Valuation Model Excel Template

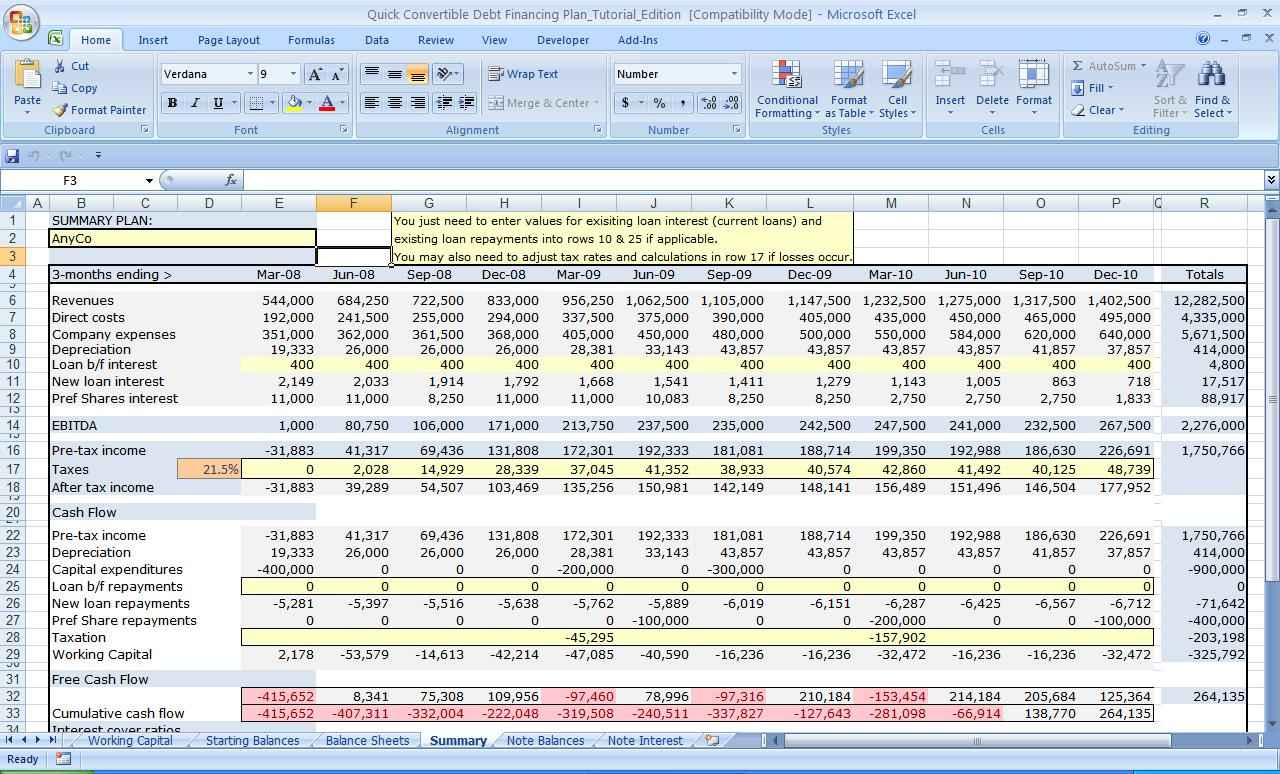

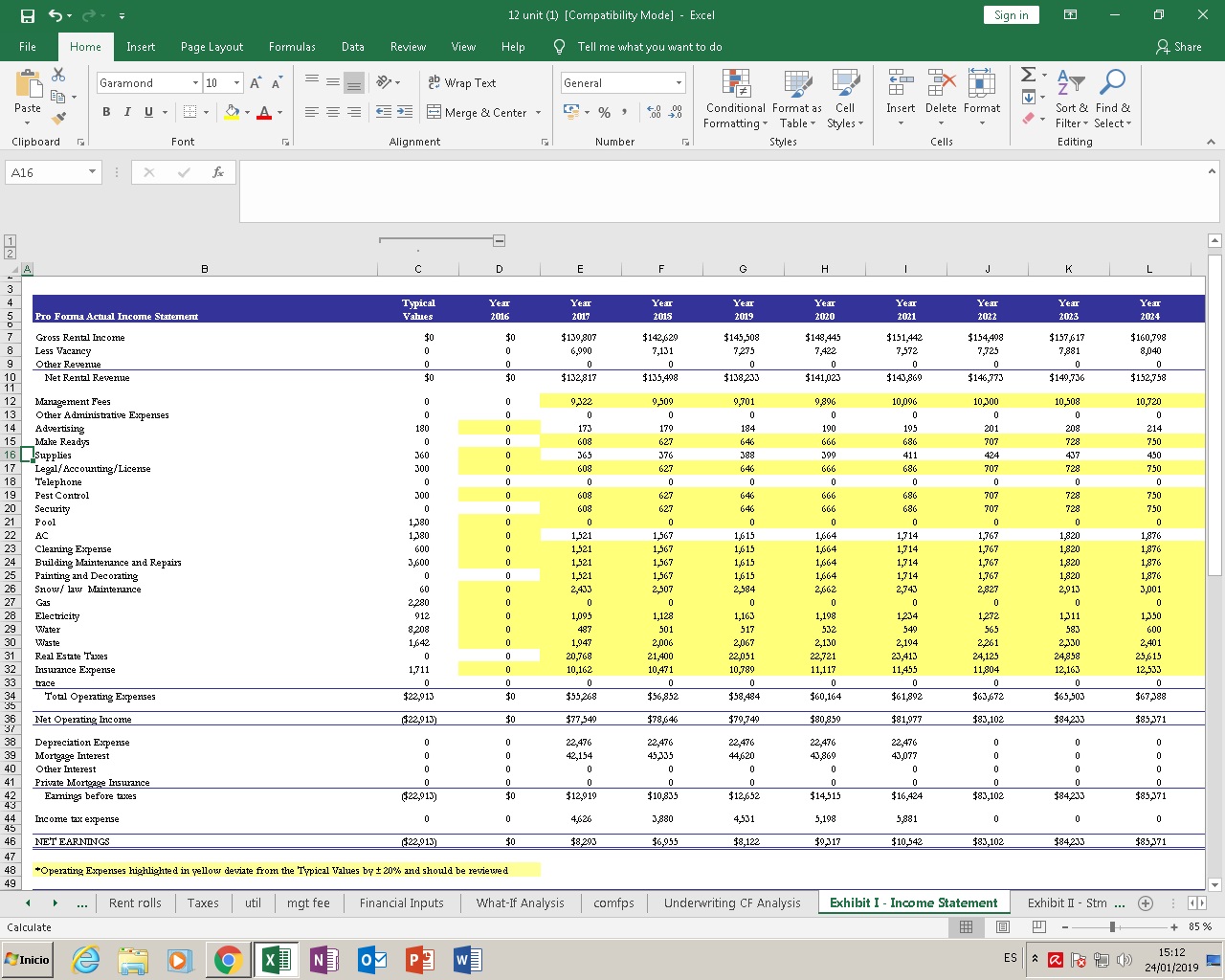

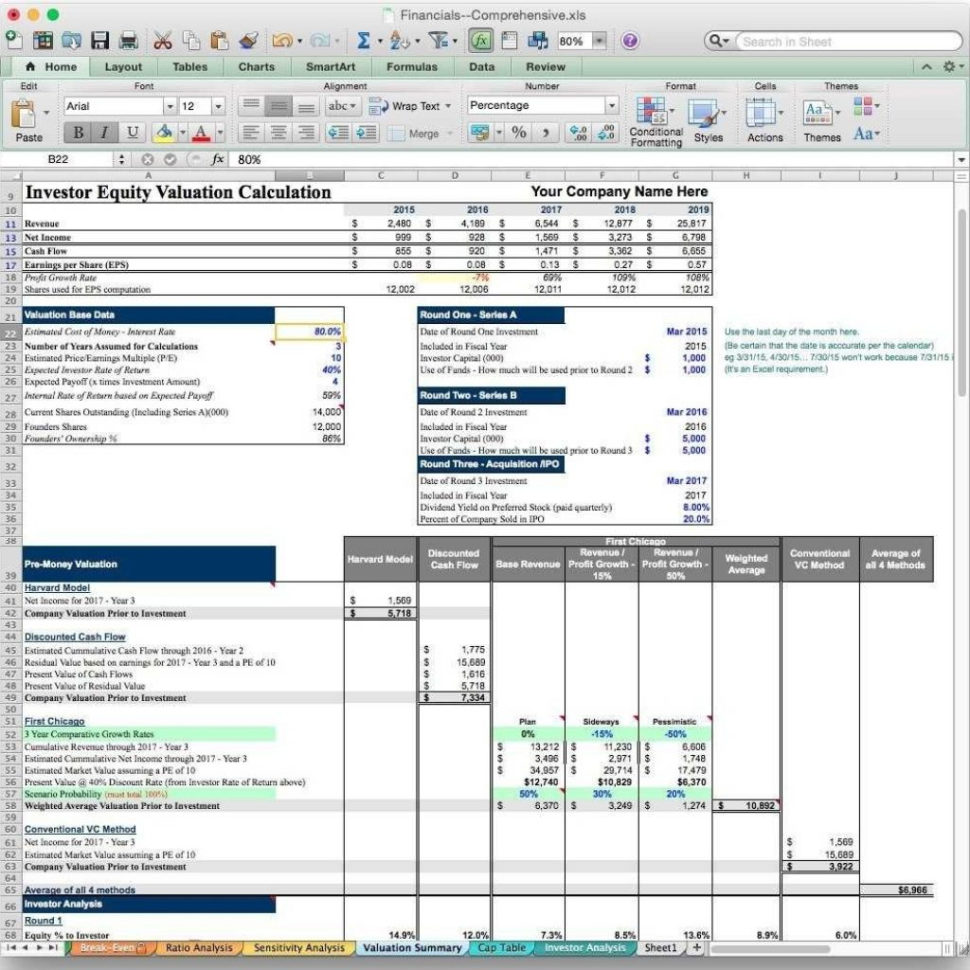

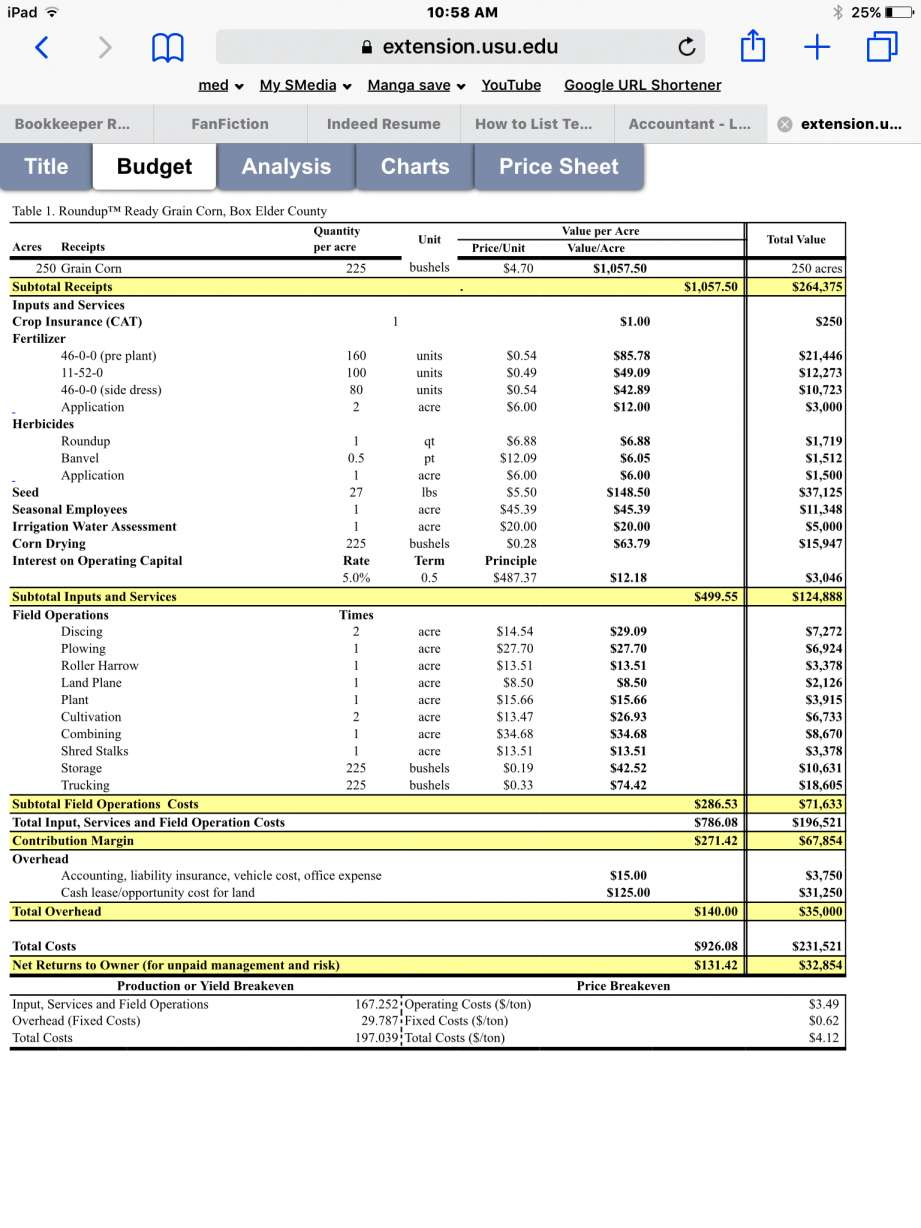

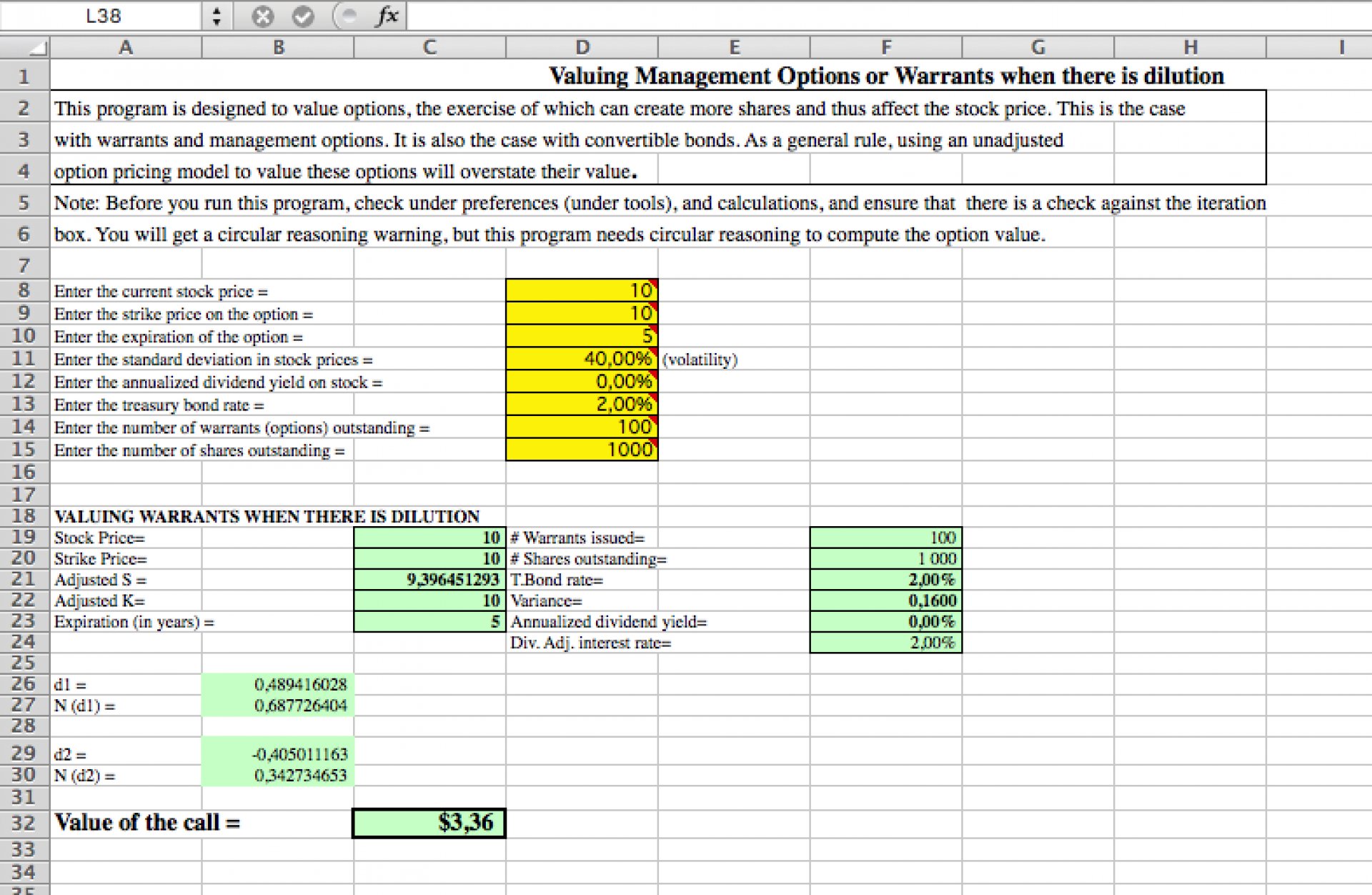

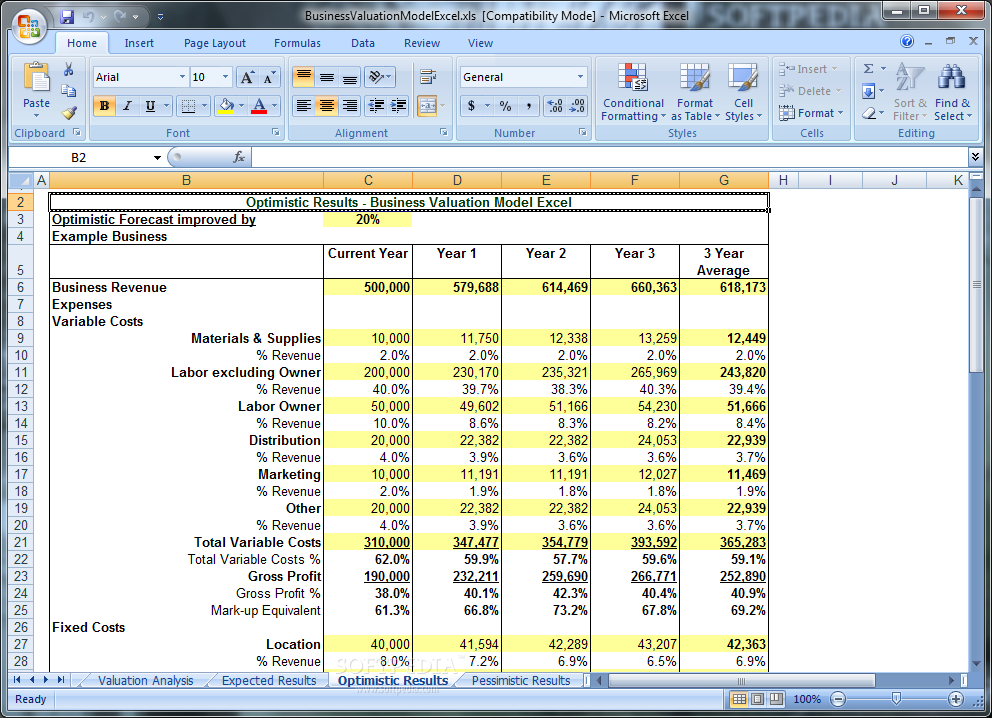

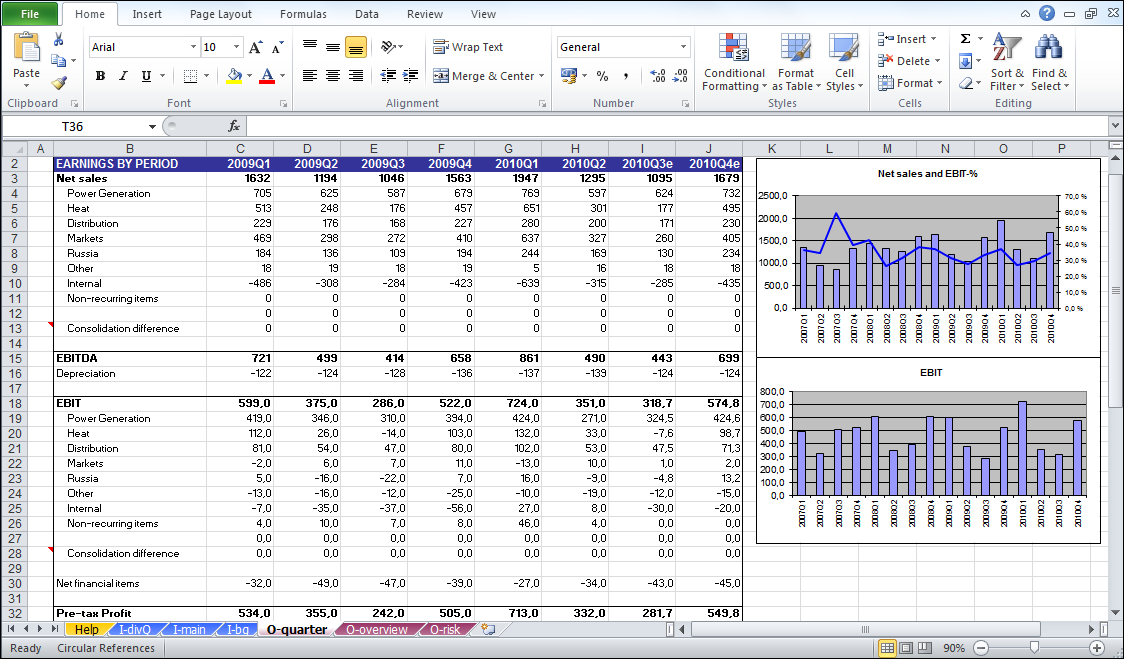

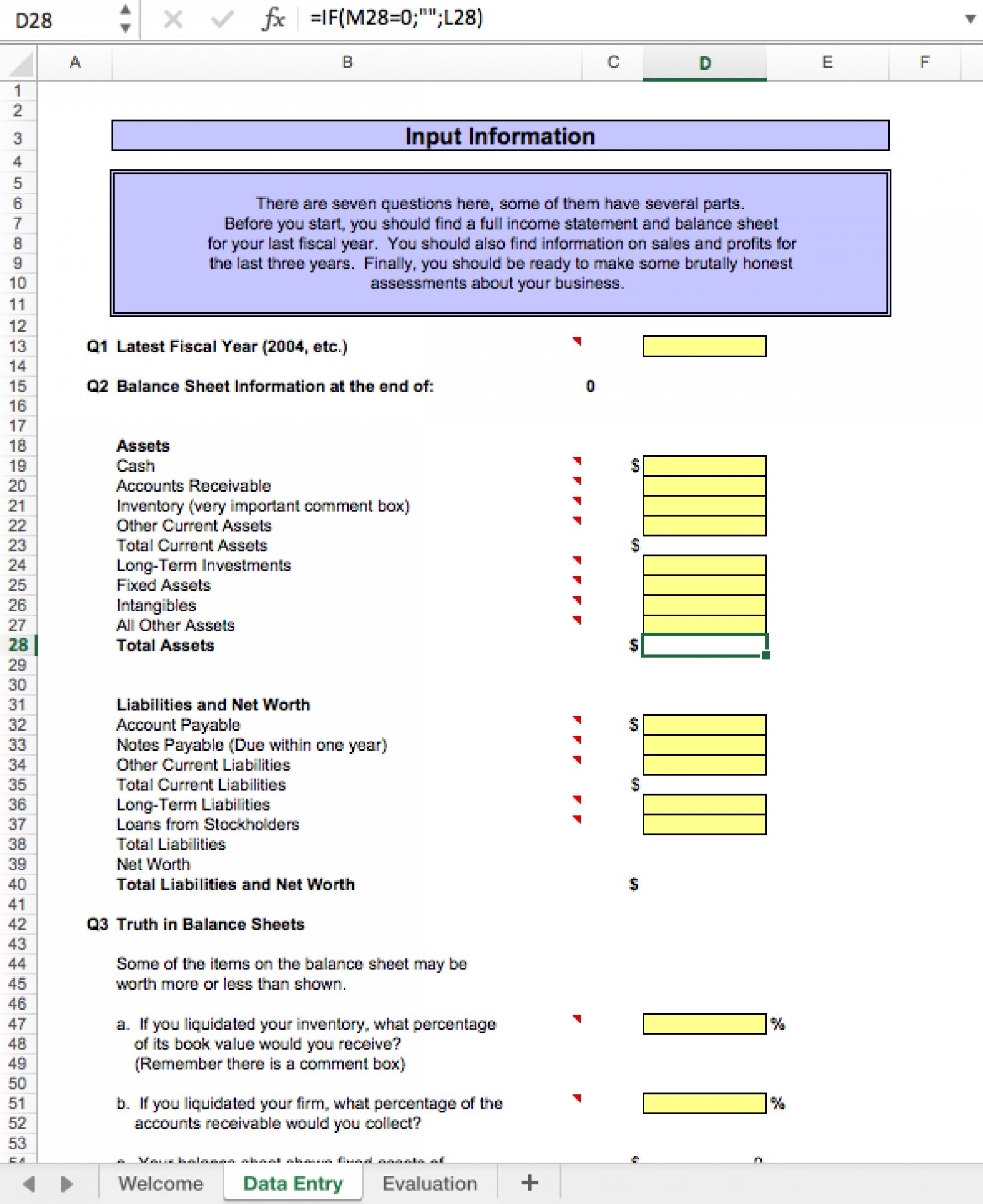

Valuation Model Excel Template - Excel models containing a valuation analysis template e.g. There are many jobs and career paths that require the skills of being able to value a company, a business unit, or an investment opportunity in excel. Calculate a stock's discounted future cash flows according to best practices; Web download the free template. Web using this stock valuation excel template, you can: Web valuation analysis excel model template. Web download now the dcf valuation model free excel template. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web valuation model excel templates 1 comment what is valuation? This is one of the more commonly used valuation. This valuation model by cfi. Ev/ebitda is a ratio that looks at a company’s. This is one of the more commonly used valuation. There are many jobs and career paths that require the skills of being able to value a company, a business unit, or an investment opportunity in excel. Web list of free excel financial model templates. Web valuation analysis excel model template. This is one of the more commonly used valuation. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. This solid and simple dcf model excel template is formulated in a way that allows users to. Calculate a stock's discounted future cash flows according. Web download the free template. Excel models containing a valuation analysis template e.g. Such as a discounted cash flow valuation analysis (dcf), residual value, replacement costs,. Quickly update the stock valuation model for. Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g. An office building, industrial site,. This template allows you to create your own adjusted present value calculation. Web january 31, 2022 download wso's free apv valuation model template below! Web dcf model template. Web the three primary stock valuation models: Ev/ebitda is a ratio that looks at a company’s. Web list of free excel financial model templates. This solid and simple dcf model excel template is formulated in a way that allows users to. This excel model includes the principal methods for the valuation of a company. Web this startup valuation model is used to estimate the present value of. Web up to 10% cash back ben graham valuation model (excel template) written by vanshika kothari thu jul 22 2021 see how marketxls helps you take advantage in the. Web valuation analysis excel model template. Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g.. This solid and simple dcf model excel template is formulated in a way that allows users to. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web this template is a unique business valuation solution which adds immeasurable value in determining and analysing the estimated value of a business. Discounted cash flow analysis the discounted cash flow analysis method treats the business as a large free cash flow. Web january 31, 2022 download wso's free apv valuation model template below! Quickly update the stock valuation model for. Web valuation model excel templates 1 comment what is valuation? Web this startup valuation model is used to estimate the present value. Web using this stock valuation excel template, you can: Discounted cash flow analysis the discounted cash flow analysis method treats the business as a large free cash flow. This template allows you to create your own adjusted present value calculation. Some of the most common careers that require such skills include the following: Valuation is the process of calculating the. Valuation is the process of calculating the current worth of an asset or liability. Web valuation analysis excel model template. Web dcf model template. Discounted cash flow analysis the discounted cash flow analysis method treats the business as a large free cash flow. Web this startup valuation model is used to estimate the present value of an investment based on. Web download now the dcf valuation model free excel template. Web using this stock valuation excel template, you can: Web up to 10% cash back ben graham valuation model (excel template) written by vanshika kothari thu jul 22 2021 see how marketxls helps you take advantage in the. This valuation model by cfi. Web valuation model excel templates 1 comment what is valuation? Ev/ebitda is a ratio that looks at a company’s. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web january 31, 2022 download wso's free apv valuation model template below! Discounted cash flow analysis the discounted cash flow analysis method treats the business as a large free cash flow. Enter your name and email in the form below and download the free template now! This is one of the more commonly used valuation. Such as a discounted cash flow valuation analysis (dcf), residual value, replacement costs,. Web dcf model template. Web valuation analysis excel model template. Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g. Calculate a stock's discounted future cash flows according to best practices; This solid and simple dcf model excel template is formulated in a way that allows users to. Web this startup valuation model is used to estimate the present value of an investment based on the company’s future cash flows. Excel models containing a valuation analysis template e.g. Quickly update the stock valuation model for. Web up to 10% cash back ben graham valuation model (excel template) written by vanshika kothari thu jul 22 2021 see how marketxls helps you take advantage in the. Web dcf model template. This template allows you to create your own adjusted present value calculation. An office building, industrial site,. Quickly update the stock valuation model for. Web download now the dcf valuation model free excel template. Web this startup valuation model is used to estimate the present value of an investment based on the company’s future cash flows. Such as a discounted cash flow valuation analysis (dcf), residual value, replacement costs,. Web valuation model excel templates 1 comment what is valuation? This solid and simple dcf model excel template is formulated in a way that allows users to. Web valuation analysis excel model template. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web this template is a unique business valuation solution which adds immeasurable value in determining and analysing the estimated value of a business on a discounted cash flow. Web using this stock valuation excel template, you can: Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g. Web download the free template.Business Valuation Template Excel Free Printable Templates

Business Valuation Template Excel Free Printable Templates

Business Valuation Excel Template for Private Equity Eloquens

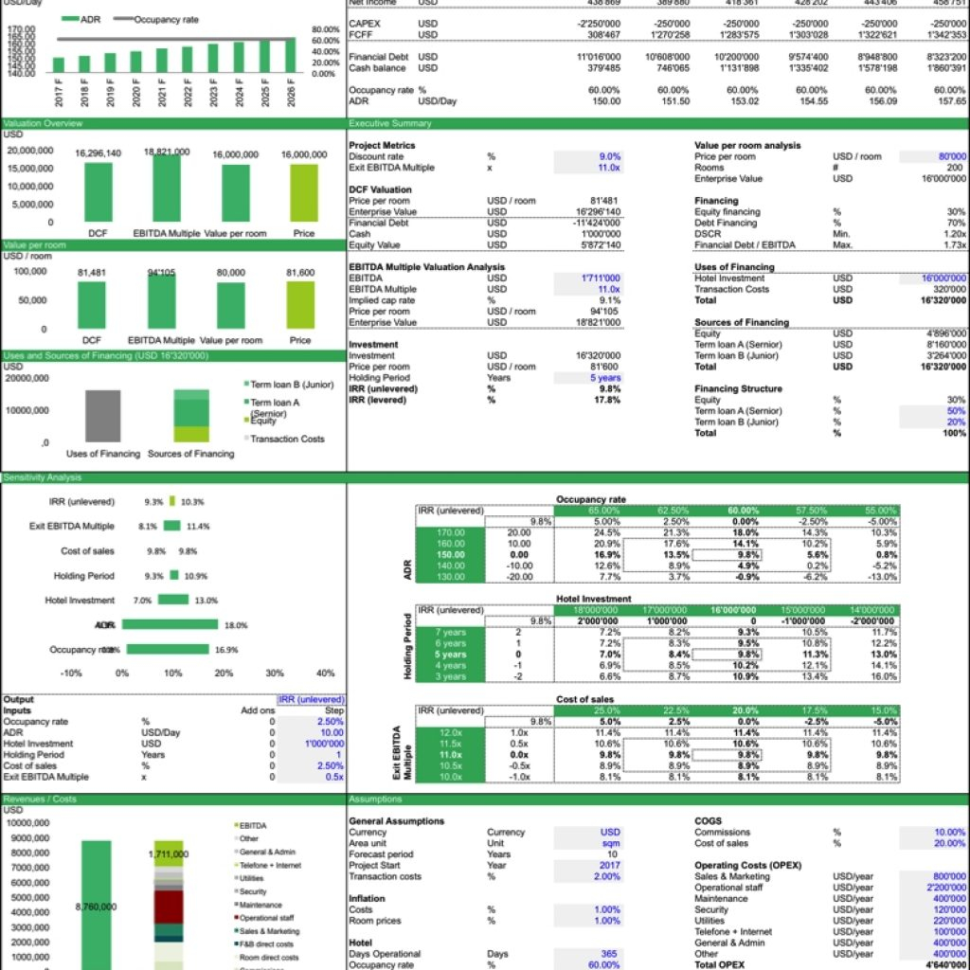

Real Estate Financial Model Excel Template for Complete Valuation with

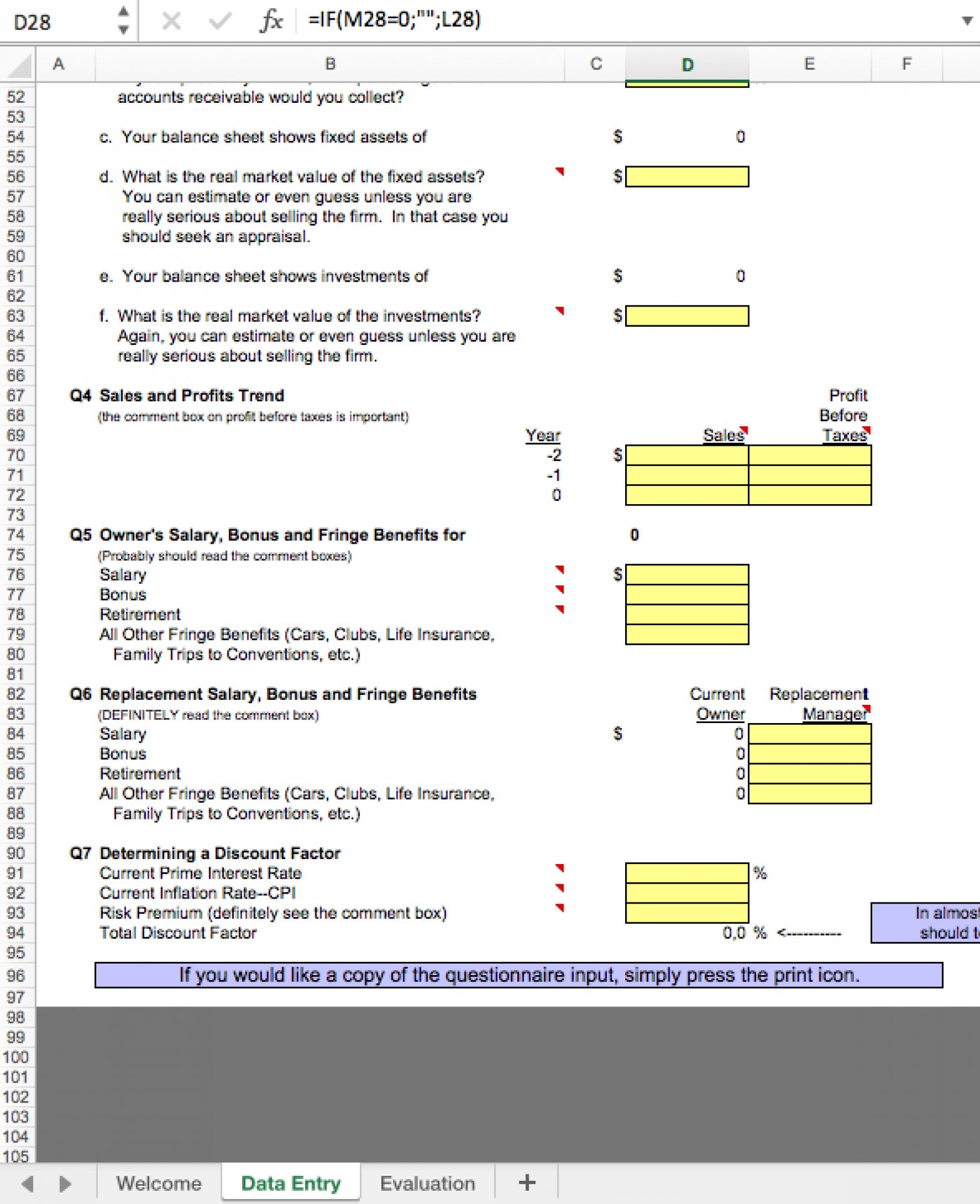

Free Excel Business Valuation Spreadsheet —

Download Microsoft Excel Business Valuation Template Fr...

Warrants and Management Options Excel Valuation Model Eloquens

Download Business Valuation Model Excel 60

Insurance Company Valuation Model Excel / Business Valuations Asset

Business Valuation Excel Template for Private Equity Eloquens

Discounted Cash Flow Analysis The Discounted Cash Flow Analysis Method Treats The Business As A Large Free Cash Flow.

Valuation Is The Process Of Calculating The Current Worth Of An Asset Or Liability.

Some Of The Most Common Careers That Require Such Skills Include The Following:

Web List Of Free Excel Financial Model Templates.

Related Post: