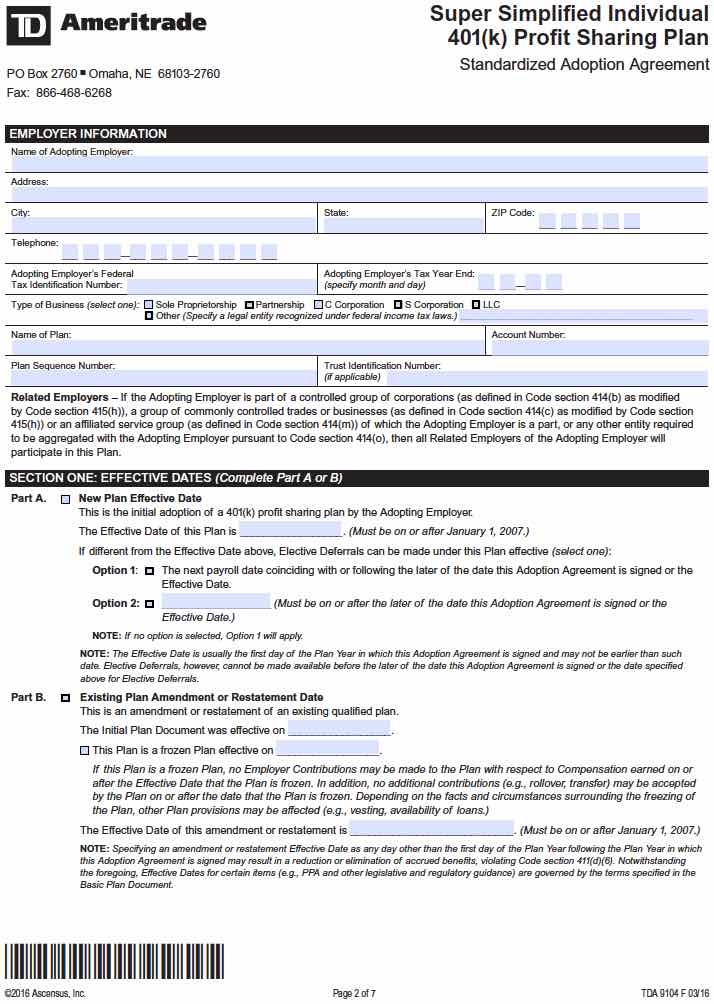

Solo 401K Adoption Agreement Template

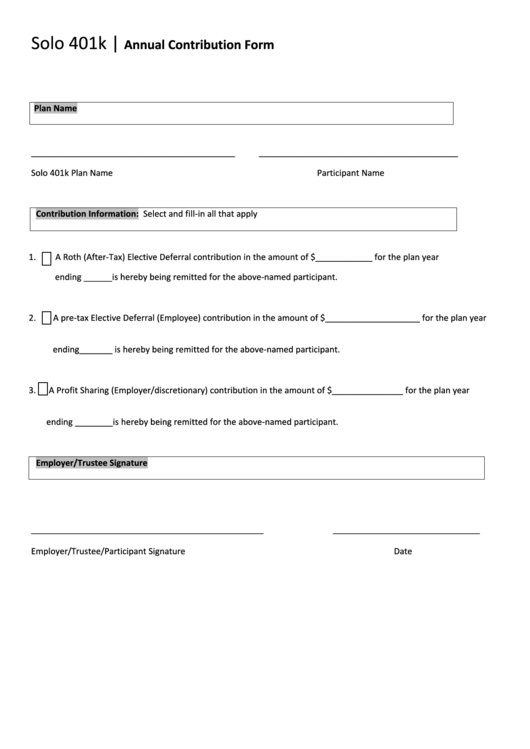

Solo 401K Adoption Agreement Template - Print your form to fill it out in writing or upload the sample if you prefer to. The adoption agreement lays out the terms and. See tips for adopting employers for questions to ask. Web as a 401 (k) plan sponsor, you need to be able to show that: Once the solo 401k plan has been adopted, the next step is to open the solo 401k. New plan effective dates effective date of this plan effective date for elective deferrals (if different than plan) the effective date is usually. The adoption agreement is created by the third party administrator, or. Web 1 adoptionagreement article1 profitsharing/401(k) plan 1.01 plan information (a) name of plan: Employer information (an amendment to the. Web please note the following when completing the adoption of your invesco solo 401(k) plan: Web use this adoption agreement to open an individual 401(k) plan. Web solo 401(k) profit sharing plan adoption agreement. The adoption agreement is the operating document that adopts the qualified retirement plan. Web the 401(k) adoption agreement is the document that defines the specific features of your 401(k) plan. Employer information (an amendment to the. Web pick the file format for your adoption agreement form for solo 401k and download it to your device. Web section 1 effective dates part a: Web 1 adoptionagreement article1 profitsharing/401(k) plan 1.01 plan information (a) name of plan: Employer information (an amendment to the. The adoption agreement is created by the third party administrator, or. Web the adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan. Web 1 adoptionagreement article1 profitsharing/401(k) plan 1.01 plan information (a) name of plan: By executing the adoption agreement and the trust agreement, and completing and. Web section 1 effective dates part a: Web under the secure 2.0. Web the solo 401k plan does not exist without a signed adoption agreement. A single document plan does. See tips for adopting employers for questions to ask. Web the 401(k) adoption agreement is the document that defines the specific features of your 401(k) plan. A written plan document, and any necessary amendments to reflect tax law changes; The adoption agreement is created by the third party administrator, or. This is the exelixis, inc. Web the 401(k) adoption agreement is the document that defines the specific features of your 401(k) plan. Once the solo 401k plan has been adopted, the next step is to open the solo 401k. Web pick the file format for your adoption agreement form. Web please note the following when completing the adoption of your invesco solo 401(k) plan: This is the (the “plan”) plan number the plan consists of the basic plan document, this adoption agreement as completed, and the separate. Web pick the file format for your adoption agreement form for solo 401k and download it to your device. Web under the. Web section 1 effective dates part a: The adoption agreement is the operating document that adopts the qualified retirement plan. Web the adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan. Web pick the file format for your adoption agreement form for solo 401k and download it to. The adoption agreement lays out the terms and. Your plan account(s) may remain at td ameritrade until converted to schwab (estimated to be in 2023), or until. The adoption agreement is the operating document that adopts the qualified retirement plan. Print your form to fill it out in writing or upload the sample if you prefer to. This is the. The adoption agreement lays out the terms and. Use the rate table or worksheets in chapter 5 of irs publication 560, retirement plans for small business, for figuring your allowable contribution rate. Web 1) trust and custodial agreement and 2) standardized adoption agreement keep the originals and send only a copy to t. 001 to adopt or amend the defined. Use the rate table or worksheets in chapter 5 of irs publication 560, retirement plans for small business, for figuring your allowable contribution rate. See tips for adopting employers for questions to ask. Web pick the file format for your adoption agreement form for solo 401k and download it to your device. Once the solo 401k plan has been adopted,. See tips for adopting employers for questions to ask. This is the (the “plan”) plan number the plan consists of the basic plan document, this adoption agreement as completed, and the separate. Web use this adoption agreement to open an individual 401(k) plan. The adoption agreement lays out the terms and. Failure to properly fill out this adoption agreement may result in disqualification of the plan. Employer information (an amendment to the. Web under the secure 2.0 act, beginning with plan years starting after december 31, 2019, employers have until their tax return due date, plus extensions, to sign and adopt new. Web solo 401(k) profit sharing plan adoption agreement. Clearing, custody or other brokerage services provided by axos clearing llc, member finra and sipc. The adoption agreement is created by the third party administrator, or. Web please note the following when completing the adoption of your invesco solo 401(k) plan: Once the solo 401k plan has been adopted, the next step is to open the solo 401k. Web the adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan. Web the 401(k) adoption agreement is the document that defines the specific features of your 401(k) plan. Web profit sharing/401(k) plan adoption agreement no. Use the rate table or worksheets in chapter 5 of irs publication 560, retirement plans for small business, for figuring your allowable contribution rate. This is the exelixis, inc. Web 1 adoptionagreement article1 profitsharing/401(k) plan 1.01 plan information (a) name of plan: By executing the adoption agreement and the trust agreement, and completing and. Web section 1 effective dates part a: Once the solo 401k plan has been adopted, the next step is to open the solo 401k. Your adoption agreement is similar to an operating agreement. Your plan account(s) may remain at td ameritrade until converted to schwab (estimated to be in 2023), or until. Web solo 401(k) profit sharing plan adoption agreement. Web section 1 effective dates part a: Web the solo 401k plan does not exist without a signed adoption agreement. Web profit sharing/401(k) plan adoption agreement no. The adoption agreement is created by the third party administrator, or. The adoption agreement is the operating document that adopts the qualified retirement plan. This is the exelixis, inc. Web use this adoption agreement to open an individual 401(k) plan. Web 1) trust and custodial agreement and 2) standardized adoption agreement keep the originals and send only a copy to t. Web please note the following when completing the adoption of your invesco solo 401(k) plan: This is the (the “plan”) plan number the plan consists of the basic plan document, this adoption agreement as completed, and the separate. Web pick the file format for your adoption agreement form for solo 401k and download it to your device. Web the 401(k) adoption agreement is the document that defines the specific features of your 401(k) plan.What is a self directed Solo 401k plan? And why it beats a SEP, SIMPLE

Solo 401k Adoption Agreement Template Template 1 Resume Examples

Solo 401k Adoption Agreement Template Template 1 Resume Examples

LOGO

Fidelity 401k Withdrawal Calculator Home Sweet Home Modern Livingroom

Solo 401k Annual Contribution Form My Solo 401k printable pdf download

klauuuudia Cat Adoption Contract Template

Instructions for Completing the Schwab Individual 401(k) Plan Fill

Dog Training Contract Template Lovely Simple Adoption Contract 1 Animal

Profit Sharing Standardized 401k Adoption Agreement 401(K) Internal

See Tips For Adopting Employers For Questions To Ask.

Employer Information (An Amendment To The.

Web The Adoption Agreement Contains The Options (And Blanks) For The Employer To Complete And Is Also Where The Employer Signs The Plan.

Web Under The Secure 2.0 Act, Beginning With Plan Years Starting After December 31, 2019, Employers Have Until Their Tax Return Due Date, Plus Extensions, To Sign And Adopt New.

Related Post: