Printable

Downloadable Form W 9 Printable W9 Printable Pages In 2020 with Free

Printable Blank W 9 Forms Pdf Example Calendar Printable

W9 Form 2019 Printable Irs W9 Tax Blank In Pdf Free Printable W9

Printable Form W 9 2021 Calendar Template Printable

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Name (As Shown On Your Income Tax Return).

Page Last Reviewed Or Updated:

Web Acquisition Or Abandonment Of Secured Property.

Related Post: