Printable Nys Sales Tax Form St-100

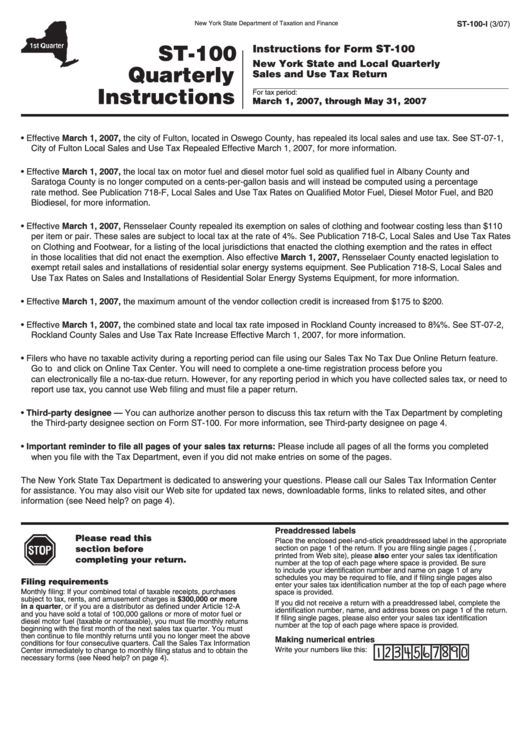

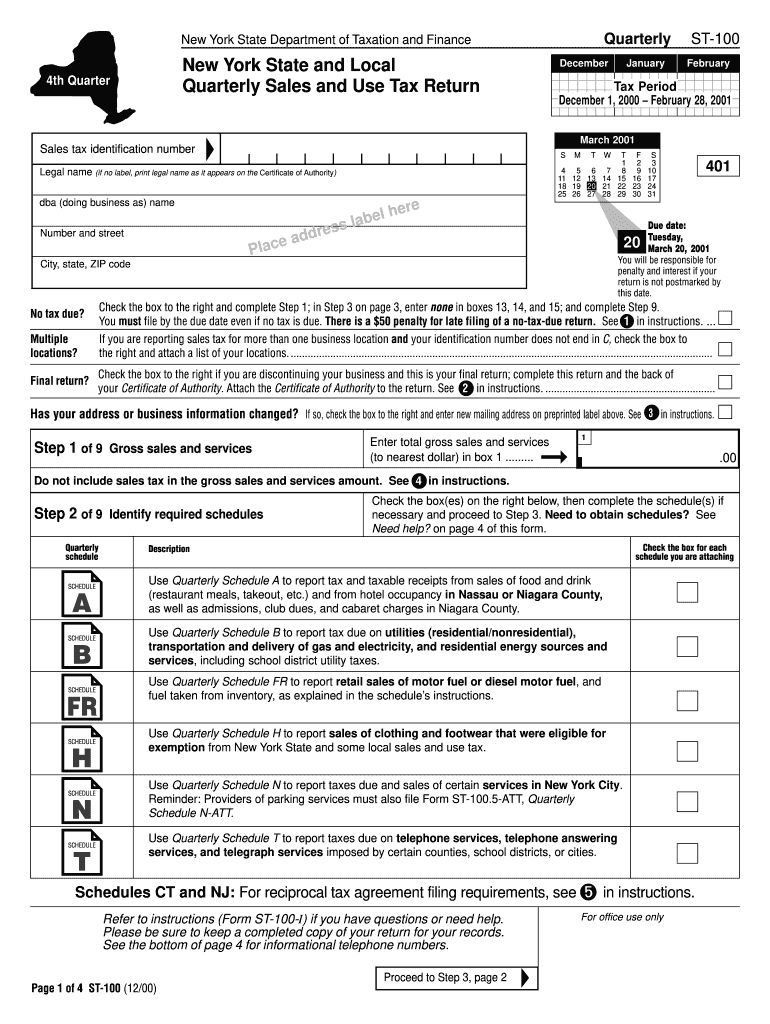

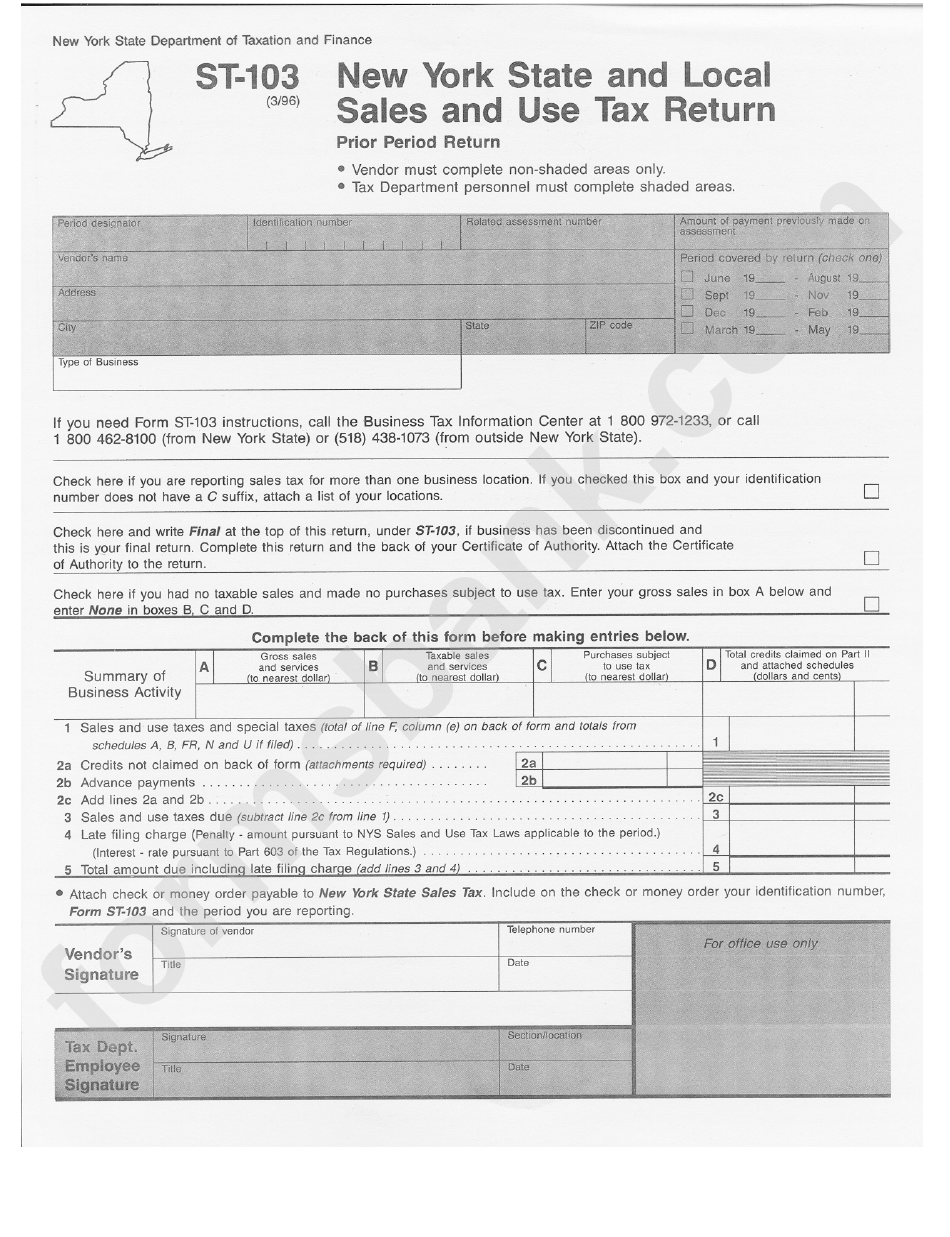

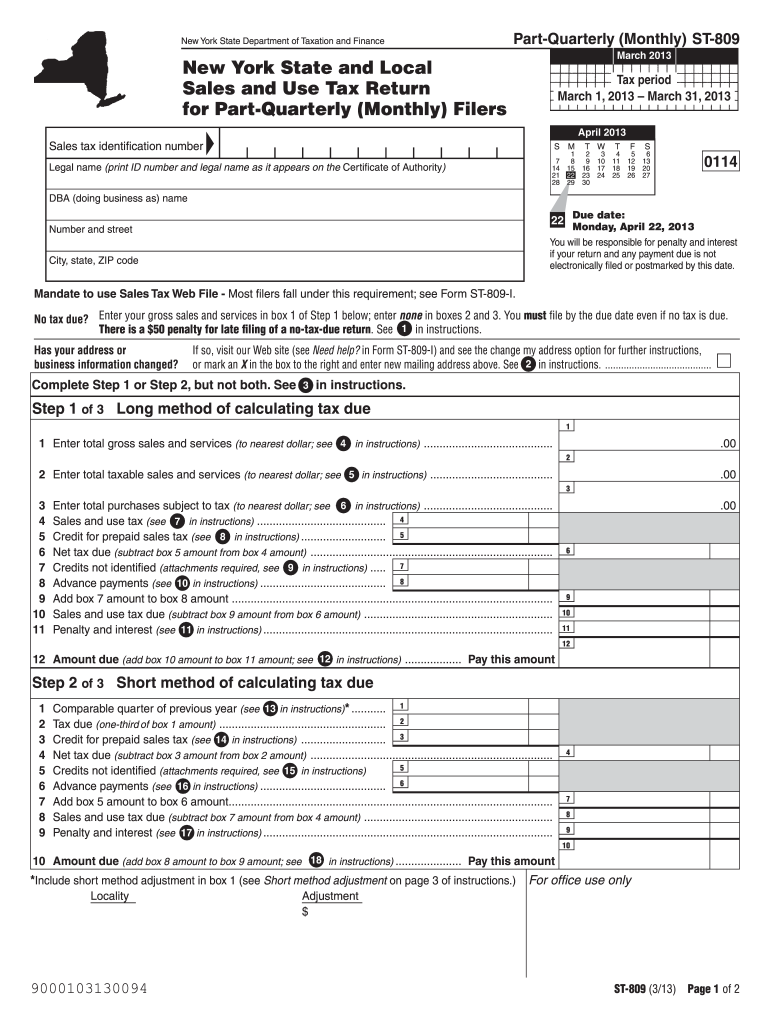

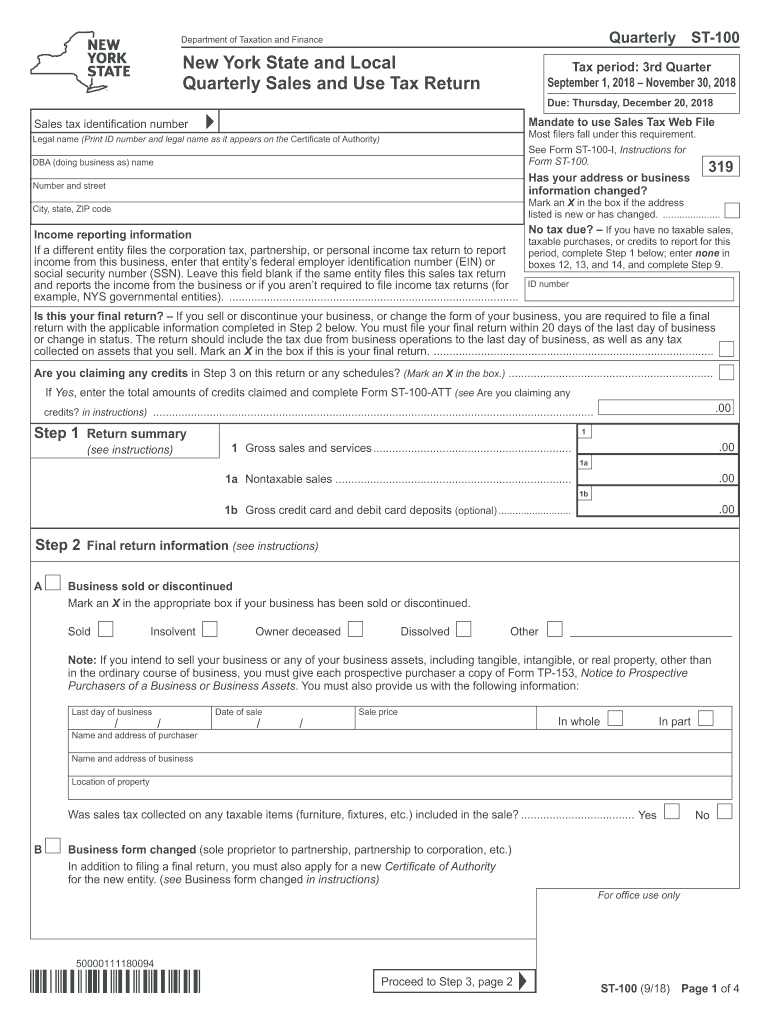

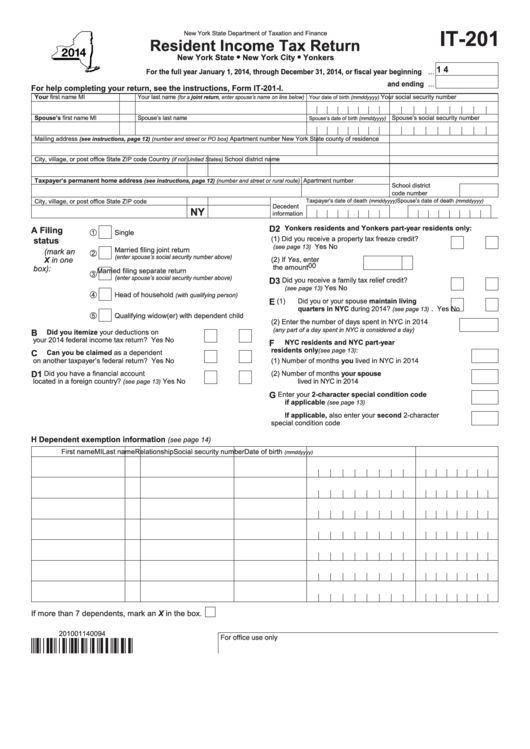

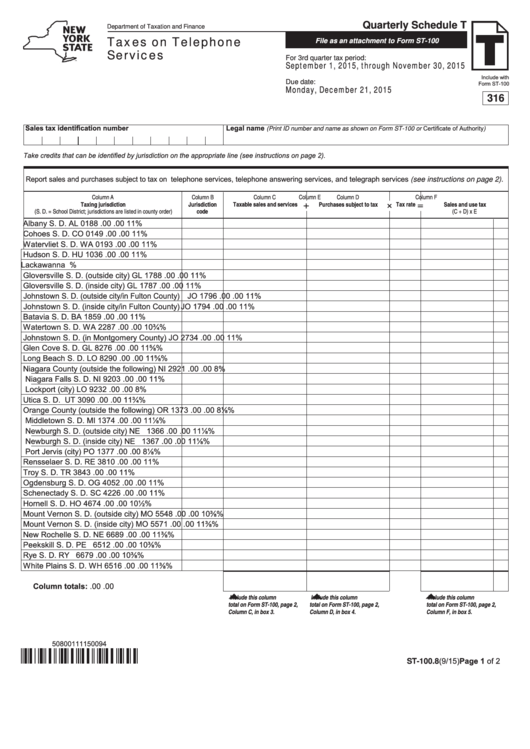

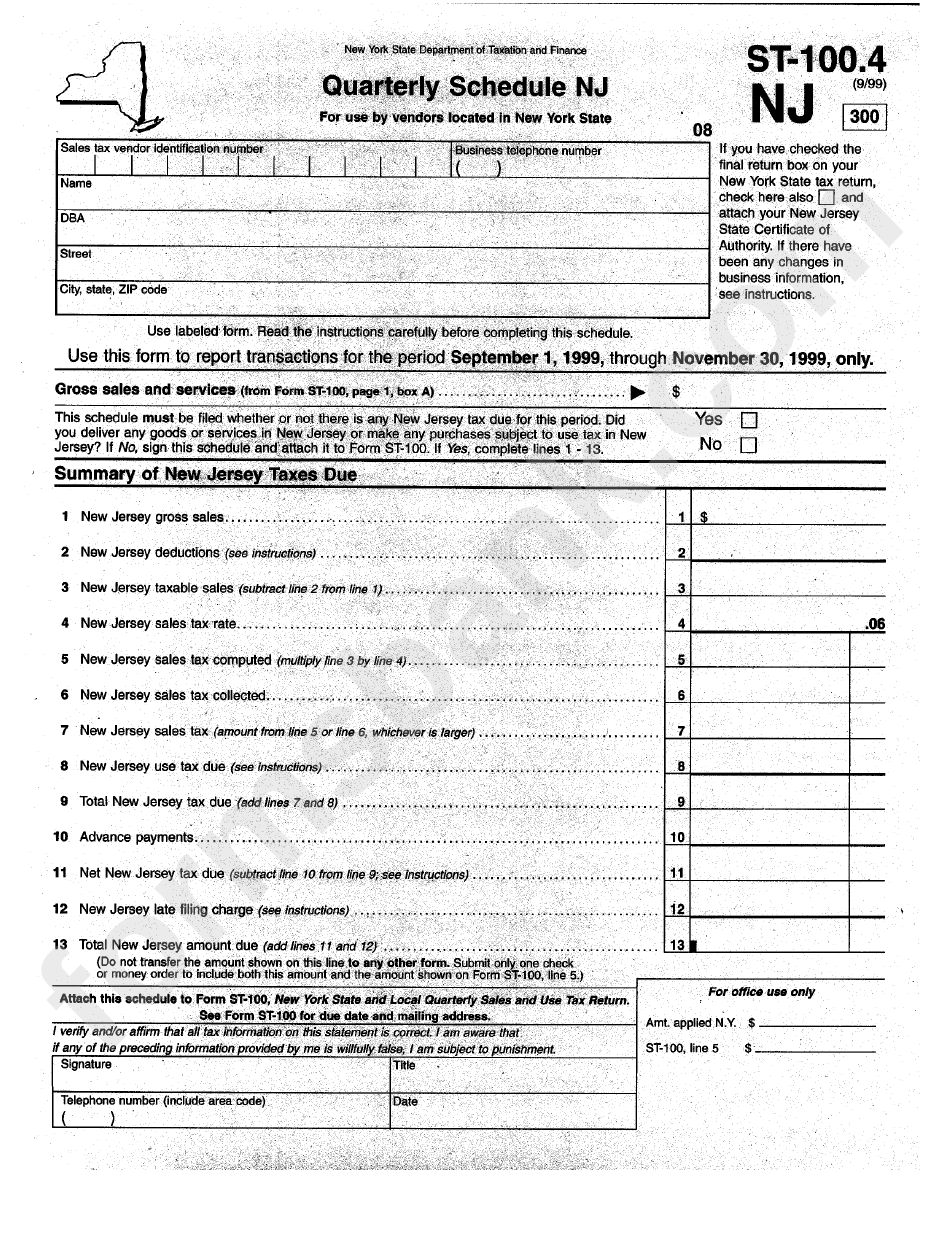

Printable Nys Sales Tax Form St-100 - Web make check or money order payable to new york state sales tax. Web gross sales and services. Or get more accurate rates by looking up the individual addresses you ship to. Web sales tax forms (current periods) commonly used forms. If you are filing this return after. New york state and local quarterly sales and use tax credit. You will be responsible for penalty and interest if your return and any payment due is not electronically filed or postmarked by. Ad choose the states you sell to and download tax rate tables, organized by zip code. Sign it in a few clicks draw your signature, type. This form can be completed. Web sales tax identification number quarterly schedule cw for 4th quarter tax period: Web new york state and local quarterly sales and use tax return. New york state and local quarterly sales and use tax return. Ad choose the states you sell to and download tax rate tables, organized by zip code. Web gross sales and services. You will be responsible for penalty and interest if your return and any payment due is not electronically filed or postmarked by. New york state and local quarterly sales and use tax credit. Web make check or money order payable to new york state sales tax. Web new york state and local quarterly sales and use tax return. In box. March 1, 2023, through may 31,. December 1, 2020, through february 28, 2021. Edit your st 100 tax form ny online type text, add images, blackout confidential details, add comments, highlights and more. Web 21 due date: December 1, 2020, through february 28, 2021 due date: Web make check or money order payable to new york state sales tax. Click the link to get the form instructions from the new york website. Web new york state and local quarterly sales and use tax return. Web make check or money order payable to new york state sales tax. Ad choose the states you sell to and download. Sign it in a few clicks draw your signature, type. Web make check or money order payable to new york state sales tax. December 1, 2020, through february 28, 2021 due date: New york state and local quarterly sales and use tax return. You will be responsible for penalty and interest if your return and any payment due is not. Click the link to get the form instructions from the new york website. December 1, 2020, through february 28, 2021. Ad choose the states you sell to and download tax rate tables, organized by zip code. New york state and local quarterly sales and use tax return. Web make check or money order payable to new york state sales tax. Sign it in a few clicks draw your signature, type. New york state and local quarterly sales and use tax credit. Web sales tax forms (current periods) commonly used forms. December 1, 2020, through february 28, 2021. Web new york state and local quarterly sales and use tax return. New york state and local quarterly sales and use tax credit. Web new york state and local quarterly sales and use tax return. Web sales tax forms (current periods) commonly used forms. You will be responsible for penalty and interest if your return and any payment due is not electronically filed or postmarked by. If you are filing this return. If you are filing this return after. Web sales tax forms (current periods) commonly used forms. New york state and local quarterly sales and use tax return. Web new york state and local quarterly sales and use tax return. B business form changed (sole. Web 21 due date: March 1, 2023, through may 31,. Web new york state and local quarterly sales and use tax return. Web sales tax identification number quarterly schedule cw for 4th quarter tax period: Web sales tax forms (current periods) commonly used forms. New york state and local quarterly sales and use tax return. March 1, 2023, through may 31,. Sign it in a few clicks draw your signature, type. Web new york state and local quarterly sales and use tax return. B business form changed (sole. December 1, 2020, through february 28, 2021 due date: Or get more accurate rates by looking up the individual addresses you ship to. Web make check or money order payable to new york state sales tax. Web new york state and local quarterly sales and use tax return. New york state and local quarterly sales and use tax credit. This form can be completed. Web make check or money order payable to new york state sales tax. In box 1, enter the total taxable, nontaxable, and exempt sales and services from your nys business locations and from locations outside nys. If you are filing this return after. Web sales tax identification number quarterly schedule cw for 4th quarter tax period: Click the link to get the form instructions from the new york website. Web gross sales and services. Web sales tax forms (current periods) commonly used forms. Edit your st 100 tax form ny online type text, add images, blackout confidential details, add comments, highlights and more. Web 21 due date: Sign it in a few clicks draw your signature, type. If you are filing this return after. December 1, 2020, through february 28, 2021. Web make check or money order payable to new york state sales tax. B business form changed (sole. This form can be completed. New york state and local quarterly sales and use tax credit. Or get more accurate rates by looking up the individual addresses you ship to. Web 21 due date: Web gross sales and services. Web sales tax identification number quarterly schedule cw for 4th quarter tax period: Web make check or money order payable to new york state sales tax. Web sales tax forms (current periods) commonly used forms. March 1, 2023, through may 31,. Web new york state and local quarterly sales and use tax return. December 1, 2020, through february 28, 2021 due date:Instructions For Form St100 New York State And Local Quarterly Sales

New york state sales tax form st 100 dec 12 feb 13 2000 Fill out

Form St103 New York State And Local Sales And Use Tax Return

St809 Fill out & sign online DocHub

nys sales tax form st 100 Fill out & sign online DocHub

Printable Ny State Tax Forms Printable Form 2022

NY NYS100 20132021 Fill and Sign Printable Template Online US

Fillable Form St100.8 Quarterly Schedule T Taxes On Telephone

Form St100.4 Quarterly Schedule Nj For Use By Vendors Located In New

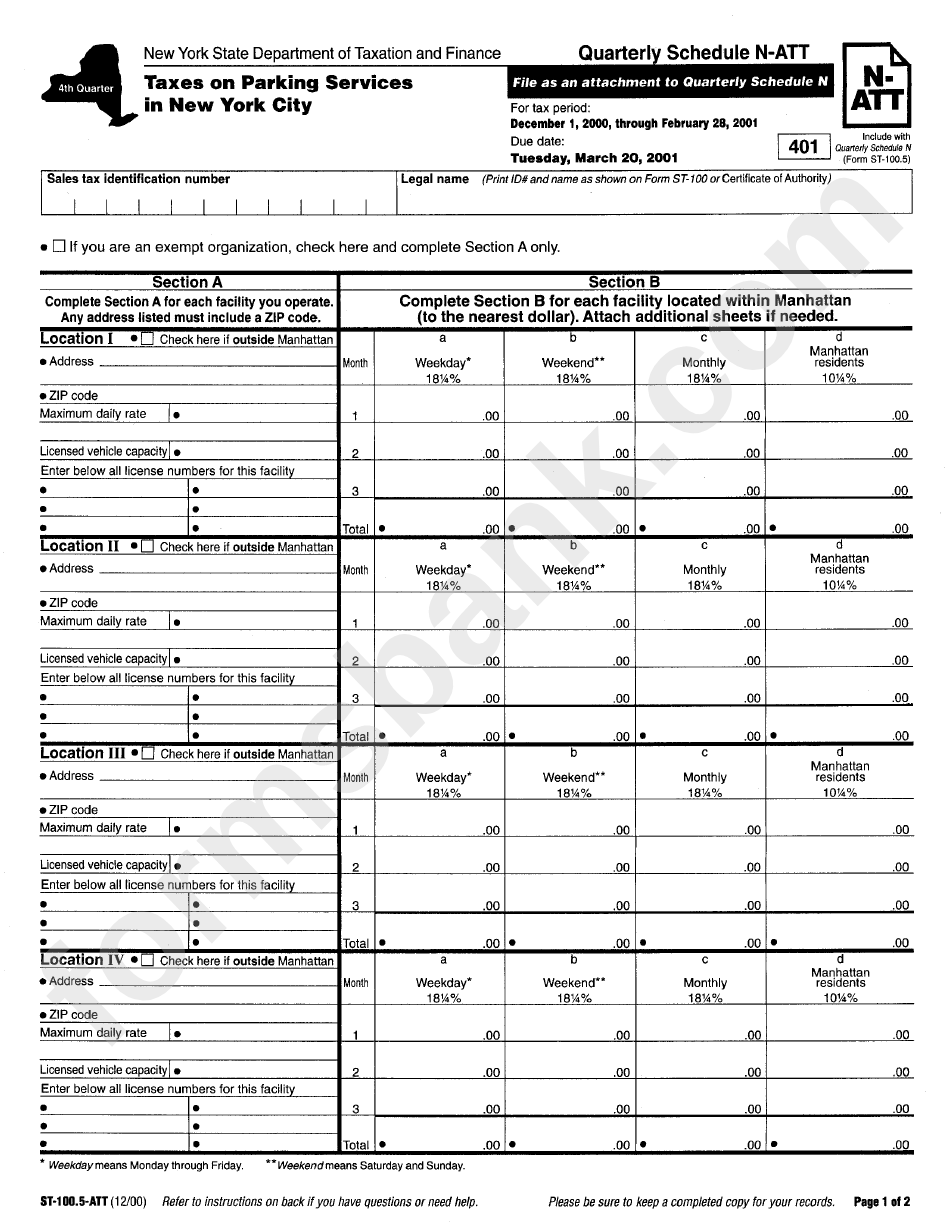

Form St100.5Att Taxes On Parking Services In New York City New

Ad Choose The States You Sell To And Download Tax Rate Tables, Organized By Zip Code.

You Will Be Responsible For Penalty And Interest If Your Return And Any Payment Due Is Not Electronically Filed Or Postmarked By.

In Box 1, Enter The Total Taxable, Nontaxable, And Exempt Sales And Services From Your Nys Business Locations And From Locations Outside Nys.

Web New York State And Local Quarterly Sales And Use Tax Return.

Related Post: