Irs Forms W 9 Printable

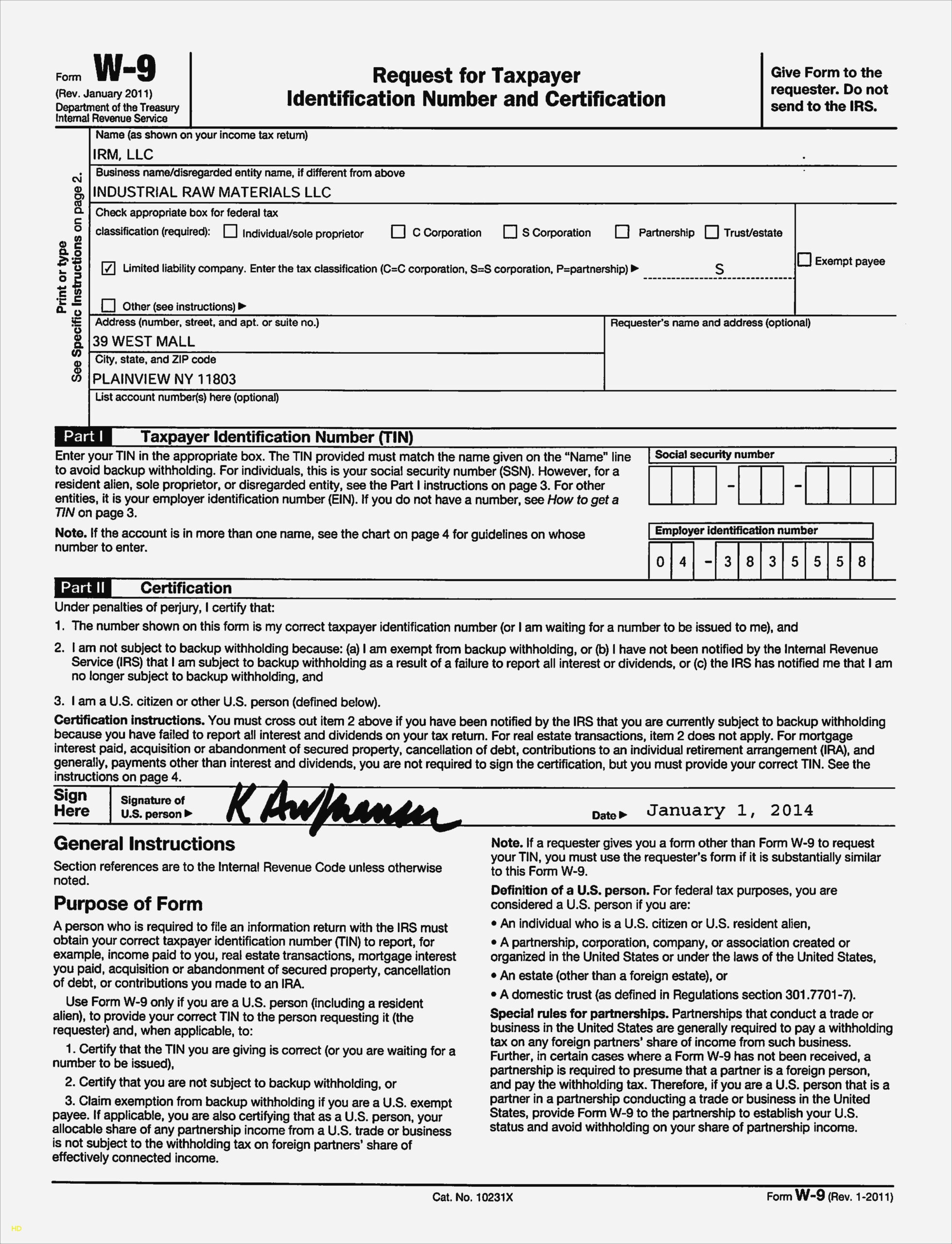

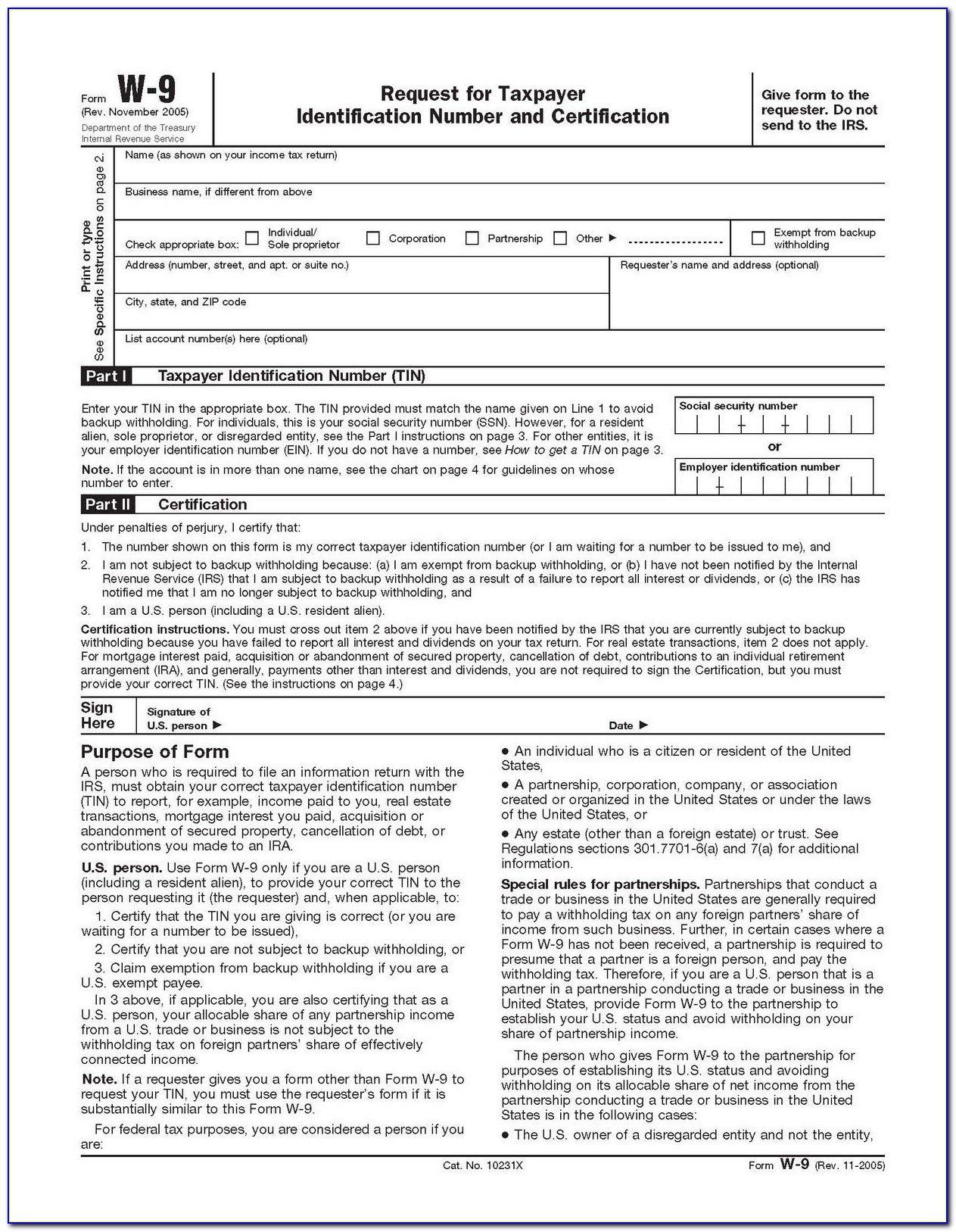

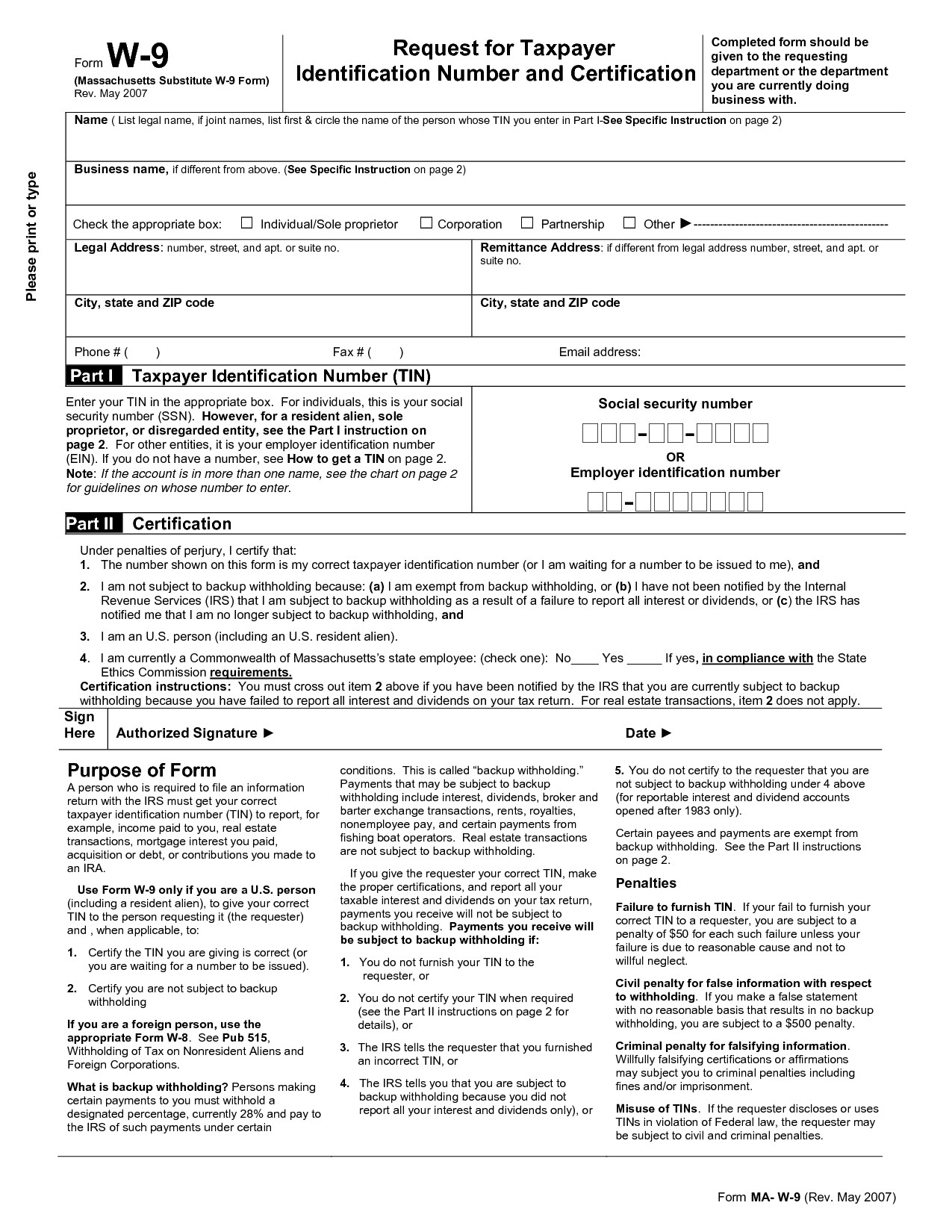

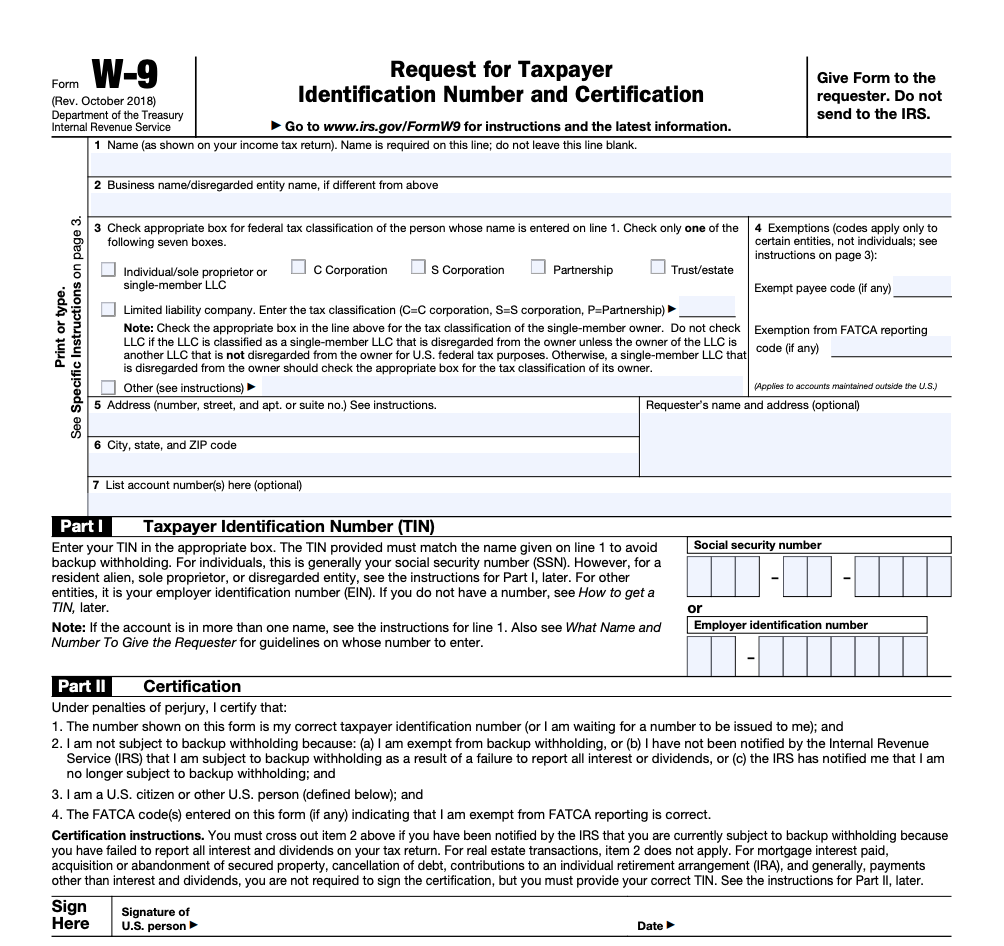

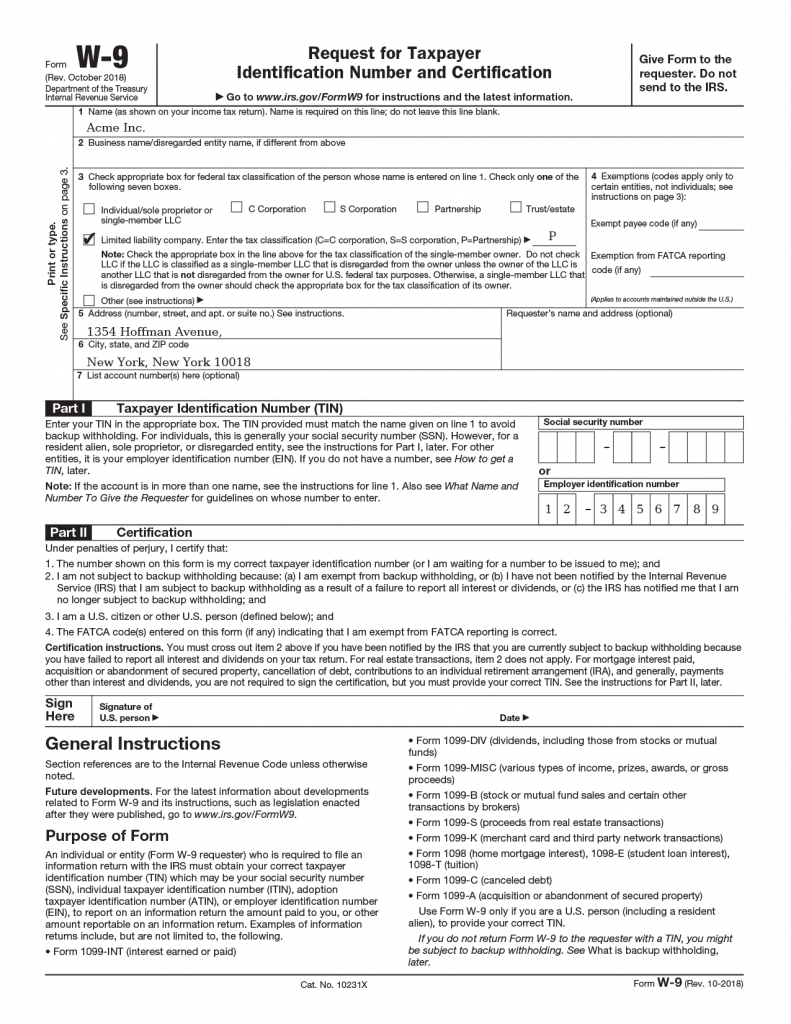

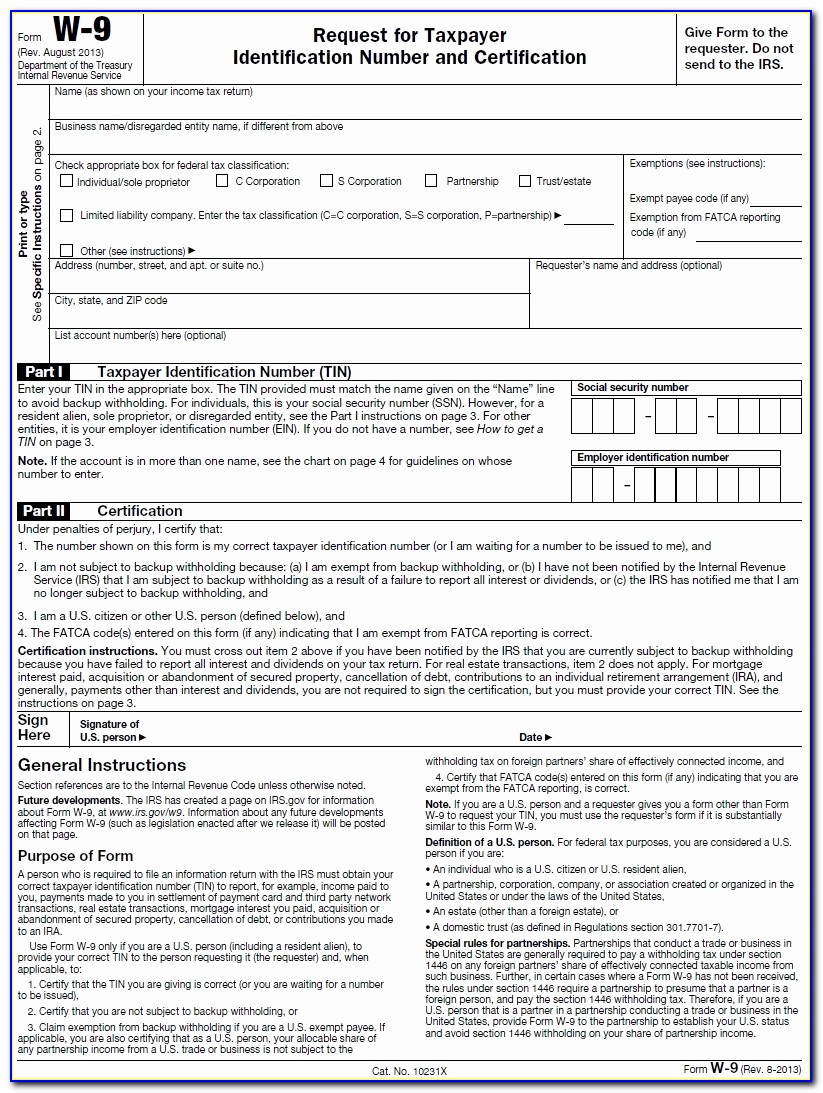

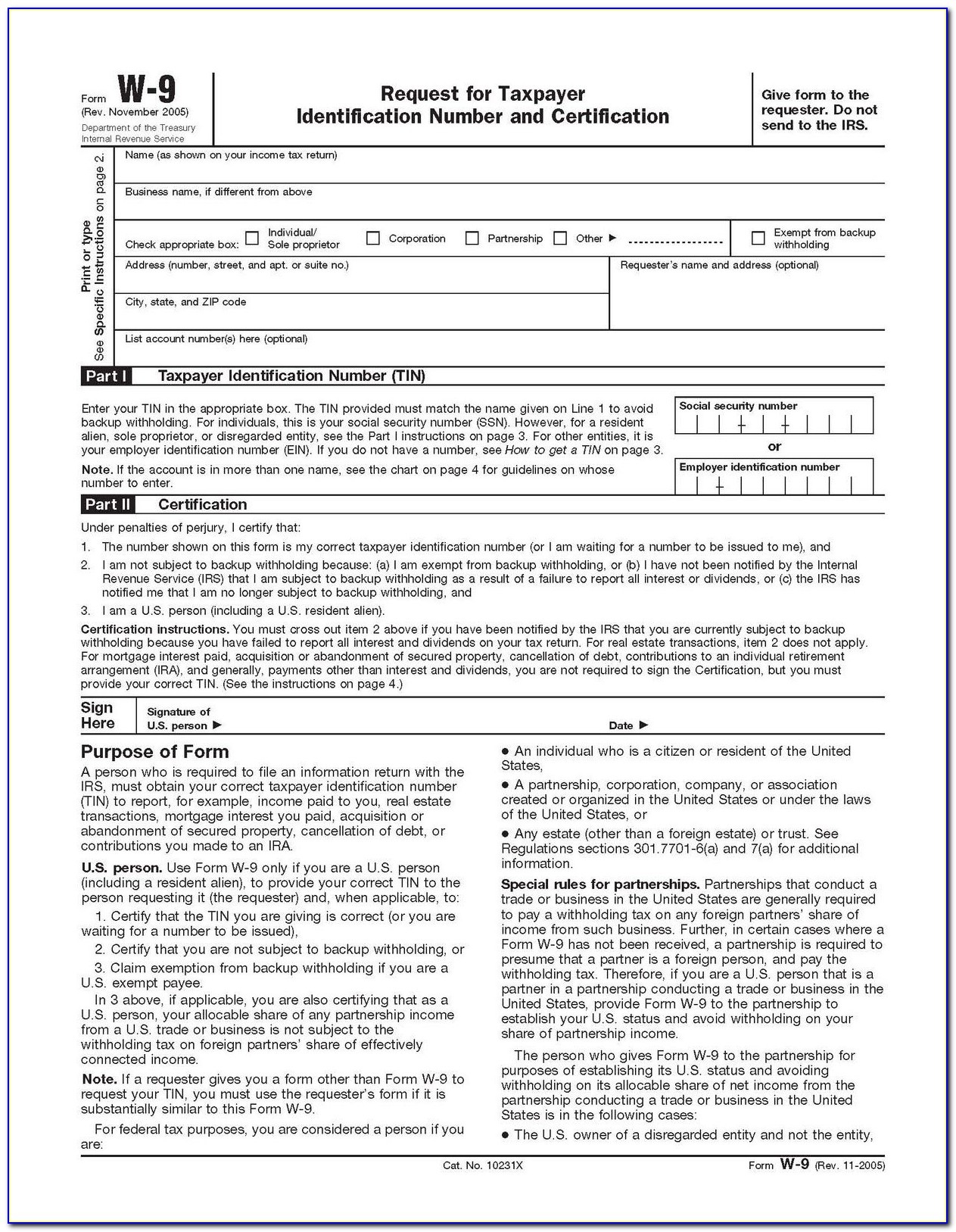

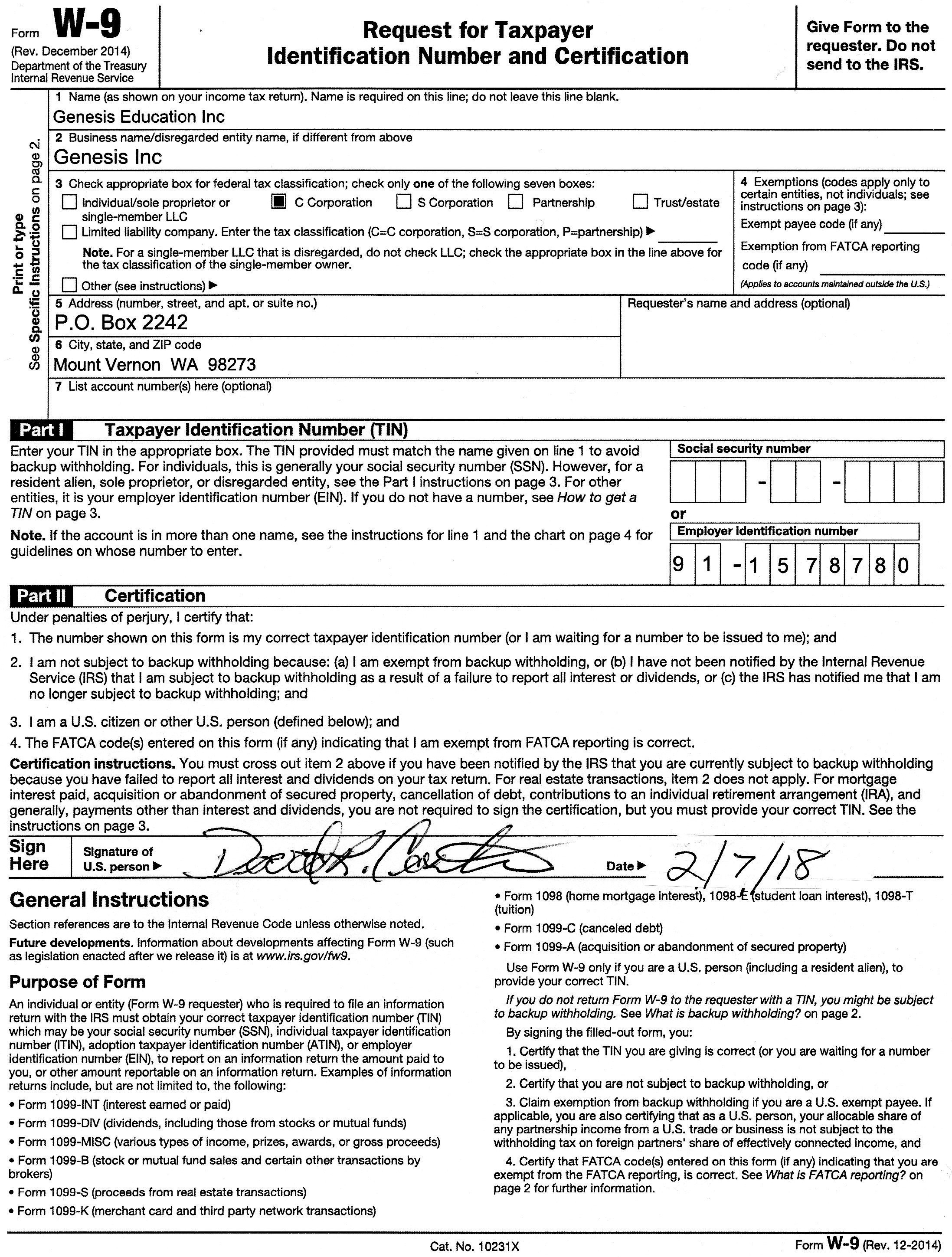

Irs Forms W 9 Printable - Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. This shows the income you earned for the previous year and the taxes withheld from those earnings. January 2011) department of the treasury internal revenue service request for taxpayer identification number and. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. $520 for married couples who filed jointly with an. Request for taxpayer identification number and certification. Do not send to the irs. Check out the examples for independent contractors & instructions for employers. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Complete irs tax forms online or print government tax documents. Do not send to the irs. January 2011) department of the treasury internal revenue service request for taxpayer identification number and. Web it’s a request for information about the contractors you pay. Ad get ready for tax season deadlines by completing any required tax forms today. January 2011) department of the treasury internal revenue service request for taxpayer identification number and. Do not send to the irs. This shows the income you earned for the previous year and the taxes withheld from those earnings. Internal revenue service part i. It’s also used by freelancers or independent contractors to provide their tax information to. Do not send to the irs. January 2011) department of the treasury internal revenue service request for taxpayer identification number and. This shows the income you earned for the previous year and the taxes withheld from those earnings. Web how much will i receive? October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Web department of the treasury request for taxpayer identification number and certification give form to the requester. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while. Ad get ready for tax season deadlines by completing any required tax forms today. Request for taxpayer identification number and certification. Web department of the treasury request for taxpayer identification number and certification give form to the requester. Do not send to the irs. Internal revenue service part i. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Request for taxpayer identification number and certification. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Internal revenue service part i. October 2018) department of the treasury internal revenue service request for taxpayer identification number and. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification. Web department of the treasury request for taxpayer identification number and certification give form to the requester. Internal revenue service part i. Web how much will i receive? January 2011) department of the treasury internal revenue service request for taxpayer identification number and. $520 for married couples who filed jointly with an. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Internal revenue service part i. December 2014) department of the treasury internal revenue service. It’s also used by freelancers or independent contractors to provide their tax information to. Yes,. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. December 2014) department of the treasury internal revenue service. Complete irs tax forms online. Check out the examples for independent contractors & instructions for employers. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Yes, you can find a. It’s also used by freelancers or independent contractors to provide their tax information to. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Request for taxpayer identification number and certification. This shows the income you earned for the previous year and the taxes withheld from those earnings. Web how much will i receive? Internal revenue service part i. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. $520 for married couples who filed jointly with an. Web department of the treasury request for taxpayer identification number and certification give form to the requester. Complete irs tax forms online or print government tax documents. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. Ad get ready for tax season deadlines by completing any required tax forms today. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: December 2014) department of the treasury internal revenue service. Do not send to the irs. January 2011) department of the treasury internal revenue service request for taxpayer identification number and. Yes, you can find a. December 2014) department of the treasury internal revenue service. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Internal revenue service part i. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Web department of the treasury request for taxpayer identification number and certification give form to the requester. It’s also used by freelancers or independent contractors to provide their tax information to. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Complete irs tax forms online or print government tax documents. This shows the income you earned for the previous year and the taxes withheld from those earnings. Request for taxpayer identification number and certification. Do not send to the irs. $520 for married couples who filed jointly with an. Web how much will i receive? Ad get ready for tax season deadlines by completing any required tax forms today.Irs W9 Form 2021 Printable Calendar Template Printable

W 9 Form To Print Calendar Template Printable Monthly Yearly

How To Fill Out A W9 Form Online Hellosign Blog Free Printable W 9

Blank 2020 W9 Form Calendar Template Printable

IRS Form W9 ZipBooks

Catch Irs W9 2020 Pdf Calendar Printables Free Blank

Irs Blank W 9 Form 2020 Printable Example Calendar Printable

W9 Form Printable 2017 Free Free Printable A to Z

2020 W9 Blank Form Calendar Template Printable

W9 Forms 2021 Printable Free Calendar Printable Free

October 2018) Department Of The Treasury Internal Revenue Service Request For Taxpayer Identification Number And Certification Go To.

January 2011) Department Of The Treasury Internal Revenue Service Request For Taxpayer Identification Number And.

Web You May Have Heard Of The Pact Act, Which Expands Va Benefits And Health Care For Veterans And Servicemembers Exposed To Toxic Substances While Serving.and.

Check Out The Examples For Independent Contractors & Instructions For Employers.

Related Post: