Snowball Bill Pay Template

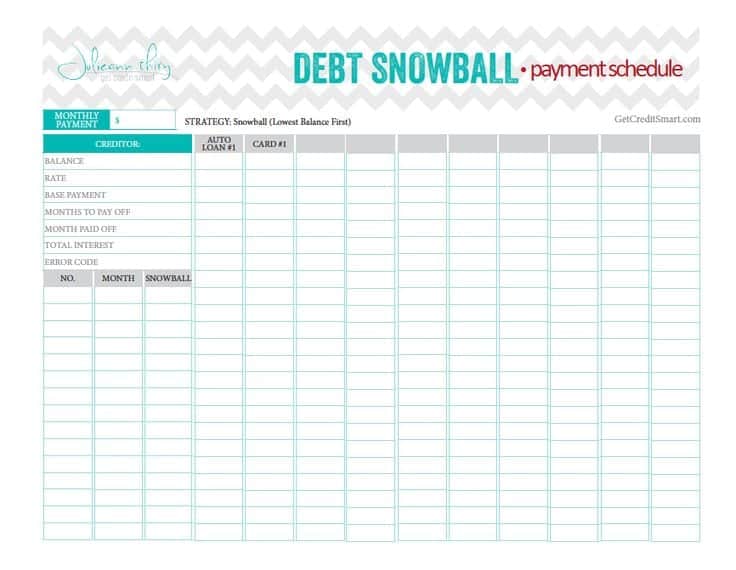

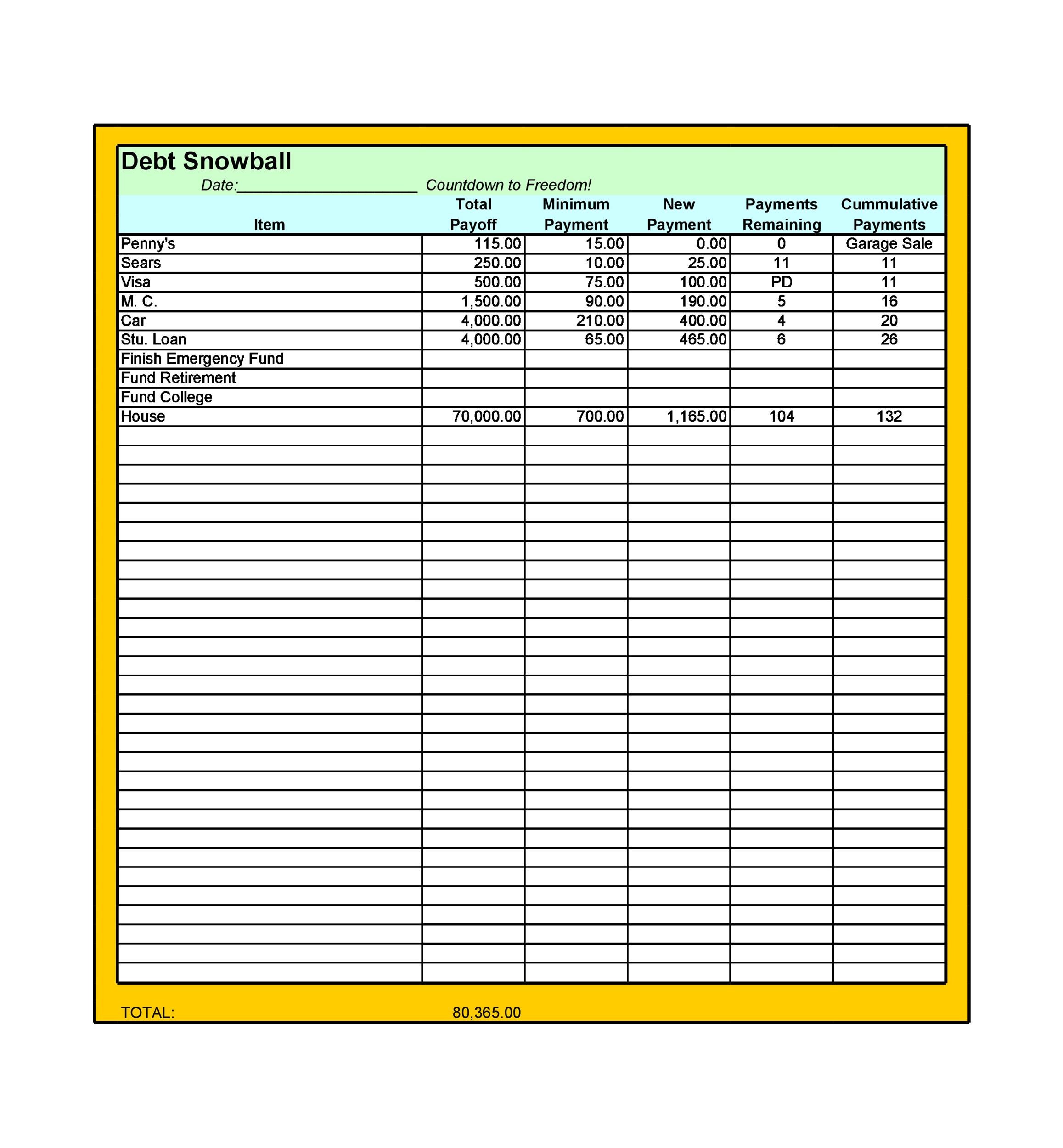

Snowball Bill Pay Template - The tiller community debt snowball spreadsheetallows you to calculate estimated payoff dates and track your progress toward debt freedom. Web here are some suggestions that can help get you started with the snowball method: So far, we’ve gone through the basics of the debt snowball excel spreadsheet,. Web simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. Find balance after 1st month of. One option on this list even. Web all you need to do is download and print the debt snowball tracker worksheets. Write each one of your debts down on this form in order from smallest to largest. Web in order to keep track of all your payments, in this method, you’ll use a debt snowball spreadsheet. Web the first free printable debt snowball worksheet is a tracking sheet. Calculate payment amount for 1st month of lowest debt step 2: List all of your debts smallest to largest, and use this sheet to mark them off one by one. Web what is the debt snowball method? Get your debt snowball rolling. Just like when you create an actual. The tiller community debt snowball spreadsheetallows you to calculate estimated payoff dates and track your progress toward debt freedom. Web how to use this debt snowball excel spreadsheet in excel and google docs. You can download a template here or make one on your. Here you will list all of your debts. So far, we’ve gone through the basics of. Create a spreadsheet or get a notepad and write down. Web with the debt snowball method, pay your smallest debts first. Find deals and low prices on debt snowball worksheet at amazon.com Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. List your debts from smallest to largest regardless of interest rate. Web free snowball debt spreadsheet templates. Web in order to keep track of all your payments, in this method, you’ll use a debt snowball spreadsheet. Use our free debt snowball calculator. Web here are some suggestions that can help get you started with the snowball method: Create a spreadsheet or get a notepad and write down. The tiller community debt snowball spreadsheetallows you to calculate estimated payoff dates and track your progress toward debt freedom. Get your debt snowball rolling. You can download a template here or make one on your. So far, we’ve gone through the basics of the debt snowball excel spreadsheet,. Web how to use this debt snowball excel spreadsheet in excel and. The debt snowball method is a way you can pay off your bills from smallest to largest. Here you will list all of your debts. Web all you need to do is download and print the debt snowball tracker worksheets. You will make this payment on all of your debts except for the smallest debt. Web the first free printable. Use our free debt snowball calculator. You can download a template here or make one on your. The tiller community debt snowball spreadsheetallows you to calculate estimated payoff dates and track your progress toward debt freedom. One option on this list even. Web the first free printable debt snowball worksheet is a tracking sheet. Use our free debt snowball calculator. Just like when you create an actual. Get your debt snowball rolling. Web what is the debt snowball method? Graphs will help you compare the two strategies side by side. Web the first free printable debt snowball worksheet is a tracking sheet. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Find deals and low prices on debt snowball worksheet at amazon.com Make minimum payments on all your debts except the smallest. Web all you. Calculate payment amount for 1st month of lowest debt step 2: Web what is the debt snowball method? The debt snowball method is a way you can pay off your bills from smallest to largest. Create a spreadsheet or get a notepad and write down. Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Web how to use this debt snowball excel spreadsheet in excel and google docs. One option on this list even. This keeps you rewarded as you pay off multiple debts. Web what is the debt snowball method? So far, we’ve gone through the basics of the debt snowball excel spreadsheet,. Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Use our free debt snowball calculator. Web find gifs with the latest and newest hashtags! Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web 12 steps to create snowball payment calculator in excel step 1: You will make this payment on all of your debts except for the smallest debt. Search, discover and share your favorite snowball gifs. Web with the debt snowball method, pay your smallest debts first. The debt snowball method is a way you can pay off your bills from smallest to largest. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Web all you need to do is download and print the debt snowball tracker worksheets. Graphs will help you compare the two strategies side by side. Make a list of debts. Web simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. You can use this sheet to switch back and forth between the avalanche and debt snowball methods. Write each one of your debts down on this form in order from smallest to largest. Web in order to keep track of all your payments, in this method, you’ll use a debt snowball spreadsheet. You can even create a. Web here are some suggestions that can help get you started with the snowball method: List your debts from smallest to largest regardless of interest rate. Web free snowball debt spreadsheet templates. Web all you need to do is download and print the debt snowball tracker worksheets. Find deals and low prices on debt snowball worksheet at amazon.com Web find gifs with the latest and newest hashtags! This keeps you rewarded as you pay off multiple debts. Calculate payment amount for 1st month of lowest debt step 2: You will make this payment on all of your debts except for the smallest debt. Find balance after 1st month of. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Create a spreadsheet or get a notepad and write down. Get your debt snowball rolling.Debt Snowball Printable room

Free Debt Snowball Printable Worksheet Track Your Debt Payoff

9+ Debt Snowball Excel Templates Excel Templates

Printable Debt Snowball Tracker Printable World Holiday

Free Printable Debt Snowball Worksheet Pay Down Your Debt! Debt

Snowball Bill Pay Template

Snowball Debt Payoff Spreadsheet ExcelTemplate

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy

38 Debt Snowball Spreadsheets, Forms & Calculators

5 Debt Snowball Excel Templates Excel xlts

Here You Will List All Of Your Debts.

Use Our Free Debt Snowball Calculator.

The First Page In The Kit Is The Debt Snowball Payments Page.

You Can Use This Sheet To Switch Back And Forth Between The Avalanche And Debt Snowball Methods.

Related Post: