Irs Form 147C Printable

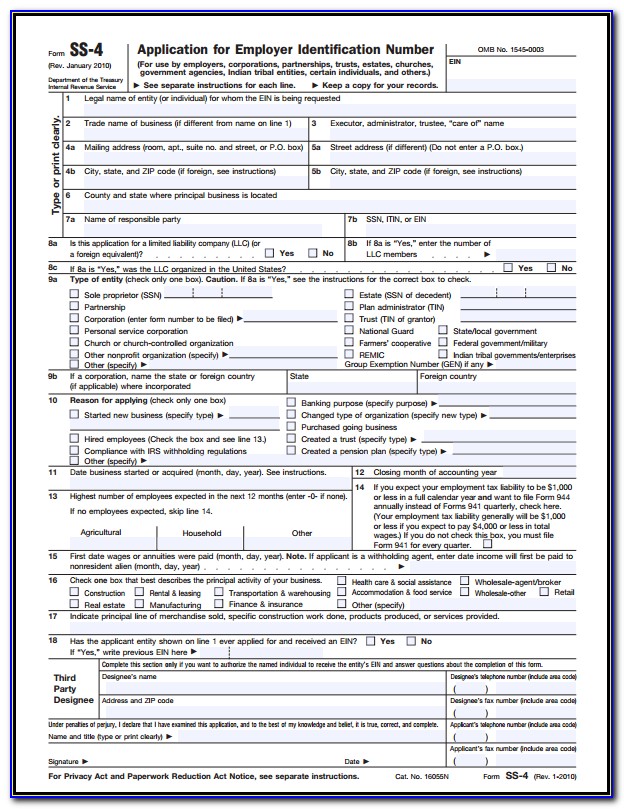

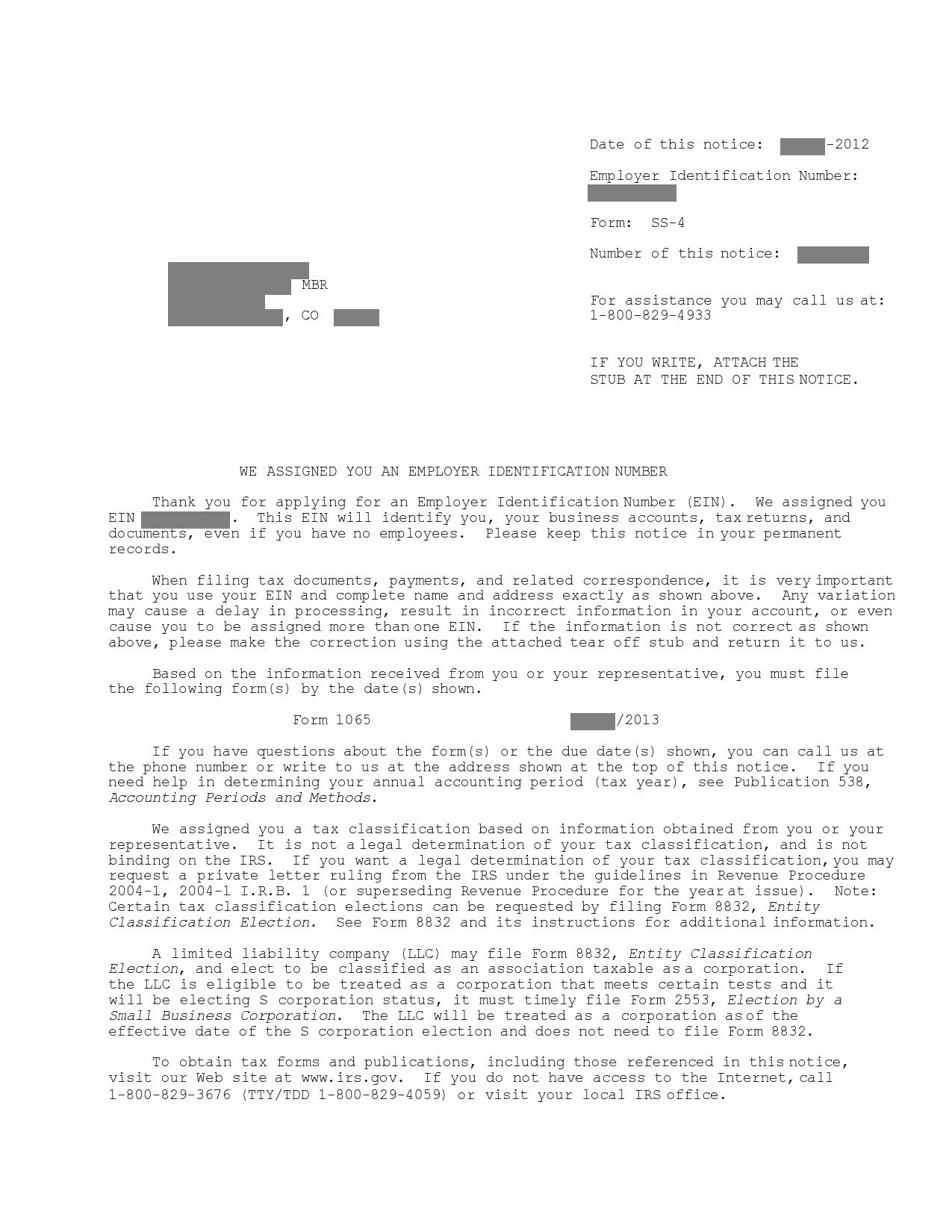

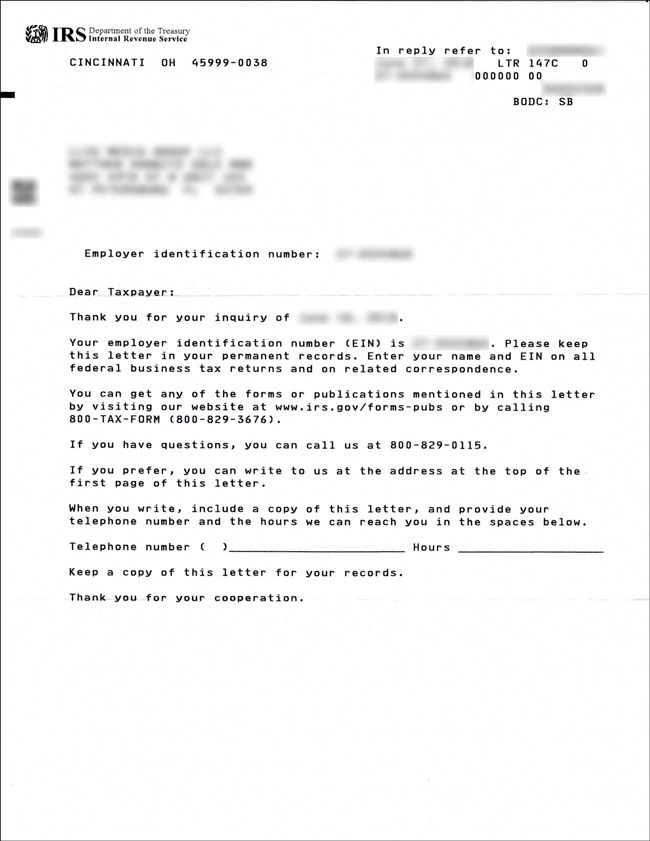

Irs Form 147C Printable - You’ll be able to confirm this address when you’re. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Ask the irs to search for your ein by calling the business & specialty tax line at. Entity department ogden, ut 84201. Web fill in every fillable field. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. You can use three available alternatives;. 2) make sure that the words ^147c. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. You can use three available alternatives;. Edit your 147c form online type text, add images, blackout confidential details, add comments, highlights and more. Web fill in every fillable field. Follow the below process to obtain a. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document. Web 1) you and your poa will need to complete the irs form 2848 and have it ready to send to the irs via fax during the phone call with the irs. Your previously filed return should be notated. You will need to request a “147c verification. You’ll be able to confirm this address when you’re. You can use three available alternatives;. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Web complete irs form 147c pdf online with us legal. You can also download it, export it or print it out. You can use three available alternatives;. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Edit your 147c form online type text, add images, blackout confidential details, add comments, highlights and. You can use three available alternatives;. The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. Ad create legal forms instantly. You will need to have the name and address of the church or entity that you have been using on your w‐2 forms, 1099 forms, or form 941. Edit your form 147c. Follow the below process to obtain a. Web as of 2021, the irs no longer provides form 147c to individuals who request it online. Web home understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an. The form can be downloaded from the irs at: Follow the below process to obtain a. Instead, this is a form that will be sent to you if you have to ask the irs to tell you what your employer identification number (ein) is, in. Web complete irs form 147c pdf online with us legal forms. Web as of 2021,. You’ll be able to confirm this address when you’re. After the submission of form 1099 information returns, the irs will send you a cp2100 or a cp2100a notice and a listing of. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Ad. Web there is a solution if you don’t have possession of the ein confirmation letter. The form can be downloaded from the irs at: 2) make sure that the words ^147c. Call the irs at (800) 829‐4933 press “1” for service in english To get a letter verifying your employer identification number in 2023, you'll need to submit a written. To get a letter verifying your employer identification number in 2023, you'll need to submit a written request to the irs and include proof of your identity as well as a copy of your ein. Instead, this is a form that will be sent to you if you have to ask the irs to tell you what your employer identification. Share your form with others send form 147c no no download needed needed via email, link, or fax. 2) make sure that the words ^147c. Easily fill out pdf blank, edit, and sign them. Web 1) you and your poa will need to complete the irs form 2848 and have it ready to send to the irs via fax during the phone call with the irs. Edit your form 147c online type text, add images, blackout confidential details, add comments, highlights and. You can also download it, export it or print it out. Your previously filed return should be notated with your ein. Use the information in the table below to validate the wpd provided by the. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Call the irs at (800) 829‐4933 press “1” for service in english Web as of 2021, the irs no longer provides form 147c to individuals who request it online. Freetaxusa.com has been visited by 10k+ users in the past month Here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. The form can be downloaded from the irs at: Web home understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an additional part of that amount to your. Edit your 147c form online type text, add images, blackout confidential details, add comments, highlights and more. You can use three available alternatives;. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web there is a solution if you don’t have possession of the ein confirmation letter. Follow the below process to obtain a. Freetaxusa.com has been visited by 10k+ users in the past month The form can be downloaded from the irs at: You will need to request a “147c verification. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission. Instead, this is a form that will be sent to you if you have to ask the irs to tell you what your employer identification number (ein) is, in. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Call the irs at (800) 829‐4933 press “1” for service in english The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. You will need to have the name and address of the church or entity that you have been using on your w‐2 forms, 1099 forms, or form 941. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. After the submission of form 1099 information returns, the irs will send you a cp2100 or a cp2100a notice and a listing of. Your previously filed return should be notated with your ein. Edit your 147c form online type text, add images, blackout confidential details, add comments, highlights and more. Add the date to the document using the date option. The irs will mail your 147c letter to the mailing address they have on file for your llc.Irs Letter 147c Sample

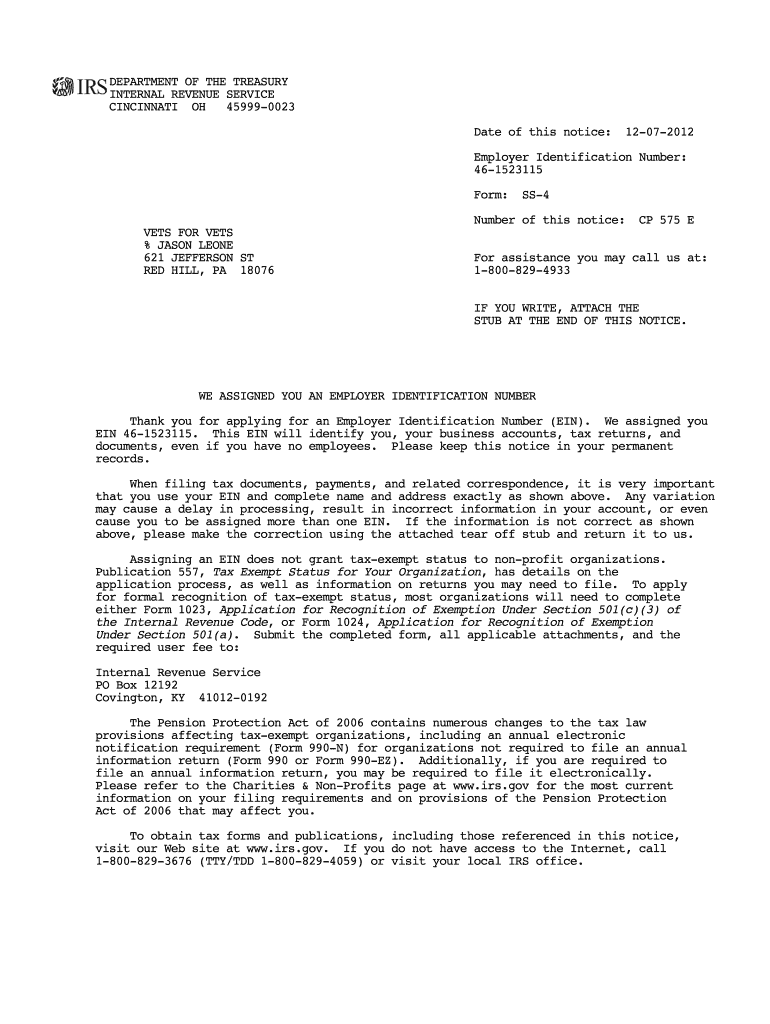

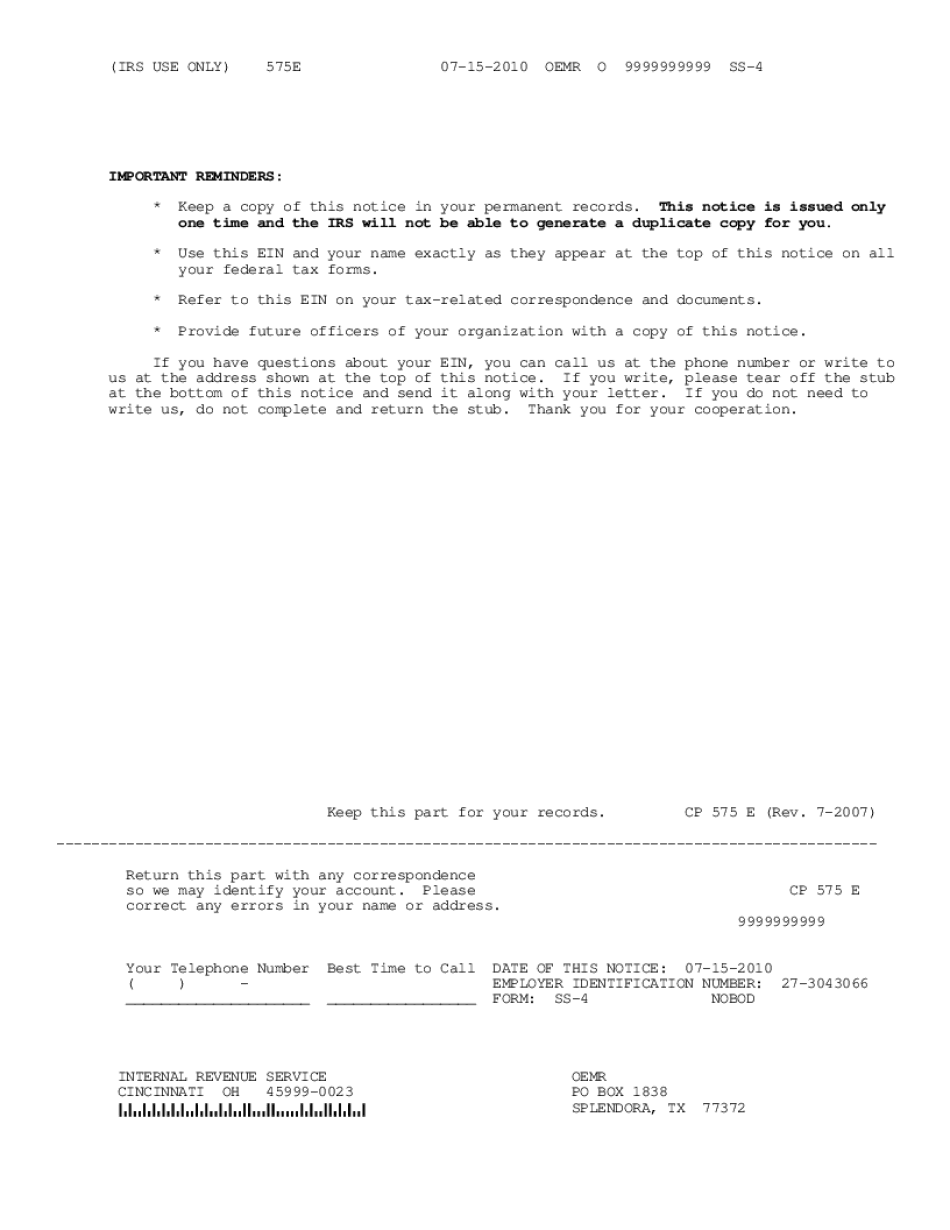

What Is Form CP575? Gusto

Ein Verification Letter 147c certify letter

Irs Form 147c Printable Printable Form, Templates and Letter

Irs Form 147c Printable Printable World Holiday

20 EIN Verification Letters (147c Letters) ᐅ TemplateLab

IRS FORM 147C PDF

Printable Cp 575 Form Printable World Holiday

Ein Verification Letter 147c certify letter

Irs Form 147c Printable Printable Form, Templates and Letter

Web 1) You And Your Poa Will Need To Complete The Irs Form 2848 And Have It Ready To Send To The Irs Via Fax During The Phone Call With The Irs.

Select The Sign Button And Make An Electronic Signature.

Entity Department Ogden, Ut 84201.

Use The Information In The Table Below To Validate The Wpd Provided By The.

Related Post: