Payback Period Excel Template

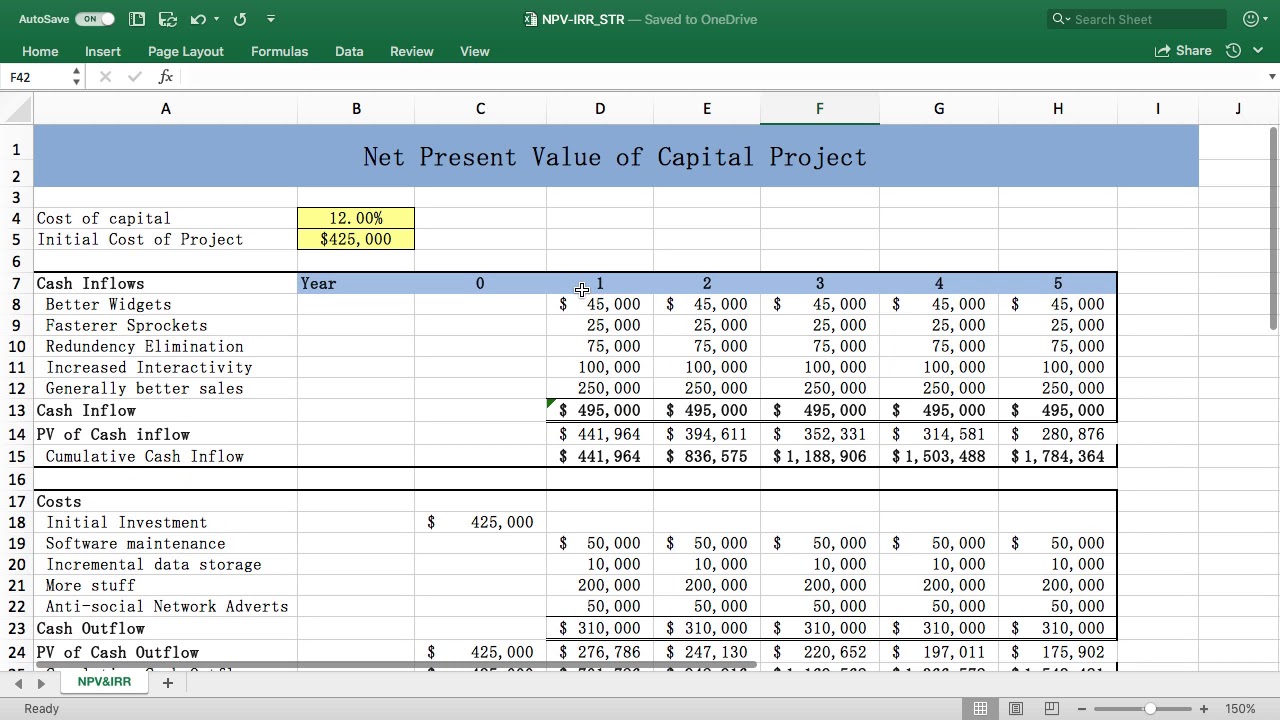

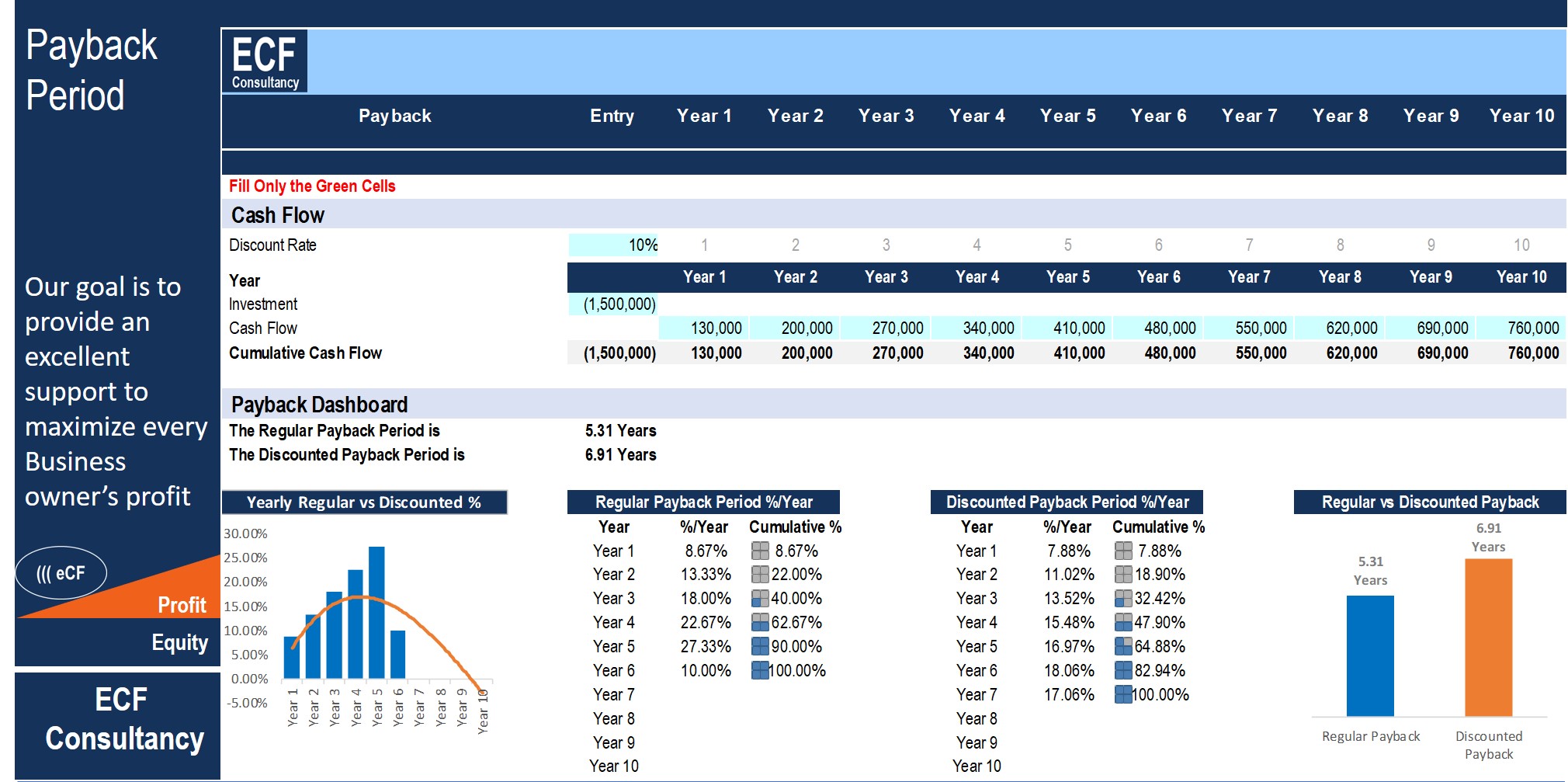

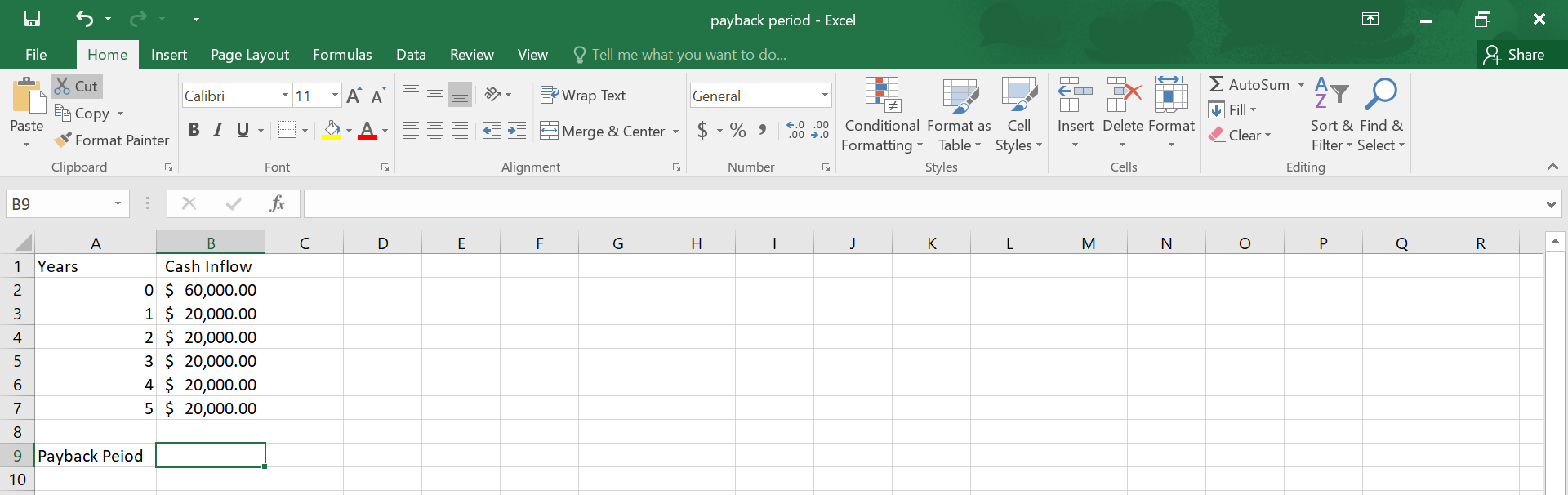

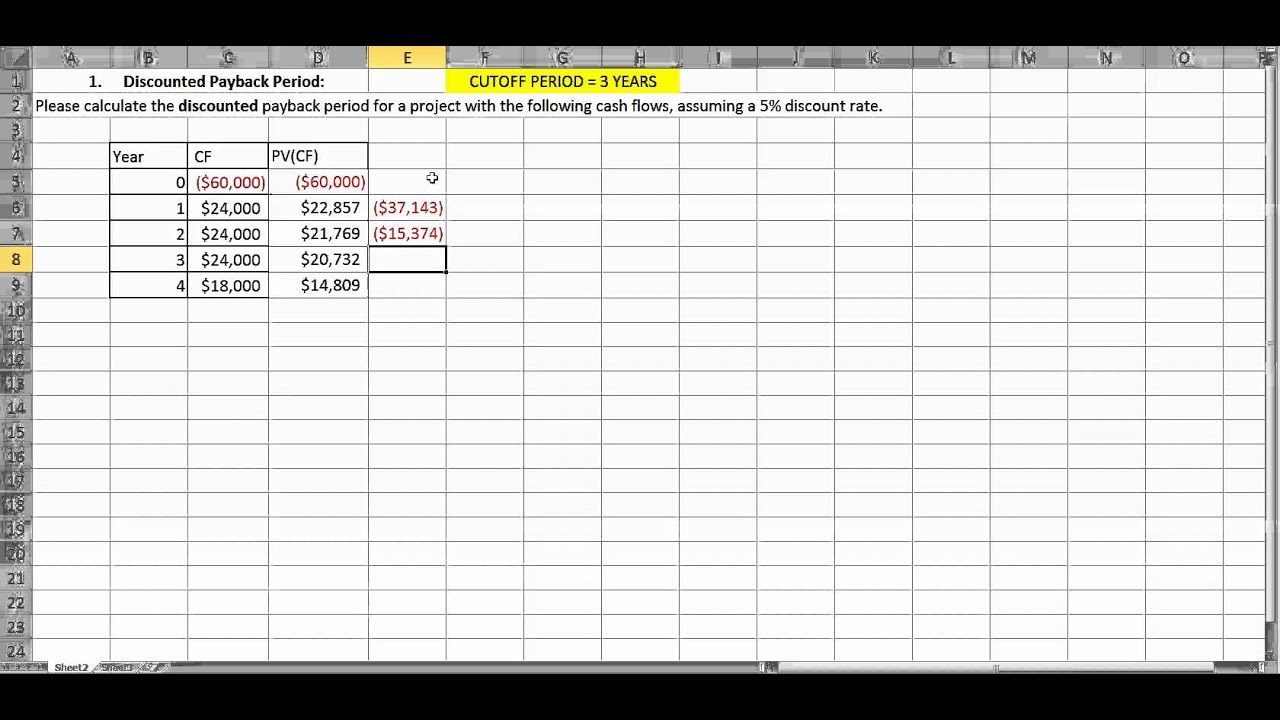

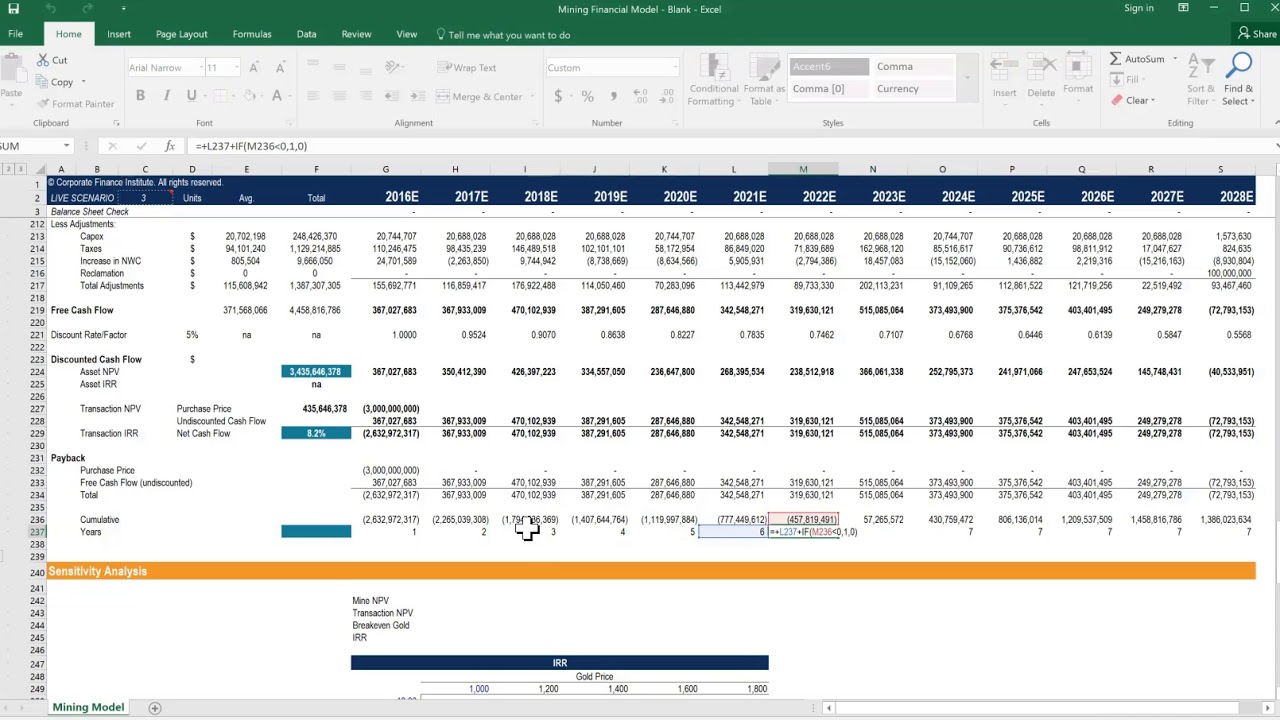

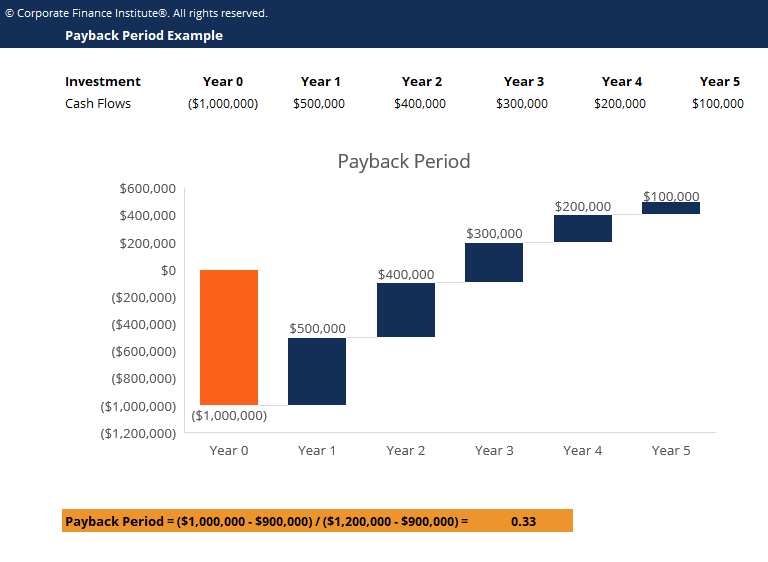

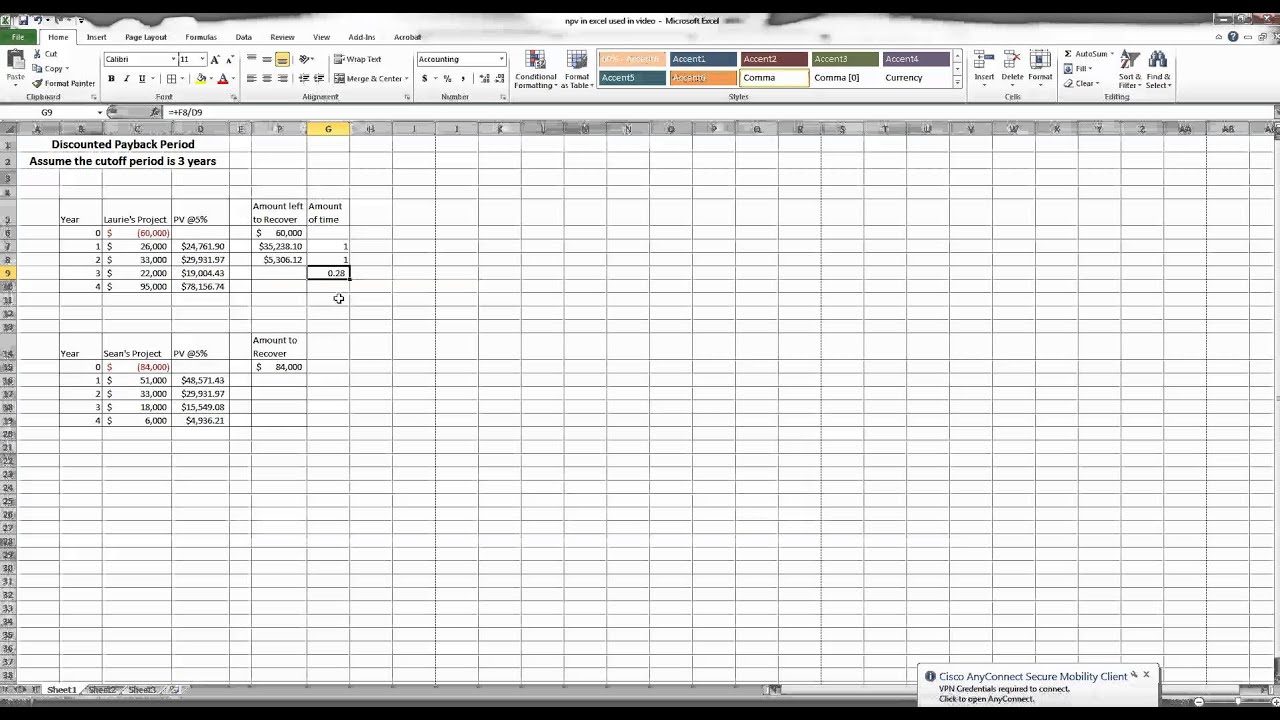

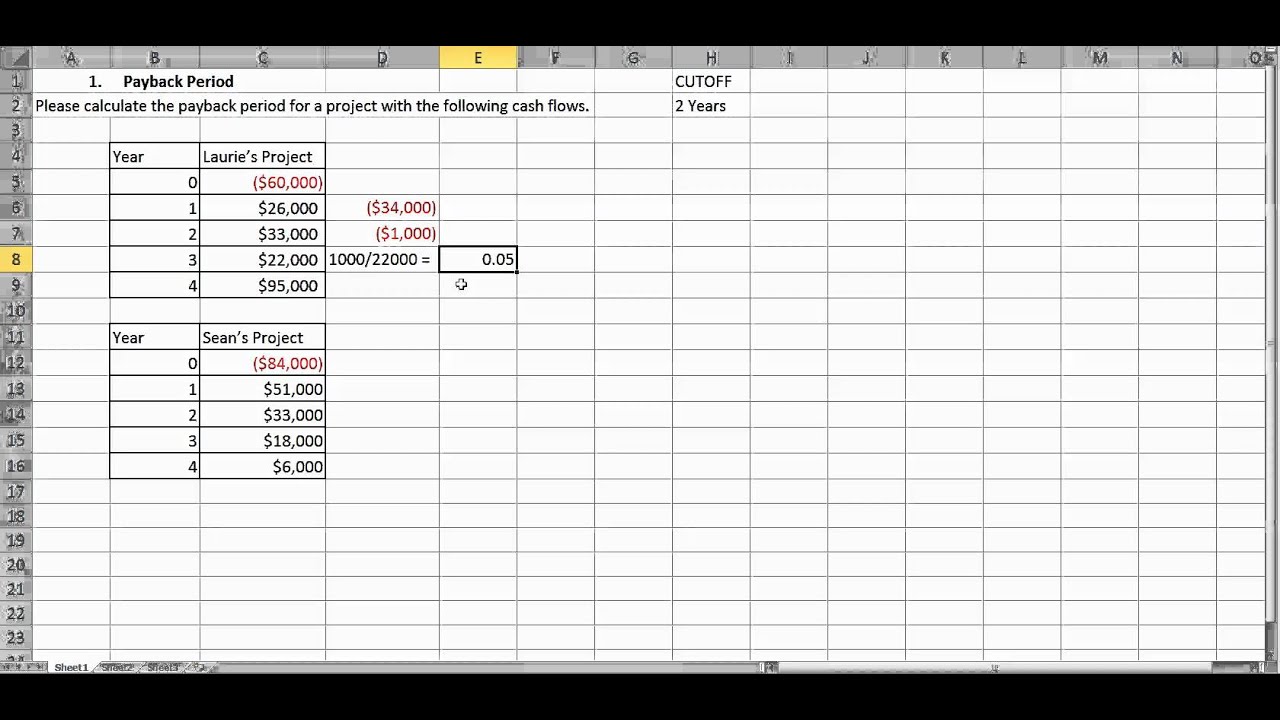

Payback Period Excel Template - Web use the formula “ if ”. Quickly calculate your investment return. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from. Web payback period excel template: Web the template includes regular and discount payback. As such, the payback period for this project is 2.33 years. Web this payback period calculator shows how many years it will take to pay off a loan, as well as irr and npv. Here is a preview of the payback period template: This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. The regular payback period is number of years necessary to recover the funds invested without taking the. Find the fraction needed, using the number of years with negative cash flow as index. Use the formula “ index ”. Payback period excel template to help you calculate the time required to recoup the. Web $400k ÷ $200k = 2 years Web types of payback period. Users fill in the blue boxes; Web determine the net present value using cash flows that occur at irregular intervals. Find the fraction needed, using the number of years with negative cash flow as index. To get the exact payback period, sum. Web this free template can calculate payback period calculator in excel, which will be used for making decisions. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web types of payback period. The regular payback period is number of years necessary to recover the funds invested without taking the. The decision rule using the payback period is to minimize the. The payback period is the amount of time (usually measured in years). The regular payback period is number of years necessary to recover the funds invested without taking the. Web determine the net present value using cash flows that occur at irregular intervals. Web $400k ÷ $200k = 2 years Each cash flow, specified as a value, occurs at a scheduled payment date. Web feasibility metrics (npv, irr and payback period) excel. Web determine the net present value using cash flows that occur at irregular intervals. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Web payback period excel template: To get the exact payback period, sum. Use the formula “ index ”. Web types of payback period. Web payback period excel template: If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Payback period excel template to help you calculate the time required to recoup the. Build the dataset enter financial data in your excel worksheet. Web this payback period calculator shows how many years it will take to pay off a loan, as well as irr and npv. Use the formula “ index ”. Web the template includes regular and discount payback. Users fill in the blue boxes; Find the fraction needed, using the number of years with negative cash flow as index. Web the template includes regular and discount payback. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Each cash flow, specified as a value, occurs at a scheduled payment date. Web types of payback period. Use the formula “ index ”. Web types of payback period. Web determine the net present value using cash flows that occur at irregular intervals. Each cash flow, specified as a value, occurs at a scheduled payment date. Web katrina munichiello what is a payback period? Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present. The rest is calculated automatically. Users fill in the blue boxes; The regular payback period is number of years necessary to recover the funds invested without taking the. The decision rule using the payback period is to minimize the. Here is a preview of the payback period template: If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web use the formula “ if ”. Build the dataset enter financial data in your excel worksheet. Web payback period excel template: Web $400k ÷ $200k = 2 years The regular payback period is number of years necessary to recover the funds invested without taking the. Find the fraction needed, using the number of years with negative cash flow as index. Web katrina munichiello what is a payback period? Use the formula “ index ”. Users fill in the blue boxes; Web determine the net present value using cash flows that occur at irregular intervals. The rest is calculated automatically. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Web this payback period calculator shows how many years it will take to pay off a loan, as well as irr and npv. As such, the payback period for this project is 2.33 years. The decision rule using the payback period is to minimize the. Enter your name and email in the form below and download the free. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Here is a preview of the payback period template: Users fill in the blue boxes; The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. The decision rule using the payback period is to minimize the. Web katrina munichiello what is a payback period? Find the fraction needed, using the number of years with negative cash flow as index. Each cash flow, specified as a value, occurs at a scheduled payment date. Web the template includes regular and discount payback. Web use the formula “ if ”. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. To get the exact payback period, sum. Web $400k ÷ $200k = 2 years As such, the payback period for this project is 2.33 years. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. Web determine the net present value using cash flows that occur at irregular intervals. Payback period excel template to help you calculate the time required to recoup the. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from.How to Calculate Accounting Payback Period or Capital Budgeting Break

Payback Period Excel Model Eloquens

Payback Time Formula Excel BHe

How to Calculate Payback Period in Excel.

Payback Period Excel Template PDF Template

Download How to calculate PAYBACK PERIOD in MS Excel Spread

Payback Period Template Download Free Excel Template

Video on how to do discounted payback period in Excel YouTube

Payback Period Calculator Double Entry Bookkeeping

Rumus Payback Period Excel kabarmedia.github.io

Enter Your Name And Email In The Form Below And Download The Free.

The Regular Payback Period Is Number Of Years Necessary To Recover The Funds Invested Without Taking The.

Web Types Of Payback Period.

Here Is A Preview Of The Payback Period Template:

Related Post: