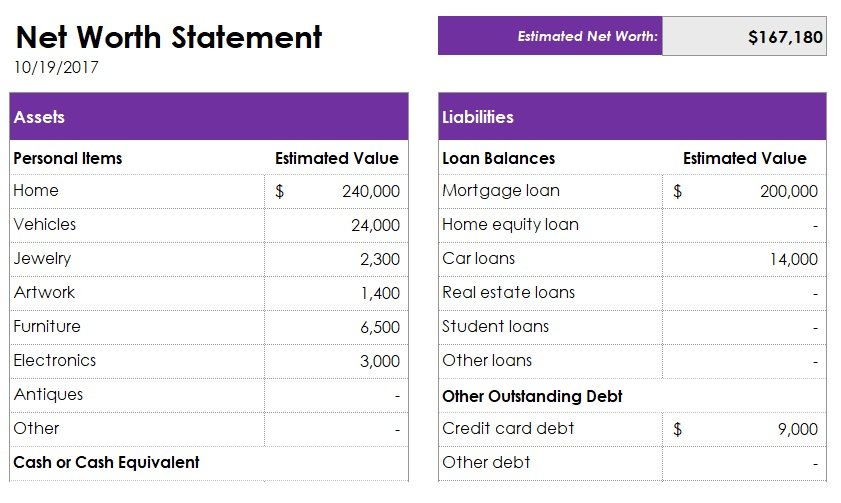

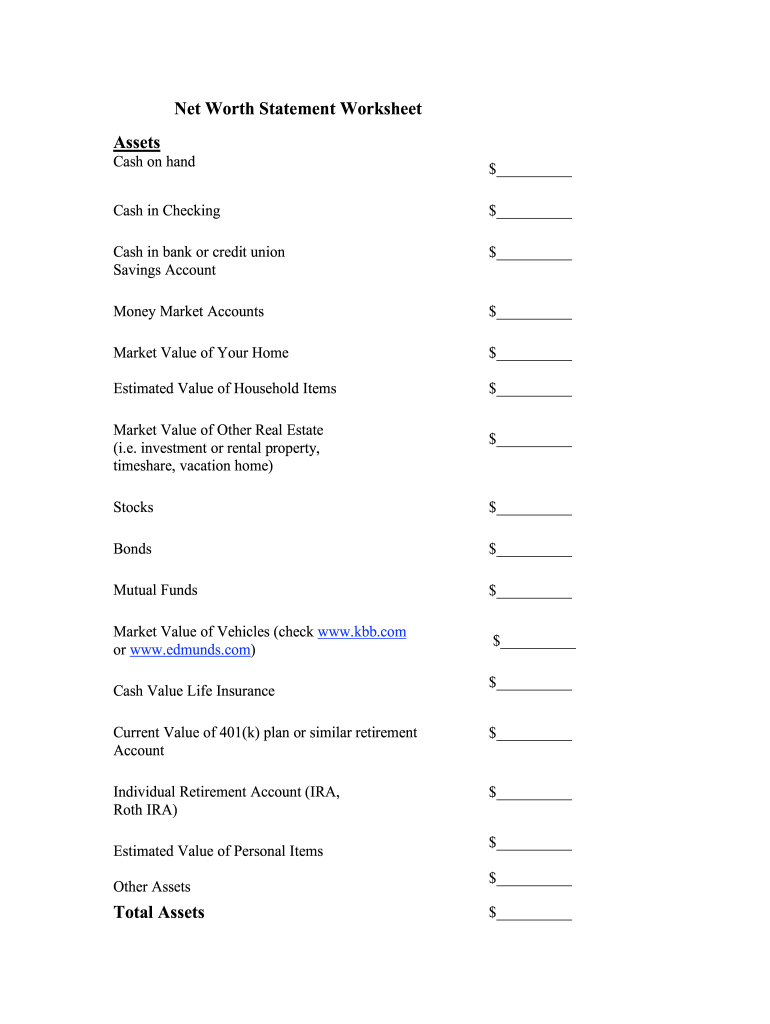

Net Worth Statement Template

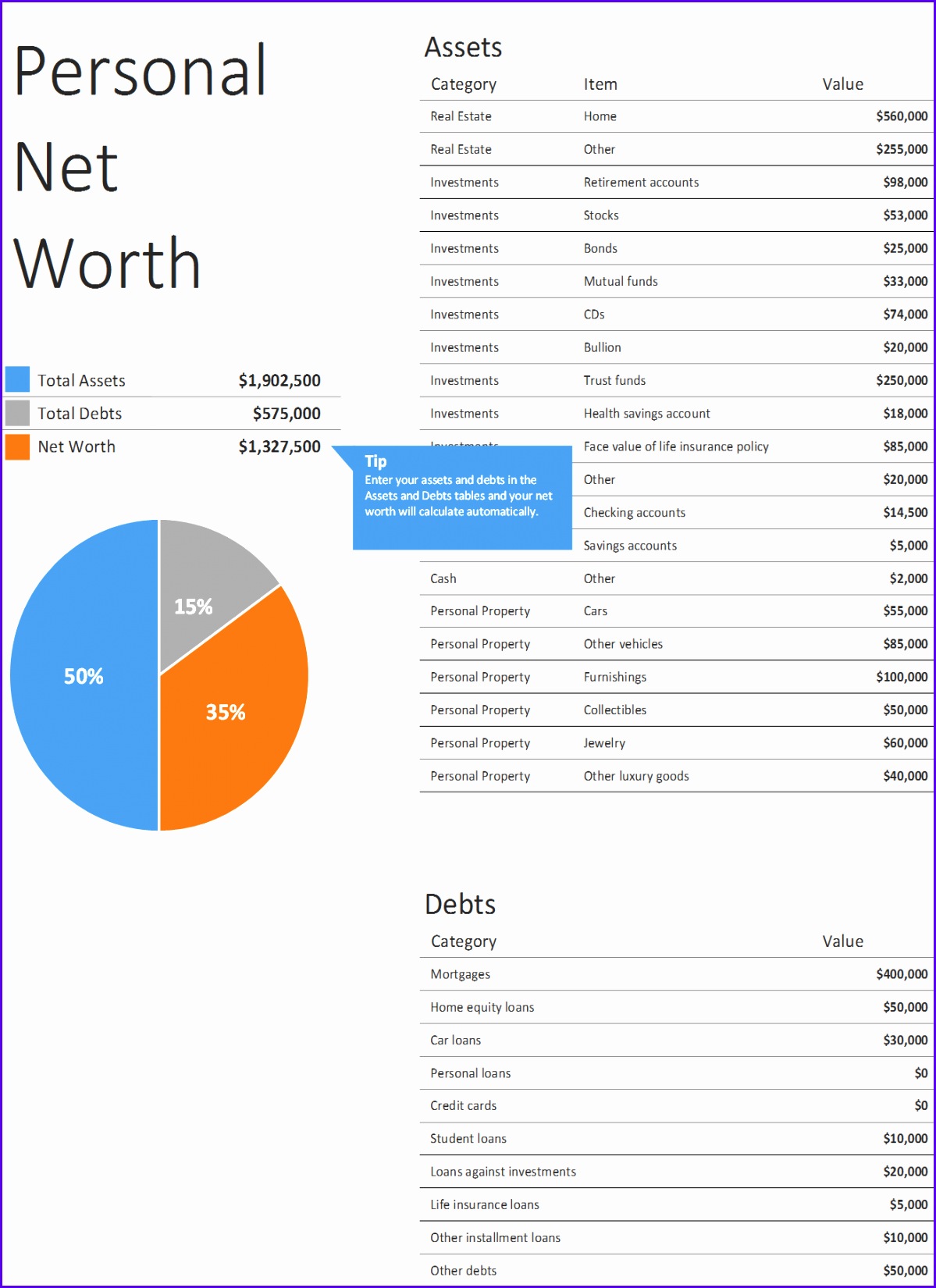

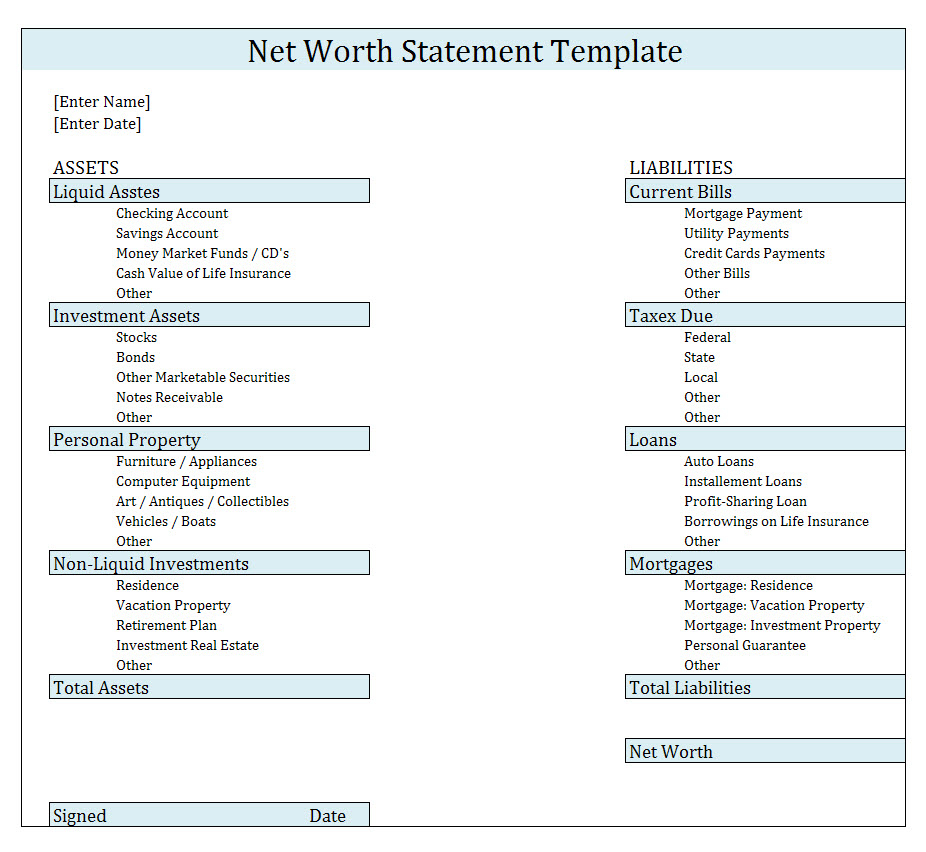

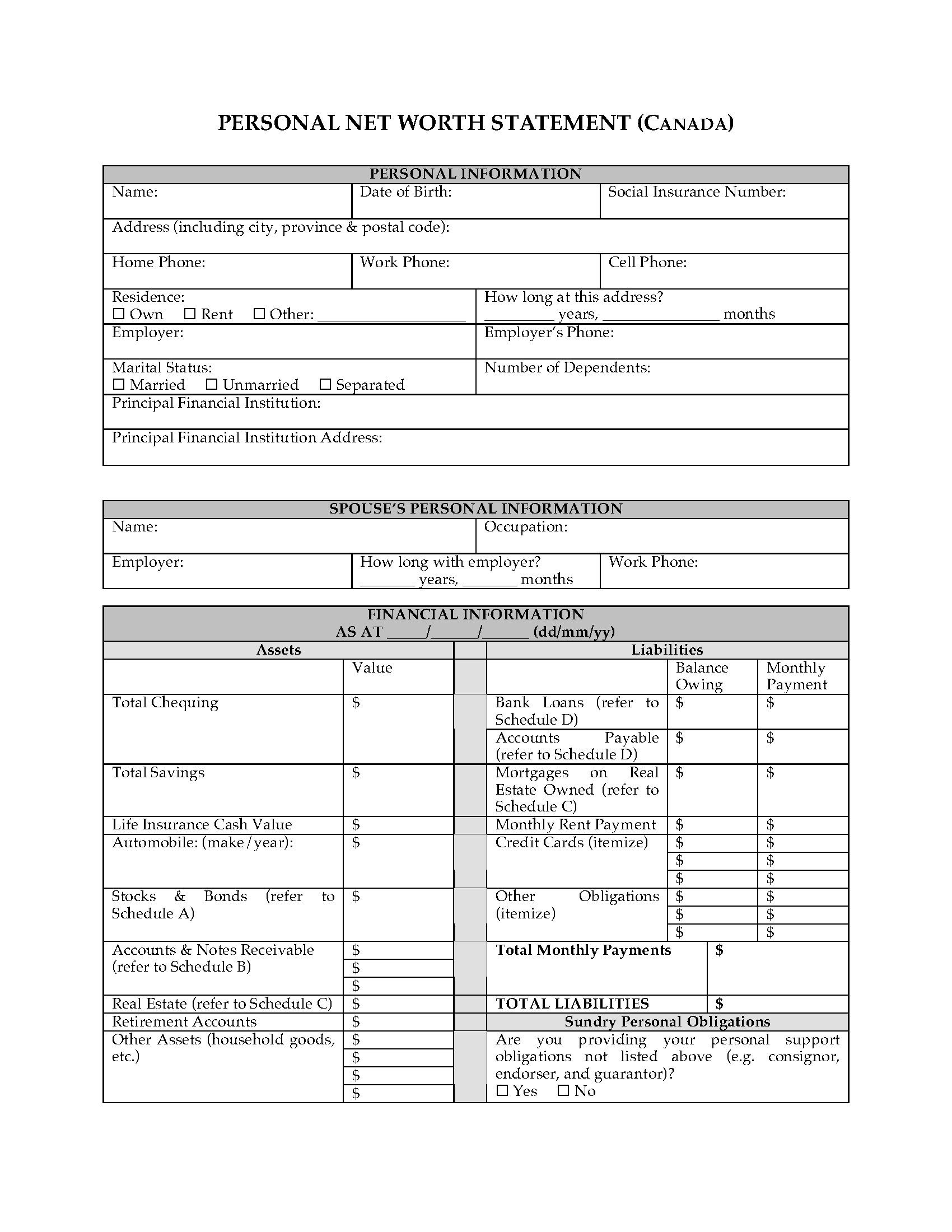

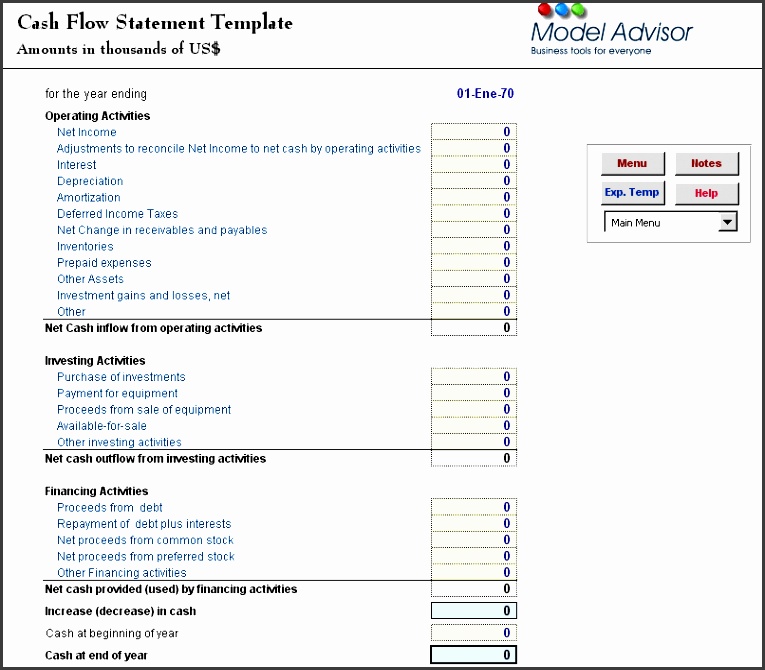

Net Worth Statement Template - Web a net worth statement calculates the difference between what you own (your assets) and what you owe (your liabilities). Web a balance sheet captures the net worth of a business at any given time. Net worth spreadsheets are the right solution for you. If assets are greater than liabilities, the individual has a positive net worth. (what you owe) current debts: Lawdepot.com has been visited by 100k+ users in the past month In this case, you can estimate your net worth annually. Financial net worth statement template; Net worth statement worksheet template; Why you should prepare a net worth. Web a personal net worth statement or personal financial statement is simply your personal balance sheet. Net worth worksheet pdf net worth worksheet excel if you plan to borrow money for your small. Web a net worth statement is a kind of financial statement in which we enlist all the assets of the company and liabilities and then deduct the. Web that’s why you should update your net worth statement at least annually. Net worth worksheet pdf net worth worksheet excel if you plan to borrow money for your small. Net worth statement worksheet template; Personal net worth statement form; Net worth spreadsheets are the right solution for you. In this case, you can estimate your net worth annually. It shows the balance between the company’s assets against the sum of its liabilities and. Personal net worth statement form; If assets are greater than liabilities, the individual has a positive net worth. Financial net worth statement template; Web last updated april 5, 2023 want to keep track of your financial situation but don’t know how to do that? Financial net worth statement template; Net worth of business and date of such valuation h. If assets are less than liabilities the individual has a. Web a personal net worth statement or personal financial statement is simply your personal. Total assets minus total liabilities = net worth. Web a net worth statement calculates the difference between what you own (your assets) and what you owe (your liabilities). Why you should prepare a net worth. Value of business interests g. Web last updated april 5, 2023 want to keep track of your financial situation but don’t know how to do. (what you owe) current debts: If assets are greater than liabilities, the individual has a positive net worth. Web last updated april 5, 2023 want to keep track of your financial situation but don’t know how to do that? Personal net worth statement form; In this guide, you’ll learn: Net worth statement worksheet template; In this case, you can estimate your net worth annually. Web a net worth statement calculates the difference between what you own (your assets) and what you owe (your liabilities). Lawdepot.com has been visited by 100k+ users in the past month Web this is a complete guide to creating a personal net worth statement. Formstemplates.com has been visited by 100k+ users in the past month Web use this simple net worth template or spreadsheet to calculate your net worth. (what you owe) current debts: Net worth spreadsheets are the right solution for you. Web net worth statement this statement will give you a picture of your current financial position on a given date and. To calculate your net worth, add the value of all of your. Total assets minus total liabilities = net worth. Net worth spreadsheets are the right solution for you. (what you owe) current debts: Personal net worth statement form; In this case, you can estimate your net worth annually. Web this is a complete guide to creating a personal net worth statement. Web a balance sheet captures the net worth of a business at any given time. Web the formula used is: Web that’s why you should update your net worth statement at least annually. Net worth worksheet pdf net worth worksheet excel if you plan to borrow money for your small. Web use this simple net worth template or spreadsheet to calculate your net worth. Net worth of business and date of such valuation h. Web net worth statement this statement will give you a picture of your current financial position on a given date and help you determine your net worth — what you “own”. Web that’s why you should update your net worth statement at least annually. Web the formula used is: Web a net worth statement calculates the difference between what you own (your assets) and what you owe (your liabilities). Net worth statement worksheet template; If assets are less than liabilities the individual has a. In this case, you can estimate your net worth annually. Web a personal net worth statement or personal financial statement is simply your personal balance sheet. Cash surrender value of life insurance 9.1 a. Web this is a complete guide to creating a personal net worth statement. Web a net worth statement is a kind of financial statement in which we enlist all the assets of the company and liabilities and then deduct the total liabilities from all the. In this guide, you’ll learn: To calculate your net worth, add the value of all of your. Value of business interests g. Total assets minus total liabilities = net worth. Web a balance sheet captures the net worth of a business at any given time. Web last updated april 5, 2023 want to keep track of your financial situation but don’t know how to do that? Lawdepot.com has been visited by 100k+ users in the past month Cash surrender value of life insurance 9.1 a. Web a net worth statement calculates the difference between what you own (your assets) and what you owe (your liabilities). Net worth worksheet pdf net worth worksheet excel if you plan to borrow money for your small. In this case, you can estimate your net worth annually. Net worth of business and date of such valuation h. Web a personal net worth statement or personal financial statement is simply your personal balance sheet. If assets are greater than liabilities, the individual has a positive net worth. Personal net worth statement form; If you were a business, what would you be worth? (what you owe) current debts: Financial net worth statement template; Web use this simple net worth template or spreadsheet to calculate your net worth. Why you should prepare a net worth. Net worth statement worksheet template; It shows the balance between the company’s assets against the sum of its liabilities and.Personal Net Worth Statement Legal Forms and Business Templates

FREE 9+ Net Worth Statement Samples in PDF Excel

5 Net Worth Statement Template SampleTemplatess SampleTemplatess

Personal Net Worth Statement Template For Excel Excel TMP

Statement Of Net Worth Template Best Of 9 Net Worth Statement Samples

Whats A Personal Financial Statement Resume Alayneabrahams

Net Worth Forms Fill Out and Sign Printable PDF Template signNow

How to Create a Personal Net Worth Statement [Free Template] (2022)

12 Net Worth Excel Template Excel Templates

Personal Net Worth Worksheet

Web That’s Why You Should Update Your Net Worth Statement At Least Annually.

Web The Formula Used Is:

If Assets Are Less Than Liabilities The Individual Has A.

Web A Net Worth Statement Is A Kind Of Financial Statement In Which We Enlist All The Assets Of The Company And Liabilities And Then Deduct The Total Liabilities From All The.

Related Post:

![How to Create a Personal Net Worth Statement [Free Template] (2022)](https://themillennialmoneywoman.com/wp-content/uploads/2021/01/Net-Worth-template.png)