R&D Tax Credit Claim Template For Smes

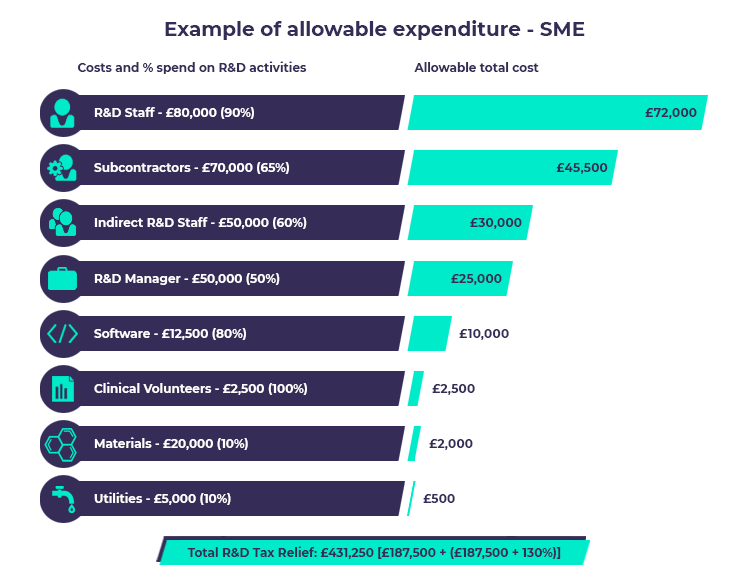

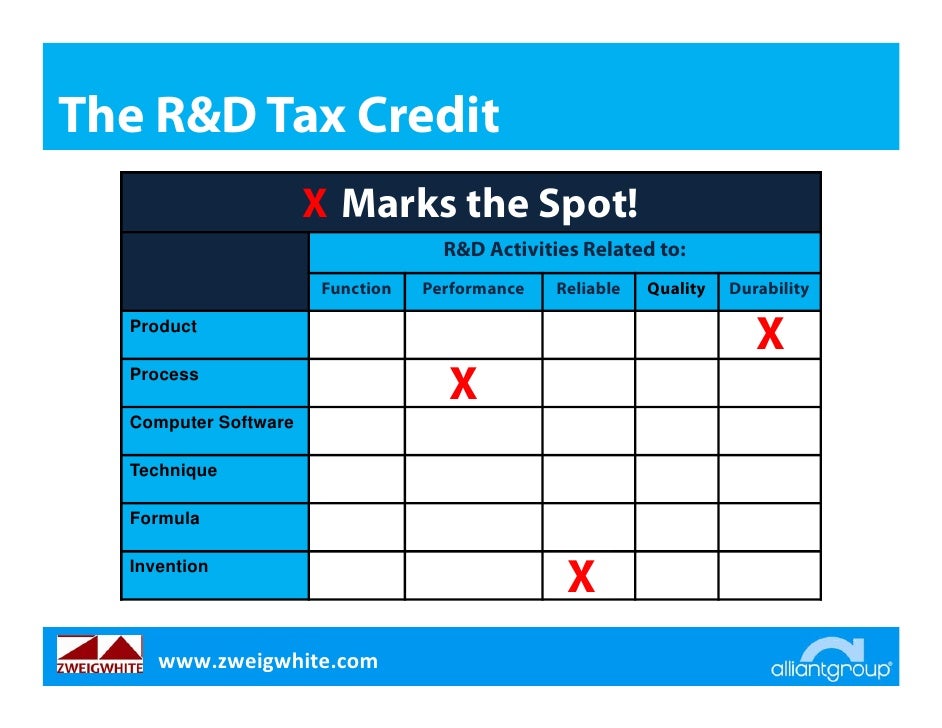

R&D Tax Credit Claim Template For Smes - Qualified research activities (qras) — sometimes called qualified research. There is no standard format for supplying your. Ad the r&d tax credit is a tax incentive that encourages businesses to invest in r&d. Web can i use an r&d tax credit claim template for smes? Web find out how to calculate r&d tax credit rates in our ultimate guide to r&d. Form 6765, credit for increasing research activities. Web identify qualifying r&d expenditure, on the basis of when it was incurred, between fy 2022 and fy2023 apply the relevant rate of relief (130% or 86%) to the qualifying expenditure. As part of the u.s. Web humanities social sciences, including economics r&d expenditure credit (rdec) expenditure credit is a tax credit and can be claimed if you’re either a: Tax code, the r&d tax. Web humanities social sciences, including economics r&d expenditure credit (rdec) expenditure credit is a tax credit and can be claimed if you’re either a: Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. There is no standard format for supplying. Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax credit. There is no standard format for supplying your. Tax code, the r&d tax. Crowe.com has been visited by 10k+ users in the past month Reduce your tax liability with r&d tax credit Crowe.com has been visited by 10k+ users in the past month Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. Less than 500 staff a turnover of under 100 million euros or a balance sheet total under. Web can i. Gusto.com has been visited by 10k+ users in the past month There is no standard format for supplying your. Web can i use an r&d tax credit claim template for smes? Ad free shipping on qualified orders. Web 5 may 2023 — see all updates contents r&d tax relief guidance tell hmrc before you make a claim submit detailed information. Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax credit. Less than 500 staff a turnover of under 100 million. Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax credit. Web sme r&d tax credit: There is no standard format for supplying your. Qualified research activities (qras) — sometimes called qualified research. Web you can claim sme r&d tax relief if you’re a sme with both of the following: Web your research and development (r&d) tax credit claim is filed via your corporation tax return (ct600). Web sme r&d tax credit: Qualified research activities (qras) — sometimes called qualified research. Web humanities social sciences, including economics r&d expenditure credit (rdec) expenditure credit is a tax credit and can be claimed if you’re either a: Web 5 may 2023 —. There are some circumstances, however,. Ad the r&d tax credit is a tax incentive that encourages businesses to invest in r&d. Form 6765, credit for increasing research activities. Web the r&d tax claim needs to be submitted with your annual corporate tax filing. There are two broad categoriesof activities that a business can claim towards the r&d tax credit: Reduce your tax liability with r&d tax credit Web sme r&d tax credit: Web deduct an extra 86% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total of 186% deduction. Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax. Web your research and development (r&d) tax credit claim is filed via your corporation tax return (ct600). Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Less than 500 staff a turnover of under 100 million euros or a balance sheet total under. Web identify qualifying r&d expenditure, on the basis of when it. Find deals and low prices on master tax guide 2021 at amazon.com Form 6765, credit for increasing research activities. Tax code, the r&d tax. Ad the r&d tax credit is a tax incentive that encourages businesses to invest in r&d. The sme scheme gives relief by way of an additional. Web types of r&d schemes. Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Qualified research activities (qras) — sometimes called qualified research. There are some circumstances, however,. There are two broad categoriesof activities that a business can claim towards the r&d tax credit: Web sme r&d tax credit: Web find out how to calculate r&d tax credit rates in our ultimate guide to r&d. As part of the u.s. Less than 500 staff a turnover of under 100 million euros or a balance sheet total under. Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. There is no standard format for supplying your. Crowe.com has been visited by 10k+ users in the past month Web can i use an r&d tax credit claim template for smes? Reduce your tax liability with r&d tax credit Gusto.com has been visited by 10k+ users in the past month Web sme r&d tax credit: There are two broad categoriesof activities that a business can claim towards the r&d tax credit: Web for expenditure incurred up to and including 31 july 2008 smes can deduct 150% in respect of their qualifying r&d expenditure and the payable tax credit can. Ad free shipping on qualified orders. Qualified research activities (qras) — sometimes called qualified research. Web deduct an extra 86% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total of 186% deduction. Form 6765, credit for increasing research activities. Reduce your tax liability with r&d tax credit Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax credit. Here are all the necessities: Tax code, the r&d tax. Web humanities social sciences, including economics r&d expenditure credit (rdec) expenditure credit is a tax credit and can be claimed if you’re either a: Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. Web identify qualifying r&d expenditure, on the basis of when it was incurred, between fy 2022 and fy2023 apply the relevant rate of relief (130% or 86%) to the qualifying expenditure. Free, easy returns on millions of items. There are some circumstances, however,.Ohio R&d Tax Credit Form Form Resume Examples K75P0KE5l2

Ach Credit Authorization Form Form Resume Examples qQ5M8VXDXg

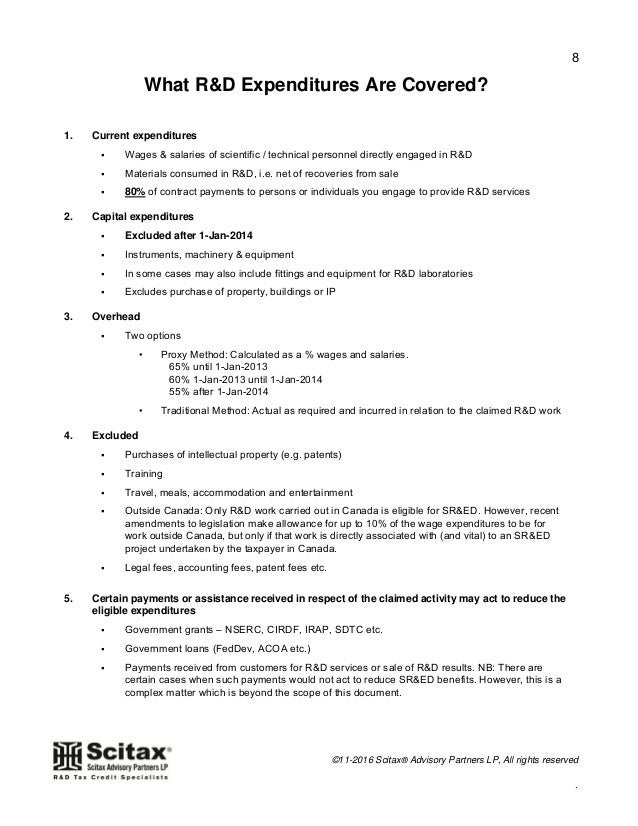

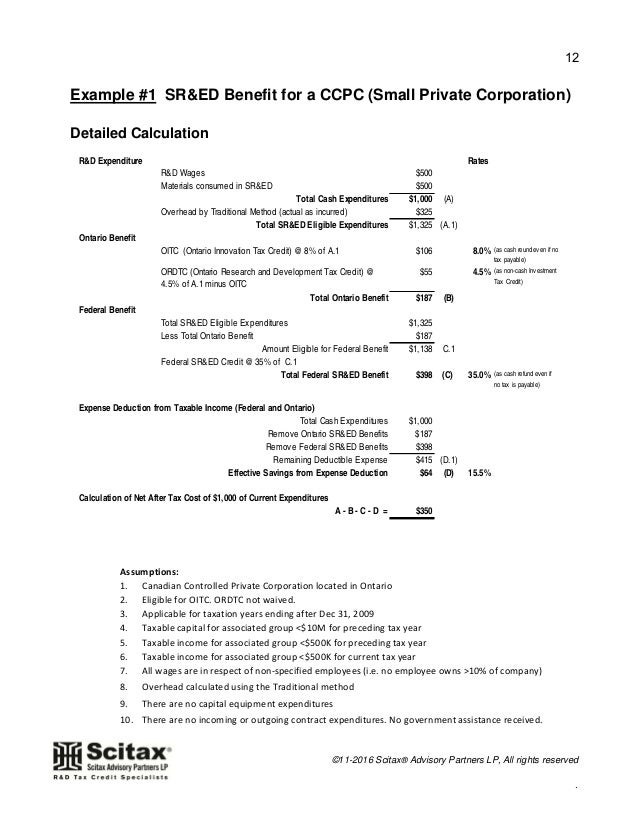

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

R&D Tax Credits The Essential Guide (2020)

R&D Tax Credit Expense Privacy

R&D Tax CreditsR & D Tax CreditsClaim what you deserve

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

R&D Tax Credit Rates For SME Scheme ForrestBrown

Navigating the R&D Tax Credit

Gusto.com Has Been Visited By 10K+ Users In The Past Month

Ad The R&D Tax Credit Is A Tax Incentive That Encourages Businesses To Invest In R&D.

Less Than 500 Staff A Turnover Of Under 100 Million Euros Or A Balance Sheet Total Under.

Web Find Out How To Calculate R&D Tax Credit Rates In Our Ultimate Guide To R&D.

Related Post: