Printable W 4 Form

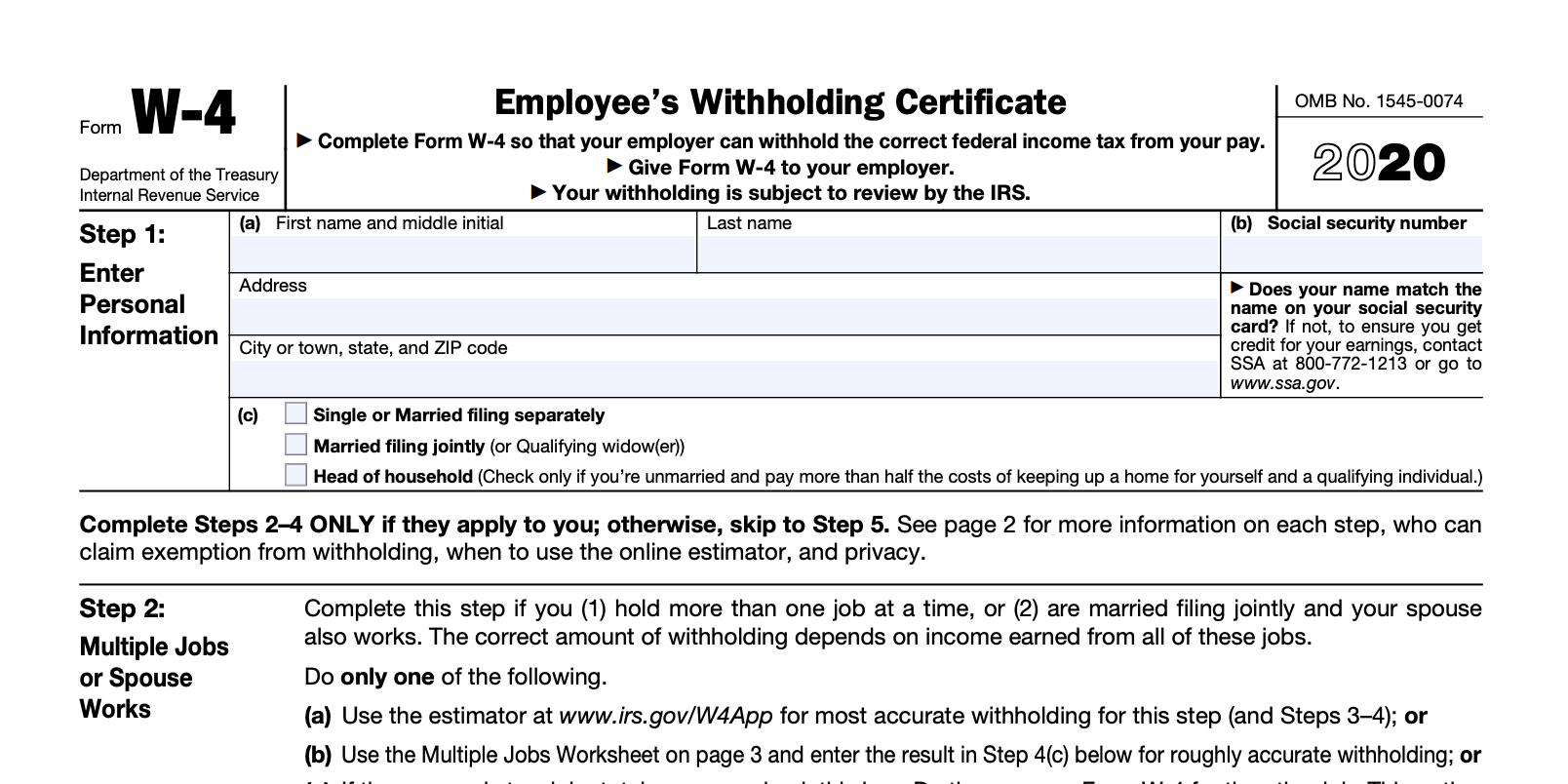

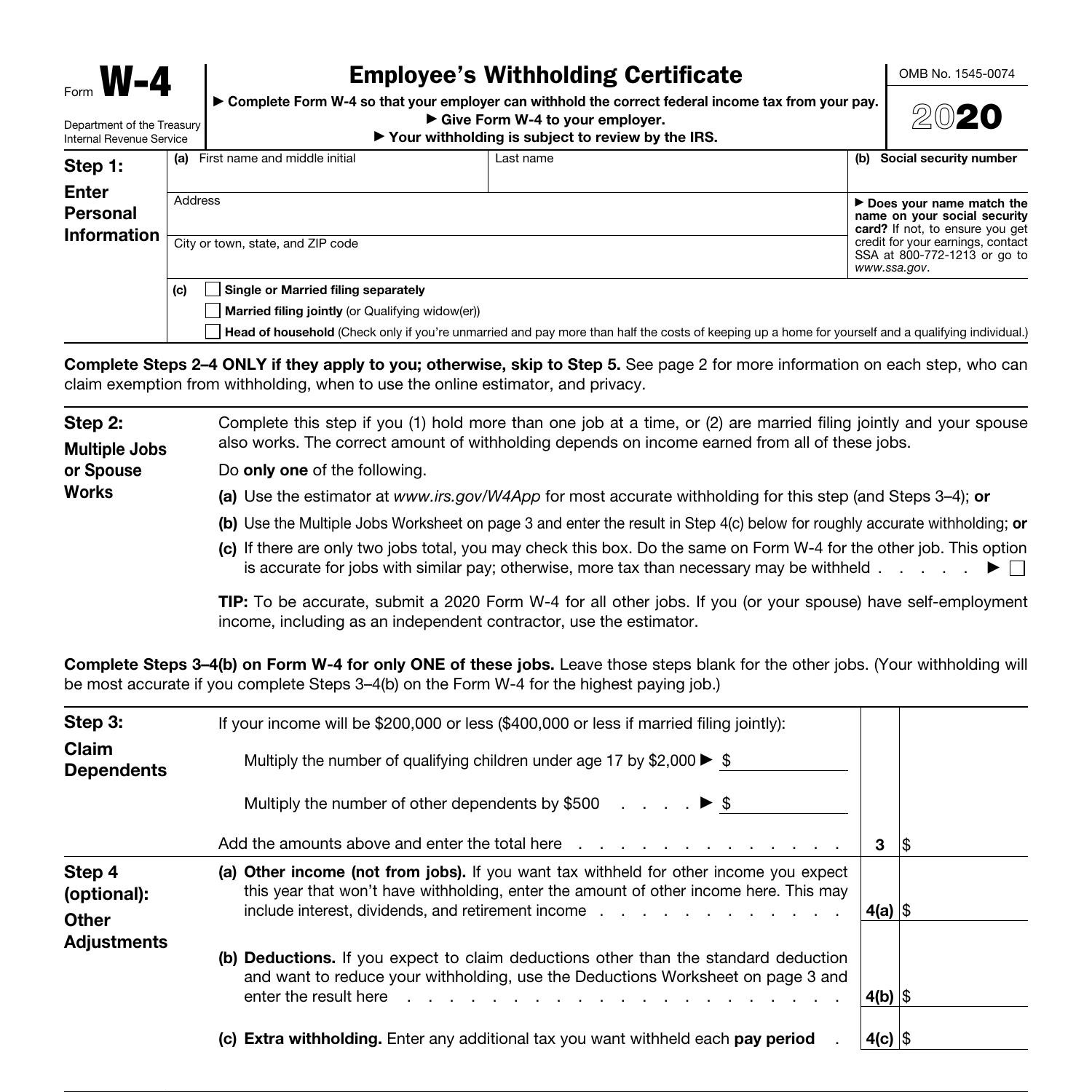

Printable W 4 Form - Web for maryland state government employees only. It tells the employer how much to withhold from an employee’s paycheck for taxes. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Amazon.com has been visited by 1m+ users in the past month Leave those steps blank for the other jobs. The amount withheld from your. If too little is withheld, you will generally owe tax when you file. Web updated august 05, 2023. Use the 2nd page for calculations to. Web in this video you’ll learn: (check only one box) 1. Web in this video you’ll learn: The amount withheld from your. Leave those steps blank for the other jobs. Web for maryland state government employees only. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. (check only one box) 1. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your. Web in this video you’ll learn: If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Begin by entering your personal information, including your full name, address, and social security number. (check only one box) 1. It tells the employer how much to withhold from. If too little is withheld, you will generally owe tax when you file your tax return. Web updated august 05, 2023. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web for maryland state government employees only. You have to submit only the 1st page that includes the aforementioned 5 steps. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. It tells the employer how much to withhold from an employee’s paycheck for taxes. If you are an employee, you must complete this form so your employer can. If too little is withheld, you will generally owe tax when you file your tax return. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web in this video you’ll learn: Leave those steps blank for the other jobs. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. The amount withheld from your. Your withholding is subject to review. If too little is withheld, you will generally owe tax when you file your tax return. Web updated august 05, 2023. If too little is withheld, you will generally owe tax when you file your tax return. Amazon.com has been visited by 1m+ users in the past month Leave those steps blank for the other jobs. The amount withheld from your. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web up to $40 cash back how to fill out w4 form 2022: If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Use the 2nd page for calculations to. Web updated august 05, 2023. If too little is withheld, you will generally owe tax when you file your tax return. Web updated august 05, 2023. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Begin by entering your personal information, including your full name, address, and social security. Your withholding is subject to review. The amount withheld from your. Web up to $40 cash back how to fill out w4 form 2022: If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. It tells the employer how much to withhold from an employee’s paycheck for taxes. You have to submit only the 1st page that includes the aforementioned 5 steps. Begin by entering your personal information, including your full name, address, and social security number. Amazon.com has been visited by 1m+ users in the past month (check only one box) 1. Web in this video you’ll learn: If too little is withheld, you will generally owe tax when you file. Web for maryland state government employees only. Leave those steps blank for the other jobs. Web updated august 05, 2023. Use the 2nd page for calculations to. Use the 2nd page for calculations to. Begin by entering your personal information, including your full name, address, and social security number. Web in this video you’ll learn: You have to submit only the 1st page that includes the aforementioned 5 steps. Web for maryland state government employees only. If too little is withheld, you will generally owe tax when you file your tax return. Your withholding is subject to review. It tells the employer how much to withhold from an employee’s paycheck for taxes. The amount withheld from your. Leave those steps blank for the other jobs. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Web up to $40 cash back how to fill out w4 form 2022: If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file.Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

Free Printable W 4 Forms 2022 W4 Form

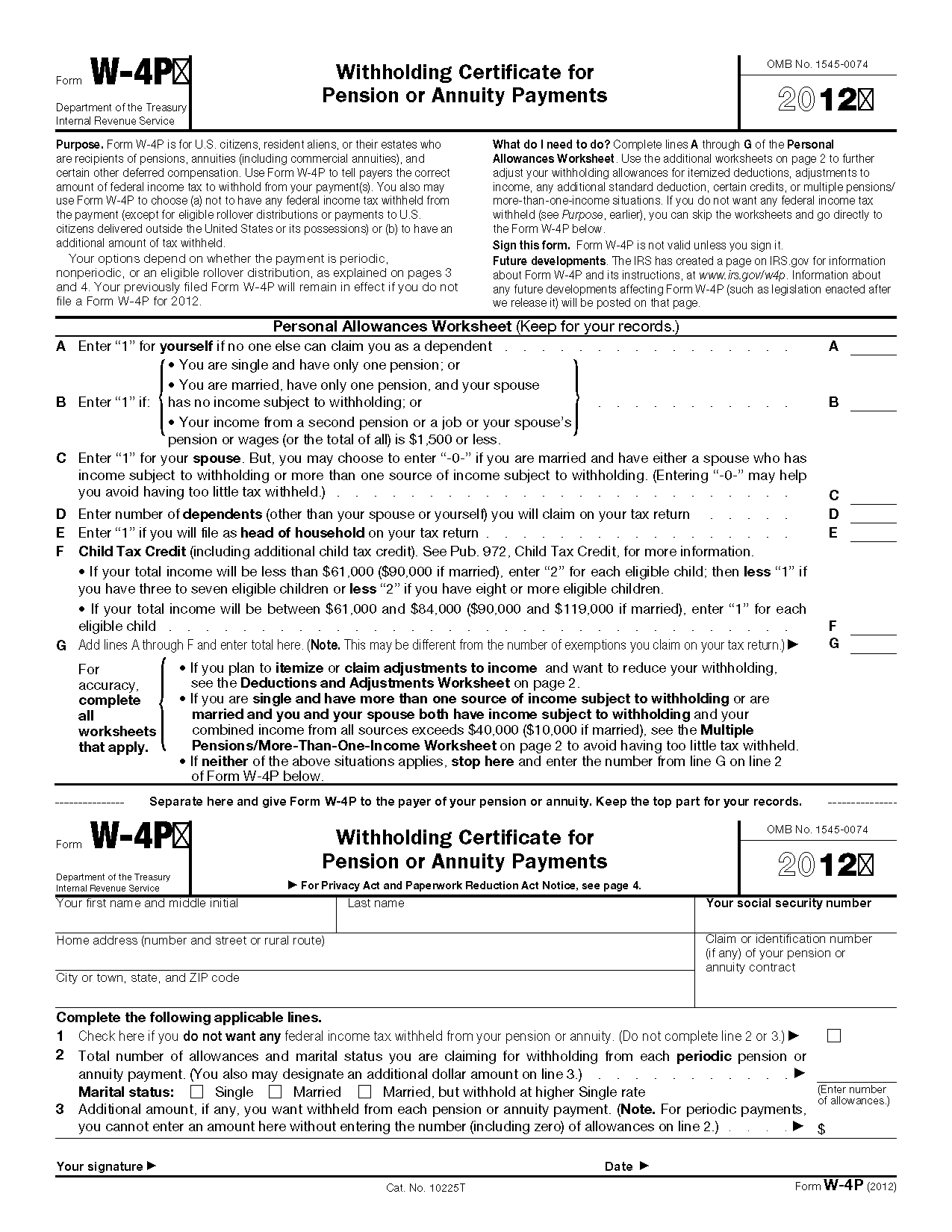

Irs Form W4p Printable Printable Forms Free Online

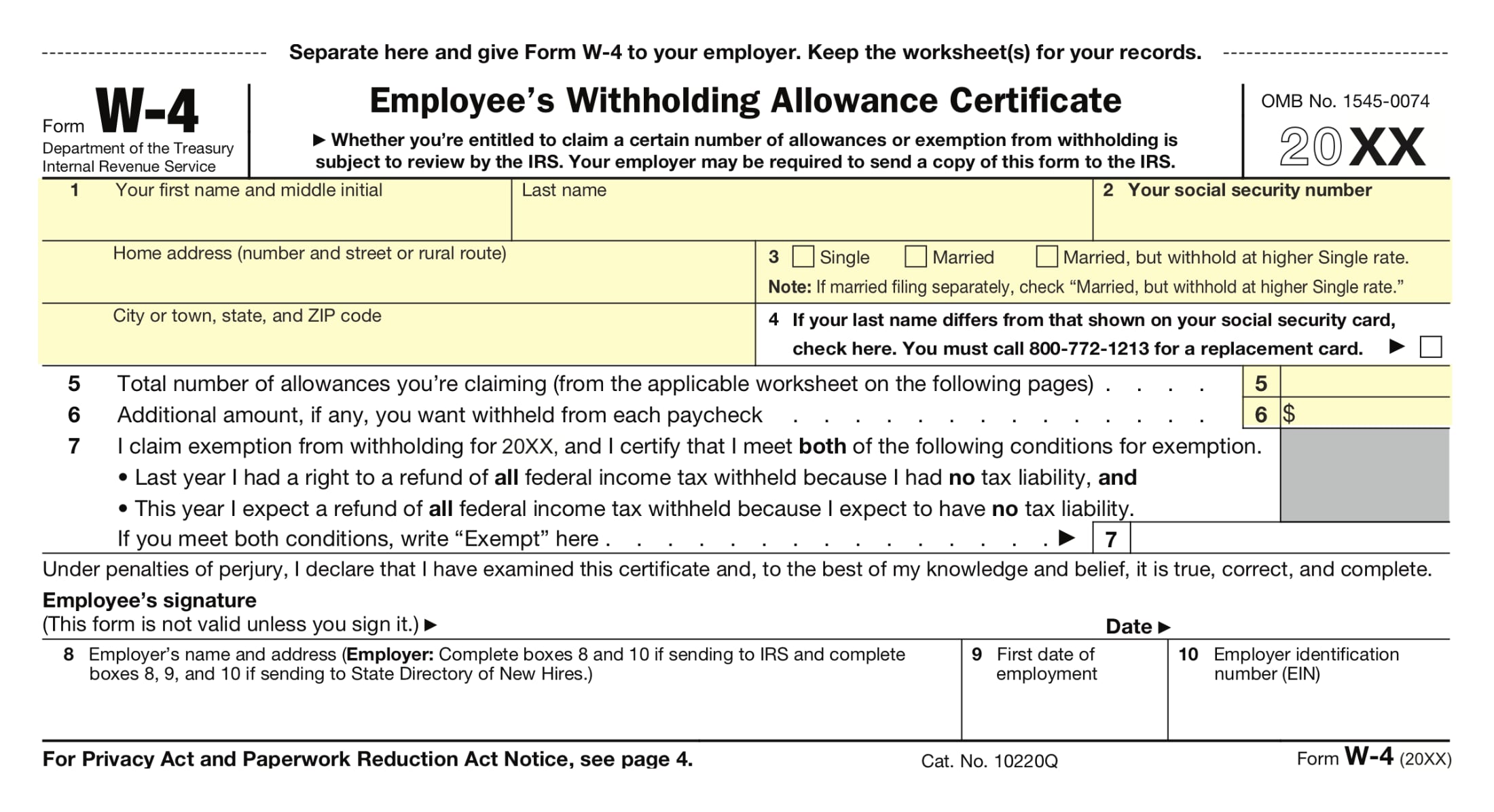

W4

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Il W 4 2020 2022 W4 Form

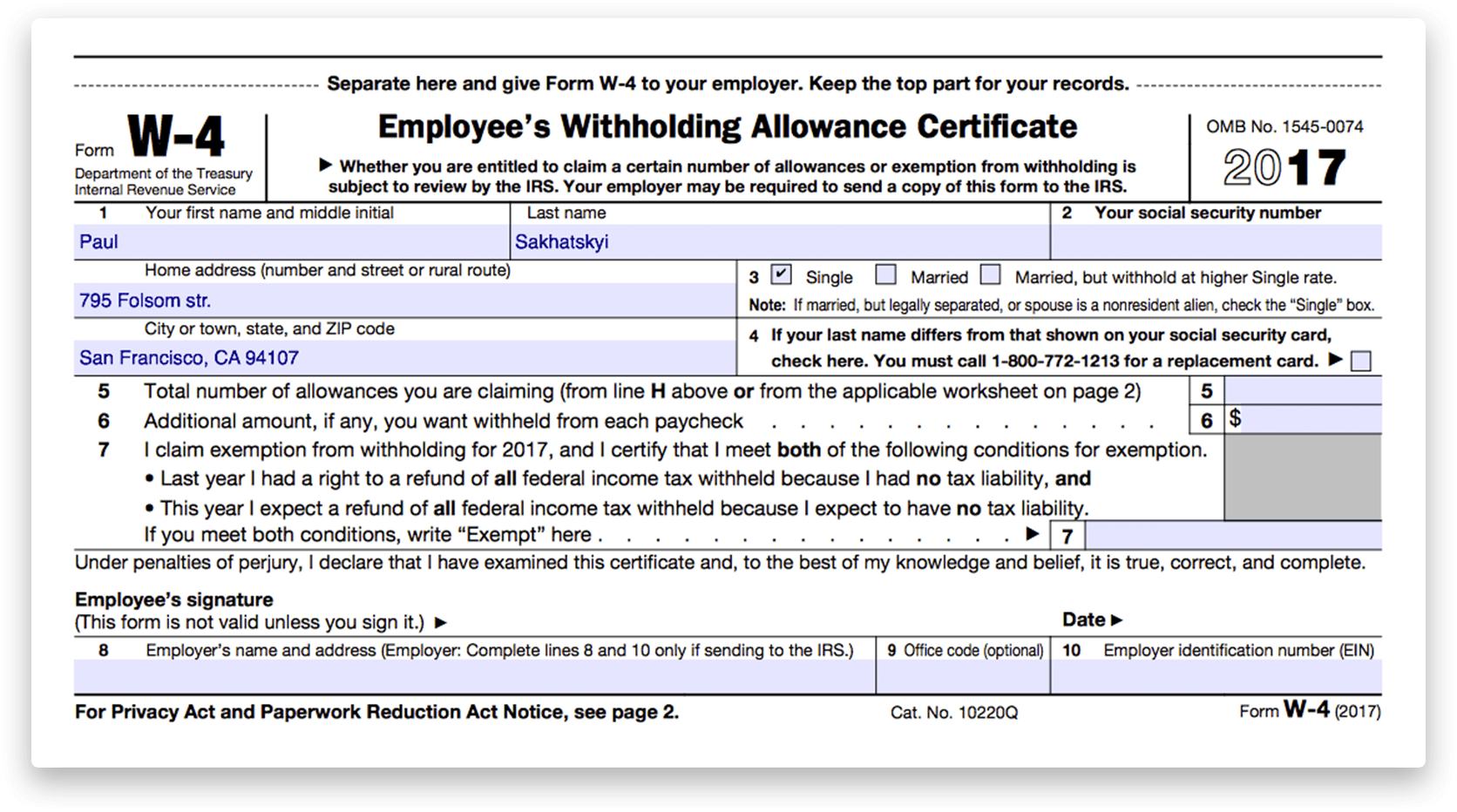

How to fill out 2018 IRS Form W4 PDF Expert

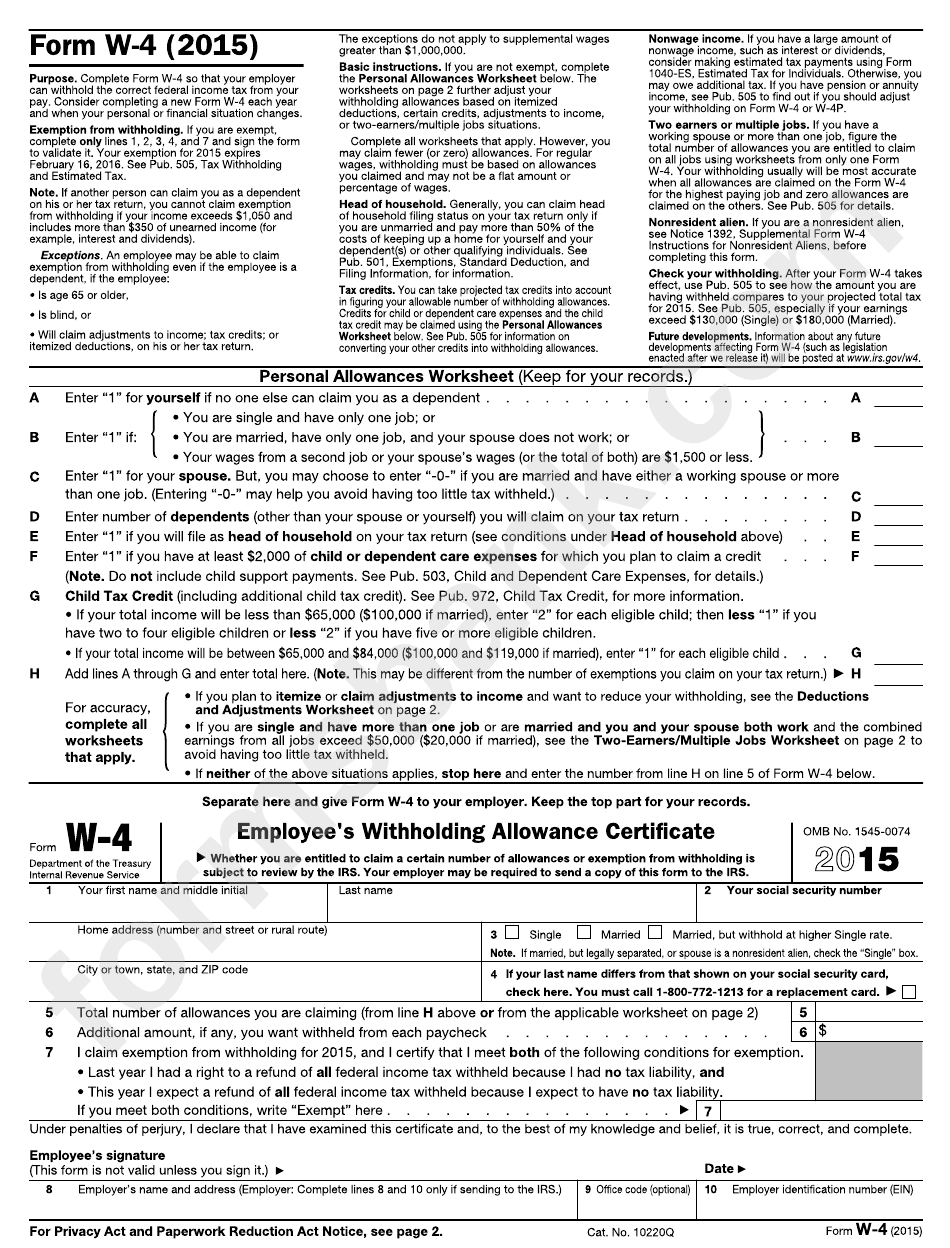

Form W4 Employee'S Withholding Allowance Certificate 2015

Printable W4 Form For Employees Free Printable Templates

Form W4 2020.pdf DocDroid

Amazon.com Has Been Visited By 1M+ Users In The Past Month

Web Updated August 05, 2023.

(Check Only One Box) 1.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

Related Post: