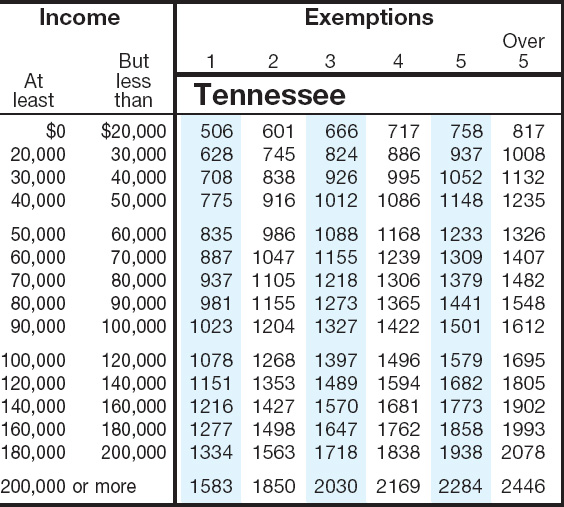

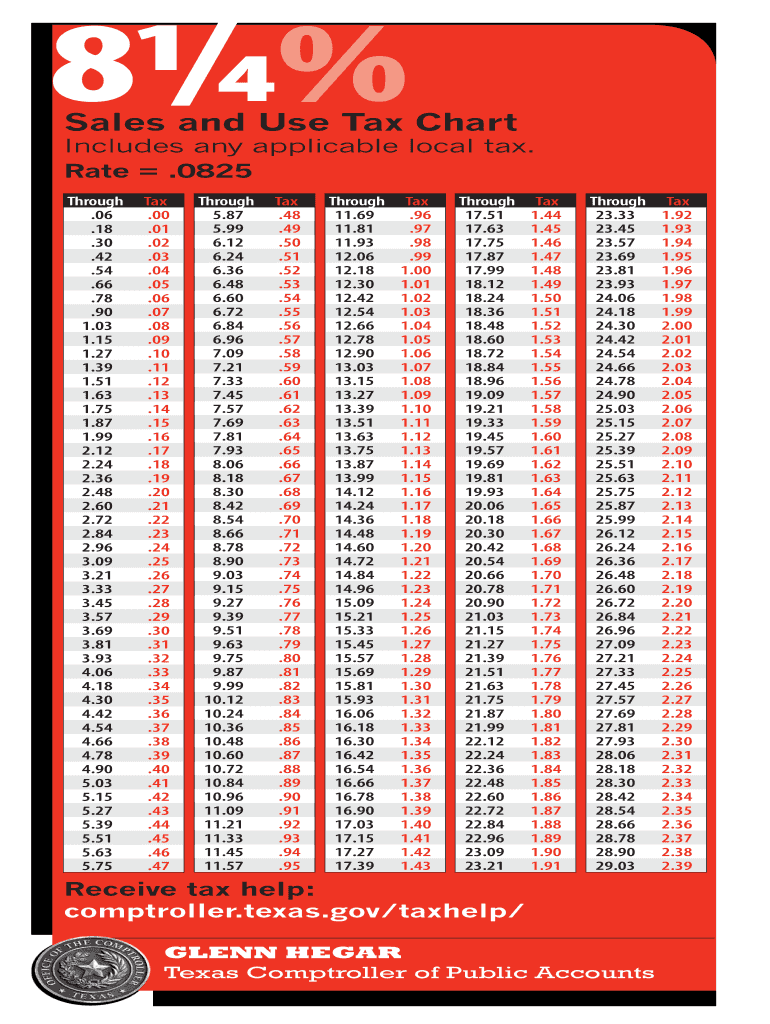

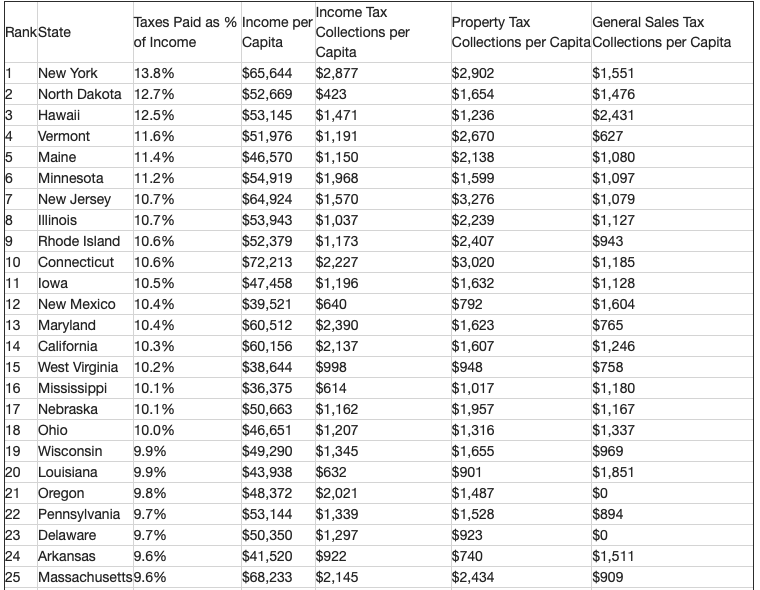

Printable Sales Tax Chart

Printable Sales Tax Chart - Web county and transit sales and use tax rates for cities and towns. Take control over your company's tax strategies and confidently manage with onesource®. City rates with local codes and total tax rates. Web local sales tax rates. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Sale is $75.95 tax on. Web 2023 texas sales tax table. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web 2023 texas sales tax table. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Download select the states in which you do. Web local sales and use tax rates. Sale is $75.95 tax on. Web 2023 texas sales tax table. Download avalara rate tables each month or find rates with the sales tax rate calculator. For quick reference, this table includes the minimum and maximum local tax rates that occur within. Sale is $75.95 tax on. Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Sale is $75.95 tax on. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Web sales. Take control over your company's tax strategies and confidently manage with onesource®. Web local sales tax rates. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). For quick reference, this table includes the minimum and maximum local tax rates that occur within. Simply enter. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Web local sales and use tax rates. Download avalara rate tables each month or find. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. City rates with local codes and total tax rates. Sale is $75.95 tax on. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web sales and use tax chart (continued). Web sales and use tax chart (continued) sales over $50 how to figure the tax example: For quick reference, this table includes the minimum and maximum local tax rates that occur within. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). Price up to. Web 51 rows this sales tax table (also known as a sales tax chart or sales. There is no applicable special tax. Use the sales tax rate locator to search for sales tax rates by address. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web instead of using your actual expenses, you can. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). Web 51 rows this sales tax table (also known as a sales tax chart or sales. Web local sales tax rates. Web county and transit sales and use tax rates for cities and towns. Web. Take control over your company's tax strategies and confidently manage with onesource®. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Use the sales tax. Web sales and use tax chart (continued) sales over $50 how to figure the tax example: Web what is the maximum local sales tax rate in your area (even down to the zip code)? Use the sales tax rate locator to search for sales tax rates by address. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. Web county and transit sales and use tax rates for cities and towns. Sale is $75.95 tax on. For quick reference, this table includes the minimum and maximum local tax rates that occur within. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Web local sales tax rates. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). City rates with local codes and total tax rates. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Take control over your company's tax strategies and confidently manage with onesource®. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web 51 rows this sales tax table (also known as a sales tax chart or sales. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web local sales and use tax rates. Web 2023 texas sales tax table. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. Web sales tax chart get our configurable sales tax chart. City rates with local codes and total tax rates. Web 2023 texas sales tax table. Web sales tax chart get our configurable sales tax chart. Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Use the sales tax rate locator to search for sales tax rates by address. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. Download avalara rate tables each month or find rates with the sales tax rate calculator. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. There is no applicable special tax. For quick reference, this table includes the minimum and maximum local tax rates that occur within. Sale is $75.95 tax on. Web county and transit sales and use tax rates for cities and towns. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web what is the maximum local sales tax rate in your area (even down to the zip code)?California 9 Sales Tax Chart Printable Total up your items purchase

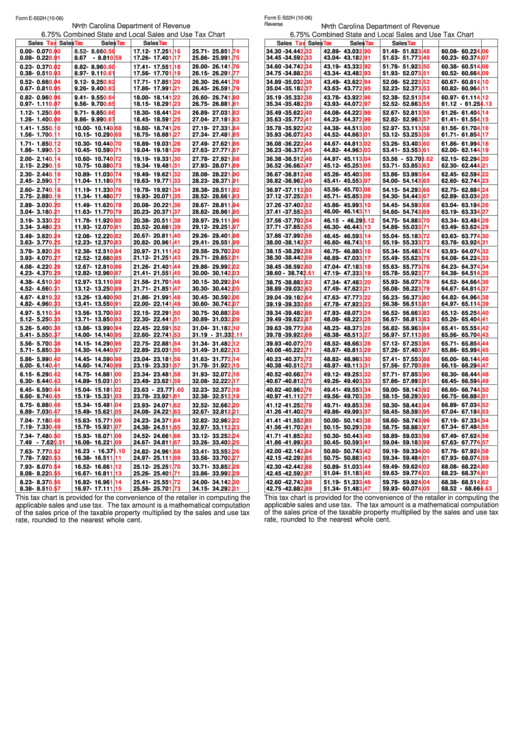

Form E502h 6.75 Combined State And Local Sales And Use Tax Chart

The Amount Listed In The Sales Tax Table For Other States Click Here

20152022 Form TX 98292 Fill Online, Printable, Fillable, Blank

Florida Sales Tax Chart My XXX Hot Girl

REV227 PA Sales and Use Tax Credit Chart Free Download

Free Printable Sales Tax Chart Printable World Holiday

Taxidermy Local rates stuffed with fewer increases

7.25 Sales Tax Chart Printable Printable Word Searches

sales tax chart 8.25 Google Search Sales tax, Market day ideas

Web Local Sales Tax Rates.

Download Select The States In Which You Do.

Web Local Sales And Use Tax Rates.

Web Sales And Use Tax Chart (Continued) Sales Over $50 How To Figure The Tax Example:

Related Post: