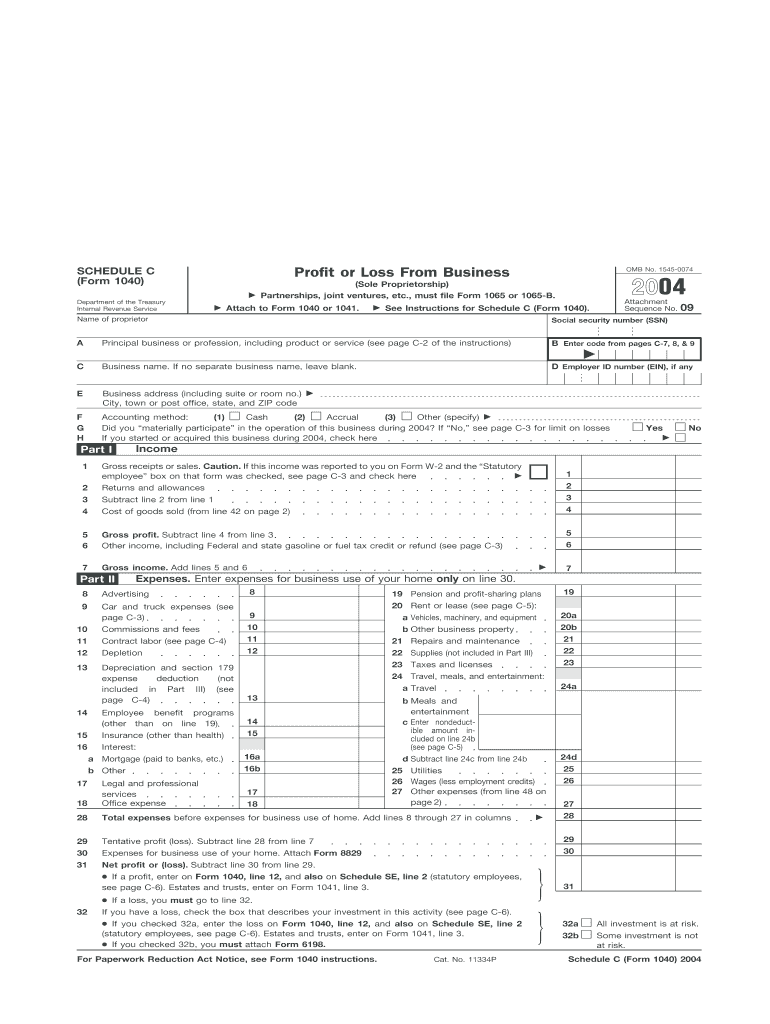

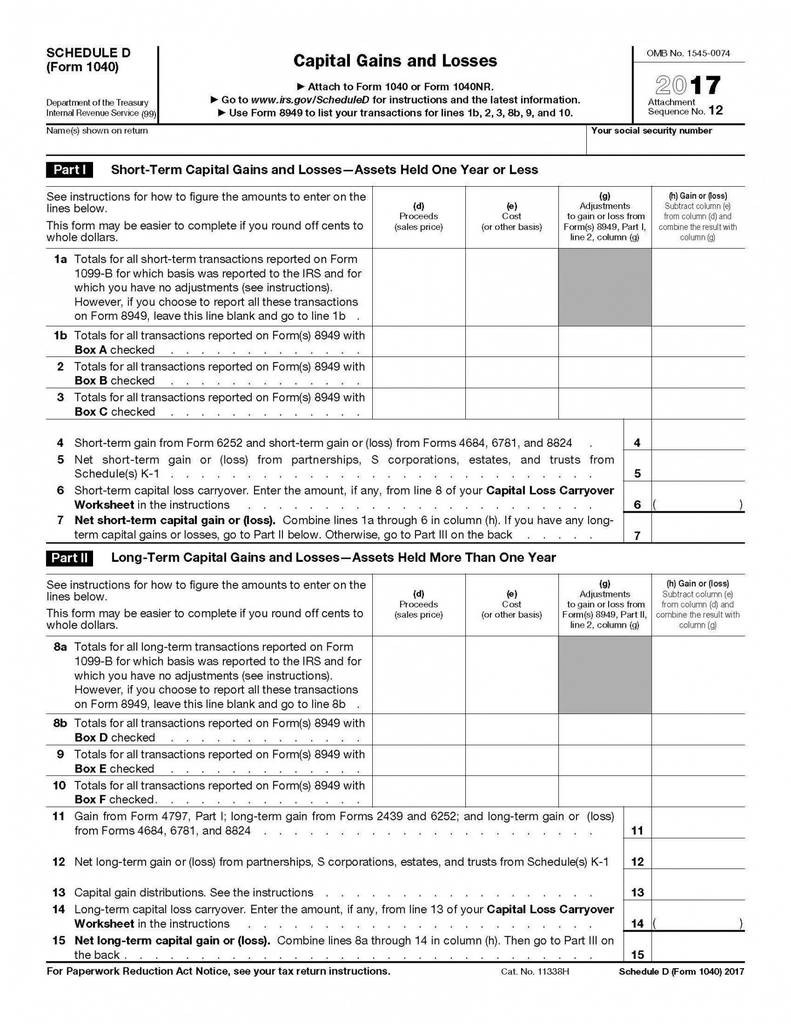

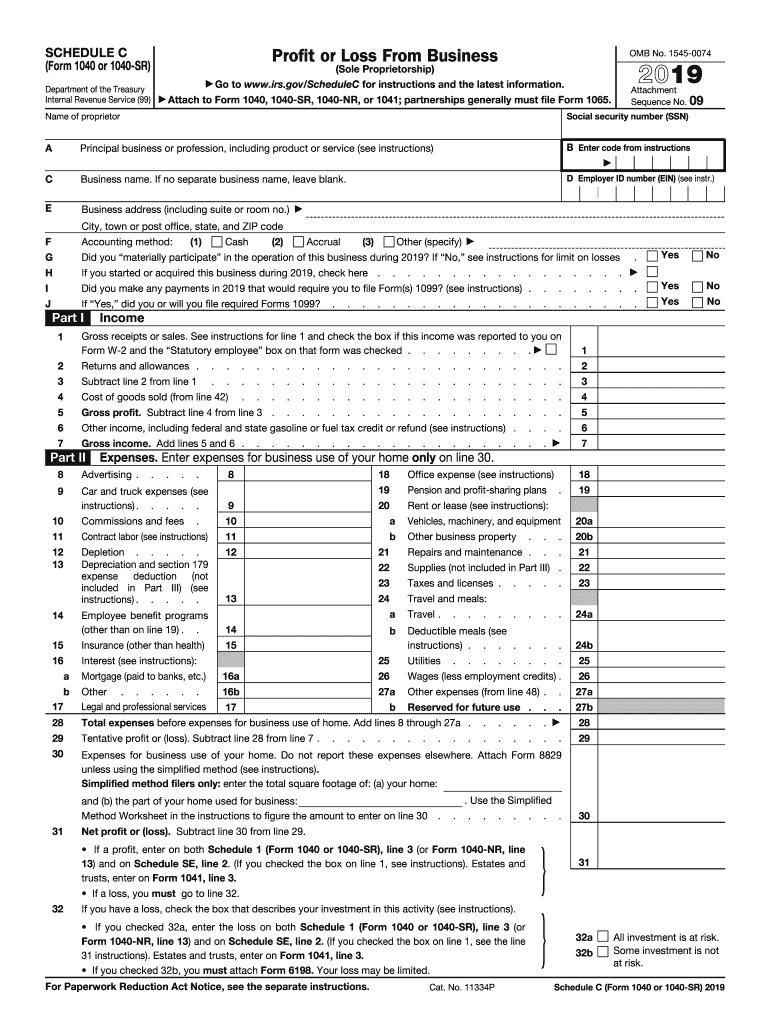

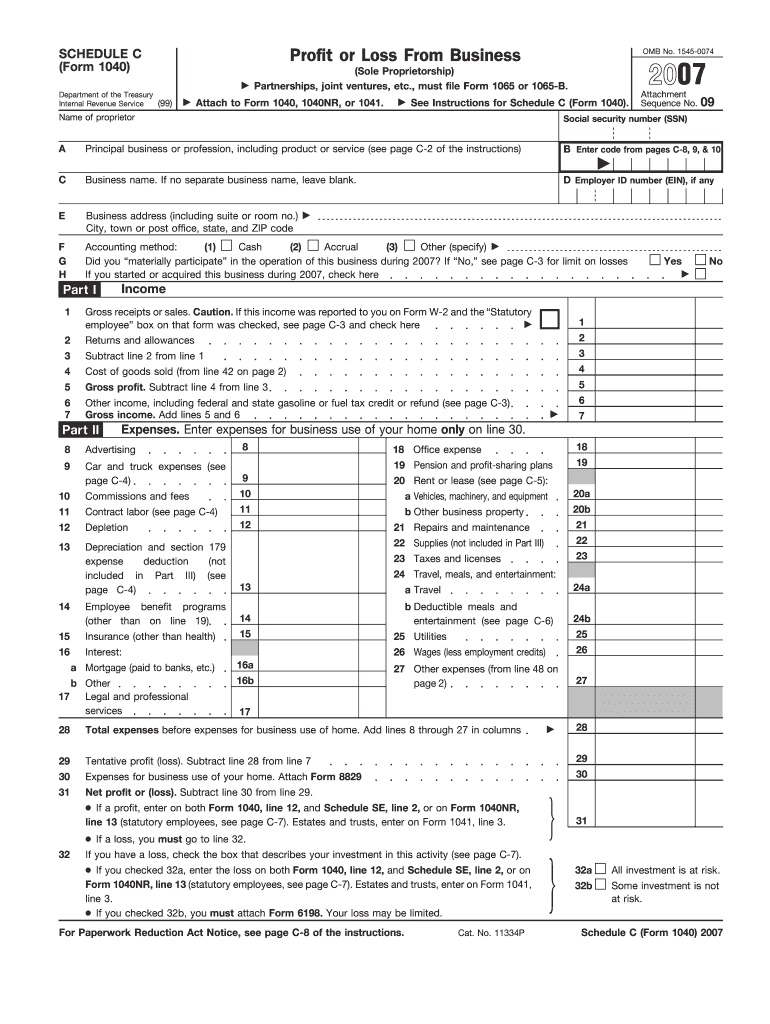

Schedule C Tax Form Printable

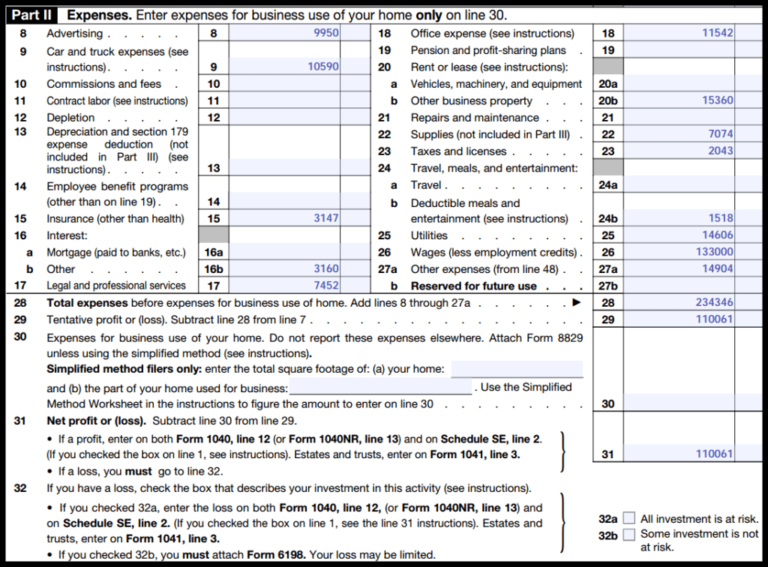

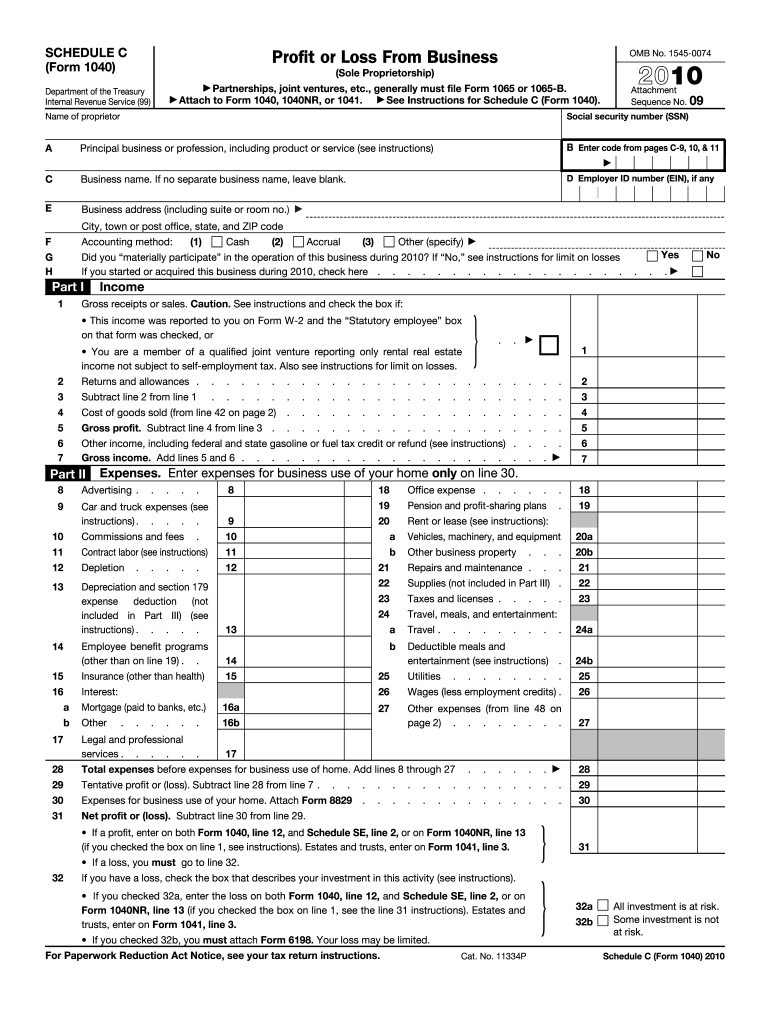

Schedule C Tax Form Printable - Web 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule c and its separate instructions is at. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web february 22, 2023. Start completing the fillable fields. Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business. Download or email schedule c & more fillable forms, register and subscribe now! And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. It’s part of your individual tax return. Do you need forms and/or other printed materials in large. The resulting profit or loss. Select the document you want to sign and click upload. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. More about the federal 1040 (schedule c) we last. Ad access irs tax forms. It’s part of your individual tax return. Web printable federal income tax schedule c. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business. Do you need forms and/or other printed materials in large. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. The resulting. Web printable federal income tax schedule c. Complete, edit or print tax forms instantly. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web go to www.irs.gov/schedulec for instructions and the latest information. Web how much will i receive? Complete, edit or print tax forms instantly. Use get form or simply click on the template preview to open it in the editor. The resulting profit or loss. When the tax season began unexpectedly or you just forgot about it, it could probably cause problems for you. Download or email schedule c & more fillable forms, register and subscribe now! Partnerships generally must file form. Web printable federal income tax schedule c. Web how much will i receive? Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web schedule c (form 1040) department of the treasury internal revenue service (99). Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Web quick steps to complete and design schedule c tax form online: When the tax season began unexpectedly or you just forgot about it, it could probably cause problems for you. Download or. $520 for married couples who filed jointly with an. Web go to www.irs.gov/schedulec for instructions and the latest information. Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business. Start completing the fillable fields. When the tax season began unexpectedly or you just forgot about it,. More about the federal 1040 (schedule c) we last. Web follow the simple instructions below: Web printable federal income tax schedule c. Select the document you want to sign and click upload. Ad access irs tax forms. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Complete, edit or print tax forms instantly. Web february 22, 2023. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web schedule c (form 1040) department of. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for your home business.include the total allowable. Use get form or simply click on the template preview to open it in the editor. Get ready for tax season deadlines by completing any required tax forms today. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Select the document you want to sign and click upload. Complete, edit or print tax forms instantly. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Download or email schedule c & more fillable forms, register and subscribe now! Web printable federal income tax schedule c. Ad access irs tax forms. It’s part of your individual tax return. Web follow the simple instructions below: Web how much will i receive? Start completing the fillable fields. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web february 22, 2023. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web how much will i receive? Web february 22, 2023. When the tax season began unexpectedly or you just forgot about it, it could probably cause problems for you. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for your home business.include the total allowable. Ad access irs tax forms. Web 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule c and its separate instructions is at. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web follow the simple instructions below: Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. It’s part of your individual tax return. Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. The resulting profit or loss. $520 for married couples who filed jointly with an. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021.FREE 9+ Sample Schedule C Forms in PDF MS Word

Form 100S Schedule C Download Printable PDF or Fill Online S

2004 1040 Schedule C Form Fill Out and Sign Printable PDF Template

2016 Schedule C Tax Form Lovely Qualified Dividends And —

IRS 1040 Schedule C 2019 Fill and Sign Printable Template Online

Schedule c tax form fleetqust

Schedule C (Form 1040) Expense Cost Of Goods Sold

Schedule C Tax Form Fill Out and Sign Printable PDF Template signNow

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form

IRS 1040 Schedule C 2010 Fill and Sign Printable Template Online

Ad Access Irs Tax Forms.

Web Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service (99) Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For.

Do You Need Forms And/Or Other Printed Materials In Large.

Start Completing The Fillable Fields.

Related Post: