Printable Tax Forms 1040Ez

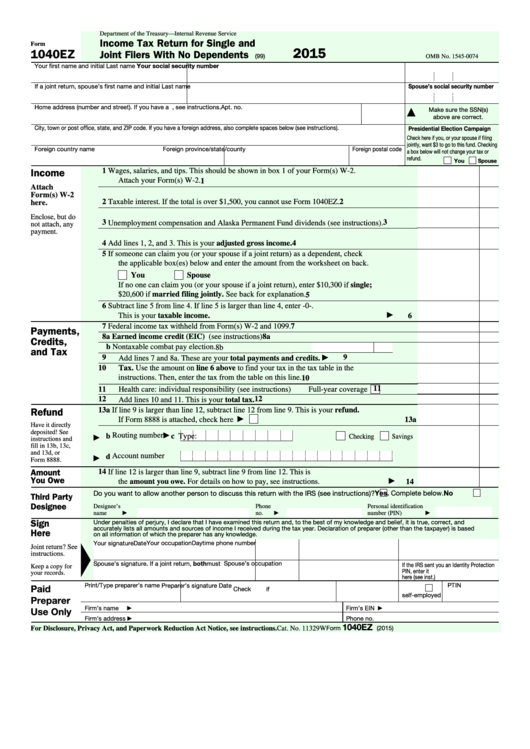

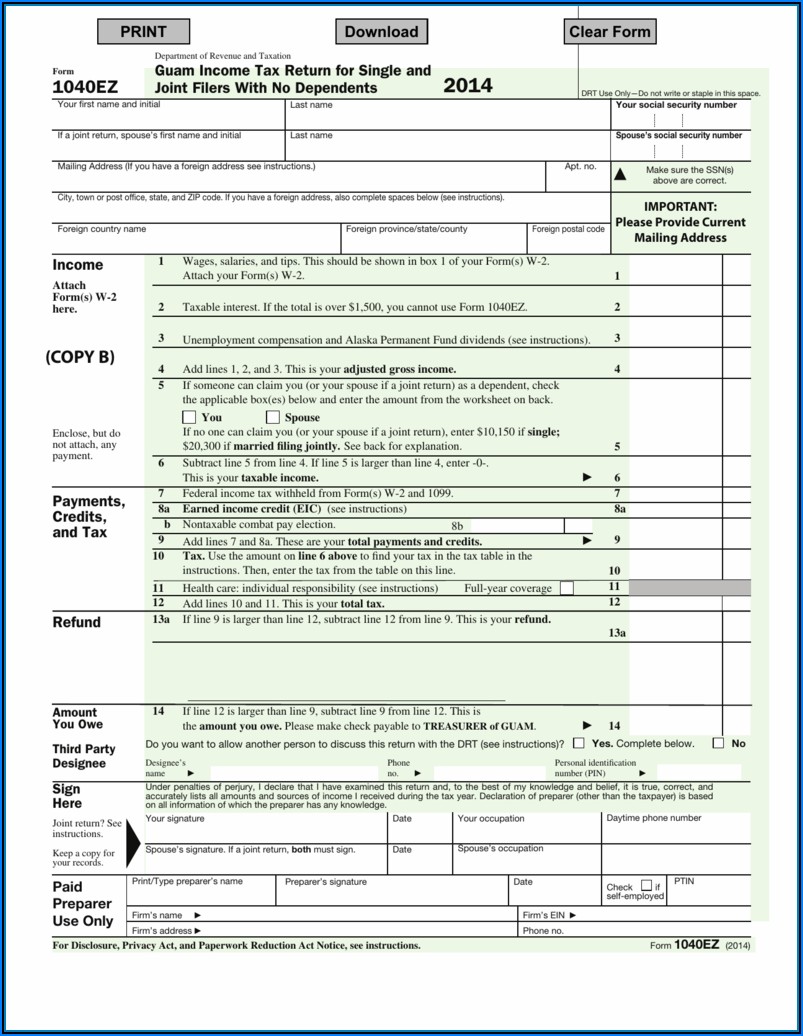

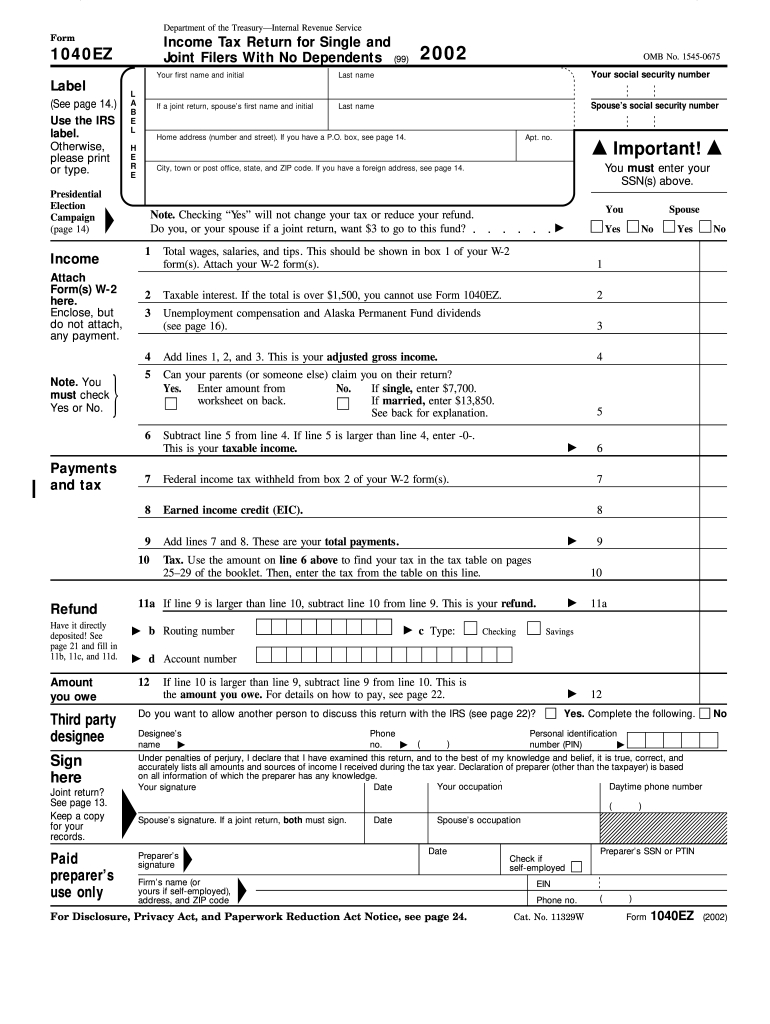

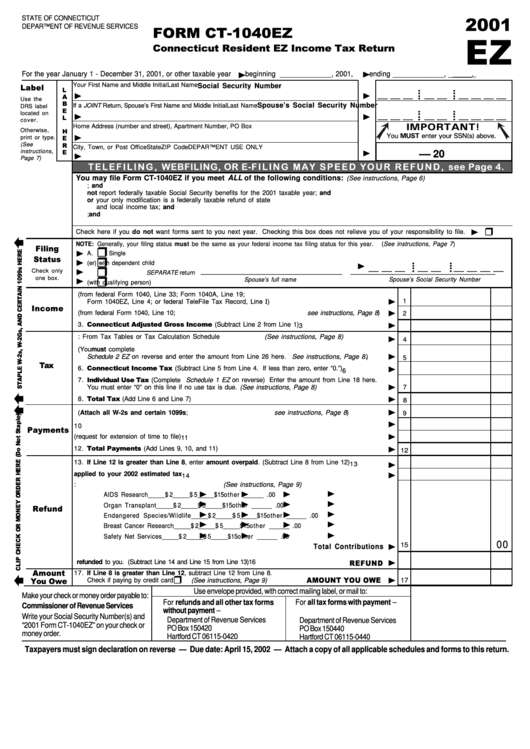

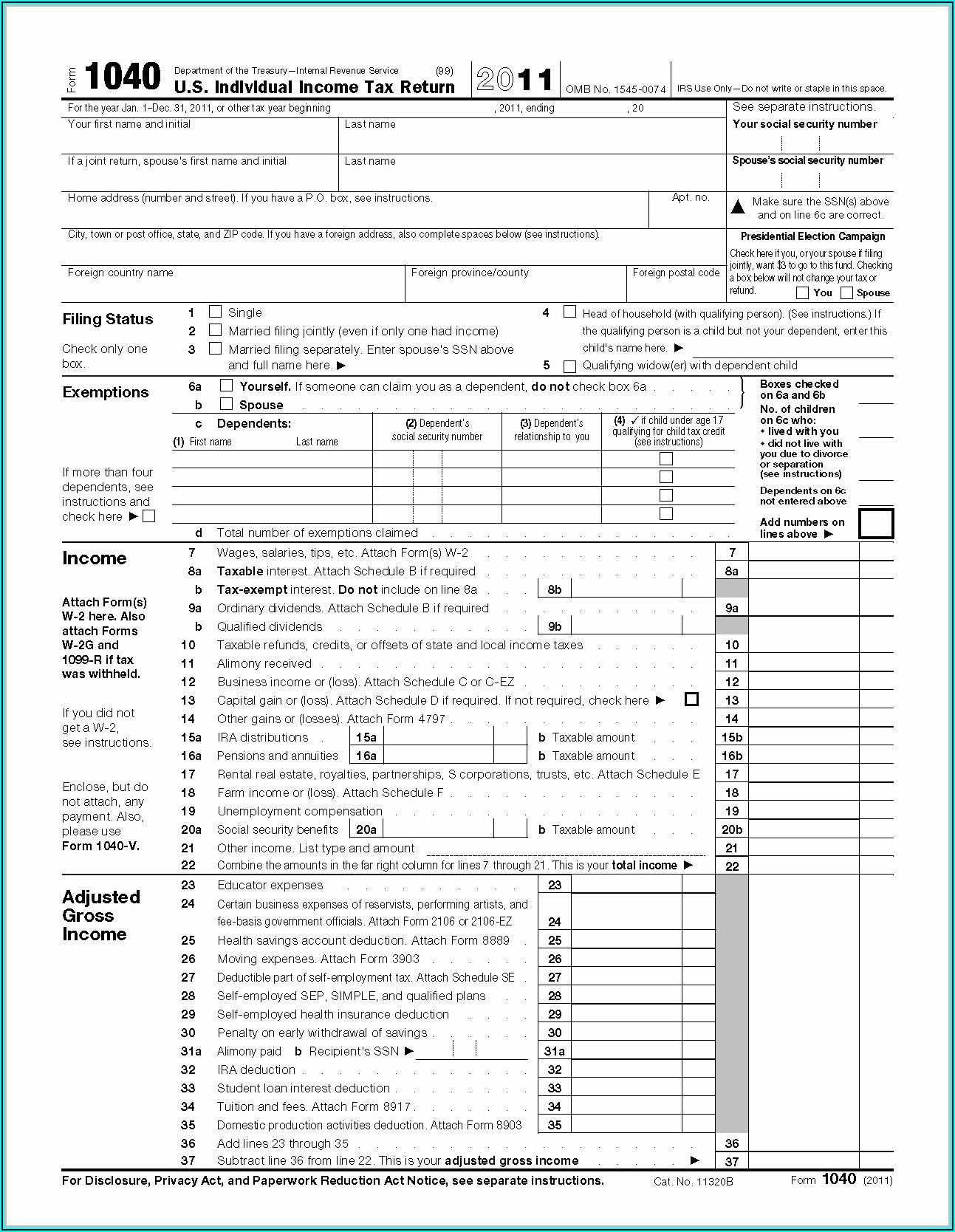

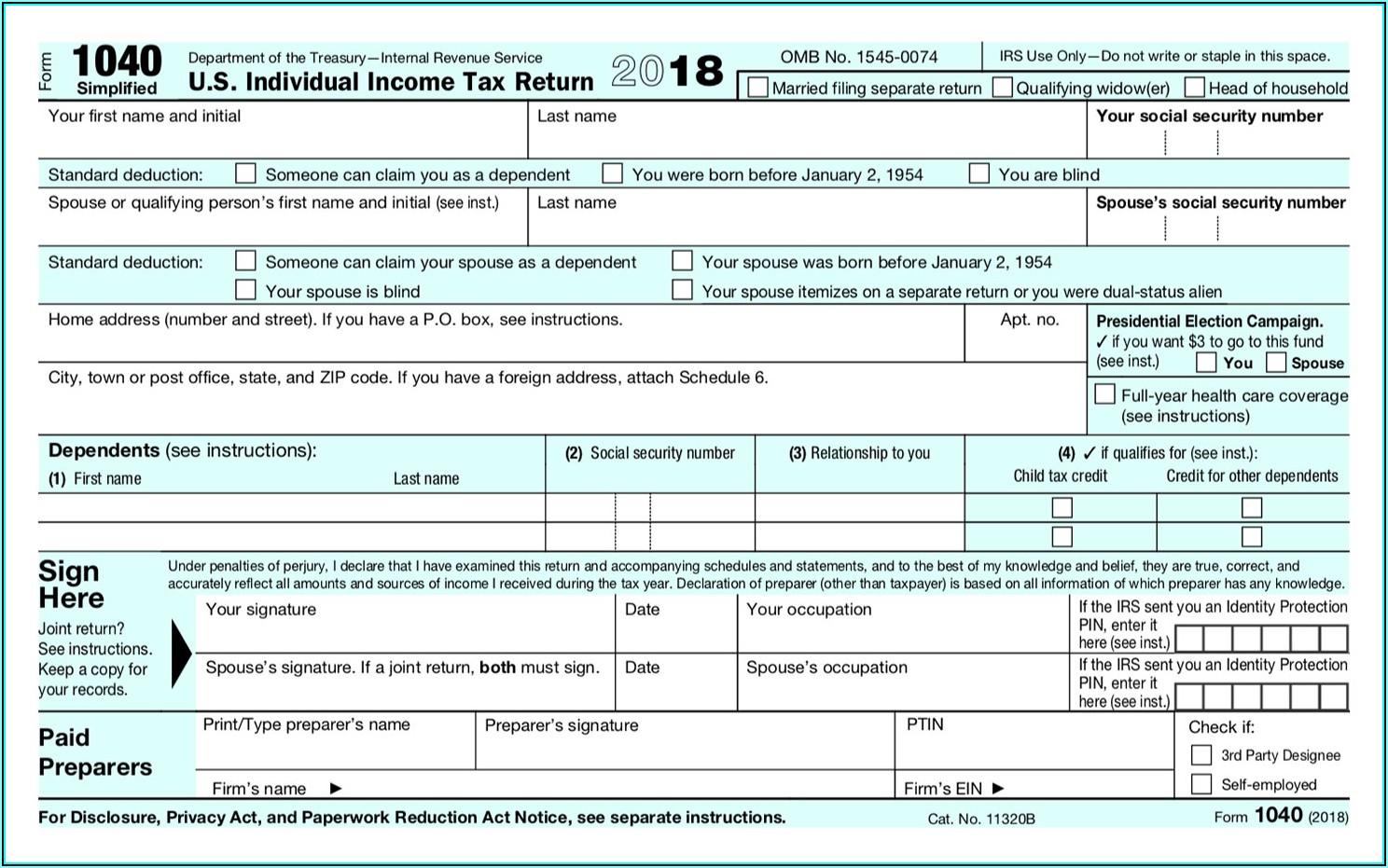

Printable Tax Forms 1040Ez - Web printable 2021 federal income tax forms 1040, 1040ss, 1040pr, 1040nr, 1040x, instructions, schedules, and more. Web the most common arizona income tax form is the arizona form 140. You had taxable income of less than $100,000. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Your taxable income is less than $100,000. Web get federal tax return forms and file by mail. Fill out general personal information (first and last name, address, and. Pick a needed year and fill out your template instantly online. Taxpayers may rely on the proposed regulations for tax years of beneficiaries beginning after 2017 and before the final regulations are published. Web 1 wages, salaries, and tips. If the total is over $1,500, you cannot use form. Web 2022 ohio it 1040 individual income tax return sequence no. Web irs form 1040ez was a shortened version of the irs tax form 1040. Find deals and compare prices on turbo tax online at amazon.com Web individual income tax forms; Web before recent tax reforms, you could file with form 1040ez if: Ad browse & discover thousands of unique brands. Web information about form 1040, u.s. Web how much will i receive? Web individual income tax forms; You had taxable income of less than $100,000. Web how much will i receive? Pick a needed year and fill out your template instantly online. Taxpayers may rely on the proposed regulations for tax years of beneficiaries beginning after 2017 and before the final regulations are published. Web the most common arizona income tax form is the arizona form 140. Form 1040 is used by citizens or residents. Printable 2021 federal tax forms are listed. Web get federal tax return forms and file by mail. Web use form 1040ez (quick & easy) if: Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. $520 for married couples who filed jointly with an. Web before recent tax reforms, you could file with form 1040ez if: Ad keep it simple when filling out your form 1040 and use pdfsimpli. Web file your taxes for free apply for an employer id number (ein) check your amended return status If the total is over $1,500, you cannot. Web get federal tax return forms and file by mail. Printable 2021 federal tax forms are listed. This form should be completed after. Read customer reviews & best sellers. Ad browse & discover thousands of unique brands. This form is used by residents who file an individual income tax return. Individual income tax return, including recent updates, related forms and instructions on how to file. To open the printable 1040 ez form, you would need to click the fill out form button. Fill out general personal information (first and last name, address, and. Web before recent tax. Pick a needed year and fill out your template instantly online. Your filing status is single or married filing jointly. If the total is over $1,500, you cannot use form. The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040 tax form. Web before recent tax reforms,. Web individual income tax forms; Your filing status is single or married filing jointly. This form should be completed after. Pick a needed year and fill out your template instantly online. This form is used by residents who file an individual income tax return. Web get federal tax return forms and file by mail. To open the printable 1040 ez form, you would need to click the fill out form button. Web find out how to save, fill in or print irs forms with adobe reader. Form 1040 is used by citizens or residents. Ad keep it simple when filling out your form 1040. Web estimated tax for individuals. Web irs form 1040ez was a shortened version of the irs tax form 1040. This form is used by residents who file an individual income tax return. Find deals and compare prices on turbo tax online at amazon.com Search for ez 1040 tax form on financeinfonow.com. Web get federal tax return forms and file by mail. Form 1040 is used by citizens or residents. Web 1 wages, salaries, and tips. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web file your taxes for free apply for an employer id number (ein) check your amended return status To open the printable 1040 ez form, you would need to click the fill out form button. Printable 2021 federal tax forms are listed. Ad keep it simple when filling out your form 1040 and use pdfsimpli. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. It allowed single and joint filers with no dependents with basic tax reporting needs to file. Individual estimated tax payment booklet. Fill out general personal information (first and last name, address, and. Pick a needed year and fill out your template instantly online. The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040 tax form. Web information about form 1040, u.s. It allowed single and joint filers with no dependents with basic tax reporting needs to file. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Taxpayers may rely on the proposed regulations for tax years of beneficiaries beginning after 2017 and before the final regulations are published. $520 for married couples who filed jointly with an. This form is used by residents who file an individual income tax return. Web the most common arizona income tax form is the arizona form 140. Web use form 1040ez (quick & easy) if: Your filing status was single or married filing jointly. Web before recent tax reforms, you could file with form 1040ez if: Your taxable income is less than $100,000. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Printable 2021 federal tax forms are listed. Pick a needed year and fill out your template instantly online. To open the printable 1040 ez form, you would need to click the fill out form button. Your filing status is single or married filing jointly. Save time with our amazing toolFillable Form 1040ez Tax Return For Single And Joint Filers

Irs Tax Form 1040ez Online Universal Network

1040ez Tax Form Definition Form Resume Examples GM9OKWM9DL

1040 Ez Fill Online, Printable, Fillable, Blank pdfFiller

Form Ct1040ez Connecticut Resident Ez Tax Return 2001

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Printable Tax Forms 1040ez 2019 Form Resume Examples vq1PyQrKkR

Federal Tax Forms 1040ez Form Resume Examples a6YnA8P9Bg

1040ez Tax Form With Dependents Form Resume Examples

Fill Out General Personal Information (First And Last Name, Address, And.

Search For Ez 1040 Tax Form On Financeinfonow.com.

Web Estimated Tax For Individuals.

The 1040Ez Is A Simplified Form Used By The Irs For Income Taxpayers That Do Not Require The Complexity Of The Full 1040 Tax Form.

Related Post: