Venture Capital Method Valuation Model Template

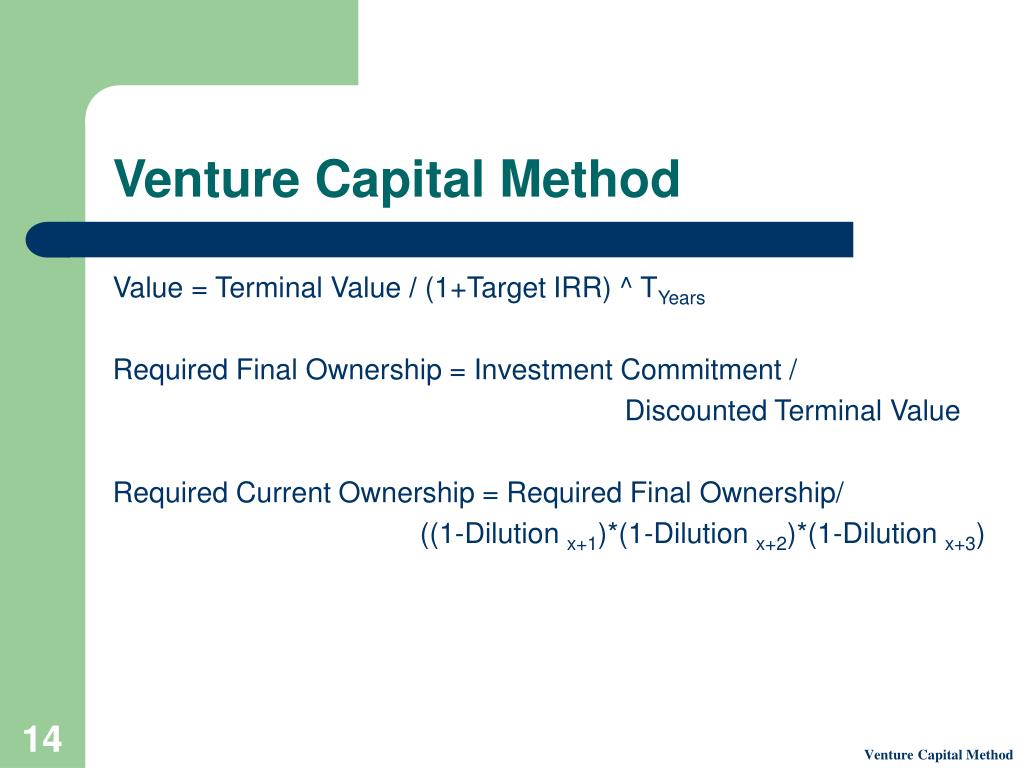

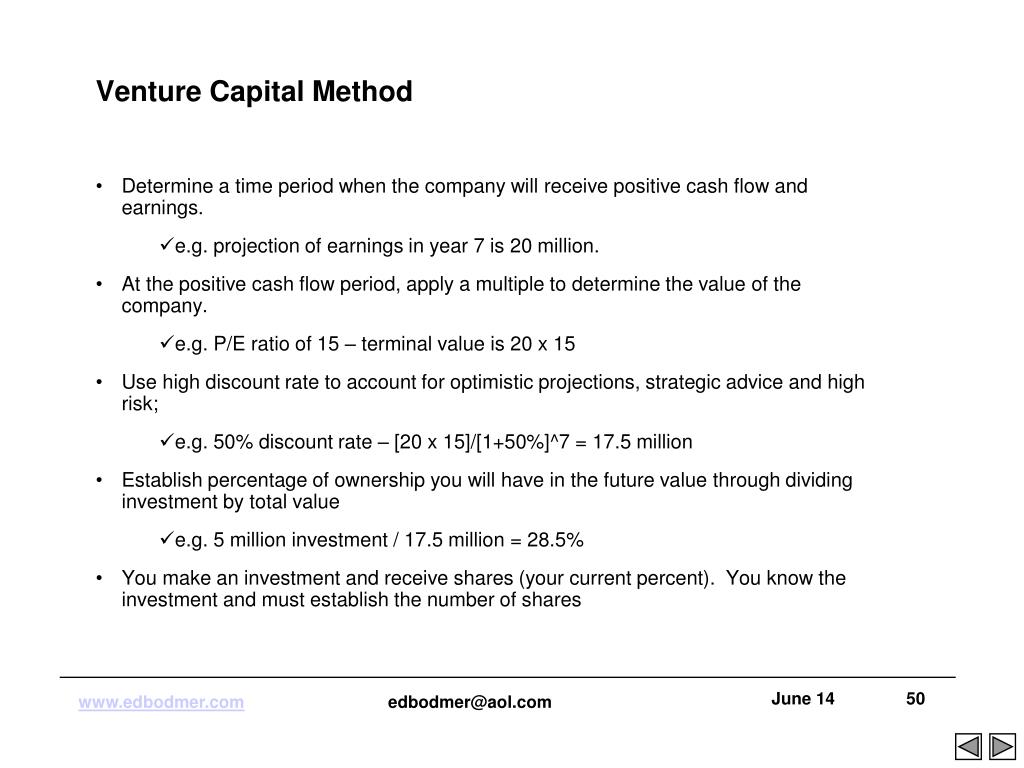

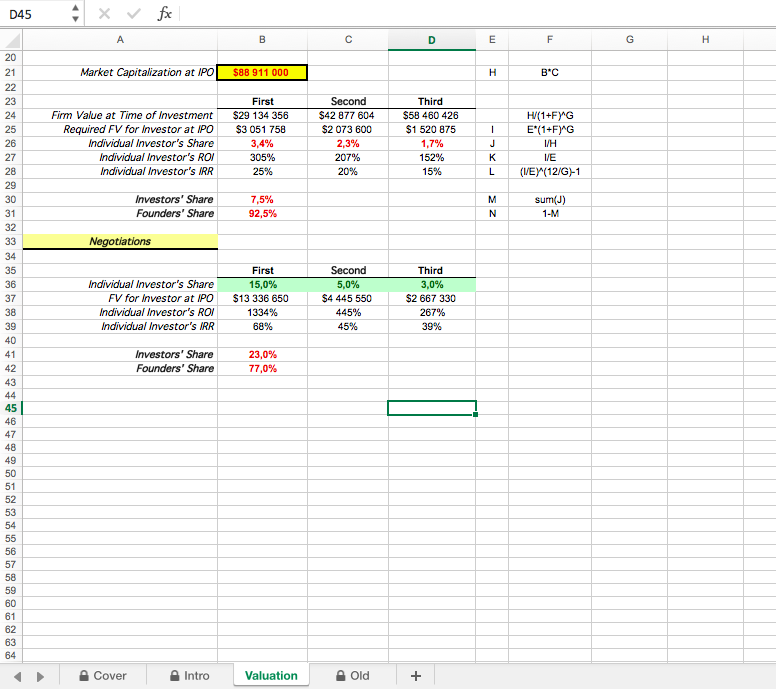

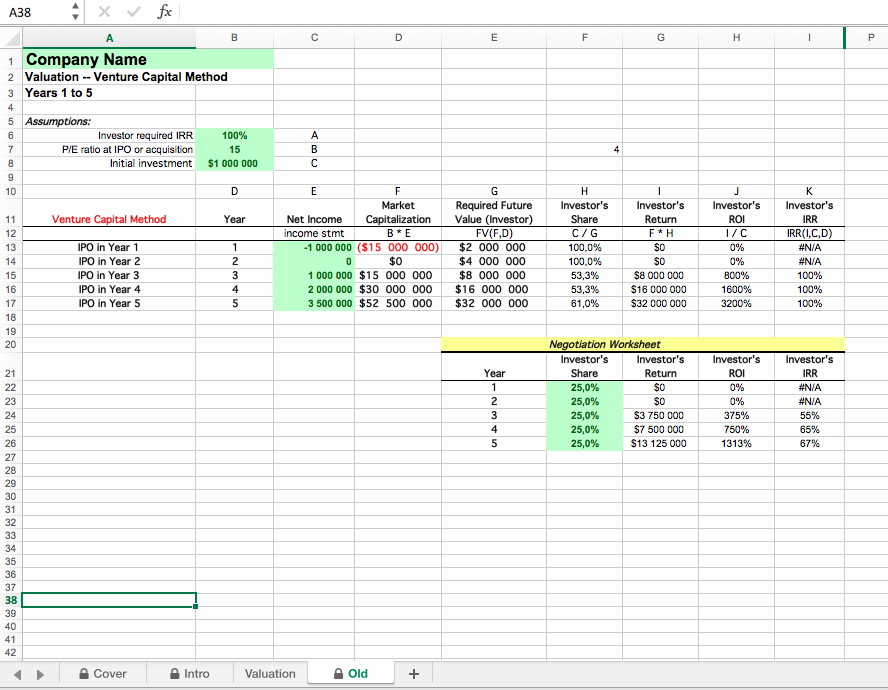

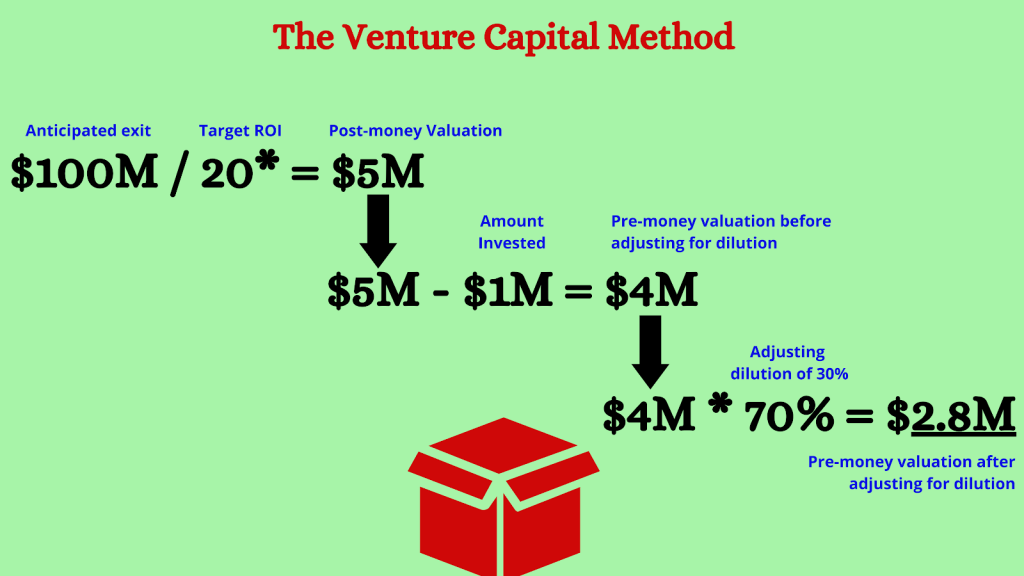

Venture Capital Method Valuation Model Template - Use code to checkout to. The venture capital method takes a finite term approach to the valuation method. Illustrates how to turn financial statement projections into cash flows and valuations. Web an excel template built to help you understand how vcs value the money that will be used to invest in a startup and the vc method used. Domontconsulting.com has been visited by 10k+ users in the past month Calculate original equity holder requirements based on. Ideal for entreprenuers and vcs. Excel template for doing valuation with vc method. Web venture capital method. Web description the venture capital method assumes that a form will undertake an initial public offering (ipo) at some point in the future. Illustrate the importance of terminal value in vc method valuation; The investor assumes an exit term, say 5 or 7. The venture capital(vc) method is comprised of six steps: Web 16k views 9 years ago thompson's prequel video tutorial, part 7. Web hurdle rates consistent with venture capital method. Web an excel template built to help you understand how vcs value the money that will be used to invest in a startup and the vc method used. Ad sign & fill out legal forms online on any device. Determine the timing of exit (ipo, m&a, etc.) 4. Web learn how till use the adventure capital valuation method to calculate. Determine the timing of exit (ipo, m&a, etc.) 4. Web introduce users to the venture capital method; The capitalization table is tracked by venture capital (vc) firms to provide a summary of the current capitalization (i.e. The investor assumes an exit term, say 5 or 7. Ad sign & fill out legal forms online on any device. Web the first chicago method or venture capital method is a business valuation approach used by venture capital and private equity investors that combines elements of both a. The investor assumes an exit term, say 5 or 7. The venture capital(vc) method is comprised of six steps: Web in the context of a private company’s capital structure, the opm strives. Web learn how till use the adventure capital valuation method to calculate one valuation for any startup (+ example). Web hurdle rates consistent with venture capital method. Ad sign & fill out legal forms online on any device. Illustrates how to turn financial statement projections into cash flows and valuations. Use code to checkout to. Ad sign & fill out legal forms online on any device. Valuation template 7 investor valuation and ownership allocation multi. Web remi april 19, 2022 valuation with more than 2,400 deals and $98 billion invested in h1 2021, fintech is (still) undeniably one of the hottest sector in tech right. Welcome to wall street prepping! The investor assumes an exit. Ad stout is a leading independent advisory firm specializing in investment banking. Web the first chicago method or venture capital method is a business valuation approach used by venture capital and private equity investors that combines elements of both a. Web hurdle rates consistent with venture capital method. Welcome to wall street prepping! Our clients and their advisors rely on. Naturally, startup investments are positioned in. Web the venture capital valuation method is a methodology that can be used to carry out a business valuation. Get access to an online library of 85k forms & packages that you can edit & esign online. The venture capital(vc) method is comprised of six steps: Web venture capital method. Naturally, startup investments are positioned in. Our clients and their advisors rely on our premier expertise and deep industry knowledge. Web hurdle rates consistent with venture capital method. This method allows investors to not only value the. Domontconsulting.com has been visited by 10k+ users in the past month The investor assumes an exit term, say 5 or 7. Ideal for entreprenuers and vcs. Web introduce users to the venture capital method; Our clients and their advisors rely on our premier expertise and deep industry knowledge. Web learn how till use the adventure capital valuation method to calculate one valuation for any startup (+ example). Welcome to wall street prepping! Domontconsulting.com has been visited by 10k+ users in the past month Web the venture capital valuation method is a methodology that can be used to carry out a business valuation. Web hurdle rates consistent with venture capital method. Web the first chicago method or venture capital method is a business valuation approach used by venture capital and private equity investors that combines elements of both a. Web learn how till use the adventure capital valuation method to calculate one valuation for any startup (+ example). Web an excel template built to help you understand how vcs value the money that will be used to invest in a startup and the vc method used. Web in venture capital valuation, the highest common approach is called the venture capital method by bill sahlman. The venture capital(vc) method is comprised of six steps: Web introduce users to the venture capital method; Estimate the investment needed 2. Web in the context of a private company’s capital structure, the opm strives to calculate the fair value of common stock based on the total equity value of a company. The investor assumes an exit term, say 5 or 7. Our clients and their advisors rely on our premier expertise and deep industry knowledge. Discount to pvat the desired rate of return 6. Web remi april 19, 2022 valuation with more than 2,400 deals and $98 billion invested in h1 2021, fintech is (still) undeniably one of the hottest sector in tech right. Web description the venture capital method assumes that a form will undertake an initial public offering (ipo) at some point in the future. Calculate original equity holder requirements based on. Web up to $3 cash back description: Determine the timing of exit (ipo, m&a, etc.) 4. Illustrate the importance of terminal value in vc method valuation; Determine the timing of exit (ipo, m&a, etc.) 4. The capitalization table is tracked by venture capital (vc) firms to provide a summary of the current capitalization (i.e. Web remi april 19, 2022 valuation with more than 2,400 deals and $98 billion invested in h1 2021, fintech is (still) undeniably one of the hottest sector in tech right. The investor assumes an exit term, say 5 or 7. Web venture capital method. Web introduce users to the venture capital method; Web an excel model outlining different startup early stage vc valuation methods (quantitative and qualitative). Web in the context of a private company’s capital structure, the opm strives to calculate the fair value of common stock based on the total equity value of a company. Ideal for entreprenuers and vcs. Web up to $3 cash back description: Web 16k views 9 years ago thompson's prequel video tutorial, part 7. Excel template for doing valuation with vc method. Illustrates how to turn financial statement projections into cash flows and valuations. The venture capital(vc) method is comprised of six steps: Web in venture capital valuation, the highest common approach is called the venture capital method by bill sahlman.PPT What is Valuation? PowerPoint Presentation, free download ID

VC Method Valuation Template Venture Capital Business

PPT Valuation PowerPoint Presentation, free download ID782817

venture capital method valuation LAOBING KAISUO

Venture Capital Valuation Method Excel Model Eloquens

Venture Capital Valuation Method Excel Model Eloquens

Tech Startup Valuation Multiples And Venture Capital Method Valuation

Venture Capital Valuation Method for Startups key2investors

Collection What’s a Startup Worth? Guidelines and Best Practices

Startup Investment For Seed Round Valuation

Web Learn Online Now What Is Capitalization Table?

Web An Excel Template Built To Help You Understand How Vcs Value The Money That Will Be Used To Invest In A Startup And The Vc Method Used.

Calculate Original Equity Holder Requirements Based On.

Web The Venture Capital Valuation Method Is A Methodology That Can Be Used To Carry Out A Business Valuation.

Related Post: