Printable Form 1099-Nec

Printable Form 1099-Nec - Do not miss the deadline. Log in to your pdfliner account. Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Pricing starts as low as $2.75/form. If you are required to file a return, a negligence penalty or. The payments were made for course that is. Quick & secure online filing. You will need to fill out this form if: Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Download tax form in your account Log in to your pdfliner account. You will need to fill out this form if: Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. If you are required to file a return, a negligence penalty or. Web federal income tax withheld copy b for recipient this is. You will need to fill out this form if: If you have made a. Web to get the form, either hit the fill this form button or do the steps below: Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Do not miss the deadline. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. The payments were made for course that is. Fill out the nonemployee compensation online and print it out for free. Download tax form in your account Specify the date range for the forms then choose ok. The payments were made for course that is. Save or instantly send your ready documents. Pricing starts as low as $2.75/form. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Since you're still unable to print the form after. Information returns file your state. Ad 1) get access to 500+ legal templates 2) print & download, start free! Do not miss the deadline. Web to get the form, either hit the fill this form button or do the steps below: Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. There were payments to nonemployees; Specify the date range for the forms then choose ok. Save or instantly send your ready documents. Web to get the form, either hit the fill this form. Do not miss the deadline. Information returns file your state. Create, edit, and print your business and legal documents quickly and easily! Log in to your pdfliner account. Easily fill out pdf blank, edit, and sign them. Information returns file your state. Save or instantly send your ready documents. Ad 1) get access to 500+ legal templates 2) print & download, start free! The payments were made for course that is. Fill out the nonemployee compensation online and print it out for free. Do not miss the deadline. Since you're still unable to print the form after. Information returns file your state. Specify the date range for the forms then choose ok. Ad 1) get access to 500+ legal templates 2) print & download, start free! You will need to fill out this form if: The payments were made for course that is. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Information returns file your state. Save or instantly send your ready documents. The payments were made for course that is. Pricing starts as low as $2.75/form. Ad 1) get access to 500+ legal templates 2) print & download, start free! Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. If you have made a. Quick & secure online filing. Create, edit, and print your business and legal documents quickly and easily! Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. You will need to fill out this form if: Information returns file your state. Fill out the nonemployee compensation online and print it out for free. Web to get the form, either hit the fill this form button or do the steps below: Save or instantly send your ready documents. If you are required to file a return, a negligence penalty or. Specify the date range for the forms then choose ok. There were payments to nonemployees; Do not miss the deadline. Log in to your pdfliner account. Easily fill out pdf blank, edit, and sign them. Download tax form in your account Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Log in to your pdfliner account. Fill out the nonemployee compensation online and print it out for free. Quick & secure online filing. Do not miss the deadline. If you are required to file a return, a negligence penalty or. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Since you're still unable to print the form after. Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. The payments were made for course that is. Download tax form in your account There were payments to nonemployees; You will need to fill out this form if: If you have made a.Form 1099NEC Nonemployee Compensation, Recipient Copy B

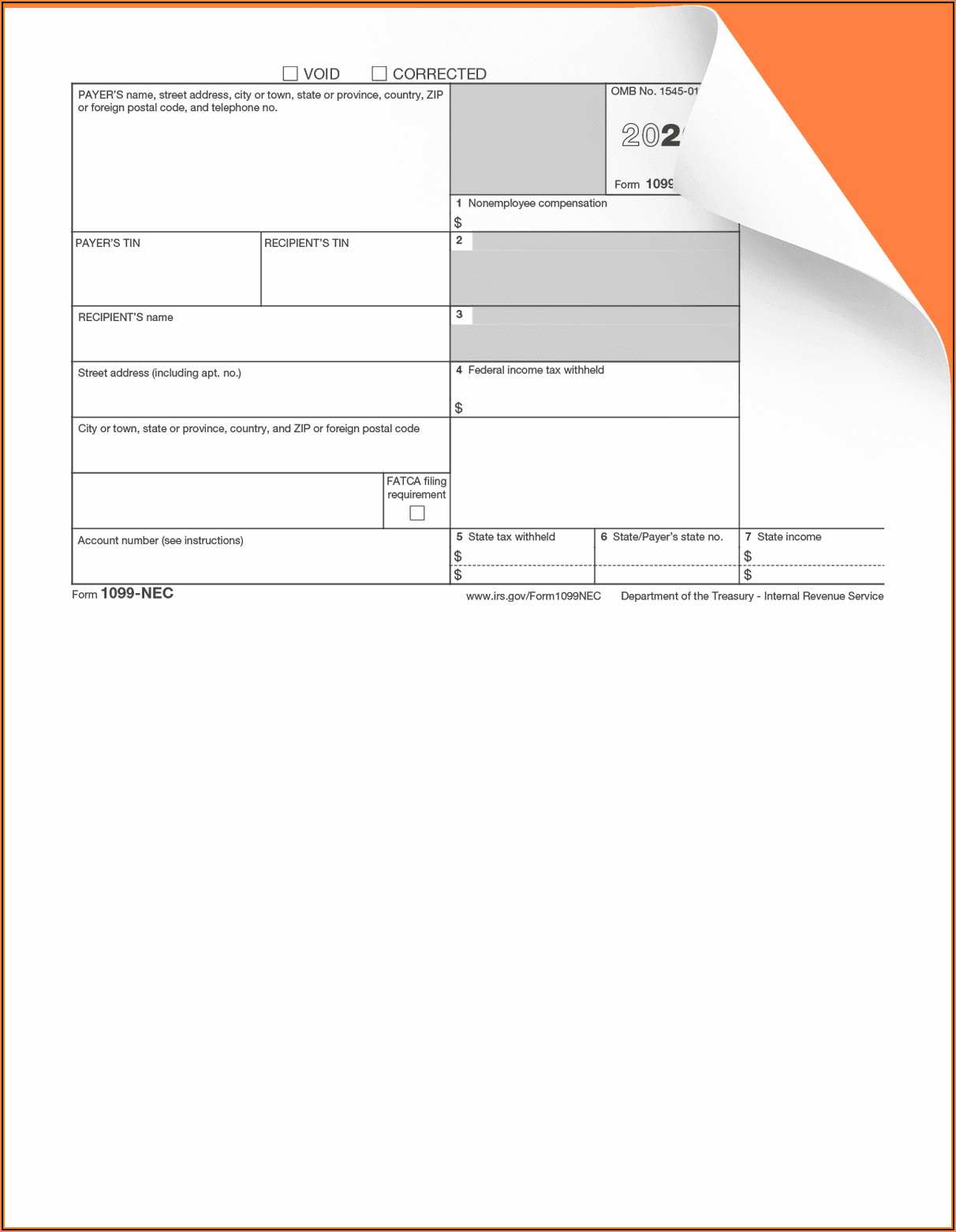

IRS 1099NEC 20202022 Fill and Sign Printable Template Online US

Printable Blank 1099 Nec Form Printable World Holiday

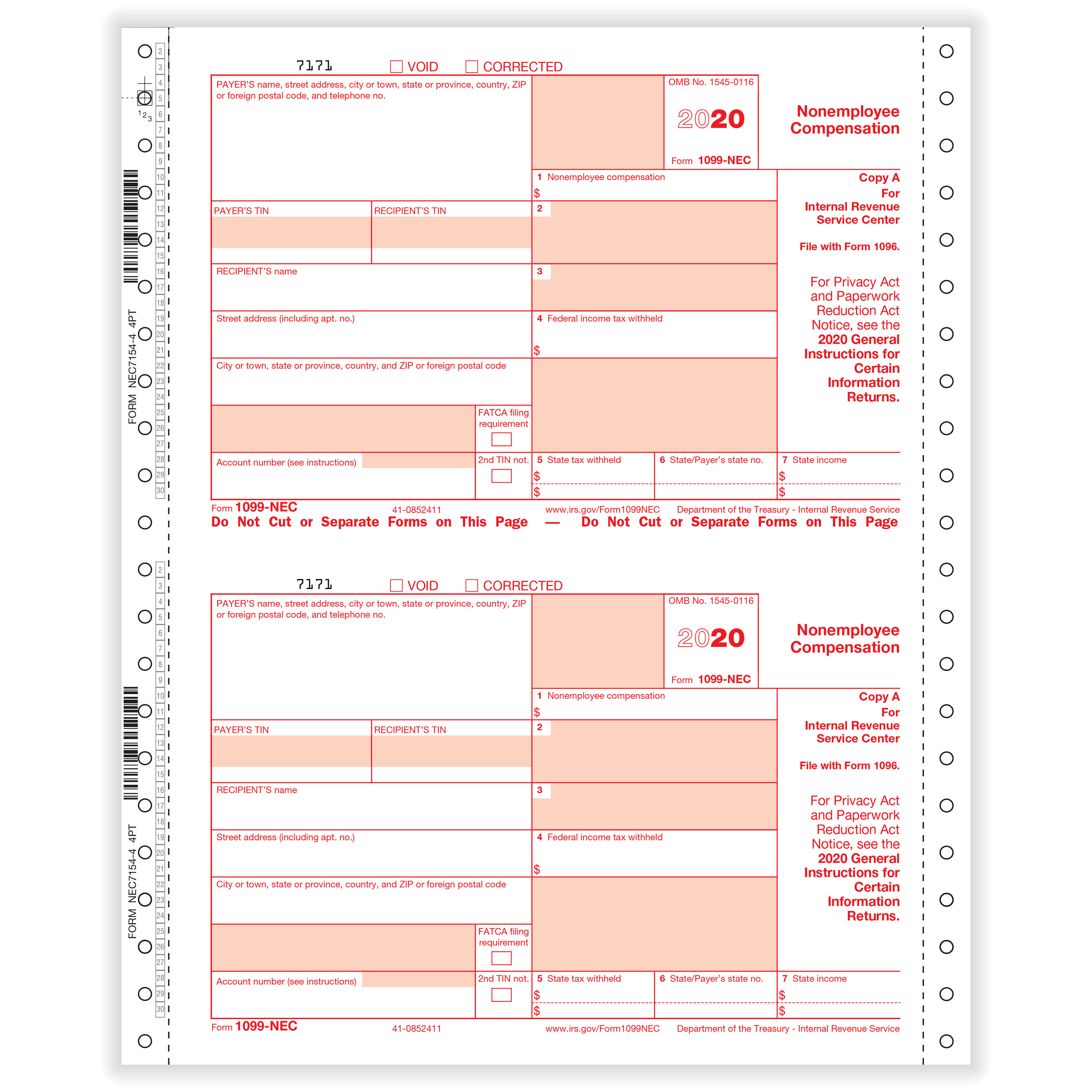

1099NEC Continuous 1" Wide 4Part Formstax

Form1099NEC

How to File Your Taxes if You Received a Form 1099NEC

What the 1099NEC Coming Back Means for your Business Chortek

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Understanding 1099 Form Samples

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

Specify The Date Range For The Forms Then Choose Ok.

Web To Get The Form, Either Hit The Fill This Form Button Or Do The Steps Below:

Information Returns File Your State.

Pricing Starts As Low As $2.75/Form.

Related Post: