Wacc Excel Template

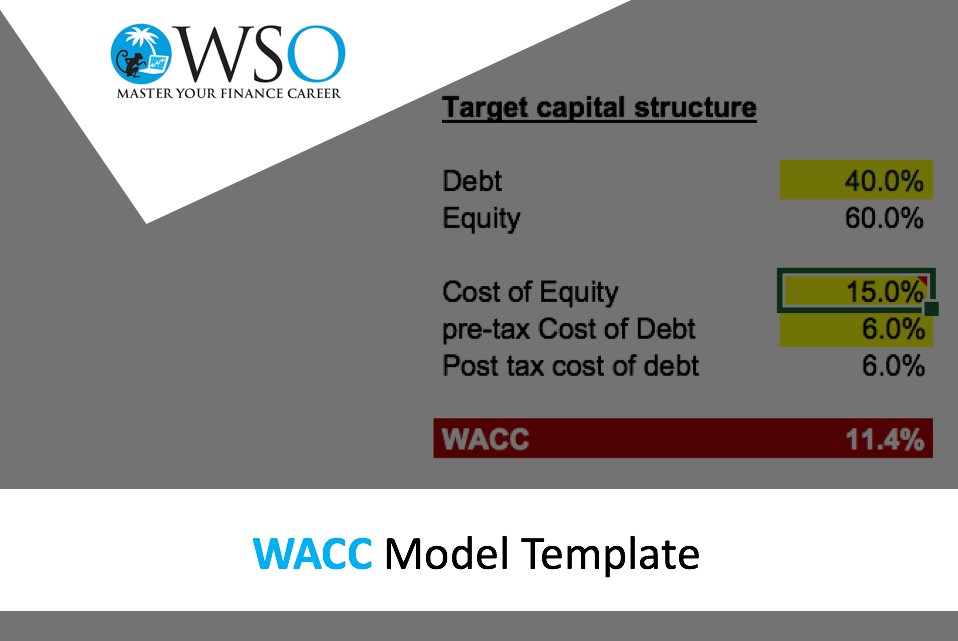

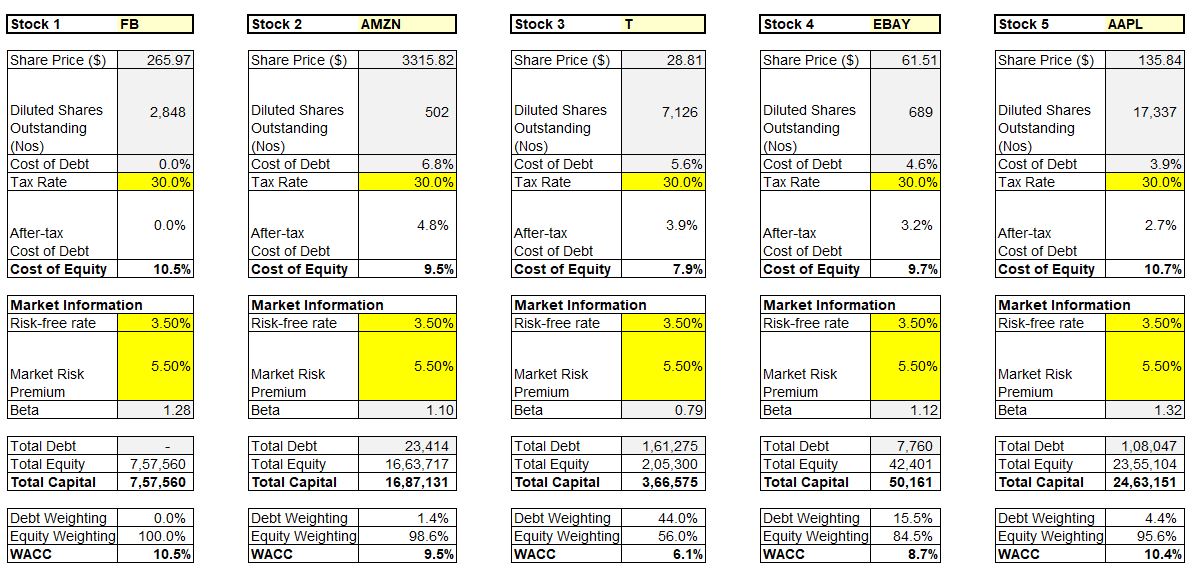

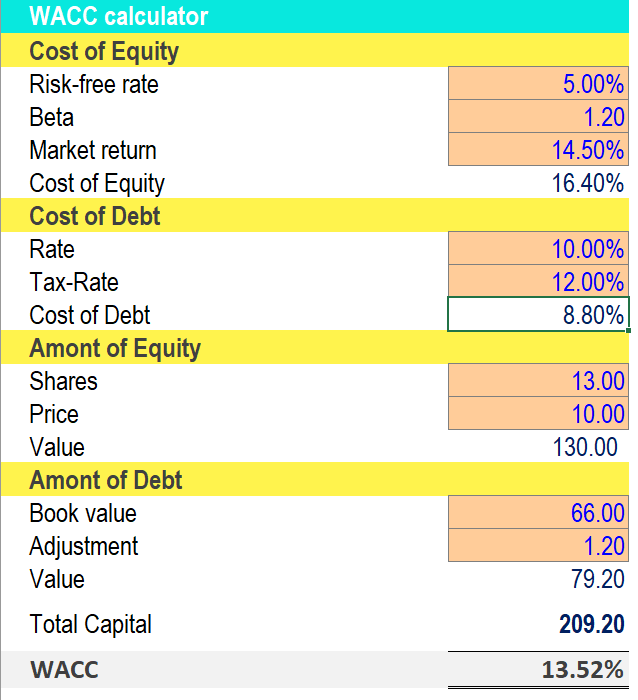

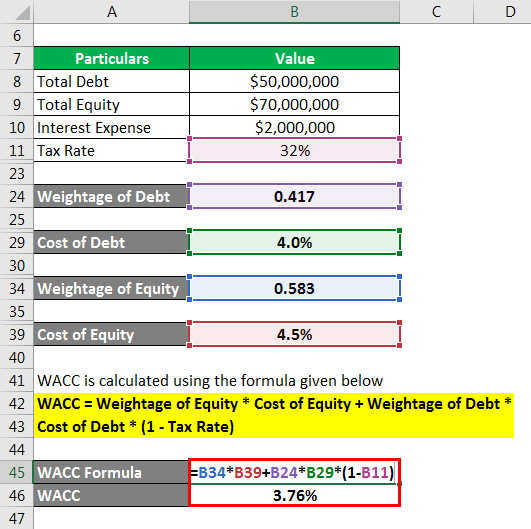

Wacc Excel Template - Comparable companies firm 1 firm 2 firm 3 average data amount of equity Web this excel model is for educational purposes only. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. Weighted average cost of capital. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps. The wacc is the weighted average cost of capital or the discount. Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. Comparable companies firm 1 firm 2 firm 3 average data amount of equity The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web what weighted average cost of capital formula firstly and most essentially, we need to understand the theoretical. Weighted average cost of capital. Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Web what weighted average cost of capital formula firstly and most essentially, we need to understand the theoretical formula of wacc which is calculated as follows: This simple wacc calculator is a free excel template for calculating weighted average. Web this excel model is for educational purposes only. Comparable companies firm 1 firm 2 firm 3 average data amount of equity Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: The. Comparable companies firm 1 firm 2 firm 3 average data amount of equity Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. The wacc is the weighted average cost of capital or the discount. Web what weighted average. Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. Web updated august 17, 2023 definition of wacc a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources,. Comparable companies firm. To find the weight of the equity and debt,. Web this excel model is for educational purposes only. Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps.. Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web to find the weighted average cost of capital, multiply the weight of value. Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. The wacc is the weighted average cost of capital or the discount. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. The term “wacc” is the acronym for a weighted. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Web updated july 3, 2023 what is the wacc formula? Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. To find the weight of the equity and debt,. Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Comparable companies firm 1 firm 2 firm 3 average data amount of equity The wacc is the weighted average cost of capital or the discount. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. Weighted average cost of capital. Web what weighted average cost of capital formula firstly and most essentially, we need to understand the theoretical formula of wacc which is calculated as follows: Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Web this excel model is for educational purposes only. Web updated august 17, 2023 definition of wacc a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources,. Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. To find the weight of the equity and debt,. The wacc is the weighted average cost of capital or the discount. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. Comparable companies firm 1 firm 2 firm 3 average data amount of equity This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web updated july 3, 2023 what is the wacc formula? Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. Weighted average cost of capital. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. Web this excel model is for educational purposes only.Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

10 Wacc Excel Template Excel Templates

Wacc Excel Template templates.iesanfelipe.edu.pe

Weighted Average Cost of Capital (WACC) Template Free Excel Template

10 Wacc Excel Template Excel Templates

Wacc Excel Template templates.iesanfelipe.edu.pe

Web This Wacc Calculator Helps You Calculate Wacc Based On Capital Structure, Cost Of Equity, Cost Of Debt, And Tax Rate.

Web Sheet1 4Estimating The Weighted Average Cost Of Capital Input Cells Are In Yellow.

Web What Weighted Average Cost Of Capital Formula Firstly And Most Essentially, We Need To Understand The Theoretical Formula Of Wacc Which Is Calculated As Follows:

Web Updated August 17, 2023 Definition Of Wacc A Firm’s Weighted Average Cost Of Capital (Wacc) Represents Its Blended Cost Of Capital Across All Sources,.

Related Post: