Printable Debt Payoff Planner

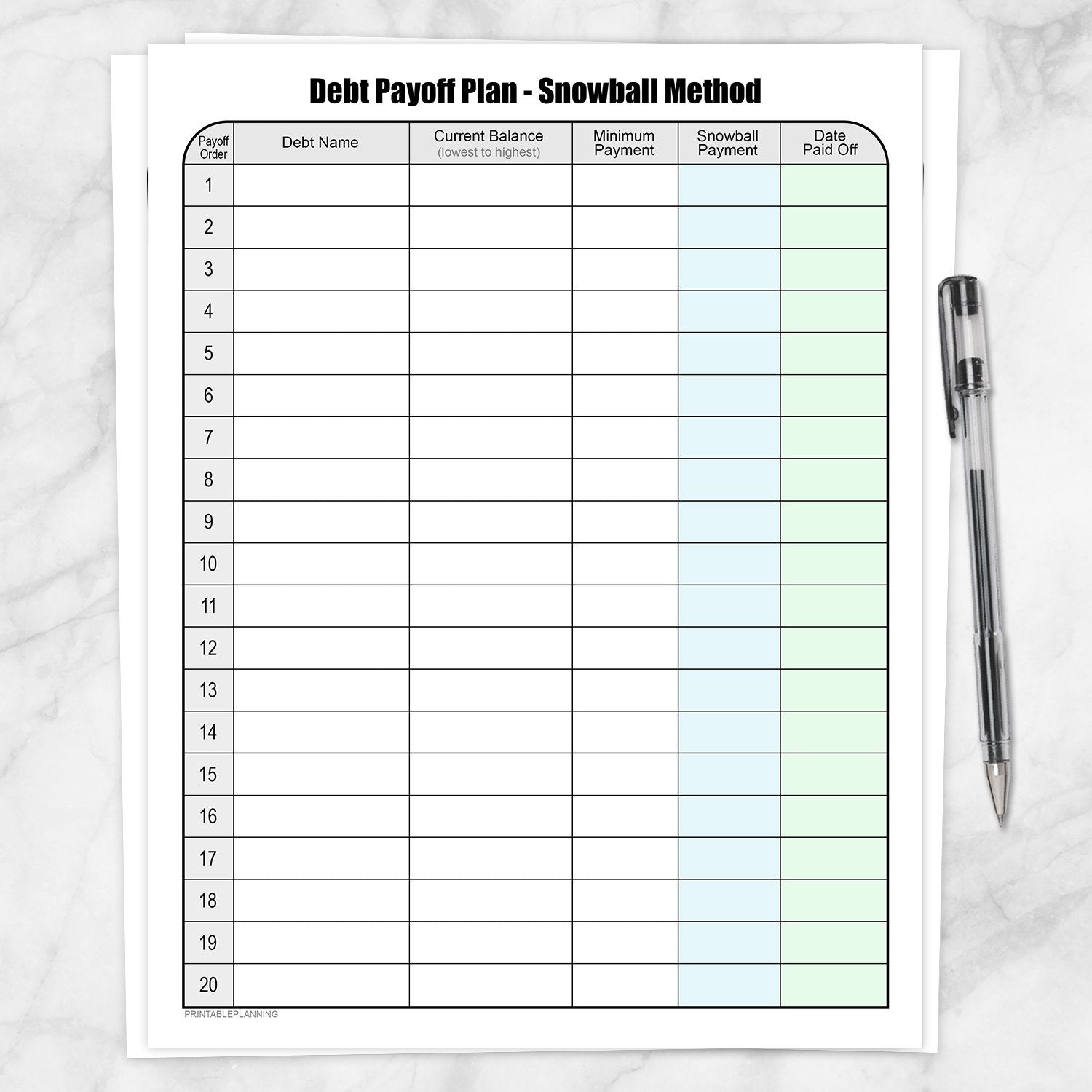

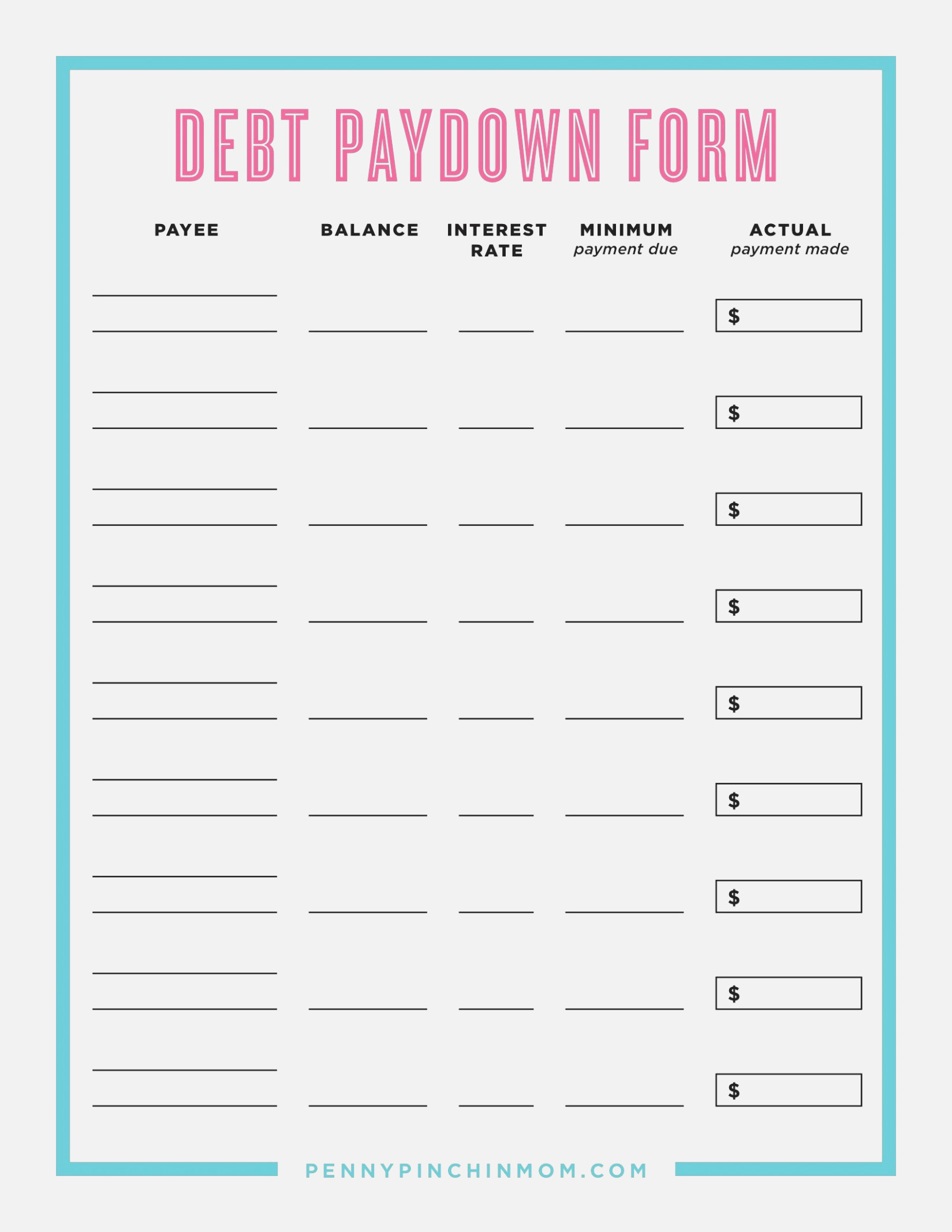

Printable Debt Payoff Planner - See which options work best for you. Web debt snowball worksheet printable. Check out best debt consolidation companies. Ad compare credit card debt relief solutions. Web when the debt is paid in full, cross it off your debt inventory worksheet with a big, fat marker, print out a fresh debt payment tracker, and get to work paying off the. Record the creditor and the minimum payment at the top of the worksheet. Use the included printable pages to see how much you currently owe and decide on a debt payoff method (either. Take the weight off of your shoulders. Web open printable default payoff planner. The debt snowball method focuses on paying one debt off at a time. All pages are 100% free. Web debt payoff planner creditor: Web debt paydown calculator advertiser disclosure if you’re looking for ways to get out of debt fast, but don’t know where to start, bankrate’s debt calculator can help. J f m a m j j a s o n d paid balance debt payoff planner. Use the included printable pages. Ad compare credit card debt relief solutions. Ad find out why personalizing your budget can make you more fiscally responsible. Month paid balance january february march april may june july august september october november december creditor: Ad find out why personalizing your budget can make you more fiscally responsible. Web when the debt is paid in full, cross it off. Learn how personalizing your budget can help you achieve your financial goals. Web how to use the debt payoff planner: Web check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently. See which options work best for you. Web start by entering your creditors, current balance, interest. Ad check if you qualify for debt consolidation. Web create your plan to pay off debt with this printable planner! Fill in the interest rate for that specific loan/debt. Check out best debt consolidation companies. Collect all of your current outstanding debt that charges interest. See which options work best for you. Web create your plan to pay off debt with this printable planner! Ad find out why personalizing your budget can make you more fiscally responsible. Ad check if you qualify for debt consolidation. We are not a loan company, we do not lend money. Web when the debt is paid in full, cross it off your debt inventory worksheet with a big, fat marker, print out a fresh debt payment tracker, and get to work paying off the. Take the weight off of your shoulders. Take the weight off of your shoulders. All pages are 100% free. See which options work best for you. Ad check if you qualify for debt consolidation. Keep track of how much you owe and record the. The debt snowball strategy of paying off your debt is so easy to use that you don’t even need a debt snowball excel spreadsheet. Ad find out why personalizing your budget can make you more fiscally responsible. Fill in the interest rate. Web check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently. Write in the minimum payment amount that is due each month along. Web debt paydown calculator advertiser disclosure if you’re looking for ways to get out of debt fast, but don’t know where to start, bankrate’s. The debt snowball strategy of paying off your debt is so easy to use that you don’t even need a debt snowball excel spreadsheet. Check out best debt consolidation companies. Ad compare credit card debt relief solutions. Web printable planner download this debt payoff planner template design in apple pages, word, google docs, pdf format. Month paid balance january february. Web debt snowball worksheet printable. Keep track of how much you owe and record the. Take the weight off of your shoulders. Ad compare credit card debt relief solutions. We are not a loan company, we do not lend money. J f m a m j j a s o n d paid balance debt payoff planner. All pages are 100% free. Web printable planner download this debt payoff planner template design in apple pages, word, google docs, pdf format. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Fill in each section of the debt payoff. The debt snowball strategy of paying off your debt is so easy to use that you don’t even need a debt snowball excel spreadsheet. Month paid balance january february march april may june july august september october november december creditor: Ad find out why personalizing your budget can make you more fiscally responsible. Month paid balance january february march april may june july august september october november december creditor: Take the weight off of your shoulders. Write in the minimum payment amount that is due each month along. Web open printable default payoff planner. Ad find out why personalizing your budget can make you more fiscally responsible. Learn how personalizing your budget can help you achieve your financial goals. The debt snowball method focuses on paying one debt off at a time. Take the weight off of your shoulders. Ad compare credit card debt relief solutions. Ad check if you qualify for debt consolidation. Ad check if you qualify for debt consolidation. See which options work best for you. Ad check if you qualify for debt consolidation. You focus on your lowest balance debt first, while paying only the. Fill in the interest rate for that specific loan/debt. Learn how personalizing your budget can help you achieve your financial goals. Take the weight off of your shoulders. Record the creditor and the minimum payment at the top of the worksheet. The debt snowball strategy of paying off your debt is so easy to use that you don’t even need a debt snowball excel spreadsheet. All pages are 100% free. Use the included printable pages to see how much you currently owe and decide on a debt payoff method (either. Check out best debt consolidation companies. Ad find out why personalizing your budget can make you more fiscally responsible. Ad find out why personalizing your budget can make you more fiscally responsible. Web printable planner download this debt payoff planner template design in apple pages, word, google docs, pdf format. Web start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly. Collect all of your current outstanding debt that charges interest. Web this printable worksheet can be used to track individual debts you are trying to pay off.Debt Payoff Plan Chart Debt Snowball Method Printable at Printable

Debt Payoff Planner Printable PDF Monthly & Yearly Debt Pay Etsy

Debt Payoff Planner Worksheet A Mom's Take

Debt Tracker Printable Debt Payoff Tracker PDF Etsy

Debt Payoff Planner Free Printable Debt payoff, Budget planner

Free Printable Debt Snowball Worksheet Lexia's Blog

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Debt Payoff Planner Printable PDF Debt Worksheets Etsy

Credit Card Debt Payoff Tracker Printable Credit Card Payoff Etsy in

Month Paid Balance January February March April May June July August September October November December Creditor:

Month Paid Balance January February March April May June July August September October November December Creditor:

Keep Track Of How Much You Owe And Record The.

Web Debt Paydown Calculator Advertiser Disclosure If You’re Looking For Ways To Get Out Of Debt Fast, But Don’t Know Where To Start, Bankrate’s Debt Calculator Can Help.

Related Post: