Printable 1099 Forms For Independent Contractors

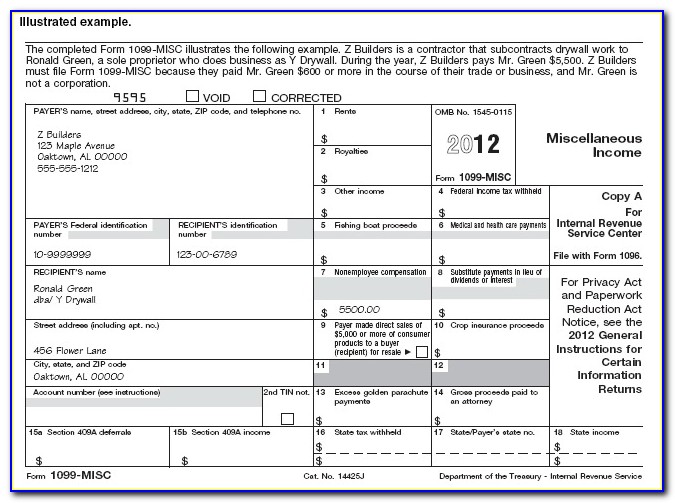

Printable 1099 Forms For Independent Contractors - Customize to fit your needs. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Web the taxpayers are supposed to send 1099 misc forms to the contractors by february 1st, 2021. Ad accurate & dependable 1099 right to your email quickly and easily. Fill in your federal tax id number (ssn or ein) and contractor’s. Gusto supports contractor payments in 120+ countries. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Ad create your 1099 independent contractor form. Submit your form 1099 online to the irs by march 31st, 2021. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Web create a high quality document now! Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Ad manage your contractors with confidence by using quickbooks® contractor. Web what is a 1099 independent contractor? In a few easy steps, you can create your own 1099 forms and have them sent to your email. We have provided you the. Gusto supports contractor payments in 120+ countries. Web what do you need to file a 1099 form for independent contractors? Transform your contingent workforce engagement and payroll management experience. Report payments made of at least $600 in the course of. Get your free demo today. A person who contracts to perform services for others without having the legal status of an employee is an independent. Ad payreel allows you to easily pay independent contractors. Customize to fit your needs. Get your free demo today. Ad create your 1099 independent contractor form. Web select one or more 1099 form recipients you want to print the 1099 form(s) for. Run payroll in one click via one powerful dashboard. The 1099 print dialog allows you to select one 1099 recipient, all 1099 recipient(s) or a range of. Gusto supports contractor payments in 120+ countries. We’ll let you know about form 1099 types of independent contractors. We have provided you the. Ad accurate & dependable 1099 right to your email quickly and easily. Ad create your 1099 independent contractor form. The 1099 print dialog allows you to select one 1099 recipient, all 1099 recipient(s) or a range of. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. To summarize, as a business, you need to file. Ad accurate & dependable 1099 right to your email quickly and easily. To summarize, as a business, you need to file a 1099 form for an independent contractor. Web what is a 1099 independent contractor? Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. An. Ad over 15,000 companies use deel to help them hire employees all over the world. Ad accurate & dependable 1099 right to your email quickly and easily. Ad payreel allows you to easily pay independent contractors. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Web select one or more 1099 form recipients you want to print the 1099 form(s) for. You must also complete form 8919 and attach it to. Ad over 15,000 companies use deel to help them hire employees all over the world. Free to print, save and download. Get your free demo today. To summarize, as a business, you need to file a 1099 form for an independent contractor. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. We have provided you the. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Report payments made. Ad create your 1099 independent contractor form. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Web getting confused who is a 1099 worker? Free to print, save and download. Run payroll in one click via one powerful dashboard. To summarize, as a business, you need to file a 1099 form for an independent contractor. Web form 1099 nec & independent contractors 1 question how do you determine if a worker is an employee or an independent contractor? Web create a high quality document now! Submit your form 1099 online to the irs by march 31st, 2021. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Gusto supports contractor payments in 120+ countries. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Web select one or more 1099 form recipients you want to print the 1099 form(s) for. We’ll let you know about form 1099 types of independent contractors. Gusto supports contractor payments in 120+ countries. The 1099 print dialog allows you to select one 1099 recipient, all 1099 recipient(s) or a range of. Web what is a 1099 independent contractor? Customize to fit your needs. A person who contracts to perform services for others without having the legal status of an employee is an independent. Report payments made of at least $600 in the course of. Customize to fit your needs. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. You must also complete form 8919 and attach it to. We have provided you the. Gusto supports contractor payments in 120+ countries. Gusto supports contractor payments in 120+ countries. Ad over 15,000 companies use deel to help them hire employees all over the world. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. The 1099 print dialog allows you to select one 1099 recipient, all 1099 recipient(s) or a range of. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Transform your contingent workforce engagement and payroll management experience. A person who contracts to perform services for others without having the legal status of an employee is an independent. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Ad payreel allows you to easily pay independent contractors. Ad manage your contractors with confidence by using quickbooks® contractor payments software.1099 Form Independent Contractor Pdf Independent Contractor Invoice

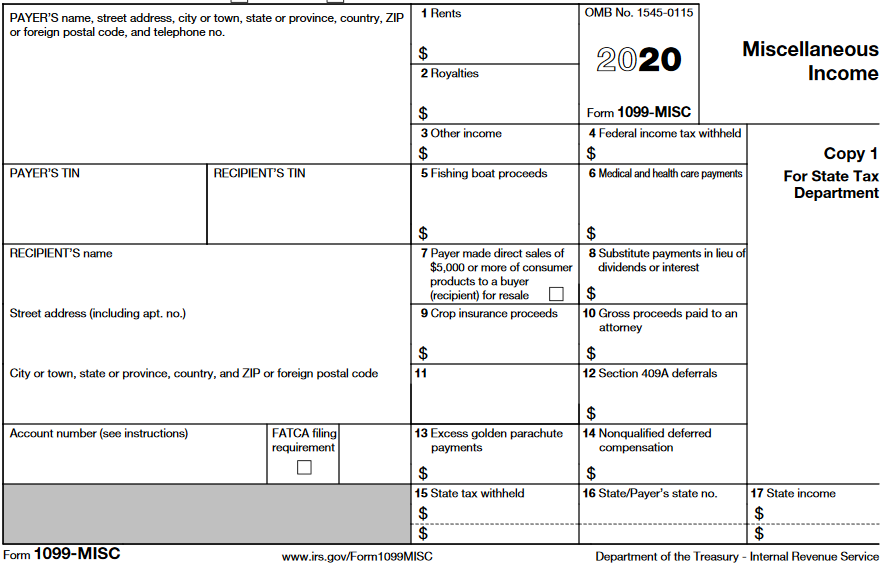

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

1099 expense independent contractor expenses spreadsheet salolines

Microsoft Word 1099 Tax Form Printable Template Printable Templates

1099 tax form independent contractor printable 1099 forms independent

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

1099 form independent contractor Fill Online, Printable, Fillable

Printable 1099 Form Independent Contractor Master of

Free 1099 Forms For Independent Contractors Universal Network

1099 Form For Independent Contractors 2019 Form Resume Examples

Fill In Your Federal Tax Id Number (Ssn Or Ein) And Contractor’s.

To Summarize, As A Business, You Need To File A 1099 Form For An Independent Contractor.

An Independent Contractor Agreement Is A Legal Document Between A Contractor That Performs A Service For A Client In.

Ad Create Your 1099 Independent Contractor Form.

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)