Irs Form 1098-C Printable

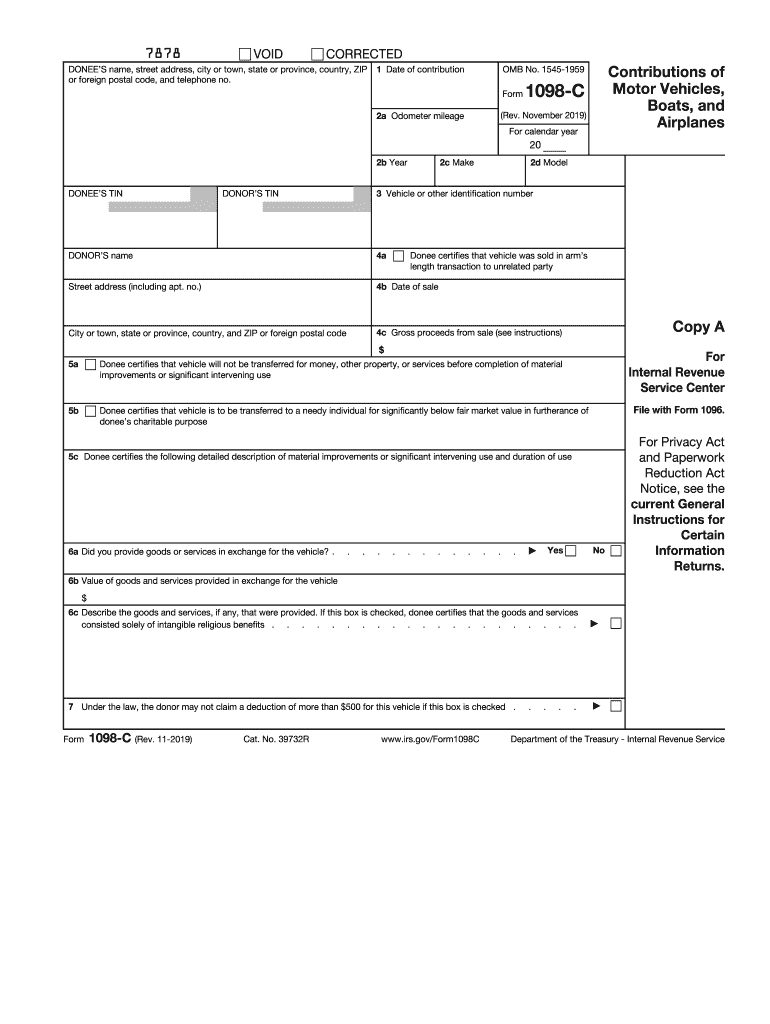

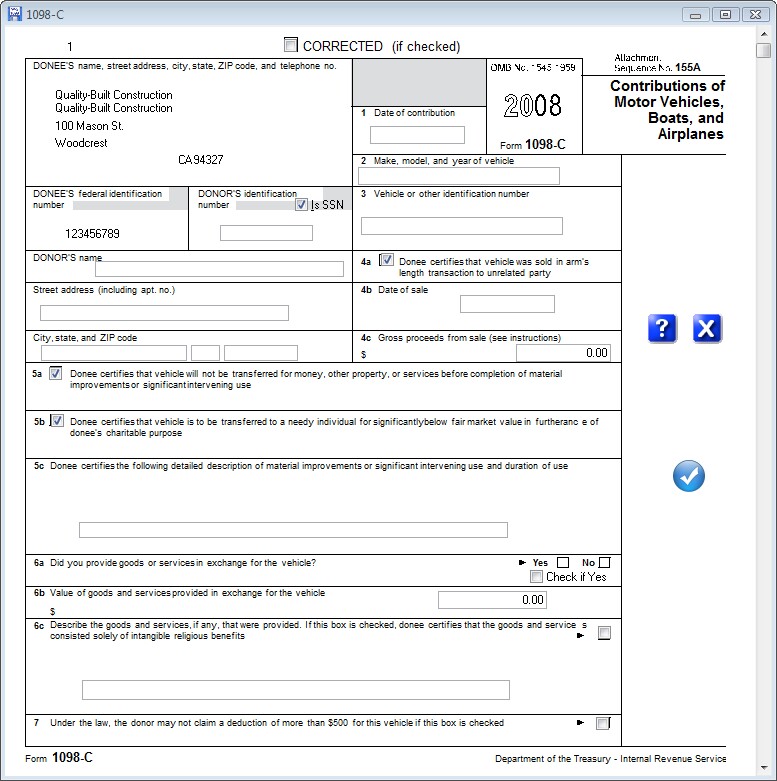

Irs Form 1098-C Printable - Web for paperwork reduction act notice, see your tax return instructions. Web attention filers of form 1096: Web copy a of this form is provided for informational purposes only. Web partnerships and s corporations. A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Upload, modify or create forms. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. For filing and furnishing instructions, including due dates, and requesting filing or furnishing. Copy a appears in red, similar to the official irs form. Generally, you must also attach form 8283, noncash charitable contributions, if the. Web attention filers of form 1096: Web 1098, 1099, 3921, or 5498 that you download and print from the irs website. Web overview when you donate a vehicle to charity, you may be able to deduct it as a charitable contribution if you itemize your deductions. It appears in red, similar to the official irs form. Because paper forms are. Web about form 1098, mortgage interest statement. For filing and furnishing instructions, including due dates, and requesting filing or furnishing. Upload, modify or create forms. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. Web for paperwork reduction act notice, see your tax. Web attention filers of form 1096: Web 1098, 1099, 3921, or 5498 that you download and print from the irs website. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922,. Complete, edit or print tax forms instantly. Open the document with our powerful pdf editor. It appears in red, similar to the official irs form. This form is provided for informational purposes only. Web attention filers of form 1096: Web file this form only if you are attaching one or more of the following forms or supporting documents. Generally, you must also attach form 8283, noncash charitable contributions, if the. Upload, modify or create forms. Web overview when you donate a vehicle to charity, you may be able to deduct it as a charitable contribution if you itemize your. A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Both the form and instructions. Web overview when you donate a vehicle to charity, you may be able to deduct it as a charitable contribution if you itemize your deductions. Because paper forms are scanned during. For filing and furnishing instructions, including due dates, and to request filing. A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Web all you need is to follow these easy instructions: Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098,. Complete, edit or print tax forms instantly. Form 1098 and these instructions have been converted from an annual revision to continuous use. It appears in red, similar to the official irs form. 8863 (2022) form 8863 (2022). Web all you need is to follow these easy instructions: Form 1098 and these instructions have been converted from an annual revision to continuous use. Open the document with our powerful pdf editor. Web file this form only if you are attaching one or more of the following forms or supporting documents. This form is provided for informational purposes only. Web about form 1098, mortgage interest statement. Form 1098 and these instructions have been converted from an annual revision to continuous use. Web 1098, 1099, 3921, or 5498 that you print from the irs website. Web most recent version, go to irs.gov/form1098c. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website.. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. This form is provided for informational purposes only. Form 1098 and these instructions have been converted from an annual revision to continuous use. Web 1098, 1099, 3921, or 5498 that you print from the irs website. Web copy a of this form is provided for informational purposes only. Try it for free now! The official printed version of copy a of this irs form is. Web attention filers of form 1096: Web 1098, 1099, 3921, or 5498 that you download and print from the irs website. Upload, modify or create forms. A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. 8863 (2022) form 8863 (2022). Web all you need is to follow these easy instructions: Web partnerships and s corporations. Copy a appears in red, similar to the official irs form. Web most recent version, go to irs.gov/form1098c. For filing and furnishing instructions, including due dates, and requesting filing or furnishing. Check the applicable box(es) to identify the. It appears in red, similar to the official irs form. Complete, edit or print tax forms instantly. For filing and furnishing instructions, including due dates, and requesting filing or furnishing. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the. Copy a appears in red, similar to the official irs form. Web overview when you donate a vehicle to charity, you may be able to deduct it as a charitable contribution if you itemize your deductions. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. Web 1098, 1099, 3921, or 5498 that you print from the irs website. Web file this form only if you are attaching one or more of the following forms or supporting documents. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Try it for free now! Form 1098 and these instructions have been converted from an annual revision to continuous use. Both the form and instructions. Web partnerships and s corporations. Open the document with our powerful pdf editor. 8863 (2022) form 8863 (2022). Web most recent version, go to irs.gov/form1098c. For filing and furnishing instructions, including due dates, and to request filing.Irs Form 1098 C Instructions Universal Network

How to Print and File Tax Form 1098C, Contributions of Motor Vehicles

IRS 1098C 20192021 Fill and Sign Printable Template Online US

14 best Form 1098C images on Pinterest Donate car, Vehicle and Vehicles

1098 C 2018 Fill Online, Printable, Fillable, Blank pdfFiller

Irs Form 1098c Printable Printable World Holiday

IRS Form 1098C Software eFile for 289, 449 Outsource 1098C Software

Pin on W2 and 1099 Software

Entering & Editing Data > Form 1098C

IRS Approved 1098C Laser Copy C Tax Form

Ad Access Irs Tax Forms.

Web Copy A Of This Form Is Provided For Informational Purposes Only.

Generally, You Must Also Attach Form 8283, Noncash Charitable Contributions, If The.

A Partnership Or S Corporation That Claims A Deduction For Noncash Gifts Of More Than $500 Must File Form 8283 (Section A Or Section.

Related Post: