Trust Accounting Template California

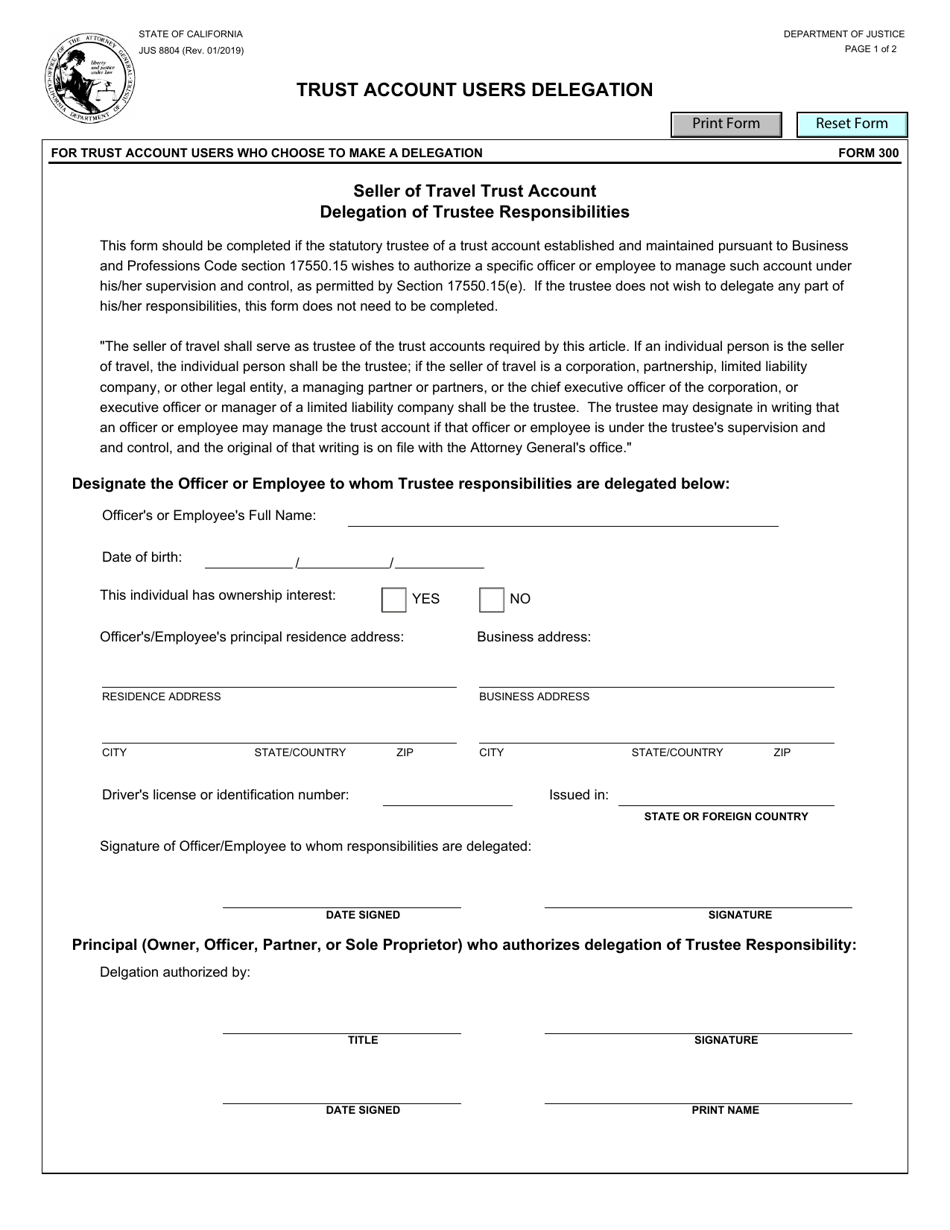

Trust Accounting Template California - New rule of court 9.8.5: Lawdepot.com has been visited by 100k+ users in the past month Web trust accounting forms. Insight into the rules and best practices to keep you compliant. Gross income is over $10,000; The routing number is listed first, then the account number, then the. Ad manage all your business expenses in one place with quickbooks®. Web if the trustee fails to produce an accounting within the required time frame (and an accounting hasn’t been provided in the last 6 months) california probate code. Judicial council of california subject: Income is distributed to a california resident beneficiary; The following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers. Income is distributed to a california resident beneficiary; These provisions relate to a lawyer's responsibilities in receiving, maintaining, and accounting for the funds of a client or a third party, including fees for legal services. Track everything in one place.. Ad manage all your business expenses in one place with quickbooks®. Odoo.com has been visited by 100k+ users in the past month Web california trust accounting requirements. Web sample trust account review (tar) reports. Web trust accounting forms. Below is a sample of a very basic accounting for a special needs trust. Gain a complete understanding of the state bar of california trust rules. Although every accounting is customized and unique, this will give you an idea of. Web in california, a trustee is required to account to the beneficiaries as to the activities of the trust unless. Below is a sample of a very basic accounting for a special needs trust. Ad manage all your business expenses in one place with quickbooks®. To maintain the account of a group of trustee, the trust account form is there which carries each detail of the account, including total. A trustee’s duties include keeping beneficiaries reasonably informed of the trust. The 2023 edition includes rules that became operative on january 1, 2023 and ctapp information. Web the trust has income from a california source; Gross income is over $10,000; Insight into the rules and best practices to keep you compliant. Web when providing a trust accounting, a trustee must include a legal notice. An accounting of a trust includes vital information about all of the trust’s financial transactions, liabilities, assets, and. Below is a sample of a very basic accounting for a special needs trust. Client trust account reporting requirements 2. Gross income is over $10,000; Web when providing a trust accounting, a trustee must include a legal notice. A trustee’s duties include keeping beneficiaries reasonably informed of the trust and its. Gross income is over $10,000; The formal requirements for a trust accounting can be. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting. Web the trust has income from a california source; Gross income is over $10,000; Rule of professional conduct 1.15: Ad manage all your business expenses in one place with quickbooks®. To maintain the account of a group of trustee, the trust account form is there which carries each detail of the account, including total. Web if the trustee fails to produce an accounting within the required time frame (and. What that accounting is and when it is required is. A trustee’s duties include keeping beneficiaries reasonably informed of the trust and its. Web download the handbook on client trust accounting for california attorneys. Track everything in one place. Web california trust accounting requirements. Ad manage all your business expenses in one place with quickbooks®. An accounting of a trust includes vital information about all of the trust’s financial transactions, liabilities, assets, and. Web what is a trust accounting objection? The objection can be based on a number of claims,. Web sample trust account review (tar) reports. Web if the trustee fails to produce an accounting within the required time frame (and an accounting hasn’t been provided in the last 6 months) california probate code. Ad manage all your business expenses in one place with quickbooks®. The objection can be based on a number of claims,. Track everything in one place. The routing number is listed first, then the account number, then the. Rule of professional conduct 1.15: Web download the handbook on client trust accounting for california attorneys. Web fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better fiduciary accounting. Web trust accounting forms. Web what is a trust accounting objection? Every trust beneficiary has the right to object to a trustee’s accounting. Web california trust accounting requirements. Web in california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. These provisions relate to a lawyer's responsibilities in receiving, maintaining, and accounting for the funds of a client or a third party, including fees for legal services. Insight into the rules and best practices to keep you compliant. Odoo.com has been visited by 100k+ users in the past month Lawdepot.com has been visited by 100k+ users in the past month What that accounting is and when it is required is. Client trust account reporting requirements 2. The 2023 edition includes rules that became operative on january 1, 2023 and ctapp information. A trustee’s duties include keeping beneficiaries reasonably informed of the trust and its. Every trust beneficiary has the right to object to a trustee’s accounting. Web 901 dove st., ste 120, newport beach, ca 92660 phone: The following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers. Although every accounting is customized and unique, this will give you an idea of. New rule of court 9.8.5: Web the trust has income from a california source; An accounting of a trust includes vital information about all of the trust’s financial transactions, liabilities, assets, and. Track everything in one place. The handbook is currently only available online. Web if the trustee fails to produce an accounting within the required time frame (and an accounting hasn’t been provided in the last 6 months) california probate code. Rule of professional conduct 1.15: Income is distributed to a california resident beneficiary; The routing number is listed first, then the account number, then the. The 2023 edition includes rules that became operative on january 1, 2023 and ctapp information. Gain a complete understanding of the state bar of california trust rules.California Testamentary Trust Form Universal Network

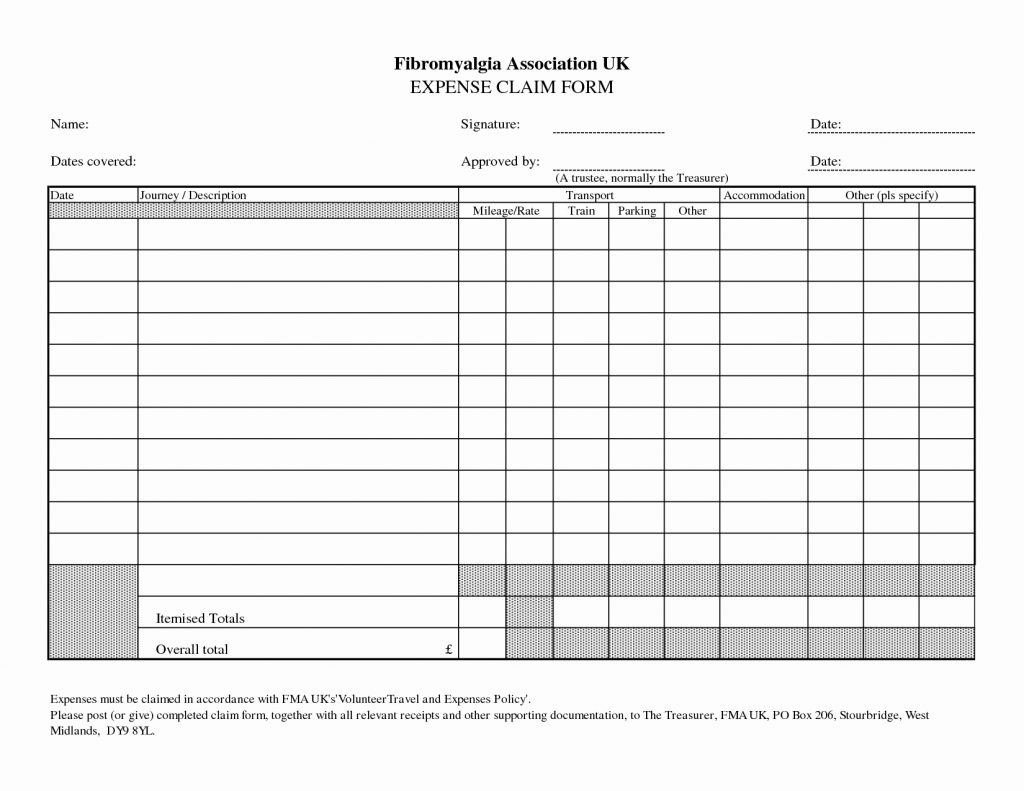

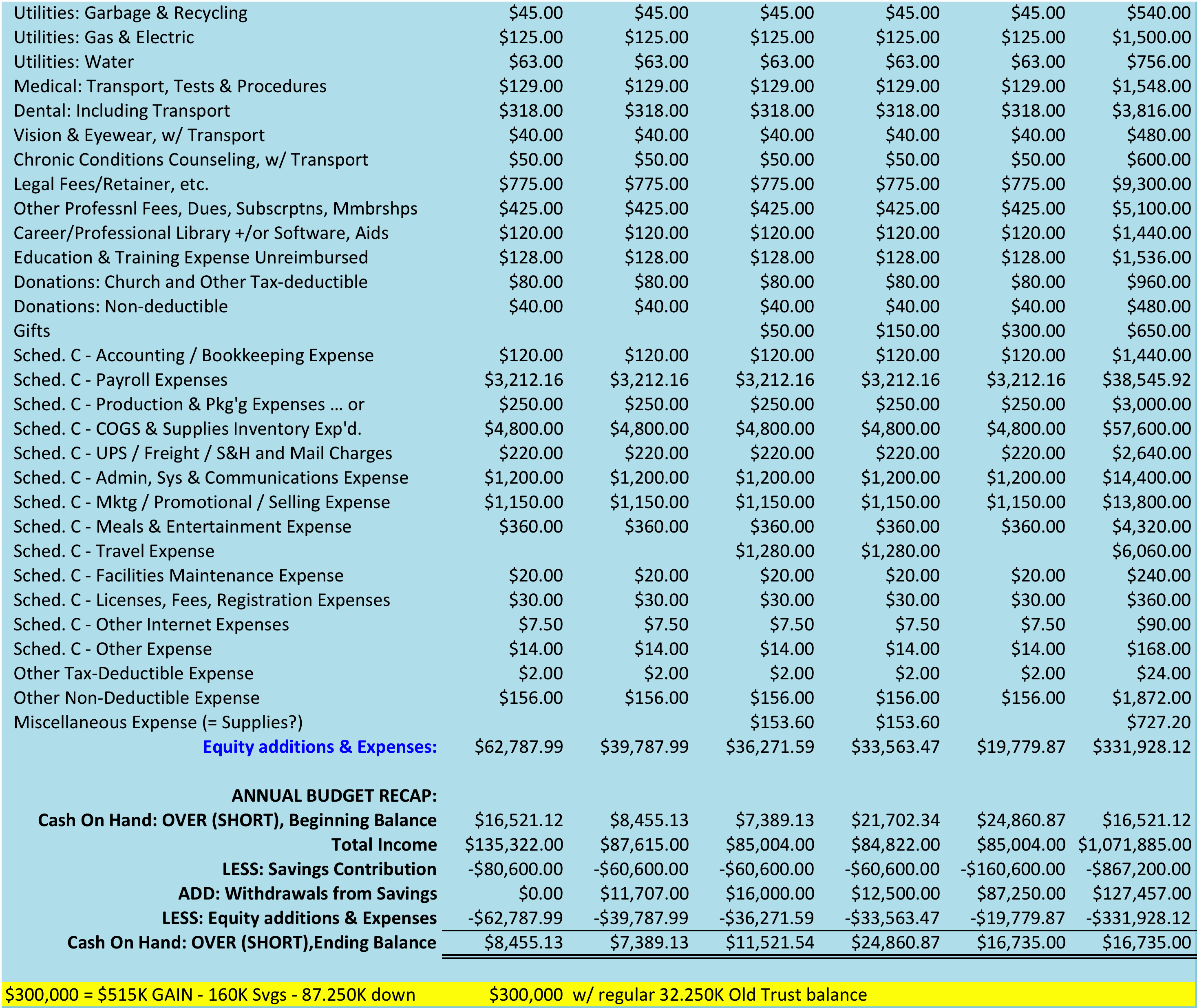

Trust Accounting Spreadsheet Google Spreadshee trust accounting

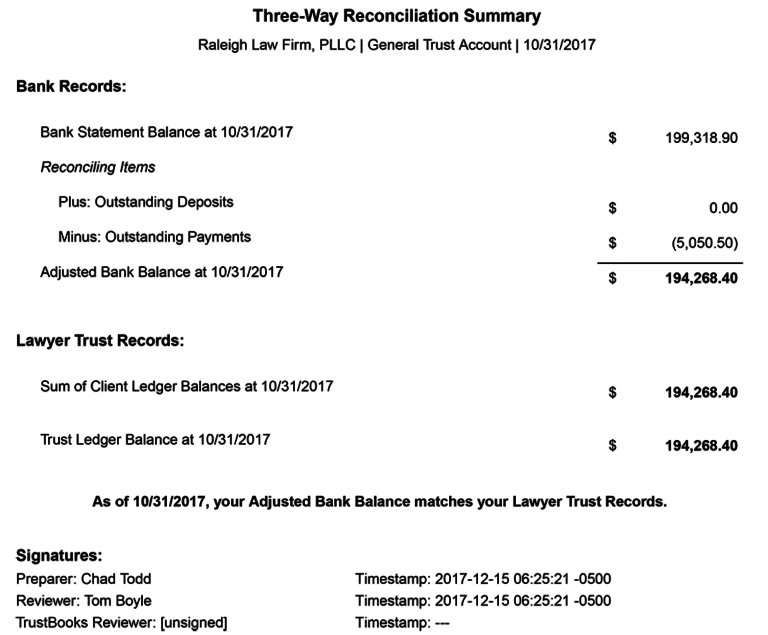

California Trust Accounting Software TrustBooks

Form 300 (JUS8804) Download Fillable PDF or Fill Online Trust Account

Petition To Remove Trustee California Pdf Fill Online, Printable

Acceptance Of Successor Trustee Form California 2020 Fill and Sign

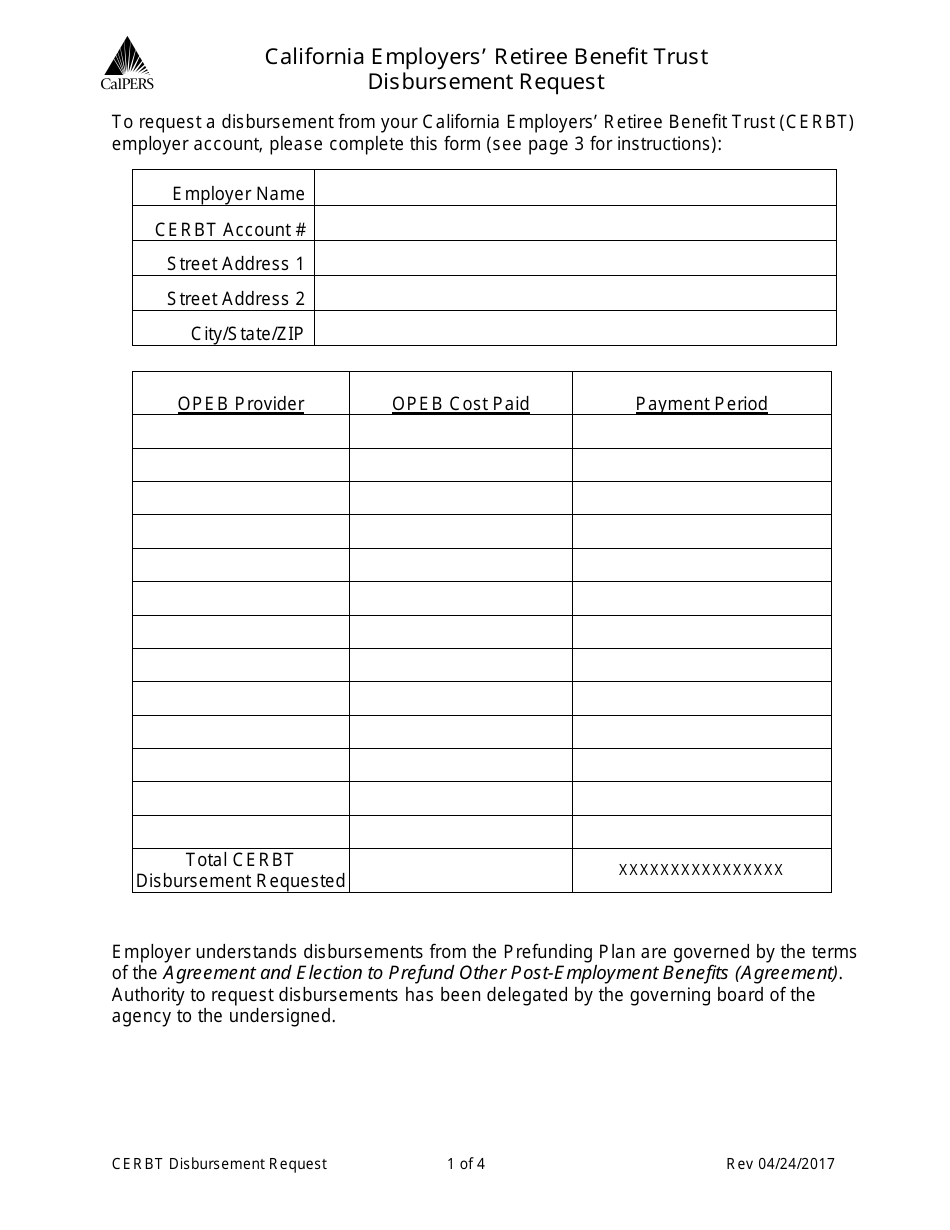

California California Employers' Retiree Benefit Trust Disbursement

Wonderful Trust Accounts Format In Excel Balance Sheet Template Xls

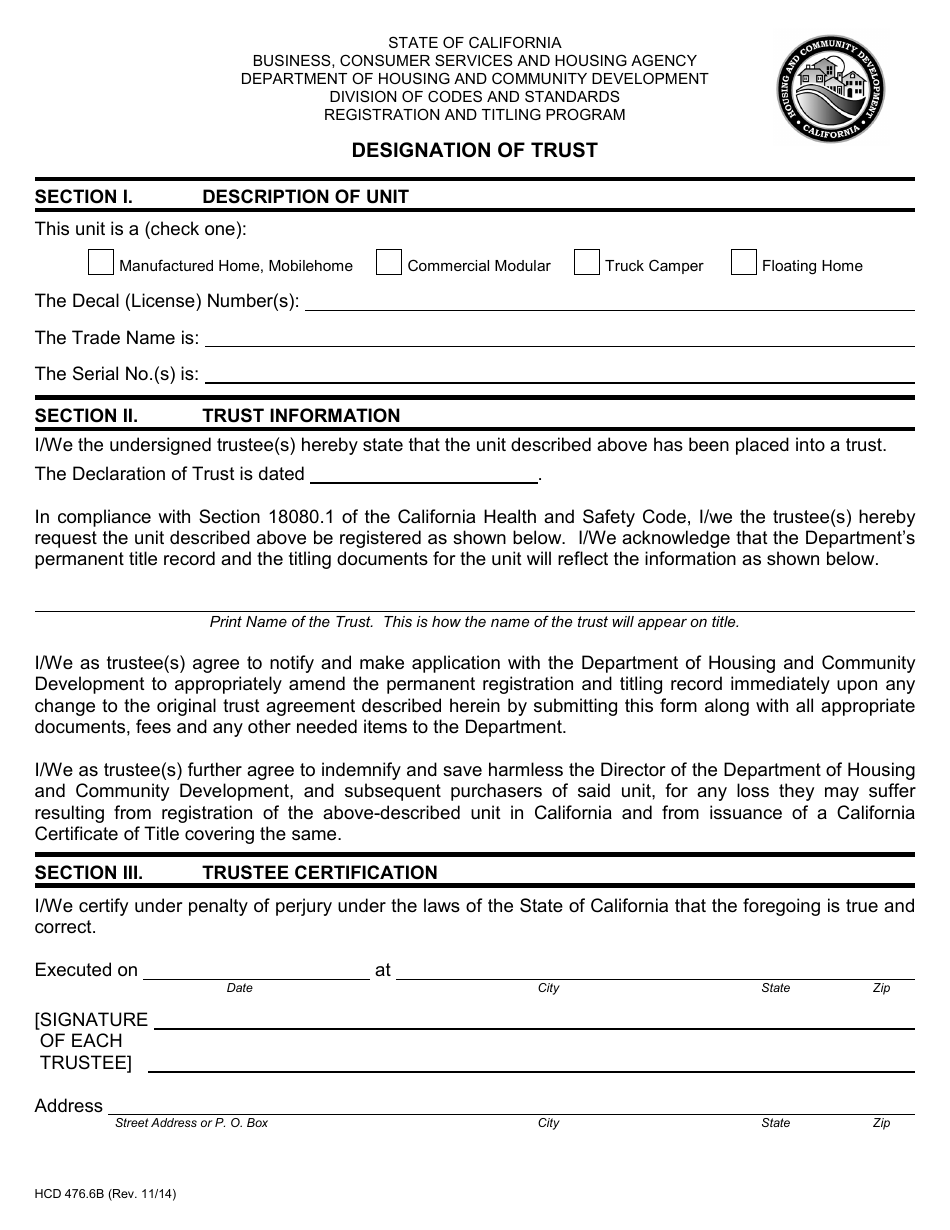

Form HCD476.6B Download Printable PDF or Fill Online Designation of

Trust Accounting Spreadsheet Google Spreadshee trust accounting excel

The Formal Requirements For A Trust Accounting Can Be.

Web California Trust Accounting Requirements.

Gross Income Is Over $10,000;

Ad Manage All Your Business Expenses In One Place With Quickbooks®.

Related Post: